SABMiller Holdings Inc. (SBMRY, SAB.JO) brewed up the largest

corporate bond deal for the U.S. markets since March 2011 on

Tuesday, offering $7 billion of bonds to refinance short-term debt

used in its takeover of Australian brewer Fosters late last

year.

The deal was split among $1 billion of three-year bonds, $2

billion of five-year bonds, $2.5 billion of 10-year bonds and $1.5

billion of 30-year bonds.

Hefty appetites helped improve the pricing by at least 10 basis

points from earlier guidance, with the latest update showing

respective bond spreads of 150 basis points, 165 basis points, 185

basis points and 200 basis points. Final pricing is expected later

Tuesday.

The SABMiller offering was one of 10 investment-grade corporate

deals to hit the U.S. markets Tuesday, with total volume of at

least $12.725 billion--the busiest day for issuance since the $15.3

billion on Nov. 7, according to data provider Dealogic.

The active session followed $8.65 billion issued Monday and

$22.6 billion issued in the four-session week to begin the

year.

"The spigot for new issuance was turned off in the second half

of December, but much is still needed to get done so issuers are

now taking advantage of market conditions," said Scott MacDonald,

head of credit and economic research at Aladdin Capital. "'Risk on'

is the name of the game. What's going to change that is a stumble

with earnings or a stumble with Europe, but we haven't seen that

yet."

Scott Kimball, portfolio manager at Miami-based Taplin, Canida

& Habacht LLC, which sub-advises the BMO/TCH corporate income

fund, said it was notable that the issuer is able to issue

short-term and long-term debt simultaneously, which he attributed

to the perception of SABMiller being a defensive credit.

"They have a pretty diversified portfolio of beverages and some

that have a cult following, for instance they recently purchased

Foster's, the 'Australian for Beer' name," said Kimball, who didn't

buy any of the bonds.

"It's not a classic defensive name like a utility," Kimball

added, but beer sales tend to be steady regardless of the state of

the economy, and SABMiller has "a wide degree of offerings."

SABMiller is the financing arm of the London global brewing

company, which owns brands including Miller Genuine Draft,

Milwaukee's Best, Castle and Pilsner Urquell. It paid $9.6 billion

for Fosters.

The $7 billion debt offering is the largest U.S. marketed deal

since March 22, 2011, when the French pharmaceutical group

Sanofi-Aventis issued $7 billion in a six-tranche deal to help it

acquire Genzyme Corporation, a Massachusetts biotechnology company,

according to Dealogic.

Investors also liked that SABMiller is an infrequent borrower,

Kimball said. It last tapped the U.S. markets in July 2008, when it

issued $1.25 billion of 5.5- and 10-year bonds. It previously

issued $1.75 billion in June 2006, Dealogic shows.

Hutchison Whampoa Ltd. (HUWHY), the Hong Kong conglomerate, was

marketing a two-tranche deal worth $1.5 billion in Tuesday's

market.

Several borrowers increased the size of their offerings thanks

to favorable conditions.

Entergy Corp. (ETR) enlarged its five-year offering to $500

million from $300 million, pricing the 4.70% notes to yield 4.726%,

a spread of 3.875 percentage points over Treasurys.

Valspar Corp. (VAL) bumped up the size its 10-year bond offering

to $400 million from $300 million, pricing the 4.20% notes to yield

4.218%, or 2.25 percentage points over the Treasury rate.

Other issues in Tuesday's market include an $800 million,

two-part deal from Macy's Inc. (M) and a $900 million secured debt

offering of 30-year bonds from John Sevier Combined Cycle

Generation LLC, which is run by the Tennessee Valley Authority

(TVA).

"Companies continue to term out their maturity profiles or, in

some cases, to prefund their acquisitions," Kimball said. He noted

deals are coming with only moderate concessions--the extra yield

demanded by investors in the primary market--indicating that

appetite for credit is holding up fairly well so far this year.

Despite the wave of new issuance, Markit's CDX North America

Investment-Grade Index, a benchmark gauge of the higher-quality

corporate bond market, had advanced 2.5% as of late afternoon

Tuesday. A similar index tracking the high-yield market was up

0.6%.

A preliminary estimate of issuance in the first six sessions of

the year is a robust $42.475 billion, but the market has a long way

to go in the coming days to match the $68 billion issued in the

first two weeks of 2011, the busiest two-week period of last

year.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

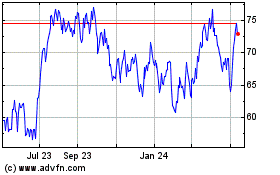

Valaris (NYSE:VAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

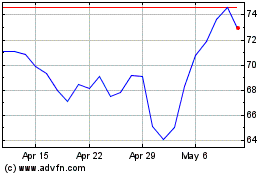

Valaris (NYSE:VAL)

Historical Stock Chart

From Sep 2023 to Sep 2024