TIDMSCT

RNS Number : 8694T

Softcat PLC

18 October 2017

SOFTCAT plc

("Softcat", the "Company")

Preliminary Results for the twelve months to 31 July 2017

Strong growth and cash generation, final and special dividends

totalling 19.6p proposed

Softcat plc (LSE: SCT.L), a leading UK provider of IT

infrastructure products and services, today publishes its full year

results to 31 July 2017. The results demonstrate strong revenue

growth, profit performance and cash generation during the

period.

Twelve months

Financial Summary ended

31 July 31 July

2017 2016 Growth

--------- --------- --------

GBPm GBPm %

Revenue GBP832.5 GBP672.4 23.8

Gross profit GBP136.3 GBP120.7 12.9

Operating profit GBP50.2 GBP42.2 18.9

Adjusted operating

profit(a) GBP51.5 GBP46.8 10.1

Cash conversion(b) 97.2% 85.5% n/a

Final dividend (p) 6.1 3.6 69.4(c)

Special dividend (p) 13.5 14.2 (4.9)

Diluted earnings per

share (p) 20.2 16.9 19.5

Adjusted diluted earnings

per share(d) (p) 20.9 19.1 9.4

(a) Adjusted operating profit is defined as operating profit

before exceptional items and share-based payment charges.

(b) Cash conversion is defined as cash flow from operations

before tax but after capital expenditure, as a percentage of

operating profit.

(c) The high growth in the final dividend reflects the reduction

applied in the prior period to account for the fact the Company was

only publicly listed for approximately two thirds of the 2016

financial year.

(d) Adjusted diluted earnings per share is defined as profit

after tax before exceptional items and share-based payment charges

divided by the weighted average number of shares including the

dilutive effect of share options.

Highlights for the twelve months to 31 July 2017

-- Revenue up 23.8% to GBP832.5m (2016: GBP672.4m)

-- Gross profit up 12.9% to GBP136.3m (2016: GBP120.7m)

-- Gross profit margin down 1.6% pts to 16.4% (2016: 18.0%)

-- Operating profit growth of 18.9% to GBP50.2m (2016: GBP42.2m)

-- Adjusted operating profit up 10.1% to GBP51.5m (2016: GBP46.8m)

-- In 2016 gross profit included the benefit of a one-off

procurement saving of GBP3.4m. Excluding this, in 2017 gross profit

grew by 16.2% (2016: 14.1%) and adjusted operating profit by 16.4%

(2016: 8.9%)

-- Cash conversion of 97.2% (2016: 85.5%), reflecting the

ongoing close management of working capital

-- Net cash position at year end of GBP61.6m, after payment of GBP40.9m dividends during 2017

-- Customer numbers up 6.0% to 13,000 (2016: 12,200), gross

profit per customer growth of 6.5%, to GBP10,500 (2016:

GBP9,900)

-- Average headcount up 18%, reflecting further investment

across all areas of the business, especially in our services and

technical capability

-- Total dividend relating to 2017 up 15% to 22.5p (2016: 19.5p)

Martin Hellawell, Softcat CEO commented

"I'm pleased to report on another very strong year for Softcat

with 24% revenue growth and double-digit growth in both gross

profit and operating profit.

Our simple strategy of winning new customers and selling more to

existing customers was successfully executed, and we were delighted

to welcome an incremental 800 customers last year and to see gross

profit per customer increase by over six per cent. Once again this

was achieved through unwavering focus on customer service,

delivered by an outstanding team of highly engaged Softcat

people.

Our search for a new CEO is progressing. In the meantime I

remain fully focussed on doing the job and look forward when the

time comes to continuing with the company as non-executive

Chairman.

It's been a privilege to lead Softcat through a period of 48

quarters of top line and bottom line year-on-year organic growth

and, while we are far from perfect and have much we can improve on,

the business is in good shape and the opportunity ahead of us is

clear."

Outlook

Our financial year starts on August 1(st) and as I write this we

are approximately ten weeks into the new year. It's very early days

and there is still all to play for but we are where we would like

to be at this stage.

Analyst meeting

A results presentation for analysts and investors will be held

today at the offices of FTI Consulting: 9(th) Floor, 200

Aldersgate, Aldersgate Street, London, EC1A 4HD. Registration will

open at 09.15 for a 09.30 start. Materials from this presentation

will be available online at www.softcat.com from 09.00. A copy of

this announcement will also be available online from 07.00.

Enquiries

Softcat plc: +44 (0)1628 403 403

Martin Hellawell, Chief

Executive Officer

Graham Charlton, Chief

Financial Officer

FTI Consulting LLP: +44 (0)2037 271 000

Ed Bridges

Dwight Burden

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". By their nature, such

statements involve risk and uncertainty since they relate to future

events and circumstances. Actual results may, and often do, differ

materially from any forward-looking statements.

Any forward-looking statements in this announcement reflect

management's view with respect to future events as at the date of

this announcement. Save as required by law or by the Listing Rules

of the UK Listing Authority, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement following any change in its expectations or to reflect

subsequent events or circumstances following the date of this

announcement.

Chief Executive Officer's Review

We had a very satisfactory financial year 2017 and I am pleased

with the outcome.

Revenue growth was really strong at 24%. I'm always most

interested in our gross profit growth and that was equally pleasing

for me being up 13% despite last year containing a one-off benefit

that we knew would not repeat. So, excluding that, in underlying

terms growth in gross profit was 16%. Our growth would indicate

that once again we have taken further market share in our

sector.

The gross profit growth resulted in 10% adjusted EBIT growth

(16% underlying, i.e. excluding the 2016 one-off

procurement-related benefit), while we continue to invest in new

capabilities. That, combined with another year of strong cash

generation, result in the special dividend we've proposed alongside

these results.

All our major business lines showed good growth in the year. Our

security and services businesses were perhaps the two stand-out

performers, delivering very strong growth.

Our security business has been one of our key strengths for many

years now. We saw strong underlying growth in this area which was

further assisted by purchases related to organisations preparing

themselves for General Data Protection Regulation (GDPR) compliance

which will be enforced from 25 May 2018. This is a significant

challenge for the majority of our customers and there is a lot more

work required in this area, which is therefore a good opportunity

for us moving forward. General security risks continue to grow in

complexity and frequency and are now a major board room priority,

highlighted by high profile events like the Wannacry attacks.

Softcat was particularly proactive in advising and assisting

customers on these types of threats.

We have invested significantly in our own services capability

and we continue to work with a number of third party organisations

to complement our internal offering. Particularly in areas such as

hybrid cloud migration and mobility, in many cases customers are

looking to Softcat to provide a complete solution rather than

trying to stitch various technology components together themselves.

We completed a large number of projects in these areas using tried

and tested expertise and templates.

We have six existing branches and all met expectations and

achieved positive growth. The stand-out performers were Manchester

and London. We very much enjoyed our first full financial year in

Scotland and are delighted with the number of new Scottish

customers who are trading with Softcat since we became established

there. We also recently announced that we intend to open a seventh

location in Southampton in the first half of this new financial

year.

The SMB and mid-market remains our largest segment and despite

our market leadership position continues to grow well from a very

large base. Our public sector business saw very strong growth again

this year and the enterprise segment also outpaced overall company

growth and it's pleasing to see us tapping into that opportunity.

The vast majority of our business is in the UK but we assist an

increasing number of our customers with their requirements outside

the UK.

In terms of market and technology trends, we see an increasing

proportion of our software licensing business transition to a cloud

based platform. For example, we may previously have sold Microsoft

licensing agreements for Office which were installed by customers

on their sites. Today, many customers are choosing to consume

Office from the Cloud with Office 365.

For reasons of control, security, cost and the difficulty of

porting legacy applications to the cloud, customers own

infrastructure and private cloud infrastructure still has its

place. Indeed we have seen several instances of customers moving

back from the public cloud to the private cloud environment.

Overall however, we see a continuing trend from customers to

transition towards the public cloud for an increasing number of

workloads. Softcat has subsequently grown a strong Microsoft Azure

business over recent years and is working with a number of

customers on the Amazon AWS platform.

Consequently we see a growing opportunity to develop our

services and support business by helping customers migrate to a

hybrid and public cloud environment. We can then work with

customers to support and manage those environments. This is

effectively an opportunity to augment our already very large

subscription licensing business, a part of the business we've been

well known for throughout our history and received many plaudits

for.

In particular, we want to be the best in cloud and traditional

subscription software, we want to be the go to security company in

the market and the partner of choice for cloud and datacentre.

There's plenty to do but we're well on our way.

We continue to define our business into three broad categories -

workplace technology which is all the standard technology on or

around a customer's desk, networking & security, and datacentre

and cloud. All areas are affording us plenty of opportunity and we

continue to expand our offering in each. In the workspace area our

managed print offering has gained significant traction. Last year

we expanded our range of extended support services particularly in

the networking area and this has added considerable incremental

business and profitability for the company.

While we have performed well for many years now and have enjoyed

48 quarters of top line and bottom line growth, the opportunity

ahead of us is clear. If you just take the list of the top 100 VARs

in the UK and put our turnover against the aggregated total, that

gives us around six and a half per cent market share. And there are

a lot more than one hundred VARs out there. That gives us at least

93.5% of the market still to go for. Our sales force strength, the

breadth and depth of our capability have never been better and

there's great momentum in the company. Despite questions around the

economy, our exit from the EU and public sector policy, the market

for what we do feels quite buoyant. We're lucky to have a very

broad portfolio and our customer centricity and flexibility allows

us to move quickly to the areas in the market where there is most

demand, which makes us far less vulnerable to specific technology

segments.

The opportunity is there for the taking but we are well aware

that only constant hard work, hunger and excellent execution will

allow us to take it.

I would like to thank our employees for taking the opportunity

last year and for all their tremendous support, commitment, hard

work and camaraderie during 2017 and over my last eleven years with

Softcat. I would also like to thank our very valued customers who

continue to be a pleasure to work with and who keep pushing us on

to ever greater things. And finally I would like to thank our

business partners who continue to give Softcat a tremendous amount

of support for which we are extremely grateful.

Chief Financial Officer's Review

Financial Summary FY17 FY16 Growth

-------------------- ------------ ------------ -----------

Revenue GBP832.5m GBP672.4m 23.8%

-------------------- ------------ ------------ -----------

Revenue split

Software GBP414.8m GBP320.0m 29.6%

Hardware GBP287.4m GBP250.7m 14.6%

Services GBP130.3m GBP101.7m 28.1%

-------------------- ------------ ------------ -----------

Gross profit GBP136.3m GBP120.7m 12.9%

-------------------- ------------ ------------ -----------

Gross profit

margin 16.4% 18.0% (1.6% pts)

-------------------- ------------ ------------ -----------

Adjusted operating

profit GBP51.5m GBP46.8m 10.1%

-------------------- ------------ ------------ -----------

Adjusted operating

profit margin 6.2% 7.0% (0.8% pts)

-------------------- ------------ ------------ -----------

Operating profit GBP50.2m GBP42.2m 18.9%

-------------------- ------------ ------------ -----------

Cash conversion 97.2% 85.5% 11.7% pts

-------------------- ------------ ------------ -----------

Revenue, gross profit and gross margin

Revenue growth was very strong at 23.8%, rising to GBP832.5m

(2016: GBP672.4m). This reflects good progress across all customer

segments with public sector business once again expanding fastest

and rising as a proportion of total income to 31% (2016: 29%).

Public sector revenue performance was boosted by the signing of a

large central government, low margin deal during the first half

worth up to GBP40m over 3 years, with GBP14m of income booked

during 2017. Revenue growth was also very strong across the

corporate sector by virtue of both new customer wins and

cross-selling new products to existing customers.

Revenue mix across technology categories (software, hardware and

services) was largely unchanged. Services expanded slightly as a

proportion of the total to 15.6% (2016: 15.1%) due to good growth

from both the expansion of in-house professional service capacity

as well as the introduction of new vendor support services.

Gross profit grew strongly, up 12.9% to GBP136.3m (2016:

GBP120.7m). Prior year gross profit includes the impact of GBP3.4m

non-recurring procurement savings within cost of sales. Excluding

this impact, gross profit grew in 2017 by 16.2% (2016: 14.1%). This

acceleration in underlying growth reflects further gains in market

share and pleasing returns on investment in sales and technical

capabilities over the past 18 months.

Gross profit margin was down during the year from 18.0% to 16.4%

due to the following key factors:

- non-recurring impact of procurement savings in 2016 (0.5% pts);

- large low margin central government contract in H1 2017 (0.3% pts)

- partial impact on Softcat margin from currency-induced vendor price rises (0.5% pts); and

- other (0.3% pts).

Customer KPIs

Customer numbers were up 6.0% to 13.0k (2016: 12.2k) reflecting

the continued efforts of both new hires and existing account

managers to expand our reach.

Perhaps even more pleasing, gross profit per customer rose 6.5%

(2016: 9.2%), or 9.6% (2016: 6.2%) on an underlying basis

(excluding the 2016 procurement benefit). This acceleration in

underlying gross profit per customer growth bears close correlation

with the Company's ability to cross-sell new product lines to

existing customers and increase share of wallet.

Revenue remains well dispersed across the customer base, with

the largest customer accounting for less than 2% of total

income.

Adjusted operating profit and operating margin

Adjusted operating profit increased by 10.1% to GBP51.5m.

Excluding the impact of the 2016 procurement upside, adjusted

operating profit grew by 16.4%, referred to as underlying adjusted

operating profit growth. This is a strong result in the context of

significant investments in the form of new graduate account

managers as well as services and technical staff. On an underlying

basis, and despite these investments, the margin of adjusted

operating profit to gross profit increased marginally from 37.7% to

37.8%.

Adjusted operating profit margin to sales of 6.2% (2016: 7.0%)

fell on the back of the gross margin reduction, detailed above.

Operating profit

Operating profit of GBP50.2m (2016: GBP42.2m) is 18.9% up due to

both the growth in adjusted operating profit and the exceptional

costs in the prior year related to the IPO.

Corporation tax charge

The effective tax rate for 2017 fell to 20.3% (2016: 21.8%),

mainly reflecting the absence from the current period of the

non-deductible expenses related to the IPO recognised in 2016.

Cash and balance sheet

Cash conversion was again strong at 97.2% (2016: 85.5%),

reflecting the ongoing close management of working capital balances

as the business continues to grow.

The broad composition of the balance sheet is unchanged,

reflecting the simple and efficient business model. The value of

stock is minimal due to the close operational partnership with

distributors and the value of inventory recognised at year end

mainly reflects goods in transit.

The Company's closing cash balance of GBP61.6m was only slightly

down on the prior year figure of GBP62.4m, having been replenished

by the results of operations following the payment of GBP40.9m

dividends during the year.

Dividend

A final dividend of 6.1p per share has been recommended by the

directors and if approved by shareholders will be paid on 15

December 2017. The record date will be 3 November and the shares

will trade ex-dividend on 2 November.

In line with the Company's stated intention to return excess

cash to shareholders over time, a further special dividend payment

of 13.5p per share has been proposed. If approved by shareholders

at the Company's AGM this would also be paid alongside the final

dividend in December 2017, and would bring total cash returned to

shareholders in the 2 years since IPO to GBP83.0m.

Principal Risks and Uncertainties

The principal risks facing the Company have been identified and

evaluated by the Board. In summary, these include:

Risk Potential Management & mitigation

impacts

---------------- --------------------------------------------- ------------------------------------------------------------

BUSINESS STRATEGY

--------------------------------------------------------------- ------------------------------------------------------------

Customer

dissatisfaction * Reputational damage * Graduate training programme

* Loss of competitive advantage * Ongoing vendor training for sales staff

* Annual customer survey with detailed follow-up on

negative responses

* Process for escalating cases of dissatisfaction to MD

& CEO

---------------- --------------------------------------------- ------------------------------------------------------------

Failure to

evolve our * Loss of customers * Processes in place to act on customer feedback about

technology new technologies

offering

with changing * Reduced profit per customer

customer * Training and development programme for all technical

needs staff

* Regular business reviews with all vendors

* Sales specialist teams aligned to emerging

technologies to support general account managers

* Regular specialist and service offering reviews with

senior management

---------------- --------------------------------------------- ------------------------------------------------------------

OPERATIONAL

--------------------------------------------------------------- ------------------------------------------------------------

Cyber and

data security * Inability to deliver customer services * Company-wide information security policy

* Reputational damage * Appropriate induction and training procedures for all

staff

* Financial loss

* External penetration testing programme undertaken

* ISO 27001 accreditation

---------------- --------------------------------------------- ------------------------------------------------------------

Business

interruption * Customer dissatisfaction * Operation of back-up operations centre and data

centre platforms

* Business interruption

* Established processes to deal with incident

management, change control, etc.

* Reputational damage

* Continued investment in operations centre management

* Financial loss and other resources

* Ongoing upgrades to network

* Regular testing of DR plans

---------------- --------------------------------------------- ------------------------------------------------------------

FINANCIAL

--------------------------------------------------------------- ------------------------------------------------------------

Profit margin

pressure * Reduced margins * Ongoing training to sales and operations team to keep

including pace with new vendor programmes

rebates

* Rebate programmes are industry standard and not

specific to the Company

* Rebates form an important but only minority element

of total operating profits

---------------- --------------------------------------------- ------------------------------------------------------------

PEOPLE

--------------------------------------------------------------- ------------------------------------------------------------

Culture change

* Reduced staff engagement * Culture embedded in the organisation over a long

history

* Negative impact on customer service

* Branch structure with empowered local management

* Quarterly staff survey with feedback acted upon

* Regular staff events and incentives

---------------- --------------------------------------------- ------------------------------------------------------------

Poor leadership

* Lack of strategic direction * Succession planning process

* Deteriorating vendor relationships * Experienced and broad senior management team

* Reduced staff engagement

---------------- --------------------------------------------- ------------------------------------------------------------

The Company is required to value share based payments, financial

instruments and apply judgment to revenue recognition and deferred

tax. A more detailed description of these estimates and

uncertainties are included in the prospectus and 2016 annual

report, which can be obtained from the Company's registered office

or from www.softcat.com.

Going Concern

The Company's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the strategic report contained within the Annual

Report. The financial position of the Company, its cash flows, and

liquidity position are described in the Chief Financial Officer's

Review above. In addition, note 20 to the financial statements

contained within the Annual Report includes the Company's

objectives, policies and processes for managing its capital, its

financial risk management objectives and its exposures to credit

risk and liquidity risk.

The Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future and have therefore continued to adopt the going

concern basis in preparing the financial statements.

Cautionary Statement

This preliminary announcement has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The preliminary announcement should not be relied on by

any other party or for any other purpose.

In making this preliminary announcement, the Company is not

seeking to encourage any investor to either buy or sell shares in

the Company. Any investor in any doubt about what action to take is

recommended to seek financial advice from an independent financial

advisor authorised by the Financial Services and Markets Act

2000.

Statement of Directors' responsibilities in relation to the

financial statements

The Directors are responsible for preparing the annual report

and the financial statements in accordance with applicable law and

regulations.

The Directors are required to prepare financial statements for

each financial year in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the European Union. Under

company law the Directors must not approve the financial statements

unless they are satisfied that they give a true and fair view of

the state of affairs of the Company as at the end of the financial

year and the profit or loss of the Company, so far as concerns

members of the Company, for the financial year. In preparing those

financial statements, the Directors are required to:

- select and apply accounting policies in accordance with IAS 8;

- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

- provide additional disclosures when compliance with the

specific requirements in IFRSs is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance;

- make judgements and estimates that are reasonable and prudent;

- state that applicable accounting standards have been followed,

subject to any material departures disclosed and explained in the

Company's financial statements; and

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records which are sufficient to disclose with reasonable accuracy

at any time the financial position of the Company and enable them

to ensure that the financial statements comply with the Companies

Act 2006 and Article 4 of the IAS Regulation. They are also

responsible for safeguarding the assets of the Company and hence

for taking reasonable steps for the prevention and detection of

fraud and other irregularities.

Fair and balanced reporting

Having taken advice from the Audit Committee, the Board

considers the Annual Report and Accounts, taken as a whole, is

fair, balanced and understandable and that it provides the

information necessary for shareholders to assess the Company's

position and performance, business model and strategy.

Responsibility statement pursuant to FCA's Disclosure Guidance

and Transparency Rule 4 (DTR 4)

Each Director of the Company confirms that (solely for the

purpose of DTR 4) to the best of his or her knowledge:

- the financial statements in this document, prepared in

accordance with the applicable accounting standards, give a true

and fair view of the assets, liabilities, financial position and

profit of the Company; and

- the Strategic Report and the Directors report include a fair

review of the development and performance of the business and the

position of the Company, together with a description of the

principal risks and uncertainties that it faces.

Statement of profit or loss and other comprehensive income

For the year ended 31 July 2017

2017 2016

GBP'000 GBP'000

Note

Revenue 3 832,486 672,351

Cost of sales (696,173) (551,634)

---------- ----------

Gross profit 136,313 120,717

Administrative expenses (86,151) (78,527)

---------- ----------

Operating profit 50,162 42,190

Adjusted operating profit 51,464 46,751

Exceptional items 4 - (3,673)

Share - based payments

charge (1,302) (888)

---------- ----------

Finance income 142 213

---------- ----------

Profit before taxation 50,304 42,403

Income tax expense 5 (10,196) (9,245)

---------- ----------

Profit for the year attributable

to owners of the Company 40,108 33,158

---------- ----------

Total comprehensive income

for the year attributable

to owners of the Company 40,108 33,158

========== ==========

Basic earnings per Ordinary

Share (pence) 9 20.4 16.9

Diluted earnings per Ordinary

Share (pence) 9 20.2 16.9

Adjusted basic earnings

per Ordinary Share (pence) 9 21.0 19.2

Adjusted diluted earnings

per Ordinary Share (pence) 9 20.9 19.1

========== ==========

All results are derived from continuing operations.

Statement of Financial Position

As at 31 July 2017

2017 2016

GBP'000 GBP'000

Note

Non-current assets

Property, plant and equipment 5,579 6,391

Intangible assets 504 667

Deferred tax asset 895 426

---------- ----------

6,978 7,484

---------- ----------

Current assets

Inventories 6,975 4,611

Trade and other receivables 7 173,506 132,787

Cash and cash equivalents 61,643 62,361

---------- ----------

242,124 199,759

---------- ----------

Total assets 249,102 207,243

========== ==========

Current liabilities

Trade and other payables 8 (155,174) (115,527)

Income tax payable (5,510) (4,352)

---------- ----------

(160,684) (119,879)

---------- ----------

Net assets 88,418 87,364

========== ==========

Equity

Issued share capital 99 99

Share premium account 4,664 4,454

Other reserves (3,214) (3,531)

Retained earnings 86,869 86,342

---------- ----------

Total equity 88,418 87,364

========== ==========

Statement of Changes in Equity

For the year ended 31 July 2017

Reserve

for

Share Share own Retained Total

capital premium shares earnings equity

--------- --------- -------- ---------- ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 August

2015 98 3,942 (3,994) 95,770 95,816

Total comprehensive

income for the year - - - 33,158 33,158

Share-based payment

transactions - - - 572 572

Dividends paid - - - (43,453) (43,453)

Shares issued in

year 1 512 - - 513

Tax adjustments - - - 295 295

Own share movement

during the year - - 463 - 463

--------- --------- -------- ---------- ---------

Balance at 31 July

2016 99 4,454 (3,531) 86,342 87,364

Balance at 31 July

2016 99 4,454 (3,531) 86,342 87,364

Total comprehensive

income for the year - - - 40,108 40,108

Share-based payment

transactions - - - 1,070 1,070

Dividends paid - - - (40,904) (40,904)

Shares issued in

the year - 210 - - 210

Tax adjustments - - - 253 253

Own share movement

during the year - - 317 - 317

--------- --------- -------- ---------- ---------

Balance at 31 July

2017 99 4,664 (3,214) 86,869 88,418

Statement of Cash Flows

For the year ended 31 July 2017

2017 2016

--------- ---------

GBP'000 GBP'000

Note

Net cash generated from

operating activities 10 40,971 29,925

Cash flows from investing

activities

Finance income 142 213

Purchase of property,

plant and equipment (945) (1,190)

Purchase of intangible

assets (516) (536)

Proceeds from asset disposals 7 11

--------- ---------

Net cash used in investing

activities (1,312) (1,502)

Cash flows from financing

activities

Issue of share capital 210 513

Deferred purchase share

proceeds - 1,773

Dividends paid 6 (40,904) (43,453)

Own share transactions 317 463

--------- ---------

Net cash used in financing

activities (40,377) (40,704)

--------- ---------

Net decrease in cash and

cash equivalents (718) (12,281)

Cash and cash equivalents

at beginning of year 62,361 74,642

--------- ---------

Cash and cash equivalents

at end of year 61,643 62,361

========= =========

Notes to the Financial Information

1. General information

Softcat plc (the "Company") is a public limited company,

incorporated and domiciled in the UK. Its registered address is

Fieldhouse Lane, Marlow, Buckinghamshire, SL7 1LW.

The annual financial information presented in this preliminary

announcement does not constitute the Company's statutory accounts

for the years ended 31 July 2017 or 2016 but is based on, and

consistent with, that in the audited financial statements for the

year ended 31 July 2017, and those financial statements will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting. The auditor's report on those financial

statements was unmodified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498(2) or

(3) of the Companies Act 2006.

2. Accounting policies

2.1 Basis of preparation

Whilst the financial information included in this announcement

has been compiled in accordance with International Financial

Reporting Standards ("IFRS") this announcement does not itself

contain sufficient information to comply with IFRS.

The Financial Statements are presented in Pounds Sterling,

rounded to the nearest GBPthousand, unless otherwise stated. They

were prepared under the historical cost convention.

Going concern

For reasons noted above, the financial information has been

prepared on the going concern basis, which assumes that the Company

will continue to be able to meet its liabilities as they fall due

for the foreseeable future, being a period of at least twelve

months from the date of signing the financial statements. At the

date of approving the financial statements, the Directors are not

aware of any circumstances that could lead to the Company being

unable to settle commitments as they fall due during the twelve

months from the date of signing these financial statements.

Changes to accounting standards

There have been no changes to accounting standards during the

year which have had or are expected to have any significant impact

on the Company.

Accounting policies

The preliminary announcement for the year ended 31 July 2017 has

been prepared in accordance with the accounting policies as

disclosed in Softcat plc's Annual Report and Accounts 2017, as

updated to take effect of any new accounting standards applicable

for the year.

Exceptional items

Items that are material in size and unusual in nature are

included within operating profit and disclosed separately in the

income statement. The separate reporting of these items helps to

provide a more accurate indication of the underlying business

performance. These costs related to the Company's Listing on the

premium main market of the London Stock Exchange in November

2015.

Share based payment charges

The share based payment charge includes a fair value charge of

GBP1,070,486 (2016: GBP572,156) and a charge for employer's

national insurance contributions of GBP231,600 (2016: GBP315,794),

which become payable on exercise of share options and long-term

incentive awards.

Adjusted operating profit

In arriving at adjusted operating profit, both exceptional items

and share based payment charges are removed in order to help

present a more accurate picture of the Company's underlying

performance.

3. Segmental information

The information reported to the Company's Chief Executive

Officer, who is considered to be the chief operating decision maker

for the purposes of resource allocation and assessment of

performance, is based wholly on the overall activities of the

Company. The Company has therefore determined that it has only one

reportable segment under IFRS 8, which is that of "value-added IT

reseller and IT infrastructure solutions provider". The Company's

revenue, results and assets for this one reportable segment can be

determined by reference to the statement of profit or loss and

other comprehensive income and statement of financial position. An

analysis of revenues by product, which form one reportable segment,

is set out below:

Revenue by type

2017 2016

GBP'000 GBP'000

Software 414,781 319,978

Hardware 287,424 250,692

Services 130,281 101,681

-------- --------

832,486 672,351

======== ========

The total revenue for the Company has been derived from its

principal activity as an IT reseller. Substantially all of this

revenue relates to trading undertaken in the United Kingdom.

4. Exceptional items

Operating profit for the year has been arrived at after

charging:

2017 2016

GBP'000 GBP'000

IPO costs - 3,673

All IPO costs incurred relate to the Company's listing on the

London Stock Exchange in November 2015.

5. Taxation

2017 2016

GBP'000 GBP'000

Current Tax

Current income tax charge

in the year 10,393 9,179

Adjustment in respect of

current income tax in previous

years 88 (7)

Deferred Tax

Temporary differences (285) 73

Total tax charge for the

year 10,196 9,245

6. Ordinary Dividends

2017 2016

GBP'000 GBP'000

Declared and paid during the

year, prior to IPO and share

reorganisation:

Ordinary dividend on ordinary

shares 36,765

Ordinary dividend on 'MR'

shares 864

Ordinary dividend on 'A' ordinary

shares 2,469

--------

40,098

Declared and paid during the

year, post IPO and share reorganisation:

Special dividend on ordinary

shares (14.2p per share) 28,060

Final dividend on ordinary

shares (3.6p per share) 7,114

Interim dividend on ordinary

shares (2.9p per share (2016:1.7p)) 5,730 3,355

-------- --------

40,904 3,355

-------- --------

40,904 43,453

The dividends paid prior to the IPO in November 2015 were paid

prior to the reorganisation of share capital, see note 11, and

therefore are shown as dividends split between the

pre-reorganisation share classes.

The Board recommends a final dividend of 6.1p per ordinary share

and a special dividend of 13.5p per ordinary share to be paid on 15

December 2017 to all ordinary shareholders who were on the register

of members at the close of business on 3 November 2017.

Shareholders will be asked to approve the final and special

dividends at the AGM on 8 December 2017.

7. Trade and other receivables

2017 2016

-------- --------

GBP'000 GBP'000

Trade and other receivables 162,089 123,833

Provision against receivables (1,263) (1,265)

-------- --------

Net trade receivables 160,826 122,568

Other debtors 59 59

Prepayments 5,415 4,764

Accrued Income 7,206 5,396

-------- --------

173,506 132,787

8. Trade and other payables

2017 2016

-------- --------

GBP'000 GBP'000

Trade payables 100,312 67,759

Other taxes and social security 12,153 11,778

Accruals 28,708 24,000

Deferred Income 14,001 11,990

-------- --------

155,174 115,527

9. Earnings per share

2017 2016

------ ------

Pence Pence

Earnings per share

Basic 20.4 16.9

Diluted 20.2 16.9

Adjusted earnings per share

Basic 21.0 19.2

Diluted 20.9 19.1

The calculation of the basic and adjusted earnings per share and

diluted earnings per share is based on the following data:

2017 2016

-------- --------

GBP'000 GBP'000

Earnings

-------- --------

Earnings for the purposes

of earnings per share being

profit for the year 40,108 33,158

-------- --------

Adjusted Earnings

Profit for the year 40,108 33,158

Exceptional costs - 3,673

Share based payment charge 1,302 888

Tax effect of adjusting items (47) (97)

-------- --------

Earnings for the purposes

of adjusted earnings per

share 41,363 37,622

-------- --------

The weighted average number of shares is given below:

2017 2016

-------- --------

000's 000's

Number of shares used for

basic earnings per share 196,959 196,040

Number of shares deemed to

be issued at nil consideration

following exercise of share

options 1,137 696

-------- --------

Number of shares used for

diluted earnings per share 198,096 196,736

-------- --------

10. Notes to the cash flow statement

2017 2016

--------- ---------

GBP'000 GBP'000

Cash flow from operating

activities

Operating profit 50,162 42,190

Depreciation of property,

plant and equipment 1,641 1,796

Amortisation of intangibles 367 327

Loss/(profit) on disposal

of fixed assets 109 (9)

Loss on disposal of intangible

assets 312 -

Cost of equity settled employee

share schemes 1,070 572

--------- ---------

Operating cash flow before

movements in working capital 53,661 44,876

Increase in inventory (2,364) (1,961)

Increase in trade and other

receivables (40,719) (12,608)

Increase in trade and other

payables 39,647 7,474

--------- ---------

Cash generated from operations 50,225 37,781

Income taxes paid (9,254) (7,856)

--------- ---------

Net cash generated from operating

activities 40,971 29,925

========= =========

11. Share capital

2015

---------

GBP'000

Authorised

Pre- reorganisation

Ordinary shares of 1p

each 112

'MR' shares of 1p each 2

'A' ordinary shares

of 1p each 6

---------

120

Limits on authorised share capital

were removed on re-registration as

a public limited company.

Allotted and called

up 2015

---------

GBP'000

Pre- reorganisation

Ordinary shares of 1p

each 90

'MR' shares of 1p each 2

'A' ordinary shares

of 1p each 6

---------

98

2017 2016

------- -------

GBP'000 GBP'000

Post- reorganisation

Ordinary shares of 0.05p

each 99 99

Deferred shares* of

1p each - -

------- -------

99 99

*At 31 July 2017 deferred shares had an aggregate nominal value

of GBP189.33 (2016: GBP189.33).

On 12 November 2015, pursuant to special resolutions of the

Company and conditional upon admission to the official list of the

FCA (which took place on 18 November 2015), it was resolved

that:

-- 188,500 'MR' shares of GBP0.01 each be redesignated as

ordinary shares of GBP0.01 each and their rights varied

accordingly;

-- 588,322 'A' ordinary shares of GBP0.01 each be redesignated

as ordinary shares of GBP0.01 each and their rights varied

accordingly;

-- 18,933 'A' ordinary shares of GBP0.01 each be redesignated as

deferred shares of GBP0.01 each; and

-- each ordinary share of GBP0.01 be sub-divided into 20

ordinary shares of GBP0.0005 each.

No issued ordinary shares of GBP0.0005 each were unpaid at 31

July 2017 (2016: nil unpaid).

Deferred shares do not have rights to dividends and do not carry

voting rights.

12. Post balance sheet events

Dividend

The Board recommends a final dividend of 6.1p per ordinary share

and a special dividend of 13.5p per ordinary share to be paid on 15

December 2017 to all ordinary shareholders who were on the register

of members at the close of business on 3 November 2017.

Shareholders will be asked to approve the final and special

dividends at the AGM on 8 December 2017.

Corporate Information

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial information differs from

legislation in other jurisdictions.

Directors

G L Charlton

L Ginsberg

M J Hellawell

V Murria

P Ventress

B Wallace

Secretary

Winifred Chime

Company registration number

02174990

Registered office

Solar House

Fieldhouse Lane

Marlow

Buckinghamshire

SL7 1LW

Auditor

Ernst & Young LLP

1 More London Place

London

SE1 2AF

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LLFIRIDLDLID

(END) Dow Jones Newswires

October 18, 2017 02:00 ET (06:00 GMT)

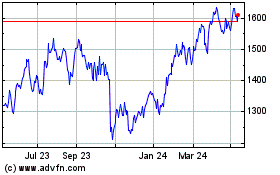

Softcat (LSE:SCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

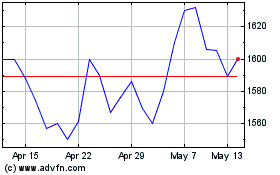

Softcat (LSE:SCT)

Historical Stock Chart

From Apr 2023 to Apr 2024