Mosaic Cuts Production Outlook

September 21 2015 - 5:31PM

Dow Jones News

By Tess Stynes

Mosaic Co. (MOS) cut its third-quarter production outlook and

will extend maintenance downtime at its Colonsay mine in Canada as

part of efforts to slow production to reflect softer demand, which

is mostly related to delayed fertilizer purchases in Brazil and

North America.

The company, one of the world's biggest fertilizer makers, said

that since its guidance in early August international and domestic

fertilizer markets have softened, including lower-than-expected

volume and weaker prices.

Mosaic expects volume for phosphate, a key product, will come in

at the lower end of the company's previous guidance for 2.1 million

tons to 2.4 million tons, though average selling prices are

projected in the upper half of its previous view for between $435 a

ton and $455 a ton.

The company also sees potash volume in the lower half of its

previous guidance for 1.6 million tons to 2 million tons, while

average selling prices also are expected in the bottom half of its

prior estimate for between $260 a ton and $280 a ton.

Mosaic in August reported its second-quarter earnings rose 57%,

boosted by cost controls and higher sales of phosphates.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 21, 2015 17:16 ET (21:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

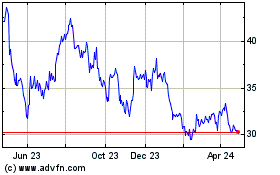

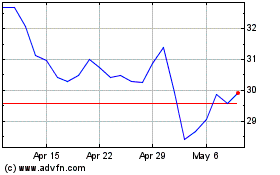

Mosaic (NYSE:MOS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Mosaic (NYSE:MOS)

Historical Stock Chart

From Sep 2023 to Sep 2024