Current Report Filing (8-k)

March 16 2016 - 10:57AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 16, 2016

MAJESCO ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-51128

|

|

06-1529524

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

404I-T Hadley Road

S. Plainfield, New Jersey 07080

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (732) 225-8910

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

ITEM 2.02

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

|

On March 16, 2016, Majesco Entertainment Company (the “Company”) issued a press release announcing results for the quarter ended January 31, 2016. A copy of the press release is attached to this report as Exhibit 99.1.

The information disclosed under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth in such filing.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

(d) Exhibits.

The exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

Majesco Entertainment Company Press Release issued March 16, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MAJESCO ENTERTAINMENT COMPANY

|

| |

|

| |

|

|

Dated: March 16, 2016

|

/s/ John Stetson

|

| |

John Stetson

|

| |

Chief Financial Officer

|

| |

|

Exhibit 99.1

Majesco Entertainment Company Reports Fiscal 2016 First Quarter Financial Results

Highlights of the Financial Results for the Quarter ending January 31, 2016 include:

|

●

|

Successfully released two new award-winning games in January 2016

|

|

●

|

New management has aligned themselves with shareholders as demonstrated through increased insider ownership. Insider ownership now stands at 40%, up from 6% in the comparable prior year period

|

|

●

|

Cash and cash equivalents of $6.65 million as of January 31, 2016

|

|

●

|

Total liabilities reduced 73.8% from the comparable prior year period; reduced from $7.2 million in the prior year period to $1.9 million as of January 31, 2016

|

SOUTH PLAINFIELD, NJ – (Marketwired – March 16, 2016) – Majesco Entertainment Company (NASDAQ: COOL) (“Majesco”, or the “Company”), an innovative provider of downloadable games for the mass market, reported financial results for the fiscal 2016 first quarter ending January 31, 2016.

Revenues for the three months ended January 31, 2016 were $591,000 with a net loss for the period of $606,000, of which $547,000 relates to non-cash stock based compensation, compared to $3.4 million in revenue and a net loss of $1.1 million in the comparable prior year period.

As of January 31, 2016, the Company’s cash and cash equivalents were $6.65 million and its working capital totaled approximately $5.7 million, compared to cash and cash equivalents of $17 million and working capital of $15.6 million as of October 31, 2015. The decrease in cash and working capital primarily reflects the special dividend of $0.33 per common share (including common share equivalents) that was paid to shareholders on January 15, 2016 in an effort to return value to shareholders.

Barry Honig, Co-Chairman and Chief Executive Officer, stated: "This quarter marked the continued successful implementation of streamlined costs, a cleansed balance sheet, and a renewed focus on maximizing shareholder value. We have reduced our Selling, General, and Administrative expenses by approximately 50% from the prior year period, while launching two new award-winning games in January 2016. Management is significantly aligned with shareholders and intends to create substantial long-term shareholder value.”

About Majesco Entertainment Company

Majesco Entertainment Company is a developer, marketer, publisher, and distributor of interactive entertainment for consumers around the world. Building on more than 25 years of operating history, Majesco develops and publishes a wide range of video games on digital networks through its Midnight City label. Majesco is headquartered in Plainfield, New Jersey, and its shares are traded on The Nasdaq Capital Market under the symbol: COOL. More info can be found online at majescoent.com or on Twitter at twitter.com/majesco.

Forward-Looking Statements

Certain statements contained in this release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward looking statements contained in this release relate to, among other things, the Company’s ongoing compliance with the requirements of The NASDAQ Stock Market. They are generally identified by words such as "believes," "may," "expects," "anticipates," "should'" and similar expressions. Readers should not place undue reliance on such forward-looking statements, which are based upon the Company's beliefs and assumptions as of the date of this release. The Company's actual results could differ materially due to risk factors and other items described in more detail in the "Risk Factors" section of the Company's Annual Reports filed with the SEC (copies of which may be obtained at www.sec.gov). Subsequent events and developments may cause these forward-looking statements to change. The Company specifically disclaims any obligation or intention to update or revise these forward-looking statements as a result of changed events or circumstances that occur after the date of this release, except as required by applicable law.

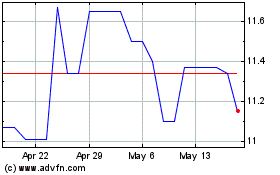

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Aug 2024 to Sep 2024

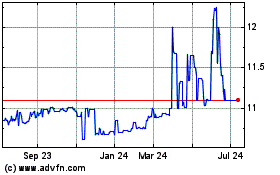

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Sep 2023 to Sep 2024