TIDMTEK

RNS Number : 3359N

Tekcapital plc

25 October 2016

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR)

Tekcapital plc

("Tekcapital")

Private Placement for Belluscura Ltd

Follow-on funding round raises US$675,000

Tekcapital plc (AIM: TEK), an international provider of

technology and intellectual property services, is pleased to

announce that Belluscura Ltd ("Belluscura") has concluded an

oversubscribed private placement to raise approximately US$675,000

("Private Placement").

The Company announced on 17 June 2016 that it planned to extend

its fundraising round and this Private Placement has been concluded

on similar terms, giving Belluscura a post-money valuation of

US$5,250,000. Tekcapital now owns approximately 65% of the share

capital of Belluscura.

In line with the previous fundraising (announced on 17 June

2016) the proceeds of the Private Placement are intended to be

applied as follows:

- regulatory, safety and quality expenses for medical products,

including CE Marking and certification for European sales;

- implementing product manufacturing and acquiring initial stock;

- acquisition of additional medical products; and

- working capital purposes.

Investors in the Private Placement include Nigel Wray and his

family and as they hold more than 10 per cent. of Tekcapital's and

Belluscura's ordinary shares, their participation of US$100,000 in

the Private Placement is deemed to be a related party transaction

pursuant to rule 13 of the AIM Rules for Companies. Accordingly,

the directors of Tekcapital consider, having consulted with the

Company's nominated adviser, Allenby Capital, that the terms of the

subscription with Nigel Wray are fair and reasonable insofar as

Tekcapital's shareholders are concerned.

Commenting on the private placement, Dr. Clifford M. Gross,

Executive Chairman of Tekcapital, said: "We are very pleased to

announce the second tranche of the private placement into

Belluscura. Belluscura's mission is to provide premium, proprietary

medical devices at affordable prices."

For further information, please contact:

Tekcapital Plc +1 305 200 3450

Clifford M. Gross info@tekcapital.com

Allenby Capital Limited (Nominated

Adviser & Joint Broker) +44 (0)20 3328 5656

Jeremy Porter / Alex Brearley

Optiva Securities Limited (Joint +44 (0) 20 3137

Broker) 1904

Jeremy King / Vishal Balasingham jeremy.king@optivasecurities.com

+44 (0) 20 7933

Walbrook PR Ltd 8780

Paul Cornelius / Paul McManus

/ Helen Cresswell tekcapital@walbrookpr.com

Tekcapital plc - The World's Largest University Network for Open

Innovation

Tekcapital helps clients profit from new, university-developed

intellectual properties. With our proprietary discovery search

engine, linked to 4,000+ universities in 160 countries, coupled

with expert scientific review, we provide a turn-key service to

make it easy for clients to find and acquire the IP, analytics and

technology transfer professionals they need to create a competitive

advantage. Tekcapital plc is listed on the AIM market of the London

Stock Exchange (AIM: symbol TEK) and is headquartered in Oxford, in

the UK. For more information, please visit www.tekcapital.com

Background to Belluscura

Belluscura (www.belluscura.com) was established in the UK in

December 2015 to provide premium proprietary medical devices at

affordable prices, to address part of the global unmet need for

inexpensive, superior medical devices. Belluscura will seek to

achieve this goal by acquiring, then manufacturing and selling,

proprietary medical devices deemed to be non-core or undervalued by

leading medical device companies on an on-going basis.

In line with this strategy, as previously announced by

Tekcapital on 13 April 2016 and 15 September 2016, Belluscura

acquired the exclusive licenses to manufacture and sell four

medical products from Stryker Corporation, a leading medical

technology company. The devices are:

1. Slyde(TM) , a lightweight stretcher designed for use in

emergency evacuations of multi-storey structures;

2. Passport(R) , a surgical trocar designed as a camera port for

use in laparoscopy (keyhole surgery);

3. SNAP II, a level of consciousness monitor for use during

surgical procedures requiring general anesthesia; and

4. Wire Caddy(TM) , an innovative wire management system that

provides lubrication and organization during multi-wire,

multi-exchange operating room cases such as cardiology

interventions, uterine fibroid embolizations and tibial

angioplasties.

These four devices are protected by a comprehensive intellectual

property portfolio of 19 issued and pending patents and industrial

designs. They have received US 510(k) regulatory clearance where

necessary and have already recorded commercial sales revenue for

Stryker. In addition, Passport has been awarded a CE Marking for

distribution in the EU.

Belluscura has begun manufacturing and selling the Slyde

products in the US and plans to subcontract the manufacturing of

the other products with the intention to sell them through external

sales channels at affordable prices globally with a focus on the

US, Europe, India and China.

In addition, Belluscura is evaluating a patented technology

relating to the non-invasive measurement of glucose in saliva for

the treatment of diabetes - Saliva Glucose Measurement Technology

("SGMT"). Tekcapital novated to Belluscura its worldwide exclusive

licenses to a patent and related patent application for SGMT for

companion animals (and humans). This technology is licensed from

and was developed by Arizona State University. Further details on

these licences were announced by Tekcapital on 2 April 2015 and 14

March 2016.

Belluscura plans to acquire additional developed medical

products which have already achieved regulatory clearance or

approval, or require limited additional regulatory clearance or

approval, and are deemed to be non-core by leading medical device

manufacturers. Furthermore, Belluscura will also endeavour to

identify and acquire undervalued proprietary technologies in the

medical space that require limited investment to reach

commercialisation.

Belluscura has an experienced executive management team,

independent of Tekcapital, with significant expertise in the

medical devices industry that covers a broad spectrum of

disciplines in business, law, medicine and technology.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMIBRTMBATBPF

(END) Dow Jones Newswires

October 25, 2016 02:00 ET (06:00 GMT)

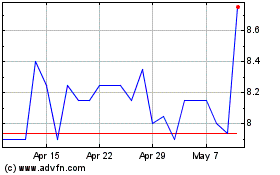

Tekcapital (LSE:TEK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tekcapital (LSE:TEK)

Historical Stock Chart

From Apr 2023 to Apr 2024