CVS Caremark Upped to Buy - Analyst Blog

April 17 2014 - 6:55PM

Zacks

On Apr 16, Zacks Investment Research upgraded CVS

Caremark Corporation (CVS) to a Zacks Rank #2 (Buy) from a

Zacks Rank #3 (Hold).

Why the Upgrade?

The long-term expected earnings growth rate for this Rhode

Island-based integrated pharmacy service provider is 13.4%.

Moreover, CVS has delivered positive earnings surprises in all of

the last 4 quarters with an average beat of 3.5%.

CVS reported its fourth-quarter and full-year 2013 results on Feb

11, 2014. Adjusted earnings per share came in at $1.12, beating the

Zacks Consensus Estimate of $1.11 by 0.90% and exceeding the

prior-year earnings by 15.8%.

Earnings were primarily aided by healthy top-line growth of 4.6% in

the reported quarter, which was largely driven by a combined force

of 5.2% year-over-year increase in net revenues from the Pharmacy

Services segment and 5.6% rise in net revenues from the Retail

Pharmacy segment.

With respect to segment performance, net revenues from CVS's

Pharmacy Services segment increased 5.2% to $19.6 billion in the

fourth quarter, principally driven by drug cost inflation, new

products and new clients in the specialty pharmacy business.

On the other hand, same-store sales increased 4.0% over the

prior-year quarter, with a 6.8% rise in pharmacy same-store sales.

This contributed to the 5.6% rise in net revenues at the Retail

Pharmacy segment to $17.2 billion.

Based on its strong performance, CVS raised its first-quarter 2014

adjusted earnings guidance to the range of $1.03–$1.06 per share.

This new guidance is higher than the previous estimation by 7 cents

and thereby, equates to adjusted EPS growth of 24.25% to

28.25%.

CVS also expects its consolidated revenues to increase 4.25% to

5.5% in the first quarter. Moreover, the company has raised its

free cash flow guidance to the band of $5.5–$5.8 billion from

$5.1–$5.4 billion guided earlier.

The Zacks Consensus Estimate for earnings for 2014 remained flat at

$4.47 per with no downward revision over the last 30 days. For

2015, however, one estimate was revised upward over the same time

frame, raising the Zacks Consensus Estimate by 0.2% to $5.02 per

share.

Other Stocks to Consider

In the broader drug retail/wholesale space, Rite Aid

Corp. (RAD), Spartan Stores Inc. (SPTN)

and Herbalife Ltd. (HLF) are performing well.

While Rite Aid and Spartan Stores hold a Zacks Rank #1 (Strong

Buy), Herbalife retains a Zacks Rank #2 (Buy).

CVS CAREMARK CP (CVS): Free Stock Analysis Report

HERBALIFE LTD (HLF): Free Stock Analysis Report

RITE AID CORP (RAD): Free Stock Analysis Report

SPARTAN STORES (SPTN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

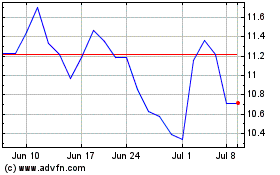

Herbalife (NYSE:HLF)

Historical Stock Chart

From Aug 2024 to Sep 2024

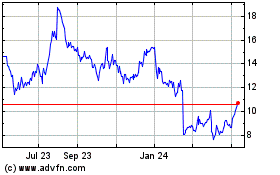

Herbalife (NYSE:HLF)

Historical Stock Chart

From Sep 2023 to Sep 2024