Tullow Oil PLC Trading Statement and Operational Update (9792M)

January 27 2021 - 2:00AM

UK Regulatory

TIDMTLW TIDMTTM TIDMTTM

RNS Number : 9792M

Tullow Oil PLC

27 January 2021

TULLOW OIL PLC

Trading Statement and Operational Update

27 JANUARY 2021 - Tullow Oil plc (Tullow) issues this update and

guidance in advance of the Group's 2020 Full Year Results. The

information contained herein has not been audited and may be

subject to further review and amendment.

Rahul Dhir, Chief Executive Officer, Tullow Oil plc, commented

today:

"Despite the challenges that 2020 presented, Tullow delivered

production in line with expectations, executed major reductions to

its cost-base and reduced net debt through the Uganda asset sale.

Tullow has a busy year ahead as we begin implementing the business

plan that we laid out at our Capital Markets Day. The plan is

focused on ensuring that Tullow's producing assets in West Africa

reach their full potential. We will leverage the new plan and our

reduced cost base to generate positive free cash flow at current

commodity prices, drive down our net debt and deliver a robust

balance sheet."

FINANCIAL AND Operational Update

2020 Performance

-- The impact of COVID-19 has been managed effectively across the Group with negligible impact on production.

-- Group working interest oil production averaged 74,900 bopd in 2020, in line with guidance.

-- 2020 full year revenue is expected to be c.$1.4 billion with a realised oil price of $50.8/bbl, including hedge

receipts of c.$0.2 billion; gross profit is expected to be c.$0.4 billion.

-- Capital and decommissioning expenditure for 2020 were c.$290 million and c.$50 million respectively.

-- Year-end net debt reduced to c.$2.4 billion (2019: $2.8 billion), as a result of $430 million free cashflow.

This includes Uganda proceeds of $500 million, c.$70 million of Group redundancy payments and

negative year-end working capital adjustments of c.$50 million.

-- Pre-tax impairments and exploration write-offs are expected to be broadly in line with the $1.4 billion reported

in 1H20 Results.

2021 Outlook

-- Group working interest oil production is forecast to average 60-66,000 bopd in 2021. This forecast reflects the

drilling hiatus in 2020, a planned shut-down in September on Jubilee and deferred development

drilling on Simba in Gabon.

-- Capital expenditure is forecast to be c.$265 million, with an additional c.$100 million to be spent on

decommissioning.

-- Organisational restructuring completed which is expected to deliver sustainable annual cash savings of over $125

million.

-- Underlying operating cash flow(1) is expected to be c.$0.5 billion at $50/bbl for the first year of Tullow's new

business plan which aims to deliver c.$7 billion underlying operating cash flow over the

next 10 years; 2021 pre-financing cash flow is expected to be c.$0.2 billion at $50/bbl(2) .

-- In Ghana, oil production from Jubilee and TEN for the year to date is in line with expectations, supported by

gas offtake from the Government of Ghana of c.125 mmscfd.

-- A new oil offloading system is being commissioned on Jubilee and is expected to be ready for a first lifting in

February.

-- A drilling rig is being mobilised to Ghana to commence operations in the second quarter of the year and the

first new production well on Jubilee is forecast to be onstream in the third quarter.

-- In the Non-operated portfolio, development drilling is restarting in Gabon and Equatorial Guinea, whilst

decommissioning activity continues in Mauritania and the United Kingdom.

-- In Kenya, following approval of the 2021 Work Programme and Budget, Tullow received an extension to its

exploration licences to the end of 2021. Tullow and its Joint Venture Partners are now re-working

the development project to ensure that it is robust at low oil prices and expect to submit a revised plan to the

Government of Kenya later this year.

-- In Côte d'Ivoire, Tullow has reduced its onshore exploration portfolio to focus on unlocking value from the

CI-520 block.

-- In the Suriname-Guyana basin, drilling of the Goliathberg-Voltzberg North exploration well in Block 47 in

Suriname is expected to commence shortly. Work also continues on developing the prospect inventory

on the Orinduik and Kanuku licences offshore Guyana.

(1) Cash flow from operating activities including lease

payments, before capital investment, decommissioning expenditure

and debt service

(2) Assumes $75 million proceeds from Uganda FID payment

Refinancing Update

Following the Capital Markets Day, at which Tullow's senior

management presented a new business plan and operating strategy,

the Group has started discussions with its creditors with regards

to its debt refinancing options. As part of these discussions,

Tullow and its lending banks have agreed to extend the

redetermination of the Group's Reserve Base Lending facility, which

was due to complete in January, by up to one month. This will allow

for additional time to review the business plan and operating

strategy.

Production guidance

Group average working interest production FY 2020 actuals (kbopd) FY 2021 forecast (kbopd)

=========================================== ======================== =========================

Ghana 52.4 40.5

=========================================== ======================== =========================

Jubilee 29.5 24.3

=========================================== ======================== =========================

TEN 23.0 16.2

=========================================== ======================== =========================

Equatorial Guinea 4.8 4.8

=========================================== ======================== =========================

Gabon 15.5 15.4

=========================================== ======================== =========================

C ô te d'Ivoire 2.1 2.3

=========================================== ======================== =========================

Oil production 74.9 63.0

=========================================== ======================== =========================

CONTACTS

=========================================== ===================

Tullow Oil plc Murrays

(London) (Dublin)

(+44 20 3249 9000) (+353 1 498 0300)

George Cazenove (Media) Pat Walsh

Matthew Evans and Chris Perry (Investors) Joe Heron

=========================================== ===================

Notes to editors

Tullow is an independent oil & gas, exploration and

production group, quoted on the London, Irish and Ghanaian stock

exchanges (symbol: TLW). The Group has interests in over 70

exploration and production licences across 15 countries.

For further information, please refer to our website at

www.tullowoil.com.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc

YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc

LinkedIn: www.linkedin.com/company/Tullow-Oil

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKQLFLFFLBBBX

(END) Dow Jones Newswires

January 27, 2021 02:00 ET (07:00 GMT)

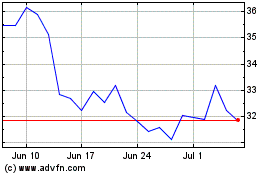

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

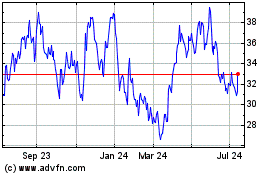

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024