ConAgra to Cut 1,500 Jobs, Move Headquarters to Chicago -- 2nd Update

October 01 2015 - 4:56PM

Dow Jones News

By Annie Gasparro

ConAgra Foods Inc. will cut about 1,500 office jobs and move its

headquarters to Chicago as part of a plan to boost profit margins

and revive an old-line packaged-foods business reeling from

shifting consumer tastes.

The Omaha, Neb., company plans to trim $300 million from its

annual budget through the layoffs, improved efficiency and expense

reductions. ConAgra said the job cuts represent 30% of its global

office staff.

The maker of Chef Boyardee canned pastas and Healthy Choice

frozen dinners identified the cost savings through zero-based

budgeting, a tool increasingly adopted by big U.S. food makers that

requires departments to justify expenses anew every year.

The actions "will make us one of the leanest organizations in

the food industry when we're done," ConAgra Chief Executive Sean

Connolly said in an interview. The company "took every expense and

put it out in the parking lot"--and only allowed "it back in based

on whether we could attach a return to it," he said.

The move to Chicago--to be aided by Illinois tax

incentives--will help ConAgra better attract talent as it

restructures, the CEO said. ConAgra's stock rose 1% on

Thursday.

Mr. Connolly took the helm at ConAgra in April amid unrelenting

weak sales and a botched acquisition of private-label business

Ralcorp Holdings Inc. The former CEO of Hillshire Brands Co. also

began facing pressure to improve results from activist investor

Jana Partners LLC, which revealed in June that it had built a

more-than 7% stake in the food maker.

ConAgra is among an array of big U.S. food companies grappling

with slowing growth as many consumers eschew traditional packaged

foods for less-processed and fresher fare.

The maker of Hunt's ketchup and Reddi-wip dessert topping also

is challenged by aggressive moves at bigger rivals, including newly

merged Kraft Heinz Co., to increase margins.

"We have to take actions within our control to improve margins

and eliminate waste," Mr. Connolly said.

ConAgra estimates the restructuring will cost $345 million over

the next two to three years. It expects to realize more than half

of the savings by the end of its 2017 fiscal year, with the balance

achieved in 2018.

The move to Chicago, planned for next summer, will bring 700

jobs to the city. ConAgra will maintain some 1,200 office employees

in Omaha, where it has maintained its headquarters since 1922.

ConAgra's relocation is part of a continuing push by Chicago

Mayor Rahm Emanuel to recruit companies to the Windy City from out

of state and elsewhere in Illinois. Motorola Solutions Inc.

announced last month it would move its global headquarters to

downtown from the Chicago suburbs, while Archer Daniels Midland Co.

moved its headquarters to the city from Decatur, Ill. last year.

Kraft Heinz announced plans to move to downtown Chicago from the

suburbs shortly after merging in July.

As part of the ConAgra move, Illinois Gov. Bruce Rauner signed

off on tax credits for the company based on 150 new jobs coming to

the state. His administration didn't put a dollar value on the

incentive package, saying it will depend on factors such as

employee salaries and future tax rates. Tax breaks for individual

companies have received increased pushback by Illinois lawmakers in

recent years as the state faces deep fiscal challenges, but the new

credits won't require legislative approval.

ConAgra has an office in the Chicago suburb of Naperville with

about 400 people. Many of those jobs will move to downtown Chicago,

along with its senior leadership team and its frozen-foods business

in Omaha.

Mr. Connolly is no stranger to such moves. He led Hillshire when

it moved its suburban Chicago headquarters to the city's downtown

in 2012. Tyson Foods Inc. acquired Hillshire last year.

"We need that energized culture for our consumer-brands

segment," Mr. Connolly said. "I know that drill."

He said more cost cuts could come at ConAgra once it completes a

similar analysis of its manufacturing operations and supply

chain.

Other food makers, including Kellogg Co. and General Mills Inc.,

have announced factory closures in the past year as Brazilian

private-equity firm 3G Capital Partners LP leads a push for

sweeping cost cuts in the industry through its control of Kraft

Heinz.

ConAgra continues to look for a buyer for its struggling

private-brands business. The company so far has announced

write-downs totaling more than $4 billion for the business, which

it bought for $5 billion less than three years ago. Mr. Connolly

said last week that the company had received a lot of interest from

potential buyers.

Mark Peters contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

Access Investor Kit for "ConAgra Foods, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US2058871029

(END) Dow Jones Newswires

October 01, 2015 16:41 ET (20:41 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

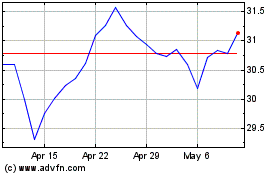

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Aug 2024 to Sep 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Sep 2023 to Sep 2024