TIDMACC

RNS Number : 7013U

Access Intelligence PLC

11 April 2016

11 April 2016

ACCESS INTELLIGENCE PLC

("Access Intelligence", "the Company" or "the Group")

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 NOVEMBER 2015

Access Intelligence Plc (AIM: ACC), a leading supplier of

Software-as-a-Service (SaaS) solutions for reputation and

operational risk management, announces its unaudited results for

the year ended 30 November 2015.

Highlights

-- Strategic M&A activity has strengthened the Group's portfolio of core products and services

-- Group revenue from continuing operations at year end up by 89% to GBP8.1m from GBP4.3m

-- Recurring revenue from continuing operations up by 99% to GBP7.5m from GBP3.7m

-- Strategic shift in focus with increased emphasis on the

development of the reputation and risk management divisions of the

business

-- Cash balance of GBP1,523,000 (2014: GBP1,144,000)

-- Total technology spend of GBP3,448,000 (2014: GBP3,940,000)

of which GBP1,526,000 (2014: GBP1,577,000) was capitalised

Michael Jackson, Non-Executive Chairman, commented:

"I am pleased to announce the results for FY2015 in what has

been a pivotal year for Access Intelligence plc. Our strategic

M&A activities have refocussed the Group firmly in the

Reputation Management market, whilst divesting a non-core asset in

software maintenance and hosting. The EBITDA loss reflects the

substantial reorganisation costs associated with Group M&A and

research and development. Post year end, the Group also divested of

a non-core asset Due North Ltd for GBP4.5 million."

For further information:

0843 659

Access Intelligence plc 2940

Michael Jackson (Non-Executive

Chairman)

Joanna Arnold (CEO)

Daryl Paton (CFO)

Allenby Capital Limited (Nominated 020 3328

Adviser & Broker) 5656

Simon Clements / James Thomas

Forward looking statements

This announcement contains forward-looking statements.

These statements appear in a number of places in this

announcement and include statements regarding our intentions,

beliefs or current expectations concerning, among other things, our

results of operations, revenue, financial condition, liquidity,

prospects, growth, strategies, new products, the level of product

launches and the markets in which we operate.

Readers are cautioned that any such forward-looking statements

are not guarantees of future performance and involve risks and

uncertainties, and that actual results may differ materially from

those in the forward-looking statements as a result of various

factors.

These factors include any adverse change in regulations,

unforeseen operational or technical problems, the nature of the

competition that we will encounter, wider economic conditions

including economic downturns and changes in financial and equity

markets. We undertake no obligation publicly to update or revise

any forward-looking statements, except as may be required by

law.

Chairman's Statement and Strategic Report

I am pleased to announce our results for the year ended 30

November 2015.

2015 has been a pivotal year for Access Intelligence, during

which we restructured our portfolio around our reputation and risk

management software interests though a series of acquisitions and

divestments.

During the year we made a substantial acquisition of the UK

operations of Cision UK Ltd and Vocus UK Ltd. This acquisition,

combined with our existing reputation business significantly

strengthens our position in the reputation management space.

Our strategic focus on reputation and risk management software

also prompted the divestment of the software maintenance and

hosting business Willow Starcom Ltd and, more recently in 2016, the

e-procurement solution provider Due North Ltd.

Outlook

The current global political, economic and business climate

continues to reinforce the importance of effective reputation and

risk management, and, moreover, the interdependence of the two.

Organisations in both regulated and non-regulated environments

recognise the importance of bringing highly flexible, domain-driven

software and responsive business analytics to bear on building and

safeguarding reputation through both responsible, compliant

operations and effective communication. It is therefore essential

that we continue to invest in innovative research and development

to unify the position of our products in the market and to make our

software synonymous with customer success.

We are excited about the acquisition and development of the

reputation management business. The media and communications

environment has been subject to dramatic change in recent years,

and as such our software is increasingly relevant, with customers

seeking to influence multiple stakeholders in support of tangible

operational success. We expect our strengthened product suite to

drive greater market share as we build on the momentum post-

acquisition.

I would like to take this opportunity on behalf of the Board to

thank you for your continued support of Access Intelligence.

Strategic Report

Results

The 2015 financial year has been a year of significant

opportunity for the Group to restructure its operations and focus

its commitment on the SaaS business model within the reputation and

risk management sectors. This has included the strategic

acquisition of a substantial new business in June 2015 to

complement the Group's existing reputation software platform and

the divestment of a non-core IT support services business in April

2015. Prior to the year-end, the Board also made the decision to

divest a further non-core e-procurement business, with the sale

being completed in February 2016.

All companies that form part of the Group's continuing

operations saw their revenue increase year on year, with the

exception of A.I. Talent Limited. Notable revenue increases were

delivered by AITrackRecord Limited (34%) and Access Intelligence

Media & Communications Limited (19%), with total revenue from

existing continuing operations increasing by 11% to GBP4,768,000

(2014: GBP4,291,000).

In addition, the acquisition contributed revenue of GBP3,351,000

for the six month period that it formed part of the Group,

resulting in Group revenue from continuing operations increasing by

89% to GBP8,119,000 (2014: GBP4,291,000). Reported revenue for the

acquisition is not considered by the Board to be fully reflective

of the business acquired due to the requirements of acquisition

accounting (see Note 8 of the consolidated accounts for further

detail on the estimation of the fair value of deferred revenue on

acquisition).

Recurring revenue from existing continuing operations increased

by 14% to GBP4,297,000 (2014: GBP3,756,000), with the acquisition

contributing a further GBP3,189,000. As a result, total recurring

revenue from continuing operations increased significantly to

GBP7,486,000 for the year (2014: GBP3,756,000) and accounted for

92% (2014: 88%) of total revenue.

At 30 November 2015, total deferred revenue from continuing

operations stood at GBP4,643,000 (2014: GBP1,932,000) reflecting

again the impact of the acquisition in the year which added

GBP2,794,000 to deferred revenue at year end. Total Group deferred

revenue at year end stood at GBP5,264,000 (2014: GBP3,246,000).

Gross margin from existing continuing operations has remained

broadly consistent at 77% (2014: 78%). However, overall gross

profit from continuing operations has fallen to 60%, primarily as a

result of the acquisition which has higher direct costs of sales

than the existing continuing operations and short-term transition

and migration costs.

The Group has undertaken extensive and ongoing restructuring

during the year to reduce costs with the full impact of this not

being fully reflected in the 2015 financial performance. In

addition, the acquisition had immediate synergistic benefits as the

Group consolidated London offices and removed duplicated roles

although it is notable that the benefit of these synergies is also

not fully reflected in the 2015 financial performance. As a result

of the restructuring and refocusing of the business during the

year, earnings before interest, tax, depreciation and amortisation

(EBITDA) pre- impairment charges from existing continuing

operations declined to a loss of GBP1,359,000 (2014: loss

GBP696,000). The acquisition contributed a further EBITDA loss for

the period that it was part of the group of GBP379,000, resulting

in a total EBITDA loss for the year of GBP1,738,000 (2014: loss

GBP696,000).

Operating loss from continuing operations before impairments was

GBP2,523,000 (2014: loss GBP565,000), with a loss of GBP1,686,000

from existing continuing operations and a loss of GBP837,000 from

the acquisition. In arriving at the operating loss the Group has

charged GBP1,922,000 (2014: GBP2,363,000) for research and

development expenditure, GBP716,000 (2014: GBP270,000) for

depreciation and amortisation, GBP153,000 (2014: Nil) in

acquisition costs, GBP70,000 (2014: Nil) loss on disposal of fixed

assets and GBP278,000 (2014: Nil) in restructuring costs.

Development costs relating to the risk platform moved to normalised

operational levels mid-year.

2016 will see continued restructuring of the business and

investment across the Company's brands with the full benefits

expected to come through towards the end of the current financial

year and into 2017.

Loss per share

The basic loss per share from continuing operations was 1.55p

(2014: loss 0.68p). Basic earnings per share from discontinued

operations was 0.27p (2014: 0.22p).

Cash

Cash at the year-end stood at GBP1,523,000 (2014: GBP1,144,000)

whilst net debt increased to GBP2,593,000 (2014: GBP157,000) during

the year, primarily as a result of new loan notes issued to finance

the strategic acquisition.

Dividend

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

As a result of the significant investment the Company has made

in the strategic product innovation and sales development, the

directors do not propose to pay a dividend for 2015.

OPERATIONS

Software as a Service

PR, Public Affairs and Reputation Management

The landscape for Vuelio radically changed in 2015 when we

acquired the UK assets of communications software company Cision,

prompting a rebrand and refocus. The deal also immediately

increased our customer base in this space from 300 to more than

2,000. Where we previously served primarily the public sector and

FTSE 100 companies, we now have customers of all sizes in numerous

sectors, in particular, marketing, PR and digital agencies.

We have reorganised our sales and marketing operations to

support a dual focus on growth and strategic services. The addition

of trade and assets of Cision UK Ltd and Vocus UK Ltd brings

immediate scale and bolsters our growth opportunity. To underpin

this, we have built a talented team to continue delivering

solutions relevant to this evolving market. This team will target

high-value accounts, particularly through up selling and cross

selling, in key public sector and high-regulation sectors.

Access Intelligence has rapidly developed Vuelio's

communications management software platform to address the needs of

this expanded market. These changes are also aimed at supporting a

swift migration of clients from Cision and Vocus software, which is

currently underway, providing a platform for profitable growth

through further development.

Incident & Crisis Management

AIControlPoint saw a 100% client retention in 2015 but limited

revenue growth due to the downturn in the oil and gas market. We

have also helped ensure future growth by diversifying our target

markets and focusing on several new industries. Among our wins were

new clients in the transport sector, including the Manchester

Airport Group, as well as building a pipeline in the aviation,

travel and local government space.

Training, Competence and Employee Performance Management

Tightening FCA regulation has brought a focus on senior managers

and individual accountability in the financial services sector.

This provided us with an opportunity to augment AITrackRecord in

2015, empowering customers in the face of these changes. Our

improved Training and Competence system unifies competence,

performance, accountability and compliance tracking and, crucially,

provides evidence of adherence to the new regime. The updated

platform centralises all pertinent information, even digitising

legacy paper-based processes. This simplifies compliance and

significantly reduces cost.

Leading FTSE 100 wealth management firm St. James's Place was an

early adopter of the new platform. Additional customers are

targeted for switchover throughout 2016.

Strategy and Market

The M&A activity that the Group has undergone over the past

12 months has created a seismic shift in focus towards Reputation

Management. We now have an exceptional portfolio of products and

services for stakeholder engagement and reputation management

throughout the UK and Europe. As customers seek to drive a unified,

consistent engagement strategy across multiple stakeholders, they

require a comprehensive software portfolio integrated across their

communications teams. Highly regulated industries continue to

champion the embedding of best practices in good corporate

governance, risk management and effective compliance ensuring that

our product suite is well positioned to gain continued traction in

both reputation and risk management.

SaaS based solutions continue to provide companies with a

scalable, resilient and value-driven alternative to the costly

maintenance of in-house on premise solutions. Access Intelligence

continues to capitalise on the wider adoption of SaaS solutions and

services to provide tangible alternatives to customers, as well as

long term revenue visibility and stability for investors.

2016 represents a challenging year of customer migrations and

further operational restructuring to ensure the optimal platform

for growth. Our focus over the coming year will be maximising the

opportunities secured from our recent acquisition and embedding our

market share in an ever-shifting competitive landscape. As the sole

provider of a multi- faceted stakeholder engagement platform we are

well positioned to offer a truly diversified offering.

Disposal of Willow Starcom

Following the Group's decision to focus on reputation and risk

management SaaS based solutions, Access Intelligence divested

Willow Starcom Limited on 21 April 2015. Willow Starcom delivered

infrastructure support and cloud based IT services but was

considered non-core to the Group as it looked to scale its SaaS

offering. The net cash inflow received for the company amounted to

GBP1,141,000 and resulted in a profit on disposal of the company of

GBP900,000.

Disposal of Due North Limited

In line with Access Intelligence's strategy to focus on SaaS

solutions in reputation and risk management, on 3 February 2016,

the Group disposed of Due North Limited for a cash consideration of

GBP4,500,000. The decision to divest Due North was a result of the

management team's commitment to dispose of non-core businesses and

provide the Group with greater financial flexibility and value for

our shareholders

Directors and Staff

2015 has demonstrated that our core belief of building a Group

based on the expertise, experience and integrity of our

industry-leading team is delivering significant value. I would like

to thank all our staff for their hard work and commitment, which

has enabled us to recognise considerable progress during 2015 and

we expect to benefit from this in the coming years. As a Group we

have delivered growth, and I look forward to our continued

operational successes in 2016.

Consolidated Statement of Comprehensive Income

Year ended 30 November 2015

Note Continuing Discontinued Continuing Discontinued

Operations Operations Operations Operations

2015 2015 2014 2014

GBP'000 GBP'000 GBP'000 GBP'000

===================================================================================== ========================== ======================== =========================

Revenue 3 8,119 2,737 4,291 4,255

Cost of sales (3,277) (881) (949) (1,419)

========================== =========== ============================================ ========================== ======================== =========================

Gross profit 4,842 1,856 3,342 2,836

Administrative expenses (7,339) (2,046) (3,871) (2,292)

Share-based payment (26) - (36) -

Operating (loss)/profit

before impairment (2,523) (190) (565) 544 544

Profit on disposal of

subsidiary undertaking 6 - 900 - -

Impairment of intangibles 11 (1,899) - (798) -

========================== =========== ============================================ ========================== ======================== =========================

Operating (loss)/profit 5 (4,422) 710 (1,363) 544

Financial income 1 - 1 -

Financial expense (266) - (115) -

(Loss)/profit before

taxation (4,687) 710 (1,477) 544

Taxation credit/(charge) 9 763 (29) (121) (28)

========================== =========== ============================================ ========================== ======================== =========================

(Loss)/profit for the

year (3,924) 681 (1,598) 516

Profit for the year

from discontinued

operations 6 681 - 516 -

Loss for the year (3,243) (1,082)

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

======================================= ============================================ ==================================================== =========================

Other comprehensive income - -

======================================= ============================================ ==================================================== =========================

Total comprehensive income

for the period attributable

to the owners of the parent

company (3,243) (1,082)

======================================= ============================================ ==================================================== =========================

Earnings per share

Basic (loss)/earnings

per share 10 (1.55)p 0.27p (0.68)p 0.22p

Diluted (loss)/earnings

per share 10 (1.55)p 0.25p (0.68)p 0.22p

========================== =========== ============================================ ========================== ======================== =========================

Consolidated Statement of Financial Position

At 30 November 2015

Note 2015 2014

GBP'000 GBP'000

------------------------------ ----- --------- ---------

Non-current assets

Property, plant and

equipment 273 523

Intangible assets 7,423 8,406

Deferred tax assets 865 419

Total non-current

assets 8,561 9,348

Current assets

Inventories - 142

Trade and other receivables 3,628 2,613

Current tax receivables 101 237

Cash and cash equivalents 1,523 1,144

Assets classified

as held for sale 7 3,869 -

============================= ===== ========= =========

Total current assets 9,121 4,136

==================================== ========= =========

Total assets 17,682 13,484

==================================== ========= =========

Current liabilities

Trade and other payables 1,225 1,526

Accruals and deferred

income 6,398 4,050

Interest bearing loans

and borrowings 12 1,277 -

Liabilities classified

as held for sale 7 1,455 -

============================= ===== ========= =========

Total current liabilities 10,355 5,576

==================================== ========= =========

Non-current liabilities

Trade and other payables 391 60

Interest bearing loans

and borrowings 12 2,839 1,301

Deferred tax liabilities 336 956

============================= ===== ========= =========

Total non-current liabilities 3,566 2,317

==================================== ========= =========

Total liabilities 13,921 7,893

==================================== ========= =========

Net assets 3,761 5,591

==================================== ========= =========

Equity

Share capital 1,535 1,324

Treasury shares (148) (148)

Share premium account 1,271 224

Capital redemption

reserve 191 191

Share option reserve 364 338

Equity reserve 255 126

Retained earnings 293 3,536

============================= ===== ========= =========

Total equity attributable

to the equity holders

of the parent company 3,761 5,591

==================================== ========= =========

Consolidated Statement of Changes in Equity

Year ended 30 November 2015

Treasury Share Capital Share

Share shares premium redemption option Equity Retained

capital GBP'000 account reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=============== ============ =============== =============== ===================== ============ ============= ================ ===========

Group

At 1 December

2013 1,324 (148) 224 191 331 126 4,618 6,666

Total

comprehensive

loss for the

year - - - - - - (1,082) (1,082)

Transactions

with owners

Share-based

payments -

current year - - - - 36 - - 36

Tax reversal

relating to

share-based

payment - - - - (29) - - (29)

--------------- ------------ --------------- --------------- --------------------- ------------ ------------- ---------------- -----------

At 30 November

2014 1,324 (148) 224 191 338 126 3,536 5,591

--------------- ------------ --------------- --------------- --------------------- ------------ ------------- ---------------- -----------

At 1 December

2014 1,324 (148) 224 191 338 126 3,536 5,591

--------------- ------------ --------------- --------------- --------------------- ------------ ------------- ---------------- -----------

Total

comprehensive

loss for the

year - - - - - - (3,243) (3,243)

Equity

component

of

convertible

loan notes

net of

deferred

tax - - - - - 129 - 129

Transactions

with owners

Issue of share

capital 211 - 1,047 - - - - 1,258

Share-based

payments -

current year - - - - 26 - - 26

Tax reversal - - - - - - - -

relating to

share-based

payment

--------------- ------------ --------------- --------------- --------------------- ------------ ------------- ---------------- -----------

At 30 November

2015 1,535 (148) 1,271 191 364 255 293 3,761

--------------- ------------ --------------- --------------- --------------------- ------------ ------------- ---------------- -----------

Consolidated Statement of Cash Flow

Year ended 30 November 2015

Note 2015 2014

GBP'000 GBP'000

Loss for the year (3,243) (1,082)

Adjusted for:

Taxation 9 (734) 149

Depreciation and amortisation 11 948 409

Impairment of intangible assets 11 1,899 798

Share option charge 26 36

Financial income (1) (1)

Financial expense 266 115

Loss on disposal of property, plant

and equipment 70 2

Profit on sale of Willow Starcom

Ltd 6 (900) -

========================================== ==== ======== ========

Operating cash (outflow)/inflow before

changes in working capital (1,669) 426

(Increase) in trade and other receivables (496) (590)

Decrease in inventories 8 26

Increase in trade and other payables 344 1,192

================================================ ======== ========

Net cash (outflow)/inflow from operations

before taxation (1,813) 1,054

Taxation received 237 356

================================================ ======== ========

Net cash (outflow)/inflow from operations (1,576) 1,410

================================================ ======== ========

Cash flows from investing

Interest received 1 1

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

Acquisition of property, plant and

equipment and software licences 11 (66) (140)

Cost of software development 11 (1,541) (1,573)

Acquisition of trade and assets 8 (1,340) -

Disposal of Willow Starcom 6 1,487 -

less: cash and cash equivalents disposed

of 6 (346) -

Move to held for sale of Due North 7 (207) -

========================================== ==== ======== ========

Net cash outflow from investing (2,012) (1,712)

================================================ ======== ========

Cash flows from financing activities

Interest paid (192) (75)

Issue of shares and share option

exercise proceeds 1,200 -

Exercise of share options 59 -

Issue of loan notes 12 2,900 -

========================================== ==== ======== ========

Net cash inflow/(outflow) from financing 3,967 (75)

================================================ ======== ========

Net increase/(decrease) in cash and

cash equivalents 379 (377)

Opening cash and cash equivalents 1,144 1,521

========================================== ==== ======== ========

Closing cash and cash equivalents 1,523 1,144

========================================== ==== ======== ========

Notes to the financial statements

1. Basis of preparation

This announcement has been prepared in accordance with the

Company's accounting policies, which in turn are in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union ("EU") applied in accordance with the provisions

of the Companies Act 2006. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

("IASB") and the IFRS Interpretations Committee and there is an

on-going process of review and endorsement by the European

Commission. The accounting policies comply with each IFRS that is

mandatory for accounting periods ended 30 November 2015.

The results are unaudited, however we do not expect there to be

any difference between the results presented and those within the

annual report.

The financial information set out above does not constitute the

Group's statutory accounts, but is derived from those accounts. The

statutory accounts for the year ended 30 November 2014 have been

delivered to the Registrar of Companies and those for 2015 will be

delivered following the Group's annual general meeting.

2. Basis of consolidation

The Group results comprise the financial statements of Access

Intelligence plc and its subsidiaries as at 30th November 2015.

They are presented in Sterling and all values are rounded to the

nearest thousand pounds (GBP'000).

3. Revenue

The Group's revenue is primarily derived from the rendering of

services with the value of sales of goods being not significant in

relation to total Group revenue.

The Group's revenue was split into the following

territories:

Continuing Discontinued Continuing Discontinued

Operations Operations Operations Operations

2015 2015 2014 2014

GBP'000 GBP'000 GBP'000 GBP'000

United Kingdom 7,269 2,737 3,790 4,255

European

Union 464 - 202 -

Rest of the

world 386 - 299 -

---------------- ------------ ------------- ------------ -------------

Total 8,119 2,737 4,291 4,255

---------------- ------------ ------------- ------------ -------------

All non-current assets are held in the United Kingdom as they

were in 2014. No customer represents 10% or more of revenue as was

the case in 2014.

4. Segment reporting

Segment information is presented in respect of the Group's

operating segments which are based upon the Group's management and

internal business reporting.

Inter-segment pricing is determined on an arm's length

basis.

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis. Unallocated items comprise mainly head office

expenses.

Segment non-current asset additions show the amounts relating to

property, plant and equipment and intangible assets including

goodwill. All non-current assets are located in the UK.

Operating segments

The Group operating segments have been decided upon according to

their revenue model and product or service offering being the

information provided to the chief operating decision maker, the

non-executive Chairman. The Reputation and Governance, Risk &

Compliance segments derive their revenues from software licence

sales and support and training revenues. As a result of the Group's

divestments and acquisitions during the year the segments reported

have changed to reflect the Board's focus. The segments are:

-- Reputation

-- Governance, Risk & Compliance

-- Discontinued - Disposals & Held for Sale

-- Head Office

The segment information for the year ended 30 November 2015 is

as follows:

.2914................... Reputation Governance, Head Consolidation Continuing Discontinued Discontinued Consolidation Discontinued Total

Risk & office adjustment Operations - Disposals - Held for adjustment Operations

Compliance Sale

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

External

revenue 6,119 2,000 - - 8,119 944 1,793 - 2,737 10,856

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

Internal - - - - - - - - - -

revenue

Operating

(loss)/profit (1,716) (1,157) (2,470) 2,820 (2,523) (366) 176 - (190) (2,712)

Profit

on sale

of subsidiary - - - - - - - 900 900 900

Impairment - (1,899) - - (1,899) - - - - (1,899)

Financial

income - - 1 - 1 - - - - 1

Financial

expense - - (266) - (266) - - - - (266)

Taxation 341 319 82 21 763 - (29) - (29) 734

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

(Loss)/profit

after

taxation (1,375) (2,737) (2,653) 2,841 (3,924) (366) 147 900 681 (3,245)

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

Reportable

segment

assets 13,393 870 10,853 (10,158) 14,958 - 4,121 - 4,121 19,080

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

Reportable

segment

liabilities 10,518 5,233 7,801 (12,105) 11,447 - 1,652 - 1,652 13,100

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

Other

information:

Additions

to property,

plant

and equipment 12 1 10 - 23 24 20 - 44 67

================================================ ========== =========== ======= ============= =========== ============ ============ ============= ============= =======

Depreciation

and amortisation 577 147 102 (110) 716 52 182 - 234 950

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

================================================ ========== =========== ======= ============= =========== ============ ============ ============= =======

The segment information for the year ended 30 November 2014

(restated), is as follows:

.2914................... Reputation Governance, Head Consolidation Continuing Discontinued Discontinued Consolidation Discontinued Total

Risk & office adjustment Operations - Disposals - Held for adjustment Operations

Compliance Sale

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 2,325 1,966 - - 4,291 2,288 1,967 - 4,255 8,546

Internal

revenue - - - - - 368 - (368) - -

Operating

(loss)/profit 953 (237) (1,272) (10) (566) 103 442 - 545 (21)

Impairment - (798) - - (798) - - - - (798)

Financial

income 1 - - - 1 - - - - 1

Financial

expense - - (115) - (115) - - - - (115)

Taxation (12) 106 (147) (68) (121) (6) (22) - (28) (149)

(Loss)/profit

after

taxation 942 (929) (1,534) (78) (1,599) 97 420 - 517 (1,082)

Reportable

segment

assets 5,677 2,457 9,996 (10,654) 7,476 2,101 3,907 - 6,008 13,484

Reportable

segment

liabilities 1,878 4,024 7,534 (8,481) 4,955 1,353 1,585 - 2,938 7,893

Other

information:

Additions

to property,

plant

and equipment 5 2 18 - 25 101 14 - 115 140

Depreciation

and amortisation 79 32 270 (115) 266 93 50 - 143 409

5. Operating loss

Operating loss is stated after charging:

2015 2014

GBP'000 GBP'000

Depreciation of property, plant and

equipment 257 233

Amortisation of development costs 378 80

Amortisation of brand values 60 60

Amortisation of software licences 44 36

Amortisation of database 138 -

Amortisation of customer list 70 -

Loss on disposal of property, plant

and equipment 70 2

Impairment of intangible assets 1,899 798

Loss on foreign currency translation - 12

Exceptional costs (see below) 278 -

Operating lease charges - land and

buildings 574 420

Auditor's remuneration (see below) 85 54

Share based payments 26 36

Research and development and other

technical expenditure (income statement)

(a further GBP1,526k (2014: GBP1,577k)

was capitalised) 1,922 2,363

Inventories recognised as expense - 514

Increase in provision for receivables 46 19

=========================================== ======== ========

Exceptional costs in the year ended 30 November 2015 were

incurred as a result of restructuring and non-recurring one off

termination of employment costs for staff and directors, along with

associated legal fees. The exceptional costs are made up of the

following:

2015 2014

GBP'000 GBP'000

------------------------------------- --------- ---------

Compensation for loss of office 88 -

- directors

Compensation and notice payments 152 -

- all staff

Legal costs incurred on compensation 38 -

of loss of office for directors

278 -

------------------------------------- --------- ---------

6. Discontinued operations

In April 2015 the Group sold its entire IT support segment (see

note 4: Discontinued - Disposals); the segment was not a

discontinued operation or classified as held for sale at 30

November 2014 and the comparative consolidated statement of

comprehensive income has been re-presented to show the discontinued

operation separately from continuing operations. Management

committed to a plan to sell this segment early in 2015 following a

strategic decision to focus on Software as a Service lines and move

away from non-core activities.

Due North Limited is also presented as a disposal group held for

sale following the commitment of the Group's management, in June

2015, to a plan to sell the entity.

2015 2014

GBP'000 GBP'000

======================================== ======== ========

Results of discontinued operation

======================================== ======== ========

Revenue 2,737 4,255

Expenses (2,927) (3,711)

======================================== ======== ========

Results from operating activities (190) 544

======================================== ======== ========

Tax (29) (28)

Results from operating activities,

net of tax (219) 516

Gain on sale of discontinued operation 900 -

Tax on gain on sale of discontinued - -

operation

======================================== ======== ========

Profit for the year 681 516

======================================== ======== ========

Basic earnings per share 0.27p 0.22p

======================================== ======== ========

Diluted earnings per share 0.25p 0.22p

======================================== ======== ========

The profit from discontinued operations of GBP681,000 is

entirely attributable to the owners of the Company.

2015 2014

GBP'000 GBP'000

======================================== ======== ================

Cash flows from (used in) discontinued

operation

======================================== ======== ================

Net cash used in operating activities 398 760

======================================== ======== ================

Net cash from investing activities (444) (876)

======================================== ======== ================

Net cash from financing activities - -

======================================== ======== ================

Net cash flows for the year (46) (116)

======================================== ======== ================

The following is a breakdown of the effects of the disposal of

the IT support segment on the financial position of the

Group:

2015

GBP'000

Goodwill 800

Property, plant and equipment 166

Inventories 134

Trade and other receivables 776

Cash and cash equivalents 346

Deferred tax liabilities (20)

Trade and other payables (1,740)

Net assets and liabilities 462

Consideration received, satisfied in cash 1,487

Cash and cash equivalents disposed of 346

7. Disposal group held for sale

Due North Limited is presented as a disposal group held for sale

following the commitment of the Group's management, in June 2015,

to a plan to sell the entity. Efforts to sell the disposal group

had therefore commenced before the year end with the sale being

completed on 3 February 2016 (see note 30).

At 30 November 2015 the disposal group comprised the following

assets and liabilities:

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

Assets classified as held for sale

2015

GBP'000

Goodwill 412

Development costs 2,661

Property, plant and equipment 73

Trade and other receivables 516

Cash and cash equivalents 207

=============================== ========

3,869

=============================== ========

Liabilities classified as held for sale

2015

GBP'000

Trade and other payables 1,022

Deferred tax liabilities 433

========================== ========

1,455

========================== ========

8. Acquisition of business combinations

On 23 June 2015, the group entered into an asset purchase

agreement to acquire certain trade and assets of Cision UK Limited

and Vocus UK Limited for an aggregate cash consideration of

GBP1,340,000. The trade and assets were acquired through a newly

incorporated subsidiary company, AIMediaData Limited, as a single

economic unit which will continue to be operated on this basis

The Board believe the acquisition will provide the Group with a

developed media contacts database which will strengthen the long

term ability of Group subsidiary Access Intelligence Media &

Communications Limited to compete within the IMS market in the

UK.

In the six months to 30 November 2015, AIMediaData Limited

contributed revenue of GBP3,351,000 and a loss of GBP929,000. The

Directors do not consider it practicable to report either the

revenue or the loss of AIMediaData as though the acquisition date

had been as of the beginning of the reporting period. The reason

that this is considered impracticable is that only certain trade

and assets of Cision UK Limited and Vocus UK Limited were acquired

and the Group has made significant changes to the operations of the

acquired business during its period of ownership. As a result, both

the revenue profile and the cost base of the business are

fundamentally different to pre-acquisition results of the Cision UK

and Vocus UK businesses.

Consideration transferred

The following table summarises the acquisition date fair value

of each major class of consideration transferred.

GBP'000

Cash 1,340

Total consideration transferred 1,340

================================= =======

Acquisition related costs

The Group incurred acquisition related costs of GBP153,000 on

legal fees and due diligence costs. These costs have been included

in 'administrative expenses'.

Identifiable assets acquired and liabilities assumed

The following table summarises the recognised amounts of assets

acquired and liabilities assumed at the date of acquisition.

GBP'000

Property, plant and equipment 254

Intangible assets 1,835

Trade and other receivables 1,452

Cash and cash equivalents -

Trade and other payables (877)

Accruals and deferred income (3,367)

============================================= =======

Total identifiable net liabilities acquired (703)

============================================= =======

The intangible assets identified above primarily comprise the

fair values estimated for the media contacts database and customer

list acquired.

A cost based approach was used to value the media contacts

database, determining the likely cost of building an equivalent

media contacts database from new. The useful life of the database

has been estimated at 3 years.

The customer list was valued by assessing a discounted cash flow

for the acquired customer list, based on customer attrition rates

and using a discount factor of 12%. This discount factor is in line

with value-in-use calculations performed for intangibles testing

(see Note 15). The useful life of the customer list has been

estimated at 5 years.

Trade and other receivables comprise gross contractual amounts

due of GBP1,536,000, of which GBP84,000 was expected to be

uncollectable at the date of acquisition.

Trade and other payables include an amount of GBP3,074,000 which

relates to the fair value of deferred revenue acquired. The fair

value has been estimated based on the value of deferred revenue

relating to contracts transferred, discounted in accordance with

IFRS.

Goodwill

Goodwill recognised on this acquisition represents the

difference between the consideration paid and the fair value of the

net liabilities acquired. It includes the value inherent in the

assembled workforce acquired. The goodwill arising has been

recognised as follows:

GBP'000

Consideration transferred 1,340

Fair value of identifiable net liabilities 703

============================================= =======

Total identifiable net liabilities acquired 2,043

============================================= =======

9. Taxation

2015 2014

GBP'000 GBP'000

=================================================== ======== ==================

Current income taxes credit:

UK corporation tax credit for the year (101) (237)

Adjustment in respect of prior year - (19)

=================================================== ======== ==================

Total current income tax credit (101) (256)

=================================================== ======== ==================

Deferred tax (note 23)

Impact of change in tax rate 27 -

De-recognition of deferred tax assets 80 363

Origination and reversal of temporary differences (740) 42

=================================================== ======== ==================

Total deferred tax (633) 405

=================================================== ======== ==================

Total tax (credit)/expense (734) 149

=================================================== ======== ==================

Attributable to:

=================================================== ======== ==================

Continuing operations (763) 121

Discontinued operations 29 28

=================================================== ======== ==================

Total (734) 149

=================================================== ======== ==================

As shown above the tax assessed on the loss on ordinary

activities for the year is higher than (2014: higher than) the

standard rate of corporation tax in the UK of 20.3% (2014:

21.7%).

The differences are explained as follows:

Factors affecting tax credit 2015 2014

GBP'000 GBP'000

========================================================== ======== ========

Loss on ordinary activities before tax (3,977) (933)

========================================================== ======== ========

Loss on ordinary activities by effective rate of tax of

20.3% (2014: 21.7%)

of 20.3% (2014: 21.7%) (809) (202)

Expenses not deductible for tax purposes 274 142

Adjustment in respect of prior year - (19)

De-recognition of deferred tax assets 80 363

Additional R&D claim CTA 2009 (279) (135)

========================================================== ======== ========

Total tax (credit)/expense (734) 149

========================================================== ======== ========

Factors that may affect future tax expenses

The main rate of corporation tax was reduced to 20% from 1 April

2015 and is due to be further reduced by a further 1% from April

2017 and by a further 1% from April 2020. All deferred tax assets

and liabilities are assumed to cease or be utilised at 19%.

10. Earnings per share

The calculation of earnings per share is based upon the total

Group loss after taxation of GBP3,243,000 (2014: loss of

GBP1,082,000) divided by the weighted average number of ordinary

shares in issue during the year which was 252,593,681 (2014:

235,110,347).

In 2015 and 2014 potential ordinary shares from the share option

schemes and convertible loan notes have an anti- dilutive effect

due to the Group being in a loss position. This includes the

convertible loan notes issued during the year. As a result,

dilutive loss per share is disclosed as the same value as basic

loss per share.

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

This has been computed as follows:

Continuing Discontinued Total Continuing Discontinued Total

Operations Operations Operations Operations

Numerator 2015 2015 2015 2014 2014 2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Loss)/Profit

for the year

and earnings

used in basic

EPS (3,924) 681 (3,243) (1,598) 516 (1,082)

Earnings used

in diluted

EPS (3,924) 681 (3,243) (1,598) 516 (1,082)

========================= =========== ============ ========= =========== ============ =========

Denominator '000 '000 '000 '000 '000 '000

Weighted average

number of shares

used in basic

EPS 252,594 252,594 252,594 235,110 235,110 235,110

Effects of:

Dilutive effect

of options N /A 14,821 14,821 N/A 420 420

Dilutive effect N/A N/A N/A N/A N/A N/A

of loan note

conversion

Weighted average

number of shares

used in diluted

EPS 252,594 267,415 267,415 235,110 235,530 235,530

========================= =========== ============ ========= =========== ============ =========

Basic (Loss)/earnings

per share (pence) (1.55) 0.27 (1.28) (0.68) 0.22 (0.46)

Diluted loss

per share for

the year (pence) (1.55) 0.25 (1.30) (0.68) 0.22 (0.46)

========================= =========== ============ ========= =========== ============ =========

On 21 September 2011 29,666,667 shares were returned to the

Company and were held in Treasury at the year end. Once in treasury

they were removed from the earnings per share calculation.

The total number of options and warrants granted at 30 November

2015 of 33,958,676 (2014: 38,436,281) would generate GBP984,626

(2014: GBP1,176,190) in cash if exercised. At 30 November 2015,

545,000 (2014: 34,936.281) were priced above the mid-market closing

price of 5.13p per share (2014: 2.31p) per share and 33,413,676

(2014: 3,500,000) were below.

At the 30 November 2015 9,258,676 (2014: 6,947,387) staff

options were eligible for exercising at an average price of 3.2p

(2014: 4.2p). Also eligible for exercising are the 21,300,000

warrants priced at 2.75p per share held by M Jackson, D Lowe and

Elderstreet VCT plc consequent to their investment in October

2008.

The below table shows the amount of outstanding convertible loan

notes at 30 November 2015 and the amount of shares they would

convert into if the holder chooses the conversion option:

Holder Loan Notes GBP'000 Convert into shares Date of conversion

'000

====================== ================== =================== ==================

Elderstreet VCT 500 12,500 31 December 2016

Unicorn AIM VCT 750 18,750 31 December 2016

Elderstreet VCT 200 6,667 4 December 2019

Hawk Investments 300 10,000 4 December 2019

Kestrel Partners LLP 400 13,333 4 December 2019

Octopus AIM VCT 200 6,667 4 December 2019

====================== ================== =================== ==================

Total 2,350 67,917

====================== ================== =================== ==================

11. Intangible fixed assets

Brand Goodwill Development Software Database Customer Total

value GBP'000 costs licences GBP'000 list GBP'000

GBP'000 GBP'000 GBP'000 GBP'000

Cost

============================== ======== ======== =========== ========= ======== ======== ========

At 1 December 2013 1,369 12,005 3,119 160 - - 16,653

Capitalised during the

year - - 1,573 - - - 1,573

============================== ======== ======== =========== ========= ======== ======== ========

At 30 November 2014 1,369 12,005 4,692 160 - - 8,226

============================== ======== ======== =========== ========= ======== ======== ========

At 1 December 2014 1,369 12,005 4,692 160 - - 18,226

Capitalised during the

year - - 1,533 68 - - 1,601

Additions through business

combination - 2,043 - 8 997 830 3,878

Disposals - (1,430) - - - - (1,430)

Held for sale - (1,481) (2,846) - - - (4,327)

============================== ======== ======== =========== ========= ======== ======== ========

At 30 November 2015 1,369 11,137 3,379 236 997 830 17,948

============================== ======== ======== =========== ========= ======== ======== ========

Amortisation and impairment

============================== ======== ======== =========== ========= ======== ======== ========

At 1 December 2013 349 7,978 472 47 - - 8,846

Charge for the year 60 - 80 36 - - 176

Impairment in year - 798 - - - - 798

============================== ======== ======== =========== ========= ======== ======== ========

At 30 November 2014 409 8,776 552 83 - - 9,820

============================== ======== ======== =========== ========= ======== ======== ========

At 1 December 2015 409 8,776 552 83 - - 9,820

Charge for the year 60 - 378 44 138 70 690

Disposals - (630) - - - - (630)

Held for sale - (1,069) (185) - - - (1,254)

Impairment in year - - 1,899 - - - 1,899

At 30 November 2015 469 7,077 2,644 127 138 70 10,525

============================== ======== ======== =========== ========= ======== ======== ========

Net Book Value

At 30 November 2015 900 4,060 735 109 859 760 7,423

============================== ======== ======== =========== ========= ======== ======== ========

At 30 November 2014 960 3,229 4,140 77 - - 8,406

============================== ======== ======== =========== ========= ======== ======== ========

For the purpose of impairment testing, goodwill is allocated by

entity, which represent the Group's CGUs and the lowest level

within the Group at which the goodwill is monitored.

The carrying value of capitalised development costs which are

not yet being amortised and goodwill, allocated to each CGU

are:

2015 Development Costs Goodwill

GBP'000 GBP'000

========================== ================= ========

Continuing operations:

Access Intelligence plc - 89

Access Intelligence Media

& Communications Ltd - 1,928

AI Media Data Ltd. 78 2,043

AITrackRecord Ltd - -

AI Talent Ltd - -

========================== ================= ========

78 4,060

========================== ================= ========

2014 Development Costs Goodwill

GBP'000 GBP'000

========================== ================= ========

Continuing operations:

Access Intelligence plc 30 89

Access Intelligence Media

& Communications Ltd 425 1,928

AITrackRecord Ltd 1,242 -

AI Talent Ltd 44 -

========================== ================= ========

1,741 2,017

========================== ================= ========

Discontinued operations:

Willow Starcom Ltd - 800

Due North Ltd 2,399 414

========================== ================= ========

4,140 3,231

========================== ================= ========

(MORE TO FOLLOW) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

At the balance sheet date, impairment tests were undertaken by

comparing the carrying values of goodwill, capitalised development

costs and other assets with the recoverable amount of the CGU to

which the goodwill, capitalised development costs and other assets

have been allocated. The recoverable amount of the CGU is based on

value-in- use calculations. These calculations use pre-tax cash

flow projections covering a five-year period based on financial

budgets and forecasts as approved by the Board with a terminal

value for goodwill impairment assessment and covering a ten-year

period based on financial budgets and forecasts as approved by the

Board with no terminal value for other intangible assets. Ten years

were selected as this represents the estimated lifetime of the

software platforms.

The key assumptions used for value-in-use calculations are those

regarding revenue growth rates and discount rates over the forecast

period. Growth rates are based on past experience, the anticipated

impact of the CGUs significant investment in research and

development, and expectations of future changes in the market. The

value in use calculations use information from approved budgets in

the first three years, followed by applying specific growth rates

for which the key assumptions in respect of annual revenue growth

rates range between 0% and 7% from year 4 onwards.

The discount rate used for all companies was 12%, based on an

assessment of the Group's cost of capital and on comparison with

other listed technology companies. The terminal growth rate used

for the purposes of goodwill impairment assessments was 2.5%. The

Board considered that no impairment to goodwill is necessary based

on the value-in-use reviews of Access Intelligence Media &

Communications Limited and AIMediaData Limited.

After review of the value-in-use of AITrackRecord Limited, the

Board considers that the recent history of losses in that company

and net cash outflows forecast in the immediate future mean that a

provision should be recognised representing the full carrying value

of development costs capitalised by that company, being

GBP1,692,000. After review of the value-in-use of AITalent Limited,

the Board considers that the recent history of losses in that

company and net cash outflows forecast in the immediate future mean

that a provision should be recognised representing the full

carrying value of development costs capitalised by that company

being GBP30,000.

The value-in-use calculations for Access Intelligence Media

& Communications Limited and AIMediaData Limited significantly

exceeded the carrying values of goodwill and intangibles relating

to those companies.

Sensitivity analysis has been performed on reasonably possible

changes in assumptions upon which recoverable amounts have been

estimated. Based on the sensitivity analysis, a reduction of 77% in

the EBITDA delivered by Access Intelligence Media &

Communications Limited would result in the carrying value of its

goodwill being to equal its recoverable amount. For AIMediaData

Limited, a 31% reduction in the revenue growth rate would result in

the carrying value of its goodwill being equal to its recoverable

amount. For both companies, an increase in the discount rate by 25

percentage points would still not result in the carrying value of

goodwill exceeding the recoverable amount.

Other impairments

Other intangible assets are tested for impairment if indicators

of an impairment exist. Such indicators include performance falling

short of expectation.

In 2015, development costs of GBP177,000 were impaired as a

result of projects that did not perform as expected.

The directors considered that there were no further indicators

of impairment relating to the remaining intangible fixed assets at

30 November 2015.

12. Interest bearing loans and borrowings

2015 2014

GBP'000 GBP'000

======================== ======== ========

Current

======================== ======== ========

Convertible loan notes 1,277 -

======================== ======== ========

1,277 -

======================== ======== ========

Non-current

Convertible loan notes 1,009 1,301

Non-convertible loan

notes 1,830 -

======================== ======== ========

2,839 1,301

======================== ======== ========

On 30th June 2009 GBP1,750,000 convertible loan notes were

issued. At 30 November 2014 and 30 November 2015, GBP1,250,000 of

these loan notes were in issue.

The original terms were that these loan notes were redeemable at

par or convertible to ordinary shares at 4p per ordinary share on

or before maturing on 30th June 2015 and carried a coupon rate of

6% per annum payable semi-annually until such time as they were

repaid or were converted in accordance with their terms. The holder

of the notes may convert all or part of the notes held by them into

new ordinary shares in the Company on delivery to the Company of a

conversion notice at 4p per share.

In 2014, the Company agreed terms with Elderstreet VCT (a

company related to Chairman Michael Jackson) and Unicorn AIM VCT

plc to extend the loans such that they mature on 31 December 2015,

with enhanced interest at 8% during this extended period with

conversion rights unchanged at 4p per share.

In January 2016 the Company agreed the same terms as those

agreed in the prior year with both note holders such that the notes

are redeemable at par or convertible to ordinary shares at 4p per

ordinary share on or before maturing on 31 December 2016 and carry

a coupon rate of 8% per annum, payable semi-annually until such a

time as they are repaid or converted in accordance with their

terms. These notes are classified as current at the year end.

In December 2014 the company issued a further GBP1,100,000 of

convertible loan notes. These loan notes are redeemable at par or

convertible to ordinary shares at 3p per ordinary share on or

before maturing on 3 December 2019 and carry a coupon rate of 8%

per annum payable semi-annually until such time as they are repaid

or converted.

No redemptions or conversions of the convertible loan stock

arose in the year ended 30 November 2015.

The net proceeds received from the issues of the convertible

loan notes have been split between the liability element and an

equity component, representing the fair value of the embedded

option to convert the liability into equity of the Company, as

follows:

2015 2014

GBP'000 GBP'000

Proceeds of issue of convertible

loan notes 1,100 -

Existing loan notes rolled over 1,250 1,250

Equity component (255) (126)

Deferred taxation (79) (49)

===================================== ======== ========

Initial fair value of liability

component 2,016 1,075

Cumulative interest charged 792 601

Cumulative interest paid (522) (375)

===================================== ======== ========

Liability component at 30 November 2,286 1,301

===================================== ======== ========

The equity component of GBP255,000 (2014: GBP126,000) has been

credited to equity reserve (see note 10 of the parent company). The

interest charged for the year is calculated by applying an

effective rate of interest of 9.8% (2014: 9.8%) to the liability

component for the 12-month period. The liability component is

measured at amortised cost. The difference between the carrying

amount of the liability component at the date of issue and the

amount reported in the balance sheet at 30 November 2015 represents

the effective interest rate less interest paid to that date.

The movement on the convertible loan note liability is

summarised below:

2015 2014

GBP'000 GBP'000

Opening loan liability 1,301 1,261

Issue of convertible loan notes 941 -

Interest charged for the year 191 115

Interest paid in the year (147) (75)

==================================== ======== ========

Liability component at 30 November 2,286 1,301

==================================== ======== ========

On 22 June 2015 the company issued GBP1,818,000 non-convertible

loan notes which carry an interest rate of 10% for one year rising

to 12% thereafter. Interest is payable quarterly in arrears. The

loans notes are fully repayable in 5 years.

2015 2014

GBP'000 GBP'000

Opening loan liability - -

Issue of non-convertible loan

notes 1,818 -

Costs associated with the issue

of loans (18)

Interest charged for the year 75 -

Interest paid in the year (45) -

==================================== ======== ========

Liability component at 30 November 1,830 -

==================================== ======== ========

13. Availability of Annual Report and AGM date

Copies of the Report and Accounts has been posted to

shareholders where requested and is available from the Company's

website (www.accessintelligence.com). It is intended that the

annual general meeting will take place at the Company's registered

office, Longbow House, 14-20 Chiswell Street, London, EC1Y 4TW, at

14.00pm on Thursday, 5 May 2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR KMGGDKRRGVZM

(END) Dow Jones Newswires

April 11, 2016 02:00 ET (06:00 GMT)

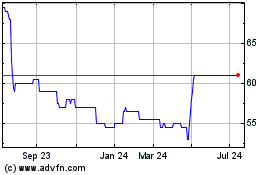

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Sep 2023 to Sep 2024