TIDMSOHO

RNS Number : 4052E

Triple Point Social Housing REIT

18 October 2018

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN,

NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION

WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OR BREACH OF ANY

APPLICABLE LAW OR TO US PERSONS. PLEASE SEE THE IMPORTANT NOTICE AT

THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

18 October 2018

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

RESULT OF PLACING, OPEN OFFER AND OFFER FOR SUBSCRIPTION OF

ORDINARY SHARES

TOTAL VOTING RIGHTS

Further to its announcement on 19 September 2018, the Board of

Triple Point Social Housing REIT plc (ticker: SOHO) is pleased to

announce that the Company has successfully raised gross proceeds of

GBP108.15 million pursuant to the issue of a total of 105,000,000

new ordinary shares in the Company (the "Ordinary Shares") at a

price of 103p per share (the "Issue Price"), (the "Issue").

The Company received subscriptions under the Open Offer and

Offer for Subscription, and orders under the Placing, which in

aggregate exceeded the Company's target issue size of 100 million

Ordinary Shares. In light of the strong pipeline identified by

Triple Point Investment Management LLP (the "Delegated Investment

Manager") for the rest of the year, the Board has increased the

size of the Issue.

Of the 105 million Ordinary Shares that will be issued by the

Company, 48,477,838 Ordinary Shares will be issued pursuant to the

Open Offer, 2,324,534 Ordinary Shares will be issued pursuant to

the Offer for Subscription and 54,197,628 Ordinary Shares will be

issued under the Placing. The Net Proceeds of the Issue will be

used by the Company to capitalise on investment opportunities

identified by the Delegated Investment Manager in the Supported

Housing sector in accordance with the Company's investment policy.

The Delegated Investment Manager expects to be able to deploy the

Net Proceeds of the Issue by 31 January 2019.

Commenting on the result of the Issue, Chris Phillips, Chairman

of Triple Point Social Housing REIT plc, said:

"We are pleased with the result of this fundraise against a

challenging market backdrop and it has given us the opportunity to

expand our shareholder base. We appreciate the continued support of

our existing shareholders and welcome our new investors.

With a strong identified pipeline of attractive investment

opportunities, we remain focused on continuing to deliver value to

shareholders through our selective investment strategy and we look

forward to reporting on the Group's further progress over the

coming months."

Max Shenkman, Partner of Triple Point Investment Management LLP,

commented:

"The Net Proceeds of the Issue will enable the Group to

capitalise on the pipeline of specific acquisition opportunities we

have identified in the Supported Housing sector, further

diversifying the Company's portfolio by way of both Registered

Provider and geography. The market fundamentals remain compelling,

underlined by undersupply and strong central and local government

support for Supported Housing, and we are confident of continuing

to generate attractive returns for investors."

The Issue is conditional, amongst other things, upon the passing

of the Issue Resolutions at the General Meeting to be held at 11.00

a.m. today, Admission of the Ordinary Shares occurring no later

than 8.00 a.m. on 22 October 2018 (or such later time and/or date

as the Company, Akur Limited ("Akur") and Canaccord Genuity Limited

("Canaccord Genuity") may agree) and the Placing Agreement not

being terminated and becoming unconditional in accordance with its

terms.

Canaccord Genuity and Akur acted as Joint Financial Advisers to

the Company. Canaccord Genuity acted as Sponsor, Sole Global

Coordinator and Bookrunner in relation to the Issue.

Admission

Application has been made for 105,000,000 Ordinary Shares to be

admitted to the premium listing segment of the Official List of the

FCA and to trading on the London Stock Exchange's main market for

listed securities ("Admission"). It is expected that Admission will

become effective, and that dealings will commence, on 22 October

2018.

Total Voting Rights

Immediately following Admission, the Company's issued share

capital will consist of 351,352,210 Ordinary Shares with voting

rights. Therefore, the total voting rights in the Company will be

351,352,210. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Timetable

Trade date (on a T+2 basis) for 18 October 2018

Ordinary Shares to be issued to

Placees pursuant to the Placing

General Meeting 11.00 a.m. on 18 October 2018

Admission of the Ordinary Shares 8.00 a.m. on 22 October 2018

to the premium segment of the Official

List and commencement of dealings

on the London Stock Exchange

Crediting of CREST stock accounts 22 October 2018

Share certificates despatched (where week commencing 29 October

appropriate) 2018 (or as soon as possible

thereafter)

The dates and times specified are subject to change without

further notice. All references to times in this Announcement are to

London time unless otherwise stated.

Dealing codes

Ordinary Shares

Ticker of the Ordinary Shares SOHO

ISIN for the Ordinary Shares GB00BF0P7H59

SEDOL for the Ordinary Shares BF0P7H5

Unless otherwise defined in this announcement, capitalised terms

used in this announcement shall have the same meanings as those

defined in the prospectus of the Company dated 19 September

2018.

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management (via Newgate below)

LLP

(Delegated Investment Manager)

James Cranmer

Ben Beaton

Max Shenkman

Justin Hubble

Canaccord Genuity Limited (Joint Tel: 020 7523 8000

Financial Adviser and Corporate

Broker)

Lucy Lewis

Denis Flanagan

Andrew Zychowski

Akur Limited (Joint Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

Newgate (PR Adviser) Tel: 020 7680 6550

James Benjamin Em: triplepoint@newgatecomms.com

Anna Geffert

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com.

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-adjusted,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring ("FRI") leases with Approved Providers (being Housing

Associations, Local Authorities or other regulated organisations in

receipt of direct payment from local government). The portfolio

comprises investments into properties which are already subject to

an FRI lease with an Approved Provider, as well as forward funding

of pre-let developments but does not include any direct development

or speculative development.

There is increasing political and financial pressure on Housing

Associations to increase their housing delivery and this is

creating opportunities for private sector investors to participate

in the market. The Group's ability to provide forward financing for

new developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

Triple Point Investment Management LLP (part of the Triple Point

Group) is responsible for management of the Group's portfolio (with

such functions having been delegated to it by Langham Hall Fund

Management LLP, the Company's alternative investment fund

manager).

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust ("REIT") and is a

constituent of the FTSE EPRA/NAREIT index.

IMPORTANT NOTICE

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States (including its

territories and possessions, any state of the United States and the

District of Columbia), Australia, Canada, South Africa, New Zealand

or Japan or to US persons. The distribution of this announcement

may be restricted by law in certain jurisdictions and persons into

whose possession any document or other information referred to

herein comes should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction.

This announcement does not contain or constitute an offer for

sale of, or the solicitation of an offer or an invitation to buy or

subscribe for, Ordinary Shares to any person in the United States,

Australia, Canada, South Africa, New Zealand or Japan or in any

jurisdiction to whom or in which such offer or solicitation is

unlawful.

The Company has not been and will not be registered under the US

Investment Company Act of 1940, as amended (the "Investment Company

Act"). In addition, the Ordinary Shares have not been and will not

be registered under the US Securities Act of 1933, as amended (the

"Securities Act") or under the securities laws of any state or

other jurisdiction of the United States and may not be offered or

sold in the United States or to or for the account or benefit of US

persons absent registration or an exemption from the registration

requirements of the Securities Act and in compliance with any

applicable state securities laws and in circumstances that will not

require registration of the Company under the Investment Company

Act. There will be no public offer of the Ordinary Shares in the

United States.

The offer and sale of Ordinary Shares has not been and will not

be registered under the applicable securities laws of any state,

province or territory of Australia, Canada, South Africa, New

Zealand or Japan. Subject to certain exceptions, the Ordinary

Shares may not be offered or sold in Australia, Canada, South

Africa, New Zealand or Japan or to, or for the account or benefit

of, any national, resident or citizen of Australia, Canada, South

Africa, New Zealand or Japan.

Canaccord Genuity is authorised and regulated by the Financial

Conduct Authority. Akur is authorised and regulated by the

Financial Conduct Authority. Each of Canaccord Genuity and Akur is

acting exclusively for the Company and no-one else in connection

with the Issue and the Placing Programme. They will not regard any

other person as their respective clients in relation to the subject

matter of this announcement and will not be responsible to anyone

other than the Company for providing the protections afforded to

their respective clients, nor for providing advice in relation to

the contents of this announcement or any transaction, arrangement

or other matter referred to herein.

None of the Company, Triple Point, Canaccord Genuity, Akur and

any of their respective affiliates accepts any responsibility or

liability whatsoever for/or makes any representation or warranty,

express or implied, as to this announcement, including the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement)

or any other information relating to the Company, its subsidiaries

or associated companies, whether written, oral or in a visual or

electronic form, and howsoever transmitted or made available or for

any loss howsoever arising from any use of the announcement or its

contents or otherwise arising in connection therewith. The Company,

Triple Point, Canaccord Genuity, Akur and their respective

affiliates accordingly disclaim all and any liability whether

arising in tort, contract or otherwise which they might otherwise

have in respect of this announcement or its contents or otherwise

arising in connection therewith.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIDDLFFVBFZFBQ

(END) Dow Jones Newswires

October 18, 2018 02:00 ET (06:00 GMT)

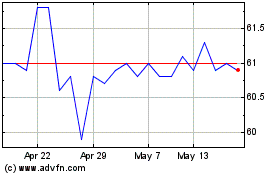

Triple Point Social Hous... (LSE:SOHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

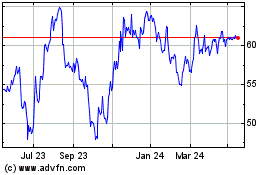

Triple Point Social Hous... (LSE:SOHO)

Historical Stock Chart

From Apr 2023 to Apr 2024