As filed with the Securities and Exchange Commission on August 27, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

DEXCOM, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 33-0857544 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

6340 Sequence Drive

San Diego, California 92121

(858) 200-0200

(Address, including zip code and telephone number, including area code, of the registrant’s principal executive offices)

Jess Roper

Senior Vice President and Chief Financial Officer

6340 Sequence Drive

San Diego, California 92121

(858) 200-0200

(Name, address, including zip code and telephone number, including area code, of the agent for service)

Copies to:

|

| |

Robert A. Freedman, Esq. Michael A. Brown, Esq. Fenwick & West LLP

Silicon Valley Center

801 California Street

Mountain View, California 94041

(650) 988-8500 | John Lister, Esq. Senior Vice President and General Counsel 6340 Sequence Drive San Diego, California 92121 (858) 200-0200 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a registration statement filed pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

| | |

Large Accelerated Filer x | | Accelerated Filer ¨ |

Non-Accelerated Filer ¨ | | Smaller Reporting Company ¨ |

CALCULATION OF REGISTRATION FEE

|

| | | | |

Title of Each Class of

Securities to be Registered | Amount to be Registered (1) | Proposed Maximum

Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price (2) | Amount of

Registration Fee |

Common stock, $0.001 par value per share (3) | 404,591 | $80.98 | $32,761,756 | $3,807 |

| |

(1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement includes an indeterminate number of additional shares of common stock that may be issued and resold resulting from stock splits, stock dividends and similar transactions. |

| |

(2) | Estimated pursuant to Rule 457(c) of the Securities Act, solely for purposes of calculating the registration fee, based on the average of the high and low sales price of the Registrant’s common stock reported on The NASDAQ Global Select Market on August 24, 2015. |

PROSPECTUS

404,591 Shares of Common Stock

This prospectus relates to the issuance by DexCom, Inc. of 404,591 shares of common stock.

The shares are proposed to be issued pursuant to that certain Collaboration and License Agreement, dated August 10, 2015, including the Common Stock Purchase Agreement dated August 27, 2015, or the Collaboration Agreement by and between DexCom, Inc. and Google Life Sciences LLC, or GLS. Under the terms of the Collaboration Agreement, we are required to pay GLS an upfront fee of $35,000,000, which we are electing to pay in shares of our common stock. The number of shares to be issued is determined based on the volume weighted average trading price of the common stock during a period of twenty consecutive trading days ended prior to the date of the Collaboration Agreement, which was $86.51.

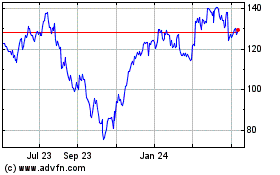

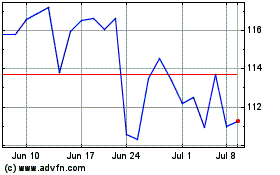

Our common stock trades on The NASDAQ Global Select Market under the symbol “DXCM.” On August 24, 2015, the closing sale price of our common stock, as reported on The NASDAQ Global Select Market, was $85.49 per share.

INVESTING IN OUR COMMON STOCK INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “RISK FACTORS” BEGINNING ON PAGE 5 OF THIS PROSPECTUS, AS WELL AS OTHER INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS BEFORE MAKING A DECISION TO INVEST IN OUR SECURITIES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 27, 2015.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 under the Securities Act of 1933, as amended, or the Securities Act, that we filed with the Securities and Exchange Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act.

You should rely only on the information we have provided or incorporated by reference in this prospectus. We have not authorized anyone to provide you with additional or different information. No person or entity is authorized to give any information or to represent anything not contained in this prospectus. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may provide to you. You must not rely on any unauthorized information or representation.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction where such offer or sale is not permitted.

This prospectus incorporates information by reference important business and financial information about us that is not included in or delivered with this document. You should read the additional information described under “Where You Can Find More Information” on page 7 and “Incorporation of Documents by Reference” on page 8.

This prospectus may be supplemented from time to time by one or more prospectus supplements. Any such prospectus supplements may include additional information, such as additional risk factors or other special considerations applicable to us, our business or results of operations or our common stock, and may also update or change the information in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement.

PROSPECTUS SUMMARY

This section contains a general summary of information contained elsewhere in this prospectus. It may not include all of the information that is important to you. Our business is subject to a number of risks, which we describe in “Risk Factors” beginning on page 5 and in the “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed with the SEC on August 5, 2015, which are incorporated by reference herein. See “Incorporation of Certain Information by Reference” on page 8. You should read the entire prospectus and the documents incorporated by reference before making an investment decision.

Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus to the terms “DexCom,” “we,” “our,” and “us” or similar references refer to DexCom, Inc., a Delaware corporation, and our consolidated subsidiaries.

DEXCOM, INC.

We are a medical device company primarily focused on the design, development and commercialization of continuous glucose monitoring systems for ambulatory use by people with diabetes and for use by healthcare providers for the treatment of people with and without diabetes.

We received approval from the FDA and commercialized our first product in 2006. In 2007, we received approval and began commercializing our second generation system, the DexCom SEVEN. In 2009 we received approval and began commercializing our third generation system, the DexCom SEVEN PLUS. We no longer market or provide support for the DexCom SEVEN or SEVEN PLUS systems. On June 14, 2012, we received Conformité Européenne Marking (“CE Mark”) approval for our fourth generation continuous glucose monitoring system, the DexCom G4 system, enabling commercialization of the DexCom G4 system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark. The DexCom G4 system was approved for use by adults at home and in healthcare facilities. On October 5, 2012, we received approval from the FDA for the DexCom G4 PLATINUM, which is designed for up to seven days of continuous use by adults with diabetes, and we began commercializing this product in the U.S. in the fourth quarter of 2012. On February 14, 2013, we received CE Mark approval for a pediatric indication for our DexCom G4 system, enabling us to market and sell this system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark to persons two years old and older who have diabetes (hereinafter referred to as the "Pediatric Indication"), and we initiated a limited commercial launch in the second quarter of 2013. In connection with our receipt of CE Mark approval for the Pediatric Indication, we changed the name of the DexCom G4 system to the DexCom G4 PLATINUM system. On February 3, 2014, we received approval from the FDA for a Pediatric Indication for the DexCom G4 PLATINUM system in the United States. On June 3, 2014, we received approval from the FDA for an expanded indication for the DexCom G4 PLATINUM for professional use. This expanded indication allows healthcare professionals to purchase the DexCom G4 PLATINUM devices for use with multiple patients. Healthcare professionals can use the insights gained from a DexCom G4 PLATINUM professional session to adjust therapy and to educate and motivate patients to modify their behavior after viewing the effects that specific foods, exercise, stress, and medications have on their glucose levels. On January 23, 2015, we received approval from the FDA for the DexCom G4 PLATINUM with Share, which is designed for up to seven days of continuous use, and we began commercializing this product in the U.S. in the first quarter of 2015. The DexCom G4 PLATINUM with Share remote monitoring system uses a secure wireless connection between a patient's receiver and an app on the patient's iPhone®, iPod touch®, or iPad® mobile digital device to transmit glucose information to apps on the mobile devices of up to five designated recipients, or "followers," who can remotely monitor a patient's glucose information and receive alert notifications anywhere they have an Internet or cellular connection. Unless the context requires otherwise, the term "G4 PLATINUM" shall refer to the DexCom G4 and DexCom G4 PLATINUM systems (and all associated indications of use for such systems, including without limitation, associated DexCom Share System functionalities) that are commercialized by us in and outside of the United States.

As compared to the SEVEN PLUS, the G4 PLATINUM offers:

| |

• | an improved sensor wire design that allows more scalable manufacturing, |

| |

• | a smaller, sleeker receiver that is capable of displaying data in color, |

| |

• | a new transmitter design that offers improved communication range with the receiver which allows for improved data capture, |

| |

• | additional user interface and algorithm enhancements that are intended to make the user experience more customizable and to make its glucose monitoring function more accurate especially in the hypoglycemic range, |

| |

• | the ability to market and sell to an expanded customer population due to the approval by the FDA of, and our obtaining a CE Mark for, a Pediatric Indication, and |

| |

• | DexCom Share remote monitoring capabilities. |

In February 2015, we filed our submission for FDA approval of the DexCom G5® Mobile Continuous Glucose Monitoring System (the "G5 Mobile"). The G5 Mobile is designed to allow our transmitter to run the algorithm that has historically run on the receiver, and to communicate directly to a patient's iPhone, iPod touch, or iPad mobile digital device to utilize DexCom Share System functionality. The G5 Mobile transmitter has a labeled useful life of three months. On August 25, 2015, we announced that we had received approval from the FDA for the G5 Mobile for use by both adults and children as young as 2 years of age, and we began commercializing this product in the third quarter of 2015.

DexCom SHARE®

On October 17, 2014, we received approval from the FDA for the DexCom SHARE remote monitoring system. DexCom SHARE enables users of our G4 PLATINUM System to have their sensor glucose information remotely monitored by their family or friends. To use DexCom SHARE, the G4 PLATINUM user docks their G4 PLATINUM Receiver in the DexCom SHARE Cradle and their sensor glucose information is wirelessly transmitted to, and viewed by, such patient’s friends or family through the DexCom SHARE mobile application. DexCom SHARE provides secondary notifications to individuals designated by a G4 PLATINUM System user and does not replace real time continuous glucose monitoring or standard home blood glucose monitoring.

On January 23, 2015, the FDA approved a version of the G4 PLATINUM Receiver that includes the DexCom Share System. The G4 PLATINUM Receiver with Share remote monitoring system uses a secure wireless connection via Bluetooth Low Energy ("BLE") between a patient's receiver and a mobile application on the patient's iPhone, iPod touch, or iPad mobile digital device to transmit glucose information to mobile applications on the mobile devices of up to five designated recipients, or "followers," without the need to use the DexCom SHARE Cradle component. The mobile applications that comprise the DexCom Share System were classified by the FDA as Class II, exempt, due to the fact that these mobile applications were secondary displays of the associated G4 PLATINUM Receiver. With the mobile applications classified as Class II, exempt, DexCom must comply with certain general and special controls required by the FDA but does not need prior FDA approval to commercialize changes to the DexCom Share System. We began commercialization of the G4 PLATINUM with Share in the first quarter of 2015 and discontinued the DexCom SHARE Cradle. Effective April 24, 2015, our DexCom Share System also supports the Apple WatchTM, allowing the Apple Watch to utilize DexCom Share System functionality. Effective June 2, 2015, the mobile application for the Share System followers became available for Android devices.

In-Hospital Product Line: GlucoClear®

To address the in-hospital critical care patient population, we entered into an exclusive agreement with Edwards in 2008 to develop jointly and market a specific glucose monitoring product platform for the in-hospital critical care market. On October 30, 2009, the first generation blood-based in-vivo automated glucose monitoring system, which was branded the GlucoClear, received CE Mark approval for use by healthcare providers in the hospital. In January 2013, Edwards received CE Mark approval for the second generation system. A very limited commercial launch of the first generation GlucoClear system was initiated in Europe in 2009. In 2013, Edwards completed another very limited commercial launch in Europe of the second generation GlucoClear system. In 2014, Edwards announced that it was likely to cease the commercialization of the GlucoClear system.

SweetSpot

Through our acquisition of SweetSpot in 2012, we have a software platform that enables our customers to aggregate and analyze data from certain diabetes devices and to share it with their healthcare providers. In November 2011, SweetSpot received 510(k) clearance from the FDA to market to clinics its initial cloud based data management service, which helps healthcare providers and patients see, understand and use blood glucose meter data to diagnose and manage diabetes. SweetSpot has also developed a data transfer service that is registered with the FDA as a Medical Device Data System (“MDDS”). This data transfer service allows researchers to control the transfer of data from certain diabetes devices to research tools and databases according to their own research workflows.

Sensor Augmented Insulin Pumps

We are leveraging our technology platform to enhance the capabilities of our current products and to develop additional continuous glucose monitoring products. In 2008 and 2012, we entered into development agreements with Animas Corporation (“Animas”), a subsidiary of Johnson & Johnson, and with Tandem, respectively. The purpose of each of these development relationships is to integrate our technology into the insulin pump product offerings of the respective partner, enabling the partner's insulin pump to receive glucose readings from our transmitter and display this information on the pump's screen. The Animas insulin pump product augmented with our sensor technology has been branded the Vibe®, and received CE Mark approval in May 2011, which allows Animas to market the Vibe in the countries that recognize CE Mark approvals. In December 2014, Animas received FDA approval for the VIBE system in the United States and began commercializing this product in the first quarter of 2015. In July 2014, Tandem filed their submission for FDA approval of their CGM-enabled insulin pump in the United States.

CORPORATE INFORMATION

We were incorporated in Delaware in May 1999. Our principal offices are located at 6340 Sequence Drive, San Diego, California 92121, and our telephone number is (858) 200-0200. Our common stock trades on The NASDAQ Global Select Market under the symbol “DXCM.” Our website address is www.dexcom.com. The information found on, or accessible through, our website is not a part of this prospectus. References in this prospectus to our website are inactive textual references only.

DexCom, the DexCom logo, SEVEN, DexCom G4 and DexCom SHARE are registered U.S. trademarks owned by DexCom, and DexCom G5 has a pending U.S. trademark registration application. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

THE OFFERING

|

| |

| |

Common stock offered by us | 404,591 shares |

| |

Use of proceeds | The principal purpose of this offering is to register shares of our common stock that are issuable to GLS pursuant to the Collaboration Agreement. We will not receive any proceeds from the sale of the shares. See the section entitled “Use of Proceeds” for additional information. |

| |

Risk factors | Investing in our common stock involves risks. You should carefully consider the risks described under “Risk Factors” beginning on page 5 of this prospectus, as well as other information contained or incorporated by reference in this prospectus before making a decision to invest in our securities. |

| |

NASDAQ symbol | “DXCM” |

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described in, and incorporated by this reference into, this prospectus, including the information provided under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, as well as in our subsequent filings with the SEC. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties of which we are currently unaware, or that we currently believe to be immaterial, may also become important factors that materially and adversely affect our business. If any of these risks actually occurs, our business operations, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the market price of the shares of our common stock could decline and you may lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and documents incorporated herein by reference contain or incorporate by reference forward-looking statements that involve risks and uncertainties. All statements other than statements of historical fact contained in this prospectus or any documents incorporated by reference in this prospectus, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should” or “will” or the negative of these terms or other comparable terminology.

We have based these forward-looking statements largely upon our current expectations, estimates and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These statements reflect our beliefs and certain assumptions based upon information made available to us at the time of this prospectus or the time of the documents incorporated by reference. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus or any documents incorporated by reference in this prospectus. Our actual results and the timing of events could differ materially from those anticipated in our forward-looking statements as a result of many factors, including product performance, a lack of acceptance in the marketplace by physicians and patients, the inability to manufacture products in commercial quantities at an acceptable cost, possible delays in our research and development programs, the inability of patients to receive reimbursements from third-party payors, inadequate financial and other resources, global economic conditions, and the other risks outlined under “Risk Factors” or elsewhere in this prospectus or any documents incorporated by reference in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment; new risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” or elsewhere in this prospectus could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this prospectus to conform our statements to actual results or changed expectations. You are advised to consult any additional disclosures we make in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC. See “Where You Can Find More Information” on page 7.

DESCRIPTION OF COLLABORATON AND LICENCE AGREEMENT AND COMMON STOCK PURCHASE AGREEMENT

On August 10, 2015, we entered into a Collaboration and License Agreement with Google Life Sciences LLC, or GLS, and on August 27, 2015 we entered into a Common Stock Purchase Agreement with GLS, as contemplated by the Collaboration and License Agreement. We refer to these agreements as the Collaboration Agreement. Pursuant to the Collaboration Agreement, we and GLS agreed to jointly develop a series of next-generation continuous glucose monitoring products. Under the terms of the Collaboration Agreement, we have agreed to pay GLS an upfront fee of $35,000,000 in cash or in shares of our common stock, at our sole election. We have elected to make the payment in shares of our common stock, equal to 404,591 shares, which number of shares was calculated based on the volume weighted average trading price during a period of twenty consecutive trading days ending prior to the date of the Collaboration Agreement, which amounts to $86.51 per share.

In addition, pursuant to the Collaboration Agreement, we will pay GLS up to $65,000,000 in additional milestone payments upon achievement of various development and regulatory objectives, which payments may be paid in cash or shares of our common stock at our sole election. If we elect to pay the milestone payments in shares, the number of shares will be calculated based on the volume weighted average trading price during a period of twenty consecutive trading days ending on the trading day prior to the date on which the applicable objective has been achieved. Any such shares will be issued pursuant to the Common Stock Purchase Agreement, which contains, among other things, closing procedures for issuing the shares, certain representations and warranties of the parties, and conditions to closing consistent with the Collaboration and License Agreement.

Unless we attain product sales subject to the Collaboration Agreement in excess of $750,000,000 per calendar year, we will not owe a royalty payment to GLS. Above this range, and upon marketing approval of the initial product contemplated by the Collaboration Agreement, or upon commercialization of any other of our product that incorporates GLS intellectual property, we will pay a royalty percentage to GLS starting in the high single digits and declining to the mid-single digits based on our aggregate annual product sales

The Collaboration Agreement provides us with an exclusive license to use certain intellectual property of GLS related to the development, manufacture and commercialization of the products contemplated under the Collaboration Agreement.

The Collaboration Agreement provides for the establishment of a joint steering committee to oversee and coordinate the parties’ activities under the Collaboration Agreement. We and GLS have agreed to make committee decisions by consensus.

The Collaboration Agreement is terminable by either party (a) upon uncured material breach of the Collaboration Agreement by the other party, (b) if the second product contemplated by the Collaboration Agreement has not been submitted to the FDA for approval by a specified date and (c) if the annual net sales for the products developed with GLS under the Collaboration Agreement are less than a specified aggregate dollar amount. Additionally, we have the right to terminate the Collaboration Agreement upon the expiration of the last to expire patent that covers a product developed under the Collaboration Agreement.

Either party may assign the Collaboration Agreement, without the written consent of the other party, to an affiliate or to an entity that acquires all or substantially all of the business or assets of such party (whether by merger, reorganization, acquisition, sale or otherwise), and agrees in writing to be bound by the terms and conditions of the Collaboration Agreement.

USE OF PROCEEDS

As set forth under “Description of Collaboration and License Agreement and Common Stock Purchase Agreement“, we entered into the Collaboration Agreement with GLS. Pursuant to the Collaboration Agreement, we

and GLS have agreed to jointly develop a series of next-generation continuous glucose monitoring products. We elected to pay GLS an upfront fee of $35,000,000 in shares of our common stock, equal to 404,591 shares, The purpose of this offering is to register the shares immediately upon issuance.

We will not receive any proceeds from the sale of the shares of common stock covered by this prospectus. We have agreed to pay all costs relating to the registration of the shares of our common stock covered by this prospectus.

PLAN OF DISTRIBUTION

Subject to the terms and conditions of the Collaboration Agreement, GLS has agreed to purchase, and we have agreed to sell, an aggregate of 404,591 shares of our common stock. We determined the price per share of the common stock through negotiations with GLS. No party has acted as an underwriter or placement agent in connection with the transaction.

The shares of common stock sold in this offering will be listed on the NASDAQ Global Select Market. The shares of common stock will be delivered only in book-entry form through The Depository Trust Company, New York, New York on or about August 27, 2015.

The expenses directly related to this offering are estimated to be approximately $73,907 and will be paid by us. Expenses of the offering include our SEC registration fee, legal and accounting fees and expenses and transfer agent fees.

LEGAL MATTERS

The validity of the securities offered under this prospectus will be passed upon for us by Fenwick & West LLP, Mountain View, California.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements and schedule included in our Annual Report on Form 10-K for the year ended December 31, 2014, and the effectiveness of our internal control over financial reporting as of December 31, 2014, as set forth in their reports, which are incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements and schedule are incorporated by reference in reliance on Ernst & Young LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. We are required to file electronic versions of these documents with the SEC. Our reports, proxy statements and other information can be inspected and copied at prescribed rates at the Public Reference Room of the SEC located at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. The SEC also maintains a website that contains reports, proxy and information statements and other information, including electronic versions of our filings. The website address is http://www.sec.gov. Our SEC filings are also available free of charge at our website at http://www.dexcom.com, as soon as reasonably practicable after we electronically file them with or furnish them to the SEC. Information contained on our web site is not part of this prospectus or our other filings with the SEC. References to our website address in this prospectus are inactive textual references only.

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the common stock offered with this prospectus. This prospectus does not contain all of the information in the registration statement, parts of which we have omitted, as allowed under the rules and regulations of the SEC. You should refer to the registration statement for further information with respect to us and the common stock. Copies of the registration statement, including exhibits, may be inspected without charge at the SEC’s Public Reference Room and on the SEC’s website at the addresses set forth above.

You should note that where we summarize in this prospectus the material terms of any contract, agreement or other document filed as an exhibit to the registration statement, the summary information provided in this prospectus is less complete than the actual contract, agreement or document. You should refer to the exhibits to the registration statement for copies of the actual contract, agreement or document.

INCORPORATION OF DOCUMENTS BY REFERENCE

This prospectus incorporates by reference some of the reports, proxy and information statements and other information that we have filed with the SEC under the Exchange Act. This means that we are disclosing important business and financial information to you by referring you to those documents. Unless expressly incorporated into this prospectus, a Current Report (or portion thereof) furnished, but not filed, on Form 8-K shall not be incorporated by reference into this prospectus. We incorporate by reference the documents listed below and any future filings made with the SEC under sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until all of the securities offered by this prospectus are sold.

| |

• | our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed on February 25, 2015; |

| |

• | our Proxy Statement on Schedule 14A for our 2015 Annual Meeting of Stockholders, filed on April 13, 2015; |

| |

• | our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015, filed on April 29, 2015; |

| |

• | our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 5, 2015; and |

| |

• | our Current Reports on Form 8-K, filed on February 25, 2015, June 2, 2015, and August 11, 2015. |

Any statements made in a document incorporated by reference in this prospectus are deemed to be modified or superseded for purposes of this prospectus to the extent that a statement in this prospectus or in any other subsequently filed document, which is also incorporated by reference, modifies or supersedes the statement. Any statement made in this prospectus is deemed to be modified or superseded to the extent a statement in any subsequently filed document, which is incorporated by reference in this prospectus, modifies or supersedes such statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

The information relating to us contained in this prospectus should be read together with the information in the documents incorporated by reference. In addition, certain information, including financial information, contained in this prospectus or incorporated by reference in this prospectus should be read in conjunction with documents we have filed with the SEC.

We will provide to each person, including any beneficial holder, to whom a prospectus is delivered, at no cost, upon written or oral request, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. Requests for documents should be directed to John Lister, DexCom, Inc., 6340 Sequence Drive, San Diego, California 92121, telephone number (858) 200-0200. Exhibits to these filings will not be sent unless those exhibits have been specifically incorporated by reference in such filings.

404,591 Shares of Common Stock

PROSPECTUS

August 27, 2015

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the estimated costs and expenses payable by us in connection with the offer and sale of the securities being registered hereunder. All amounts shown are estimates, except for the SEC registration fee.

|

| | | |

SEC registration fee | $ | 3,807 |

|

Accounting fees and expenses | 20,000 |

|

Legal fees and expenses | 50,000 |

|

Transfer agent fees and expenses | 100 |

|

Total | $ | 73,907 |

|

| |

Item 15. | Indemnification of Directors and Officers |

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities (including reimbursement for expenses incurred) arising under the Securities Act.

As permitted by the Delaware General Corporation Law, the Registrant’s restated certificate of incorporation includes a provision that eliminates the personal liability of its directors for monetary damages for breach of fiduciary duty as a director, except for liability:

| |

• | for any breach of the director’s duty of loyalty to the Registrant or its stockholders, |

| |

• | for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, |

| |

• | under section 174 of the Delaware General Corporation Law (regarding unlawful dividends and stock purchases), or |

| |

• | for any transaction from which the director derived an improper personal benefit. |

As permitted by the Delaware General Corporation Law, the Registrant’s restated bylaws provide that:

| |

• | the Registrant is required to indemnify its directors and officers to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions, |

| |

• | the Registrant may indemnify its other employees and agents as set forth in the Delaware General Corporation Law, |

| |

• | the Registrant is required to advance expenses, as incurred, to its directors and officers in connection with a legal proceeding to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions, and |

| |

• | the rights conferred in the bylaws are not exclusive. |

The Registrant has entered into Indemnification Agreements with its directors and officers to provide such directors and officers additional contractual assurances regarding the scope of the indemnification set forth in the Registrant’s restated certificate of incorporation and restated bylaws and to provide additional procedural protections. At present, there is no pending litigation or proceeding involving a director, officer or employee of the Registrant regarding which indemnification is sought, nor is the Registrant aware of any threatened litigation that may result in claims for indemnification by any executive officer or director.

The Registrant has directors’ and officers’ liability insurance for securities matters.

See also the undertakings set out in response to Item 17 hereof.

Item 16. Exhibits

A list of exhibits filed with this registration statement on Form S-3 is set forth on the Exhibit Index and is incorporated herein by reference.

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or any decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of the registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated

or deemed incorporated by reference into the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Diego, State of California, on the 27th day of August, 2015.

|

| | |

| | |

DEXCOM, INC. |

| |

By: | | /s/ Kevin Sayer |

| | Kevin Sayer |

| | President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below constitutes and appoints Kevin Sayer and Jess Roper, and each of them, or his true and lawful attorneys-in-fact and agents with full power of substitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post- effective amendments) to this Registration Statement on Form S-3, and to file the same, with all exhibits thereto and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done with respect to this Registration Statement, including post-effective amendments, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his or their substitute or substitutes, may lawfully do or cause to be done or by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

| | |

Name | Title | Date |

Principal Executive Officer and Director: | | |

/s/ Kevin Sayer | President, Chief Executive Officer and Director | August 27, 2015 |

Kevin Sayer | | |

| | |

Principal Financial Officer and Principal Accounting Officer: | | |

/s/ Jess Roper | Senior Vice President and Chief Financial Officer | August 27, 2015 |

Jess Roper | | |

Additional Directors: | | |

/s/ Terrance H. Gregg | Executive Chairman of the Board of Directors | August 27, 2015 |

Terrance H. Gregg | | |

| | |

/s/ Jonathan Lord | Lead Independent Director | August 27, 2015 |

Jonathan Lord, M.D. | | |

| | |

/s/ Steven R. Altman | Director | August 27, 2015 |

Steven R. Altman | | |

| | |

/s/ Nicholas Augustinos | Director | August 27, 2015 |

Nicholas Augustinos | | |

| | |

/s/ Mark Foletta | Director | August 27, 2015 |

Mark Foletta | | |

| | |

/s/ Barbara Kahn | Director | August 27, 2015 |

Barbara Kahn | | |

| | |

/s/ Jay Skyler | Director | August 27, 2015 |

Jay Skyler, M.D. | | |

| | |

/s/ Eric Topol | Director | August 27, 2015 |

Eric Topol, M.D. | | |

EXHIBIT INDEX

|

| | | | | | |

| | Incorporated by Reference | |

Exhibit Number | Exhibit Document | Form | File No. | Date of First Filing | Exhibit Number | Provided Herewith |

3.01 | Registrant’s Restated Certificate of Incorporation. | S-1/A | 333-122454 | March 3, 2005 | 3.03 | |

3.02 | Registrant’s Amended and Restated Bylaws. | 8-K | 000-51222 | March 23, 2011 | 99.01 | |

4.01 | Form of Specimen Certificate for Registrant’s common stock. | S-1/A | 333-122454 | March 24, 2005 | 4.01 | |

4.02 | Common Stock Purchase Agreement dated August 27, 2015 by and between DexCom, Inc. and Google Life Sciences, LLC. | | | | | X |

5.01 | Opinion of Fenwick & West LLP regarding legality of the securities being registered. | | | | | X |

23.01 | Consent of Fenwick & West LLP (included in Exhibit 5.01). | | | | | X |

23.02 | Consent of Independent Registered Public Accounting Firm. | | | | | X |

24.01 | Power of Attorney (see page II-5 of this registration statement). | | | | | X |

Exhibit 4.02

THE ISSUER MAY FILE A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND OTHER DOCUMENTS THE ISSUER HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT THE ISSUER AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT www.sec.gov. ALTERNATIVELY, THE COMPANY WILL ARRANGE TO SEND YOU THE PROSPECTUS AFTER FILING IF YOU REQUEST IT BY CALLING TOLL FREE 1-888-738-3646. YOU MAY ALSO REQUEST A COPY TO BE SENT TO YOU THROUGH OUR WEBSITE AT http://investor.shareholder.com/dexcom/investorkit.cfm.

COMMON STOCK PURCHASE AGREEMENT

This COMMON STOCK PURCHASE AGREEMENT (“Agreement”) is made as of August 27, 2015, by and between DexCom, Inc., a Delaware corporation (the “Company”) and Google Life Sciences LLC (“GLS”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Collaboration and License Agreement (as defined below).

RECITALS

WHEREAS, the Company and GLS are parties to that certain Collaboration and License Agreement (the “Collaboration and License Agreement”) dated as of August 10, 2015 (the “CLA Effective Date”).

WHEREAS, Section 8.1 of the Collaboration and License Agreement provides that the Company shall pay to GLS, in partial consideration of the licenses granted to the Company pursuant to the Collaboration and License Agreement and GLS’s performance of its activities under the Collaboration and License Agreement, an upfront payment in the amount of Thirty-Five Million Dollars ($35,000,000) (the “Upfront Payment Amount”), payable in, at the Company’s sole election, cash or registered and freely tradable shares of the Company’s common stock, $0.001 par value per share (such shares, the “Common Stock,” and such transaction, the “Upfront Payment”); provided, that if the Company elects to pay the Upfront Payment Amount in shares of Common Stock, then (i) the Company shall issue such shares within fifteen (15) Business Days after the CLA Effective Date and (ii) the Common Stock must be registered under the Securities Act of 1933, as amended (“Securities Act”) and freely tradable at the time of issuance and valued at the VWAP ending on the trading day prior to the CLA Effective Date (the “Upfront Payment Amount VWAP Price”).

WHEREAS, Section 8.2 of the Collaboration and License Agreement provides that upon achievement of the completion of the first receipt of a Marketing Approval of the First Product (but no later than Launch) (the “First Milestone Event”) the Company shall pay to GLS an amount equal to Fifteen Million Dollars ($15,000,000) (the “First Milestone Payment Amount”), payable in, at the Company’s sole election, cash or in registered and freely tradable Common Stock (such transaction, the “First Milestone Payment”); provided, that if the Company elects to pay the First Milestone Payment in shares of Common Stock, then, subject to the terms of the Collaboration and License Agreement, it shall issue such shares within thirty (30) days following the First Milestone Event; provided, further, that such Common Stock must be registered and freely tradable at the time of issuance and shall be valued at the VWAP ending on the trading day prior to the date of the achievement of the First Milestone Event (the “First Milestone Event VWAP Price”).

WHEREAS, Section 8.2 of the Collaboration and License Agreement provides, further, that upon achievement of the completion of the first receipt of a Marketing Approval of the Second Product (the “Second Milestone Event”) the Company shall pay to GLS an amount equal to Fifty Million Dollars ($50,000,000) (the “Second Milestone Payment Amount” and, together with the Upfront Payment Amount and the First Milestone Payment Amount, each, a “Payment Amount”),

payable in, at the Company’s sole election, cash or in registered and freely tradable Common Stock (such transaction, the “Second Milestone Payment”); provided, that if the Company elects to pay the Second Milestone Payment in shares of Common Stock, then, subject to the terms of the Collaboration and License Agreement, it shall issue such shares within thirty (30) days following the Second Milestone Event; provided, further, that such Common Stock must be registered and freely tradable at the time of issuance and shall be valued at the VWAP ending on the trading day prior to the date of the achievement of the Second Milestone Event (the “Second Milestone Event VWAP Price”).

AGREEMENT

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1.1. Upfront Closing. Pursuant to Section 8.1 of the Collaboration and License Agreement, the Company hereby elects to pay the Upfront Payment Amount to GLS through the issuance to GLS of that number of shares of Common Stock (the “Upfront Shares”) equal to the number of shares determined by dividing the Upfront Payment Amount by the Upfront Payment Amount VWAP Price (rounded down to the nearest whole share) within fifteen (15) Business Days following the CLA Effective Date. The Company will provide written notice to GLS as soon as reasonably practicable following the Upfront Shares being registered under the Securities Act and available for issuance to GLS (such notice, the “Registration Notice”). The issuance of the Upfront Shares shall be in consideration for GLS entering into the Collaboration and License Agreement and the Upfront Shares must be duly and validly issued, fully paid, nonassessable, registered and freely tradable at the time of the issuance of the Upfront Shares to GLS. The Upfront Shares shall be uncertificated and shall be registered in GLS’s name on the books of the Company by the Company’s transfer agent (unless otherwise instructed by GLS in writing). The closing of the sale and purchase of the Upfront Shares (the “Upfront Closing”) will take place remotely via the exchange of documents and signatures after the satisfaction or waiver of each of the conditions set forth in Section 4 (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the fulfillment or waiver of those conditions) within fifteen (15) Business Days of the CLA Effective Date.

1.1. First Milestone Closing. In the event that the Company elects to pay the First Milestone Payment Amount by issuing Common Stock to GLS pursuant to Section 8.2.2 of the Collaboration and License Agreement, the Company shall provide written notice of such election to GLS within two (2) Business Days following achievement of the First Milestone Event (a “First Milestone Stock Payment Election”). In the event that the Company makes a First Milestone Stock Payment Election, then, within thirty (30) days following the achievement of the First Milestone Event, the Company shall issue to GLS that number of shares of registered and freely tradable Common Stock (the “First Milestone Shares”) equal to the number of shares determined by dividing the First Milestone Payment Amount by the First Milestone Event VWAP Price (rounded down to the nearest whole share) (the “First Milestone Closing”). The issuance of the First Milestone Shares to GLS by the Company shall be in consideration of GLS’s prior performance of its obligations under the Collaboration and License Agreement and the First Milestone Shares must be duly and

validly issued, fully paid, nonassessable, registered and freely tradable at the time of the delivery of the First Milestone Shares to GLS. The First Milestone Shares shall be uncertificated and shall be registered in GLS’s name on the books of the Company by the Company’s transfer agent (unless otherwise instructed by GLS in writing). The First Milestone Closing, if applicable, will take place remotely via the exchange of documents and signatures after the satisfaction or waiver of each of the conditions set forth in Section 4 (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the fulfillment or waiver of those conditions) and must occur, if at all, within thirty (30) days following achievement of the First Milestone Event.

1.2. Second Milestone Closing. In the event that the Company elects to pay the Second Milestone Payment Amount by issuing Common Stock to GLS pursuant to Section 8.2.2 of the Collaboration and License Agreement, the Company shall provide written notice of such election to GLS within two (2) Business Days following achievement of the Second Milestone Event (a “Second Milestone Stock Payment Election”). In the event that the Company makes a Second Milestone Stock Payment Election, then, within thirty (30) Business Days of achievement of the Second Milestone Event, the Company shall issue to GLS that number of shares of Common Stock (the “Second Milestone Shares” and, together with the Upfront Shares and the First Milestone Shares, the “Shares”) equal to the number of shares determined by dividing the Second Milestone Payment Amount by the Second Milestone Event VWAP Price (rounded down to the nearest whole share) (the “Second Milestone Closing” and, together with the Upfront Closing and the First Milestone Closing, each, a “Closing”). The issuance of the Second Milestone Shares to GLS by the Company shall be in consideration of GLS’s prior performance of its obligations under the Collaboration and License Agreement and the Second Milestone Shares must be duly and validly issued, fully paid, nonassessable, registered and freely tradable by the delivery of the Shares. The Second Milestone Shares shall be uncertificated and shall be registered in GLS’s name on the books of the Company by the Company’s transfer agent (unless otherwise instructed by GLS in writing). The Second Milestone Closing, if applicable, will take place remotely via the exchange of documents and signatures after the satisfaction or waiver of each of the conditions set forth in Section 4 (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the fulfillment or waiver of those conditions) and must occur, if at all, within thirty (30) days following achievement of the Second Milestone Event.

1.3. Obligations and Remedies; Issuance to Affiliates. Notwithstanding anything contained in this Section 1, nothing in this Agreement shall limit the Company’s or GLS’s rights, obligations or remedies under the Collaboration and License Agreement. If instructed by GLS in writing, the Company shall issue any Shares issuable pursuant to this Agreement and the Collaboration Agreement to any GLS Affiliate.

2. Representations and Warranties of the Company. The Company hereby represents and warrants to GLS that the following representations are true and correct as of the date hereof (except to the extent any such representations and warranties expressly relate to an earlier date, in which case such representations and warranties are true and correct as of such earlier date).

2.1. Organization, Valid Existence and Qualification. The Company is a corporation duly organized and validly existing under the laws of the State of Delaware and has all requisite corporate power and authority to carry on its business as currently conducted. The Company is duly qualified to transact business as a foreign corporation in each jurisdiction in which it conducts its business, except where failure to be so qualified could not reasonably be expected to result, either

individually or in the aggregate, in a material adverse effect on the Company’s financial condition, business or operations.

2.2. Authorization. All corporate action on the part of the Company, its officers, directors and shareholders necessary for (i) the authorization, execution and delivery of this Agreement; (ii) the performance of all obligations of the Company hereunder; and (iii) the authorization, issuance, sale and delivery of the Shares has been taken or, in the case of the preceding clause (iii), will be taken prior to the applicable Closing, and this Agreement constitutes the valid and legally binding obligation of the Company, enforceable in accordance with its terms, except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally and (b) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies.

2.3. Valid Issuance of Registered Shares. The Shares that are being issued to GLS by the Company hereunder, when issued, sold and delivered in accordance with the terms of this Agreement for the consideration expressed herein, will be duly and validly issued, fully paid, nonassessable, registered under the Securities Act and freely tradable and will be issued to GLS free of liens, encumbrances and restrictions on transfer, other than any liens, encumbrances or restrictions on transfer that are created or imposed by GLS.

2.4. Non-Contravention. No consent, approval, order or authorization of, or registration, qualification, designation, declaration or filing with, any federal, state or local governmental authority on the part of the Company is required in connection with the consummation of the issuance of the Shares contemplated by this Agreement, except for the filing of a registration statement with the Securities and Exchange Commission (the “SEC”) prior to the applicable Closing covering the shares of Common Stock issued to GLS hereunder in such Closing. The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby will not (x) violate any provision of the organizational documents of the Company or (y) result in any violation of, or constitute, with or without the passage of time and giving of notice, either (i) a default in any material respect of any contract, agreement, instrument, judgment, order, writ or decree or (ii) an event that results in the creation of any lien, charge or encumbrance upon any assets of the Company or the suspension, revocation, impairment, forfeiture or nonrenewal of any material contract, agreement, order, instrument, indenture, permit, license, authorization or approval applicable to the Company.

2.5. SEC Compliance. The Company is in compliance in all material respects with all of its filing requirements under the Securities Exchange Act of 1934, as amended, and all of the rules and regulations promulgated thereunder (the “Exchange Act”) and the documents filed with the SEC during the twelve month period prior to the Upfront Closing (the “SEC Documents”) comply in all material respects with the requirements of the Exchange Act and the rules and regulations of the SEC thereunder. As of their respective filing dates, none of the SEC Documents contained any untrue statement of material fact or omitted a material fact required to be stated therein or necessary in order to make the statement therein, in the light of the circumstances under which they were made, not misleading.

2.6. Reporting Company; Form S‑3. The Company is not an “ineligible issuer” (as defined in Rule 405 promulgated under the Securities Act) and is eligible to register the Shares on a registration statement on Form S-3 under the Securities Act. To the Company’s

knowledge, there exist no facts or circumstances (including without limitation any required approvals or waivers or any circumstances that may delay or prevent the obtaining of accountant’s consents) that reasonably could be expected to prohibit or delay the preparation and filing of a registration statement on Form S‑3.

2.7. NASDAQ. Immediately prior to the Upfront Closing, the Company’s Common Stock is listed on the NASDAQ Global Select Market and there are no proceedings to revoke or suspend such listing.

3. Representations and Warranties of the GLS. GLS hereby represents and warrants to the Company that the following representations are true and correct as of the date hereof and as of the applicable Closing (except to the extent any such representations and warranties expressly relate to an earlier date, in which case such representations and warranties are true and correct as of such earlier date):

3.1. Authorization. GLS has all requisite power and authority to enter into this Agreement, and such agreement constitutes its valid and legally binding obligation, enforceable in accordance with its terms except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally and (b) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies.

4. Conditions to GLS’s Obligations at Closing. The obligations of GLS at each Closing are subject to the fulfillment, on or by the applicable Closing, of each of the following conditions, any of which may be waived, in writing, exclusively by GLS.

4.1. Representations and Warranties. Each of the representations and warranties of the Company contained in Section 2 shall have been true and accurate when made and shall be true and correct on and as of the applicable Closing with the same force and effect as if they had been made at such Closing.

4.2. Performance. The Company shall have performed and complied in all material respects with all agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by it on or before the applicable Closing and shall have obtained all approvals, consents and qualifications necessary to complete the purchase and sale described herein at such Closing.

4.3. Registration. The Shares issuable in each Closing shall have been registered under the Securities Act and shall be freely tradable by GLS at the time such Shares are issued to GLS in such Closing.

4.4. Officer’s Certificate. At each Closing, an authorized officer of the Company shall have delivered to GLS a certificate in the form attached here as Exhibit A, certifying that the conditions specified in Sections 4.1, 4.2 and 4.3 have been fulfilled and, with respect to the First Milestone Closing or Second Milestone Closing, setting forth the VWAP calculation and the number of shares of Common Stock to be issued at such First Milestone Closing or Second Milestone Closing, as applicable.

4.5. Qualifications. All authorizations, approvals or permits, if any, of any governmental authority or regulatory body of the United States or of any state that are required in connection with the lawful issuance of the Shares pursuant to this Agreement shall have been duly obtained and effective as of the applicable Closing. The Company shall have obtained any and all consents and waivers necessary for the consummation of the transactions contemplated by this Agreement.

4.6. No Injunction. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court, governmental authority or regulatory body of competent jurisdiction which prohibits the consummation of any of the transactions contemplated by this Agreement.

4.7. No Proceedings or Litigation. No action, suit or proceeding before any court, arbitrator or any governmental authority or regulatory body shall have been commenced, and no investigation by any governmental authority or regulatory body shall have been threatened, against the Company or any of the officers, directors or affiliates of the Company, seeking to restrain, prevent or change the transactions contemplated by this Agreement, or seeking damages in connection with such transactions.

4.8. SEC Compliance. With respect to the First Milestone Closing and the Second Milestone Closing, the documents filed with the SEC during the period following the Upfront Closing and prior to the First Milestone Closing or the Second Milestone Closing (as applicable) shall comply in all material respects with the requirements of the Exchange Act and the rules and regulations of the SEC thereunder.

4.9. NASDAQ. Immediately prior to each Closing, the Company’s Common Stock shall be listed on the NASDAQ Global Select Market and there shall be no proceedings to revoke or suspend such listing.

5. Conditions to the Company’s Obligations at Closing. The obligations of the Company to GLS at each Closing are subject to the fulfillment, on or by the applicable Closing, of each of the following conditions, any of which may be waived, in writing, exclusively by the Company.

5.1. Representations and Warranties. The representations and warranties of GLS contained in Section 3 shall have been true and correct when made and shall be true and accurate in all respects on and as of the applicable Closing with the same force and effect as if they had been made at such Closing.

5.2. Performance. GLS shall have performed and complied in all material respects with all agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by it on or before the Closing and shall have obtained all approvals, consents and qualifications necessary to complete the purchase and sale described herein.

5.3. No Injunction. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court, governmental authority or regulatory body of competent jurisdiction which prohibits the consummation of any of the transactions contemplated by this Agreement.

5.4. No Proceedings or Litigation. No action, suit or proceeding before any court, arbitrator or any governmental authority or regulatory body shall have been commenced, and no investigation by any governmental authority or regulatory body shall have been threatened, against the Company or any of the officers, directors or affiliates of the Company, seeking to restrain, prevent or change the transactions contemplated by this Agreement, or seeking damages in connection with such transactions.

6. Miscellaneous.

6.1. Survival of Representations and Warranties. The representations and warranties of the Company and GLS contained in or made pursuant to this Agreement shall survive the execution and delivery of this Agreement and the applicable Closing, and shall in no way be affected by any investigation of the subject matter thereof made by or on behalf of GLS or the Company.

6.2. Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of California (without reference to the conflicts of law provisions thereof).

6.3. Counterparts; Facsimile Signatures. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. This Agreement may be executed and delivered by facsimile, or by email in portable document format (.pdf) and upon such delivery of the signature page by such method will be deemed to have the same effect as if the original signature had been delivered to the other parties.

6.4. Headings; Interpretation. In this Agreement, (a) the meaning of defined terms shall be equally applicable to both the singular and plural forms of the terms defined, (b) the captions and headings are used only for convenience and are not to be considered in construing or interpreting this Agreement and (c) the words “including,” “includes” and “include” shall be deemed to be followed by the words “without limitation.” All references in this Agreement to sections, paragraphs, exhibits and schedules shall, unless otherwise provided, refer to sections and paragraphs hereof and exhibits and schedules attached hereto, all of which exhibits and schedules are incorporated herein by this reference. In the event of any inconsistency between the terms of this Agreement and those contained in the Collaboration and License Agreement, unless otherwise mutually agreed to in writing by GLS and the Company, the terms of the Collaboration and License Agreement shall govern.

6.5. Notices. Any and all notices required or permitted to be given to a party pursuant to the provisions of this Agreement must be made in compliance with and subject to the terms and conditions set forth in Section 14.3 of the Collaboration and License Agreement.

6.6. Amendments and Waivers. Any term of this Agreement may be amended and the observance of any term of this Agreement may be waived (either generally or in a particular instance and either retroactively or prospectively), only with the written consent of the Company and GLS. Any amendment or waiver effected in accordance with this Section 6.6 shall be binding upon GLS and the Company. No delay or failure to require performance of any provision of this Agreement shall constitute a waiver of that provision as to that or any other instance. No waiver

granted under this Agreement as to any one provision herein shall constitute a subsequent waiver of such provision or of any other provision herein, nor shall it constitute the waiver of any performance other than the actual performance specifically waived.

6.7. Severability. If any provision of this Agreement is determined by any court or arbitrator of competent jurisdiction to be invalid, illegal or unenforceable in any respect, such provision will be enforced to the maximum extent possible given the intent of the parties hereto. If such clause or provision cannot be so enforced, such provision shall be stricken from this Agreement and the remainder of this Agreement shall be enforced as if such invalid, illegal or unenforceable clause or provision had (to the extent not enforceable) never been contained in this Agreement.

6.8. Entire Agreement. This Agreement, together with the Collaboration and License Agreement and all exhibits and schedules hereto and thereto, constitute the entire agreement and understanding of the parties with respect to the subject matter hereof and supersede any and all prior negotiations, correspondence, agreements, understandings duties, or obligations, whether oral or written, between or among the parties hereto with respect to the specific subject matter hereof.

6.9. Third Parties. Nothing in this Agreement, express or implied, is intended to confer upon any person, other than the parties hereto and their successors and assigns, any rights or remedies under or by reason of this Agreement.

6.10. Costs, Expenses. The Company and GLS will each bear its own expenses in connection with the preparation, execution and delivery of this Agreement.

6.11. No Finder’s Fees. GLS agrees to indemnify and to hold harmless the Company from any liability for any commission or compensation in the nature of a finder’s or broker’s fee (and any asserted liability as a result of the performance of services of any such finder or broker) for which GLS or any of its officers, partners, employees or representatives is responsible. The Company agrees to indemnify and hold harmless GLS from any liability for any commission or compensation in the nature of a finder’s or broker’s fee (and any asserted liability as a result of the performance of services by any such finder or broker) for which the Company or any of its officers, employees or representatives is responsible.