TIDMSOHO

RNS Number : 7252Y

Triple Point Social Housing REIT

14 May 2021

14 May 2021

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

RESULT OF ANNUAL GENERAL MEETING

The Board of Triple Point Social Housing REIT plc (ticker: SOHO)

is pleased to announce that at the Company's Annual General Meeting

held today, all resolutions were voted on by way of a poll and were

passed by shareholders.

Resolutions 1 to 12 (inclusive) were proposed as ordinary

resolutions and resolutions 13 to 16 (inclusive) were proposed as

special resolutions. The results of the poll were as follows:

Resolution Votes For % Votes Against % Total votes Total votes Votes Withheld**

validly cast as %

cast of issued

share capital*

To receive and

adopt the

Annual

Report and

accounts of the

Company for the

year ended

31 December

1 2020 287,517,021 100.00 0 0.00 287,517,021 71.38% 497,934

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To approve the

Directors'

Remuneration

2 Report 282,385,621 98.22 5,125,111 1.78 287,510,732 71.38% 504,223

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To approve the

Directors'

Remuneration

3 Policy 281,378,243 97.87 6,132,489 2.13 287,510,732 71.38% 504,223

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To re-elect

Christopher

Phillips

as a Director

4 of the Company 285,402,267 99.14 2,471,379 0.86 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To re-elect Ian

Reeves CBE

as a Director

5 of the Company 287,865,395 100.00 8,251 0.00 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To re-elect

Peter Coward as

a Director of

6 the Company 287,865,395 100.00 8,251 0.00 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To re-elect

Paul Oliver as

a Director of

7 the Company 287,865,395 100.00 8,251 0.00 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To re-elect

Tracey

Fletcher-Ray

as a Director

8 of the Company 287,865,395 100.00 8,251 0.00 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To re-appoint

BDO LLP as

Auditors

9 of the Company 287,865,395 100.00 8,251 0.00 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To authorise

the Audit

Committee

to determine

the Auditors'

10 remuneration 286,866,268 100.00 8,251 0.00 286,874,519 71.22% 1,140,436

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To authorise

the Directors

11 to allot shares 286,536,958 99.54 1,336,688 0.46 287,873,646 71.47% 141,309

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To authorise

the Directors

to declare and

pay all

dividends

of the Company

as interim

12 dividends 287,608,645 99.91 254,636 0.09 287,863,281 71.47% 151,674

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To dis-apply

statutory

pre-emption

13 rights up to 5% 282,713,555 98.33 4,793,101 1.67 287,506,656 71.38% 508,299

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To dis-apply

pre-emption

rights

up to a further

5% in

connection

with an

acquisition or

specified

capital

14 investment 278,308,510 96.80 9,187,363 3.20 287,495,873 71.38% 519,082

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To authorise

the Company to

purchase its

15 own shares 274,013,692 95.19 13,854,400 4.81 287,868,092 71.47% 146,863

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

To authorise

the calling of

general

meetings, other

than

an annual

general

meeting,

on not less

than 14 clear

days'

16 notice 282,957,400 98.30 4,899,174 1.70 287,856,574 71.47% 158,381

---------------- ------------ ------- -------------- ----- ------------ ---------------- -----------------

*Excluding treasury shares.

**A vote withheld is not a vote in law and is not counted in the

calculation of the votes for or against a resolution.

Every shareholder has one vote for every Ordinary Share held. As

at 14 May 2021, the issued share capital of the Company consisted

of 403,239,002 Ordinary Shares. The Company holds 450,000 Ordinary

Shares in treasury, which do not carry voting rights. Therefore,

the total voting number of voting rights in the Company is

402,789,002 Ordinary Shares.

The full text of all the resolutions can be found in the Notice

of Annual General Meeting dated 4 March 2021, a copy of which is

available on the Company's website at

https://www.triplepointreit.com/investors/72/ .

In accordance with Listing Rule 9.6.2 copies of all the

resolutions passed, other than ordinary business, will be submitted

to the National Storage Mechanism and will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management Tel: 020 7201 8989

LLP

(Investment Manager)

Max Shenkman

Isobel Gunn-Brown

Freddie Cowper-Coles

Akur Capital (Joint Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

Stifel (Joint Financial Adviser Tel: 020 7710 7600

and Corporate Broker)

Mark Young

Mark Bloomfield

Rajpal Padam

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com .

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-linked,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring ("FRI") leases with Approved Providers (being Housing

Associations, Local Authorities or other regulated organisations in

receipt of direct payment from local government). The portfolio

comprises investments into properties which are already subject to

an FRI lease with an Approved Provider, as well as forward funding

of pre-let developments but does not include any direct development

or speculative development.

There is increasing political pressure and social need to

increase housing supply across the UK which is creating

opportunities for private sector investors to help deliver this

housing. The Group's ability to provide forward funding for new

developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust ("REIT") and is a

constituent of the FTSE EPRA/NAREIT index.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGDKQBPNBKDKPD

(END) Dow Jones Newswires

May 14, 2021 09:52 ET (13:52 GMT)

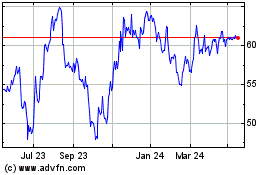

Triple Point Social Hous... (LSE:SOHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

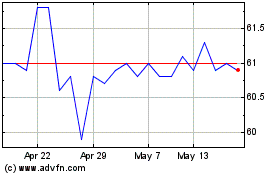

Triple Point Social Hous... (LSE:SOHO)

Historical Stock Chart

From Apr 2023 to Apr 2024