TIDMOPM

RNS Number : 8088Z

1PM PLC

15 January 2020

15 January 2020

1pm plc

(the "Group" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHSED 30 NOVEMBER 2019

Record new business origination during half-year; Balance Sheet

further strengthened; Investment in senior personnel and operations

in line with stated plans;

Increased interim dividend declared

1pm plc, the AIM listed independent specialist finance provider

of funding facilities to UK SMEs and consumers, is pleased to

announce interim results for the six-month period ended 30 November

2019 ("Results" or "Interims").

The Interims reflect continued demand for finance from UK SMEs

and consumers across a comprehensive range of products offered by

the group. The results are underpinned by the Group's prudent

underwriting and provisioning policies which are continuously under

review, given the extended period of uncertainty experienced in the

wider macro-economic environment. The Group remains resilient and

profitable thanks to its ability to offer a complete range of

finance products (asset, vehicles, loan and invoice finance) to UK

SMEs; its flexible business model which enables it to act as either

a funder or a broker in order to maintain margins and manage credit

risk, and its current focus on increasing Group synergies and

operational efficiencies.

Highlights:

-- Deal origination increased 7% to GBP87.8m (H1 2018/19:

GBP82.3m), 65% of which was brokered to other lenders for

commissions (H1 2018/19 60%)

-- Group revenue of GBP15.6m (H1 2018/19: GBP16.0m), reflecting slight change in product mix

-- Group operating profit before exceptional items of GBP3.2m (H1 2018/19: GBP4.1m)

-- Fully Diluted EPS of 2.70 pence per share (H1 2018/19: 3.14 pence per share)

-- Net Assets increased 4% to GBP56.1m at 30 November 2019 (31 May 2019: GBP53.8m)

-- 'Own-book' lending portfolio increased 1% to GBP143.5m at 30

November 2019 (31 May 2019: GBP141.7m)

-- Funding facilities increased to GBP170.7m at 30 November 2019 (31 May 2019: GBP167.1m)

-- The blended cost of borrowings in the period was 3.9% (year to 31 May 2019: 4.0%)

-- Bad debt provisions prudently increased to 2.2% (GBP2.7m) of

the total net portfolio (31 May 2019:1.9% or GBP2.4m)

-- Interim dividend declared up 29% to 0.36 pence per share (Interim 2019: 0.28 pence per share)

-- Significant investment in senior personnel and business

functions in line with strategy; integration progressing as

planned

Commenting on the Interim Results, John Newman, Non-Executive

Chairman, said:

"Given the macro-economic and political uncertainty experienced

in the UK throughout 2019, including the run-up to December's

General Election, which clearly dampened business activity levels,

we are satisfied with the trading momentum maintained across the

Group during the first half. The Board believes that the Group's

strategy of being a multi-product provider of finance to UK SMEs

and consumers, allied to the flexibility of our "hybrid" operating

model of either funding or broking-on new business origination

remains sound and will facilitate future growth as well as

mitigating the risks associated with any future economic downturn.

This has enabled the Group to generate robust levels of demand

whilst being able to maintain margin, control credit and spread

risk. As a result, the Group remains strategically and

operationally well positioned to deliver future growth.

I am also pleased to confirm that, in line with our progressive

dividend policy, the Board is declaring an interim dividend of 0.36

pence per share for the half year period ended 30 November 2019.

The dividend will be paid on 12 May 2020 to shareholders on the

register at 17 April 2020."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

For further information, please contact:

1pm plc

Ian Smith, Chief Executive Officer 01225 474 230

James Roberts, Chief Financial Officer 01225 474 230

Cenkos (NOMAD)

Max Hartley / Ben Jeynes (NOMAD) 0207 397 8900

Julian Morse (Sales)

Walbrook PR 0207 933 8780

Paul Vann

07768 807631

About 1pm:

1pm's strategy is to focus on providing or arranging the finance

UK SMEs require to fund their businesses and arranging vehicle and

property-backed finance for consumers. The multi-product range for

SMEs includes asset, vehicle, loan and invoice finance facilities.

The Group operates a "hybrid" lending and broking model enabling it

to optimize business levels through market and economic cycles.

More information is available on the Company website

www.1pm.co.uk

CHIEF EXECUTIVE OFFICER'S STATEMENT

FOR THE SIX-MONTH PERIODED 30 NOVEMBER 2019

Introduction

The 1pm group is a multi-product speciality finance business

providing funding for UK SMEs as a lender and arranging funding for

both UK SMEs and consumers as a broker. The Group comprises four

operating divisions, namely Asset Finance, Vehicle Finance, Loan

Finance and Invoice Finance. Following the completion of a recent

buy-and-build phase of expansion, the current strategic focus is on

integration as a group and investment in order to lay the

foundations for the next phase of organic and inorganic growth

through to 2024.

Financial Results

Against a backdrop of uncertain macro-political and economic

conditions, which have undoubtedly impacted UK business activity

levels during the entire financial period under review, it is

pleasing to report ongoing progress in the first half of the

current financial year, with revenues delivered in line with

budget. New business origination increased 7% to GBP87.8m in the

half-year ended 30 November 2019, compared with GBP82.3 million for

the same period in the prior year. Furthermore, new business

origination in the 12-month period ended 30 November 2019 totalled

GBP166.6m, compared with GBP153.1m in the preceding 12 months, an

annualised increase of 9%.

Group revenue in the half-year ended 30 November 2019 amounted

to GBP15.6m compared with GBP16.0m for the same period in the prior

year, a marginal decrease of 2.5%. This reflects a slight change in

the mix of revenue in the half-year, with less interest and related

income from lending activities, and more income generated from

broking activities, which has a lower margin, compared to the same

period in the prior year. This, in turn, reflects the higher

proportion of origination brokered-on, which was 65% of total new

business in the half-year compared with 60% in the prior year. The

Group's ability to choose between lending and broking-on, i.e.

utilisation of the "hybrid" operating model, continues to be both a

differentiator and a key business advantage, enabling the Group to

robustly manage credit risk whilst maintaining net interest margin,

which was a blended 12% in the first half, in line with 12% for the

same period in the prior year.

Profit before tax and exceptional items in the half-year

amounted to GBP3.2m compared with GBP4.1m in the prior period. This

reflects the planned investment in both personnel and operations in

the current financial year, highlighted in the Annual Report for

the year ended 31 May 2019, together with the policy decision to

further increase impairment provisions. At 30 November 2019, these

provisions stood at GBP2.7m, or 2.2% of the receivables' portfolio,

compared with GBP2.4m, or 1.9%, of the portfolio at 31 May 2019.

The lending portfolio continued to grow and, at 30 November 2019,

amounted to GBP143.5m compared with GBP141.7m at the prior year

end. The Balance Sheet has also been strengthened with Net Assets

at the period-end amounting to GBP56.1m compared with GBP53.8m at

the prior year end and GBP50.8m at 30 November 2018.

Earnings per share and interim dividend

Earnings per share for the first half of the financial year were

2.76 pence compared with 3.62 pence per share in the comparable

period for the previous year. Notwithstanding this reduction, the

Board has determined to maintain its progressive dividend policy

and is pleased to declare an interim dividend of 0.36 pence per

share for the half-year ended 30 November 2019, an increase of 29%

from 0.28 pence per share declared in the prior period. This will

be paid on 12 May 2020 to shareholders on the register at 17 April

2020. The shares will be marked ex-dividend on the 16 April 2020.

The Group paid a total dividend in respect of the financial year

ended 31 May 2019 of 0.84 pence per share.

Funding

The Group's capital management objective is to maintain a strong

capital base to support its current operations and planned growth

whilst continuing to reduce the cost of capital in order to provide

returns for shareholders and benefits for other stakeholders. The

Group increased its funding facilities during the period to

GBP170.7m at 30 November 2019 compared with GBP167.1m at the prior

year end, 31 May 2019. The increase in facilities includes the

renewal and extension of the Group's key block discounting

facilities for leasing and the addition of a further loan note

facility for funding secured business loans.

The Group's blended cost of borrowing in the first half

marginally improved to 3.9% from 4.0% for the year ended 31 May

2019.

Strategy and Outlook

The Group remains committed to providing a comprehensive range

of finance solutions to support the UK SME sector and UK consumers

whilst aiming to deliver profitable growth in order to increase

shareholder value. The Board is satisfied with the progress made

during the first half, laying the operational foundations for

delivering the next phase of its strategic development through to

2024.

Demand for business-critical asset, loan and invoice finance

from UK SMEs and cost-effective vehicle and property finance for

consumers continues to increase. The levels of demand the Group is

able to generate is encouraging given an increasingly competitive

market for bank and alternative finance and against the background

of political and economic uncertainty which has prevailed for the

past 12 months. The Board continues to see opportunities for

further organic and strategic growth as certainty returns to UK

markets.

Ian Smith

Chief Executive Officer, 1pm plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS TO 30 NOVEMBER

2019

Unaudited Unaudited Audited

6 months to 6 months 12 months

30 November to 30 November to

2019 2018 31 May

2019

Note GBP'000 GBP'000 GBP'000

REVENUE 15,570 15,967 31,814

Cost of sales (5,537) (5,245) (10,271)

------------- ---------------- -----------

GROSS PROFIT 10,033 10,722 21,543

Administrative expenses (6,794) (6,634) (13,292)

------------- ---------------- -----------

OPERATING PROFIT BEFORE EXCEPTIONAL

ITEMS 3,239 4,088 8,251

Exceptional items (122) (89) (221)

Share-based payments (51) (110) (3)

------------- ---------------- -----------

OPERATING PROFIT AFTER EXCEPTIONAL

ITEMS 3,066 3,889 8,027

Finance income 2 46 67

Finance expense (58) (79) (218)

------------- ---------------- -----------

PROFIT BEFORE TAXATION 3,010 3,856 7,876

Adjusted earnings before interest,

tax, exceptional items and

share-based payments 3,183 4,055 8,100

Exceptional items (122) (89) (221)

Share-based payments (51) (110) (3)

------------- ---------------- -----------

PROFIT BEFORE TAXATION 3,010 3,856 7,876

----------------------------------------------- ------- ------------- --- ---------------- --- -----------

Taxation (572) (728) (1,524)

------------- ---------------- -----------

PROFIT AND TOTAL COMPREHENSIVE

INCOME 2,438 3,128 6,352

============= ================ ===========

Attributable to equity holders

of the company 2,438 3,128 6,352

============= ================ ===========

Profit per share attributable

to the equity holders of the

company during the Period

Pence per Pence per Pence per

share share share

- basic 6 2.76 3.62 7.30

============= ================ ===========

- diluted 6 2.70 3.14 6.61

============= ================ ===========

All of the above amounts are in respect of continuing

operations.

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

FOR THE SIX MONTHS TO 30 NOVEMBER 2019

Unaudited Audited

6 months to 12 months

30 November to

31 May

2019 2019

GBP'000 GBP'000

NON-CURRENT ASSETS

Goodwill 27,847 27,847

Intangible assets 430 493

Property, plant and equipment 1,380 1,418

Trade and other receivables 43,599 50,710

Deferred tax 958 945

------------- -----------

74,214 81,413

------------- -----------

CURRENT ASSETS

Cash and cash equivalents 2,294 1,851

Trade and other receivables 87,291 74,432

------------- -----------

89,585 76,283

------------- -----------

TOTAL ASSETS 163,799 157,696

============= ===========

EQUITY

Called up share capital 8,899 8,760

Share premium account 25,360 25,134

Employee Shares 298 298

Treasury Shares (300) (300)

Retained earnings 21,828 19,888

------------- -----------

TOTAL EQUITY 56,085 53,780

LIABILITIES

NON-CURRENT LIABILITIES

Trade and other payables 30,744 29,805

Financial liabilities - borrowings - 469

Provisions - 801

------------- -----------

30,744 31,075

------------- -----------

CURRENT LIABILITIES

Trade and other payables 71,335 67,563

Financial liabilities - borrowings 3,425 3,278

Provisions 745 691

Dividends payable 498 -

Tax payable 967 1,309

------------- -----------

76,970 72,841

------------- -----------

TOTAL LIABILITIES 107,714 103,916

------------- -----------

TOTAL EQUITY AND LIABILITIES 163,799 157,696

============= ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS TO 30 NOVEMBER 2019

Unaudited

6 months Unaudited

to 6 months

30 November to 30 November

2019 2018

GBP'000 GBP'000

Cash generated from operations

Profit before tax 3,010 3,856

Depreciation and amortisation charges 364 637

Finance costs 58 79

Finance income (2) (46)

Decrease/(Increase) in inventory - (119)

Decrease/(Increase) in trade and

other receivables (5,748) (60)

(Decrease)/Increase in trade and

other payables 4,711 (2,688)

Movement in non-cash items 15 (42)

-------------- ------------------

2,408 1,617

Cash flows from operating activities

Interest paid (58) (79)

Tax paid (913) (759)

-------------- ------------------

Net cash generated from operating

activities 1,437 779

-------------- ------------------

Cash flows from investing activities

Interest received 2 46

Contingent consideration paid (367) (536)

Purchase of software, property, plant

& equipment (261) (451)

-------------- ------------------

Net cash generated from investing

activities (626) (941)

-------------- ------------------

Cash flows from financing activities

Loan repayments in period (621) (651)

Loans issued in period (inc overdrafts) 300 326

Dividends paid - (560)

-------------- ------------------

Net cash generated from financing

activities (321) (885)

-------------- ------------------

Increase in cash and cash equivalents 490 (1,047)

Cash and cash equivalents at the

beginning of the period 331 2,070

-------------- ------------------

Cash and cash equivalents at the

end of the period 821 1,023

============== ==================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS TO 30 NOVEMBER 2019

Share Share Retained Treasury Employee Total

Capital Premium Earnings Shares Shares Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 May

2019 8,760 25,134 19,888 (300) 298 53,780

Total comprehensive

income - - 2,438 - - 2,438

Transactions with

owners

Dividends

- - (498) - - (498)

Issue of share

capital 139 226 - - - 365

Balance at 30

November

2019 8,899 25,360 21,828 (300) 298 56,085

======== ======== ========= ========= ========= ========

Share Share Retained Treasury Employee Total

Capital Premium Earnings Shares Shares Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 May

2018 8,621 24,721 14,342 (300) 295 47,679

Total comprehensive

income - - 3,128 - - 3,128

Transactions with

owners

Dividends

- - (560) - - (560)

Issue of share

capital 139 413 - - - 552

Balance at 30

November

2018 8,760 25,134 16,910 (300) 295 50,799

======== ======== ========= ========= ========= ========

1 BASIS OF PREPARATION

The financial information set out in the interim report does not

constitute statutory accounts as defined in section 434(3) and

435(3) of the Companies Act 2006. The Group's statutory financial

statements for the year ended 31 May 2019 prepared in accordance

with IFRS as adopted by the European Union and with the Companies

Act 2006 have been filed with the Registrar of Companies. The

auditor's report on those financial statements was unqualified

and did not contain a statement under Section 498(2) of the Companies

Act 2006. These interim financial statements have been prepared

under the historical cost convention.

These interim financial statements have been prepared in accordance

with the accounting policies set out in the most recently available

public information, which are based on the recognition and measurement

principles of IFRS in issue as adopted by the European Union (EU)

and are effective at 31 May 2019. The condensed set of financial

statements included in this half-yearly financial report has been

prepared in accordance with International Accounting Standard

34 'Interim Financial Reporting', as adopted by the European Union.

The financial information for the six months ended 30 November

2018 and the six-month period to 30 November 2019 are unaudited

and do not constitute the Group's statutory financial statements

for these periods. The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

interim financial statements.

Going Concern

The directors are satisfied that the Group has sufficient resources

to continue in operation for the foreseeable future, a period

of not less than 12 months from the date of this report. Accordingly,

they continue to adopt the going concern basis in preparing the

condensed financial statements.

Recent Accounting developments

IFRS 16, 'Leases' addresses the recognition of leases on the balance

sheet. The standard is effective for accounting periods beginning

on or after 1 January 2019. The standard eliminates the classification

of leases as either operating or finance leases and results in

operating leases being treated as finance leases. This has resulted

in previously recognised operating leases being treated as property,

plant and equipment and a finance lease creditor. The issue of

the standard has increased the value of property, plant and equipment

and the finance lease liability on the balance sheet, but the

adoption of this standard has not had a material impact on the

profit of the Group.

2 SEGMENTAL REPORTING

The Group has one business segment to which all revenue, expenditure,

assets and liabilities relate.

3 BASIS OF CONSOLIDATION

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries). Control is achieved where the Company has

the power to govern the financial and operating policies of an

entity so as to obtain benefit from its activities.

All intra-Group transactions, balances, income and expenses are

eliminated on consolidation.

4 TAXATION

Taxation charged for the period ended 30 November 2019 is calculated

by applying the directors' best estimate of the annual tax rate

to the result for the period.

5 SHARE CAPITAL

The Articles of Association of the company state that there is

an unlimited authorised share capital.

Each share carries the entitlement to one vote.

On 4 September 2019 the Company issued 1,388,888 Ordinary GBP0.10

shares at GBP0.2625 per share, being deferred consideration to

the vendors of Positive Cashflow (Holdings) Limited, as part of

the Share Purchase Agreement entered into on 29 June 2017.

6 EARNINGS PER ORDINARY SHARE

The earnings per ordinary share has been calculated using the profit for the period and the weighted

number of ordinary shares in issue during the period. For diluted earnings per share, the weighted average

number of shares is adjusted to assume conversion of all dilutive potential ordinary shares.

6 months 6 months 12 months

to to to

30 Nov 31 May

30 Nov 2019 2018 2019

GBP'000 GBP'000 GBP'000

Earnings attributable to ordinary

shareholders 2,438 3,128 6,352

Basic EPS

Weighted average number of shares 88,264,309 86,503,533 87,048,483

Per-share amount pence 2.76 3.62 7.30

Diluted EPS

Weighted average number of shares 90,375,095 99,617,558 96,058,428

Per-share amount pence 2.70 3.14 6.46

7 DIVIDENDS

Dividends provided for or paid during the half year:

6 months 6 months 12 months

to to to

30 Nov 31 May

30 Nov 2019 2018 2019

GBP'000 GBP'000 GBP'000

Ordinary shares of GBP0.10 each

Final 498 561 561

Interim - - 245

------------------------------------ ------------ --- ---------- --- ----------

Total 498 561 806

On 12 December 2019 the company paid a final dividend of GBP498,317

for the financial year ending 31 May 2019, being 0.56 pence per

Ordinary GBP0.10 share. This was in addition to a maiden dividend

for the year of GBP245,269 (0.28 pence per share) which was paid

on 1 May 2019. Taken together the total dividend for the year

ending 31 May 2019 was thus GBP743,586 (total 0.84 pence per share).

GBP560,349 was paid by the company on 1 November 2018 being 0.65

pence per share for the financial year ending 31 May 2018. Since

the end of the half-year the Board have recommended the payment

of an interim dividend of 0.36 pence per share for the period

ended 30 November 2019. This is expected to be paid on 12 May

2020.

8 COPIES OF THE INTERIM REPORT

Copies of the Interim Report are available from

www.onepmfinance.co.uk and the Company Secretary at the registered

office: 2(nd) Floor, St James House, The Square, Lower Bristol

Road, Bath, BA2 3BH

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SFLEELESSEIF

(END) Dow Jones Newswires

January 15, 2020 02:00 ET (07:00 GMT)

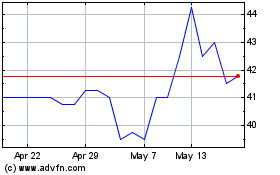

Time Finance (LSE:TIME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Time Finance (LSE:TIME)

Historical Stock Chart

From Apr 2023 to Apr 2024