TIDMRNO

RNS Number : 8978X

Renold PLC

25 November 2014

Renold plc

("Renold" or the "Group")

Interim results for the half year ended 30 September 2014

Renold, a leading international supplier of industrial chains

and related power transmission products, today announces a strong

performance for the half year ended 30 September 2014 ('the

period') driven by the continuing successful implementation of the

Group's Strategic Plan.

Performance highlights

-- Self help measures drove underlying adjusted operating profit up 67%

-- Adjusted[1] EPS more than doubled to 2.3p

-- Leverage[2] cut to 1.3x from 1.6x in prior year, to benefit financing costs

-- Double digit operating margin achieved in Chain division

-- Foundations being put in place for Organic Growth phase of our Strategic Plan

Financial Summary Half year ended

30 September

2014 2013

GBPm GBPm

Underlying adjusted results

Underlying[3] revenue 90.5 89.2

Underlying adjusted operating profit 7.5 4.5

Underlying adjusted operating margin 8.3% 5.0%

Reported statutory results

Revenue 90.5 95.6

Operating profit 6.6 3.7

Operating margin 7.3% 3.9%

Profit before tax 4.4 1.1

Net debt 24.4 22.0

Other information

Basic earnings per share 1.5p -

Adjusted earnings per share 2.3p 1.1p

Robert Purcell, Chief Executive of Renold plc, said:

"We continue to deliver robust and sustainable improvements in

operating profits and margins."

"Numerous self help projects remain to be exploited in future

years and their benefits will contribute to further margin

enhancement and revenue growth as we lay the foundations for the

Organic Growth phase of our Strategic Plan to be entered at the end

of the current financial year."

25 November 2014

Reconciliation of reported, underlying and adjusted results

Revenue Operating Profit

---------------------------- ----------------------- -------------------

2014/15 2013/14 2014/15 2013/14

First half year GBPm GBPm GBPm GBPm

Reported 90.5 95.6 6.6 3.7

Exchange impact - (6.4) - (0.6)

---------------------------- -------- -------- ----------- -----------

Underlying 90.5 89.2 6.6 3.1

Exceptional items - - 0.6 1.0

Pension administration

costs - - 0.3 0.4

Underlying adjusted 90.5 89.2 7.5 4.5

---------------------------- -------- -------- ----------- -----------

ENQUIRIES:

Renold plc Tel: 0161 498 4500

Robert Purcell, Chief Executive

Brian Tenner, Group Finance Director

Arden Partners Tel: 020 7614 5917

Chris Hardie

Instinctif Partners Tel: 020 7457 2020

Mark Garraway

Helen Tarbet

NOTES FOR EDITORS

Renold is a global leader in the manufacture of industrial

chains and also manufactures a range of torque transmission

products which are sold throughout the world to a broad range of

original equipment manufacturers, end users and distributors. The

Company has a well deserved reputation for quality that is

recognised worldwide. Its products are used in a wide variety of

industries including manufacturing, transportation, energy, steel

and mining.

Further information about Renold can be found on the website at:

www.renold.com

Chief Executive's Statement

We are pleased to report that we have continued to make further

significant and sustainable progress with phase one (the

'Restructuring' phase) of our Strategic Plan, as demonstrated by

the 67% increase in underlying adjusted operating profit compared

to the prior year. This improvement was primarily the result of the

cost savings generated from the Bredbury site closure but was also

supported by leveraging higher value added products and by other

group wide initiatives to reduce production costs and

overheads.

Strategic Plan Progress Review

Phase 1 - 'Restructuring'

We previously set out our medium term objective to deliver

steady and continuous improvements in adjusted earnings per share.

This would be delivered by implementing a three phase plan based

around 'Restructuring' in Phase 1, 'Organic Growth' in Phase 2, and

ultimately 'Structural Activities' in Phase 3. Phase 1 is based on

self help and continuous improvement activities in all aspects of

our business.

During the period we completed the closure of our Bredbury

facility and the transfer of its production to sister sites. The

project completed slightly ahead of schedule and within its

original budget. While still early days, it is reassuring to note

that our risk based allowance for the loss of up to 10% of the

Chain division sales that originated from our Bredbury facility has

not materialised, partly due to transitional protective

arrangements that were put in place. The project has already

delivered annualised operating profit gains of approximately

GBP3.2m with effect from the end of May 2014.

Further benefits from the closure project are expected to

include a series of efficiency gains in manufacturing processes at

the sites now responsible for the products formerly manufactured in

Bredbury. The activities to capture these benefits are collectively

referred to as 'Bredbury Phase 2'. We have already commissioned the

first 'Bredbury Phase 2' project in one plant and, through a rapid

payback capital investment, will add GBP0.2m of annual operating

profit next year by reducing considerably the production times on

an important range of products. The project will also help reduce

lead times and improve customer service.

Other expected benefits from Bredbury Phase 2 include:

-- concentration of capital spend in fewer facilities leveraged

for higher returns on investment;

-- greater selectivity in the quality of revenue streams we accept;

-- overall reduction in the level of working capital; and

-- further reductions in lead times and improvements to customer service.

During the period we initiated a detailed strategic planning

exercise in each individual business unit with a view to

identifying a road map of continuous improvement activities in the

areas of manufacturing efficiency but also in business process

efficiency. Our aim is to develop a series of improvement

initiatives for each of our business units that will span the next

five years.

Phase 2 - 'Organic Growth'

Given our goal of commencing the second, 'Organic Growth' phase

of our plan, towards the end of the current financial year, we have

also started to put in place foundations to support that phase.

Revenue expenditure on activities to support growth will increase

in the second half of the year. These preparations are being made

in parallel with the continuous improvement activities which will

be a permanent feature of our business in the future.

We have opened new customer service offices in a number of key

European territories reversing closures that have taken place in

recent years. Elsewhere we are splitting the activities of our

sales forces in a number of territories to allow more focussed and

dedicated sales effort on our Chain and Torque Transmission product

ranges. As part of our detailed strategic planning exercise we are

also further refining our commercial strategy and product

management ideas.

Business Review

Group Results

The Group experienced improving trading conditions in a number

of key markets in the first half of 2014/15. The table below shows

the change in underlying orders and sales for the last three

consecutive half year periods.

Underlying orders and sales

First

Second

half half First half

2014/15 2013/14 2013/14

Year on year change % % %

------------------------- --------- --------- -----------

Underlying order intake 4.0 2.2 (0.2)

Underlying sales 1.5 (0.8) (2.3)

------------------------- --------- --------- -----------

Both order intake and sales show an improving trend for

consecutive half years. These are discussed in further detail in

the Chain and Torque Transmission divisional operating segment

reviews below.

Underlying adjusted operating profit of GBP7.5m moved ahead

strongly (2013: GBP4.5m) as both divisions delivered on the self

help measures set out in the Strategic Plan announced in the

2013/14 Annual Report. The result was achieved despite the GBP0.6m

adverse impact of translational foreign exchange in the first half

of the current year.

Chain

The improving trends in the Group's order intake and sales have

been driven by a significantly improved performance in the Chain

division as shown below.

Underlying orders and sales

Second

First half half First half

2014/15 2013/14 2013/14

Year on year change % % %

------------------------- ----------- --------- -----------

Underlying order intake 8.0 2.2 0.4

Underlying sales 3.1 0.7 (0.9)

------------------------- ----------- --------- -----------

Underlying external sales increased in a number of regions.

Europe delivered 8.0% growth in underlying sales driven primarily

by a large project win that benefits the first and second half in

Switzerland. Excluding growth in Swiss orders, order intake in

Chain grew by 5.5% in the period. Modest growth was achieved in the

other major European sales territories of Germany, the UK and

France. Indian underlying sales grew by 26.0% with particularly

strong demand from domestic original equipment manufacturers. The

Americas were flat year on year, while in Australasia, underlying

external sales fell by 7.0% and remain depressed by the weak

domestic mining sector in Australia. In China the focus was on

Bredbury production transfers and our small external sales declined

slightly.

Chain delivered a key milestone in its development by achieving

a double digit operating margin. Adjusted underlying operating

profit of GBP7.1m was almost double that for the first half of the

prior year (2013: GBP3.8m), with adjusted ROS increasing from 5.7%

to 10.2%. Improvements in profitability were firstly driven by the

closure of the Bredbury manufacturing facility which completed in

the first quarter of the year and reduced the division's overhead

base. Secondly, growth of GBP2.1m in underlying sales combined with

an improving mix of higher value added products to improve margins.

Thirdly, other business improvement projects delivered better

operating margins in all regions except Australasia, which was

negatively impacted by the continued slow down in the domestic

mining sector.

Torque Transmission

The table below shows a more mixed picture for order intake and

sales in Torque Transmission.

Underlying orders and sales

Second

First half half First half

2014/15 2013/14 2013/14

Year on year change % % %

------------------------- ----------- --------- -----------

Underlying order intake (8.0) 2.3 (2.2)

Underlying sales (3.8) (5.3) (6.2)

------------------------- ----------- --------- -----------

The current year fall in underlying external order intake

primarily reflects a slow down in demand for UK sourced gear

products for use in power generation (from power stations in China

and engine manufacturers more generally). The fall in underlying

external revenues of 3.8% was driven firstly by this power

generation slow down and secondly, by the end of a mass transit

contract in the USA that had generated GBP1.1m of sales in the

first half of the prior year.

Adjusted underlying operating profit improved from GBP2.8m to

GBP3.4m in the first half compared to the prior year, with adjusted

ROS increasing from 12.7% to 16.0%. These gains reflect an

improving mix of higher value added product sales and a broad range

of continuous improvement initiatives across all sites to reduce

the overhead base. Overhead reductions in the first half compared

to the same period in the prior year amounted to GBP0.3m.

Financial Review

Underlying External Adjusted Operating Adjusted Operating

Revenue Profit Margin

--------------------- ---------------------- --------------------- ---------------------

2014/15 2013/14 2014/15 2013/14 2014/15 2013/14

First half year GBPm GBPm GBPm GBPm % %

Chain 69.3 67.2 7.1 3.8 10.2 5.7

Torque Transmission 21.2 22.0 3.4 2.8 16.0 12.7

Head office

costs - - (3.0) (2.1) - -

Total 90.5 89.2 7.5 4.5 8.3 5.0

--------------------- ---------- ---------- ---------- --------- ---------- ---------

Growth in underlying external revenue of 1.5% added

approximately GBP0.7m to the operating result in the period. The

Bredbury closure project had four full months of benefits in the

period and added approximately GBP1.0m to operating profit. Other

net overhead reduction projects added a further GBP1.0m across the

Group as a whole with the balance of the increase reflecting a

change in the mix of products towards a higher value added product

range. The increase in central costs reflects revenue investments

required to support the delivery of the Strategic Plan such as

market research and consulting activities. It also includes the

impact of new hires into the business to drive the group wide

initiatives in the Strategic Plan (for example, a new Group HR

Director and a Director of Business Systems) as well as increased

charges for long term incentive plans and annual bonus

provisions.

Exceptional items

During the period the Board concluded a review of the Group's

Strategy for a single integrated Enterprise Resource Planning

('ERP') system. While the merits of a single ERP remain compelling,

the Board concluded that a successful global implementation could

best be achieved by changing to a different system whose logic and

functionality was already better understood in the business. The

Board has selected M3, which is the updated version of Movex, an

ERP system which is already in use in a number of Renold locations.

This revised approach will deliver a lower risk and more effective

implementation across the business. No material change is

anticipated in the time required or cost to complete the new system

compared to the estimates to complete the previous ERP.

As a result of this decision a number of licences for the

original ERP system have been impaired as they are unlikely ever to

be used generating a charge of GBP0.2m. A further GBP0.4m of

exceptional charges were incurred as the Group continues to

restructure and streamline the business. The total exceptional

charges of GBP0.6m (2013: GBP1.0m) are detailed further in Note 4

to the Interim Financial Statements.

Cash Flow and Net Debt

2014/15 2013/14

Half year to 30 September GBPm GBPm

Adjusted Operating Profit 7.5 5.1

Add back depreciation and amortisation 2.6 2.8

--------------------------------------------- -------- --------

Adjusted EBITDA 10.1 7.9

Net Working Capital movement (0.9) -

Pension cash costs and administration costs (2.4) (1.5)

Movements in provisions (1.9) (0.5)

Other operating cash flows (0.8) (1.6)

--------------------------------------------- -------- --------

Net cash flow from operating activities 4.1 4.3

Net capital expenditure (2.7) (3.0)

Net financing costs (0.8) (1.0)

Other net impacts on net debt (0.1) 0.7

Impact of foreign exchange (0.1) (0.2)

--------------------------------------------- -------- --------

Change in net debt 0.4 0.8

--------------------------------------------- -------- --------

Net Debt (Note 11) (24.4) (22.0)

--------------------------------------------- -------- --------

The business also continued to improve its cash performance with

net debt in the period reducing by GBP0.4m. Cash of GBP6.5m was

generated by operations before pension contributions and

administration costs of GBP2.4m. The prior year pension cash flow

was assisted by the refund of a GBP1.4m surplus in the South

African defined benefit scheme. The key performance indicator of

working capital as a ratio of rolling 12 month revenue weakened

slightly to an average level of 18.9% (2013: 18.5%). This was

largely driven by an increase in inventory levels required to

support the Bredbury factory closure and transfer of production

elsewhere in the Group. Selective investment was also made in

certain stock lines, to support sales growth. Working capital

remains an area where more gains can be made.

Pensions

The Group is responsible for a number of defined benefit pension

schemes which it accounts for in accordance with IAS 19 Employee

benefits. The Group's retirement benefit obligations increased from

GBP64.9m (GBP49.3m net of deferred tax) at 31 March 2014 to

GBP68.6m (GBP51.8m net of deferred tax) at 30 September 2014. This

mainly reflects the declining yield on UK corporate bonds which

drives the discount rate used to value the liabilities (4.5% at 31

March 2014 to 4.0% at 30 September 2014). In Germany discount rates

fell by 0.9%. These impacts were substantially offset by superior

asset returns with the UK assets returning more than double the

assumed rate of return.

The aggregate expense of administering the pension schemes was

GBP0.3m (2013: GBP0.4m) which is now included in operating costs

following the adoption of IAS 19R in the prior year. However, it is

excluded in arriving at adjusted operating profit as it relates to

closed legacy pension schemes which bear no relation to the ongoing

business and its performance. The net financing expense on pension

scheme balances was GBP1.2m (2013: GBP1.5m). It is similarly

excluded when calculating adjusted EPS.

Dividend

In light of the ongoing actions being taken to improve the

performance of the business, and the opportunities we have to

invest in new capital equipment, the Board has decided not to

declare an interim dividend. The dividend policy will remain under

review as performance continues to improve.

Risks and uncertainties

The principal risks and uncertainties affecting the business

activities of the Group, as well as the risk mitigating controls

put in place, remain those detailed in the 2013/14 Annual Report.

The exception to this is the specific risk regarding the Bredbury

site closure which has now diminished significantly. These include

macro-economic risks as well as various risks relating to Group

treasury activities. Key operational risks are raw material prices

and other input cost prices.

During the period, foreign exchange rates have proved highly

volatile. These have had an adverse translational impact on Group

revenue and operating profit. The anticipated GBP0.5m adverse full

year impact on operating profit actually materialised in the first

half alone. A similar impact is expected in the second half if

exchange rates remain unchanged. Underlying business performance

has not been significantly impacted. The Group's business and

assets are spread across multiple currencies and this provides a

form of natural hedge against some currency risks.

The valuation of retirement benefit obligations can be

significantly impacted by changes to the market based yields on

corporate bonds and inflation prospects. The schemes investment

strategies do provide a partial hedge against these risks. However,

it should be noted that the cash flows of the pension schemes are

more stable and subject to long term funding plans which are

reviewed every three years.

Outlook

In this first phase of our Strategic Plan, our attention remains

focussed on delivering internal self help measures. A detailed

planning exercise is underway in each of our operating units and

has already identified a wide range of opportunities for further

continuous improvement. These activities will remain an ongoing

value adding feature of our business even as we transition into the

'Organic Growth' phase towards the end of the current financial

year. Preparations for that transition are already underway. As the

remainder of the year progresses, we expect to increase revenue

investments in activities to support growth.

The Board's expectations for full year adjusted operating profit

remain in line with current market forecasts.

Statement of directors' responsibilities

The directors confirm that to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of interim financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the Group during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

The directors of Renold plc are listed in the Annual Report for

the year ended 31 March 2014. A list of current directors is

maintained on the Group website at www.renold.com.

By order of the Board

Robert Purcell Brian Tenner

Chief Executive Finance Director

25 November 2014 25 November 2014

RENOLD PLC

Condensed Consolidated Income Statement

for the six months ended 30 September 2014

First half Full year

Note 2014/15 2013/14 2013/14

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

--------------------------------------- ----- ------------- ------------- -----------

Revenue 3 90.5 95.6 184.0

Operating costs before pension

administration costs and exceptional

items (83.0) (90.5) (172.9)

Operating profit before pension

administration costs and exceptional

items 7.5 5.1 11.1

Pension administration costs

(excluding exceptional items)

Exceptional items

(0.3) (0.4) (0.6)

4 (0.6) (1.0) (11.8)

--------------------------------------- ----- ------------- ------------- -----------

Operating profit/(loss) 6.6 3.7 (1.3)

--------------------------------------- ----- ------------- ------------- -----------

Financing costs (0.9) (1.1) (1.8)

Net IAS 19 financing costs (1.2) (1.5) (2.8)

Discount on provisions (0.1) - -

Net financing costs 5 (2.2) (2.6) (4.6)

--------------------------------------- ----- ------------- ------------- -----------

Profit/(loss) before tax 4.4 1.1 (5.9)

Taxation 6 (0.9) (1.1) (4.8)

--------------------------------------- ----- ------------- ------------- -----------

Profit/(loss) for the period 3.5 - (10.7)

--------------------------------------- ----- ------------- ------------- -----------

Attributable to:

Owners of the parent 3.4 (0.1) (10.9)

Non-controlling interests 0.1 0.1 0.2

--------------------------------------- ----- ------------- ------------- -----------

3.5 - (10.7)

--------------------------------------- ----- ------------- ------------- -----------

Earnings per share 7

Basic earnings/(loss) per

share 1.5p - (4.9)p

Diluted earnings/(loss) per

share 1.5p - (4.9)p

Adjusted earnings per share 2.3p 1.1p 3.2p

Diluted adjusted earnings

per share 2.3p 1.1p 3.2p

--------------------------------------- ----- ------------- ------------- -----------

RENOLD PLC

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 September 2014

First half Full

year

2014/15 2013/14 2013/14

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

--------------------------------------------- ------------- ------------- -----------

Profit/(loss) for the period 3.5 - (10.7)

--------------------------------------------- ------------- ------------- -----------

Other comprehensive income/(expense)

Items that may be reclassified to

profit or loss in subsequent periods:

Net (losses)/gains on cash flow hedges

taken to other comprehensive income (0.2) 0.3 0.2

Foreign exchange translation differences 0.5 (3.5) (8.5)

Foreign exchange differences on loans

forming part of the net investment

in foreign operations (0.1) (2.3) 0.6

0.2 (5.5) (7.7)

Items not to be reclassified to profit

or loss in subsequent periods:

Re-measurement (losses)/gains on retirement

benefit obligations (5.8) 4.0 2.9

Tax on components of other comprehensive

income 0.9 (2.5) 2.1

--------------------------------------------- ------------- ------------- -----------

(4.9) 1.5 5.0

Other comprehensive expense for the

period, net of tax (4.7) (4.0) (2.7)

--------------------------------------------- ------------- ------------- -----------

Total comprehensive expense for the

period, net of tax (1.2) (4.0) (13.4)

--------------------------------------------- ------------- ------------- -----------

Attributable to:

Owners of the parent (1.3) (4.0) (13.5)

Non-controlling interests 0.1 - 0.1

--------------------------------------------- ------------- ------------- -----------

Total comprehensive expense for the

period (1.2) (4.0) (13.4)

--------------------------------------------- ------------- ------------- -----------

RENOLD PLC

Condensed Consolidated Statement of Financial Position

as at 30 September 2014

Note 30 September 30 September 31 March

2014 2013

(unaudited) (unaudited) 2014

GBPm GBPm (audited)

GBPm

----------------------------------- ----- ------------- ------------- -----------

Assets Non-current assets

Goodwill 20.1 20.3 19.8

Other intangible fixed assets 6.5 6.4 6.1

Property, plant and equipment 38.2 38.3 39.3

Investment property 1.3 1.4 1.3

Other non-current assets 0.2 0.2 0.2

19.3 18.1 18.9

Deferred tax assets Retirement

benefit surplus 8 0.5 - 0.4

----------------------------------- ----- ------------- ------------- -----------

86.1 84.7 86.0

----------------------------------- ----- ------------- ------------- -----------

Current assets

Inventories 38.1 38.3 35.9

Trade and other receivables 29.0 29.7 29.7

Retirement benefit surplus - 0.1 -

Derivative financial instruments 8 - - 0.1

Cash and cash equivalents 11 10.6 9.2 6.7

----------------------------------- ----- ------------- ------------- -----------

77.7 77.3 72.4

Non-current asset classified

as held for sale 1.5 1.7 1.6

----------------------------------- ----- ------------- ------------- -----------

79.2 79.0 74.0

----------------------------------- ----- ------------- ------------- -----------

Total assets 165.3 163.7 160.0

----------------------------------- ----- ------------- ------------- -----------

Liabilities

Current liabilities

Borrowings 11 (0.7) (0.1) (0.1)

Trade and other payables (35.9) (36.0) (34.9)

Current tax (1.8) (1.5) (1.7)

Derivative financial instruments (0.1) - -

Provisions (1.7) (1.4) (2.4)

----------------------------------- ----- ------------- ------------- -----------

(40.2) (39.0) (39.1)

----------------------------------- ----- ------------- ------------- -----------

Net current assets 39.0 40.0 34.9

----------------------------------- ----- ------------- ------------- -----------

Non-current liabilities

Borrowings 11 (33.8) (30.6) (30.9)

Preference stock 11 (0.5) (0.5) (0.5)

Trade and other payables (0.3) (0.1) (0.6)

Deferred tax liabilities (0.2) (0.6) (0.2)

Retirement benefit obligations 8 (69.1) (65.4) (65.3)

Provisions (4.3) - (5.3)

----------------------------------- ----- ------------- ------------- -----------

(108.2) (97.2) (102.8)

----------------------------------- ----- ------------- ------------- -----------

Total liabilities (148.4) (136.2) (141.9)

----------------------------------- ----- ------------- ------------- -----------

Net assets 16.9 27.5 18.1

----------------------------------- ----- ------------- ------------- -----------

Equity

Issued share capital 12 26.6 26.6 26.6

Share premium 29.9 29.9 29.9

Currency translation reserve (1.3) 0.4 (1.7)

Other reserves 1.0 1.3 1.2

Retained earnings (41.9) (33.1) (40.4)

----------------------------------- ----- ------------- ------------- -----------

Equity attributable to owners

of the parent 14.3 25.1 15.6

Non-controlling interests 2.6 2.4 2.5

----------------------------------- ----- ------------- ------------- -----------

Total shareholders' equity 16.9 27.5 18.1

----------------------------------- ----- ------------- ------------- -----------

RENOLD PLC

Condensed Consolidated Statement of Cash Flows

for the six months ended 30 September 2014

First half Full year

2014/15 2013/14 2013/14

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

-------------------------------------------- ------------- ------------- -----------

Cash flows from operating activities

(Note 9)

Cash generated by operations 4.6 4.8 7.0

Income taxes paid (0.5) (0.5) (0.9)

-------------------------------------------- ------------- ------------- -----------

Net cash flows from operating activities 4.1 4.3 6.1

-------------------------------------------- ------------- ------------- -----------

Cash flows from investing activities

Purchase of property, plant and equipment (1.5) (2.3) (6.0)

Purchase of intangible assets (1.2) (0.7) (1.1)

Net cash flows from investing activities (2.7) (3.0) (7.1)

-------------------------------------------- ------------- ------------- -----------

Cash flows from financing activities

Proceeds from share issue - 0.4 0.4

Financing costs paid (0.8) (1.0) (1.5)

Proceeds from borrowings 3.2 6.0 8.0

Repayment of borrowings - (6.4) (8.0)

Net cash flows from financing activities 2.4 (1.0) (1.1)

-------------------------------------------- ------------- ------------- -----------

Net increase/(decrease) in cash and

cash equivalents 3.8 0.3 (2.1)

Net cash and cash equivalents at beginning

of period 6.6 9.2 9.2

Effects of exchange rate changes (0.1) (0.4) (0.5)

-------------------------------------------- ------------- ------------- -----------

Net cash and cash equivalents at end

of period 10.3 9.1 6.6

-------------------------------------------- ------------- ------------- -----------

Cash and cash equivalents (Note 11) 10.6 9.2 6.7

Overdrafts (included in borrowings

- Note 11) (0.3) (0.1) (0.1)

-------------------------------------------- ------------- ------------- -----------

Net cash and cash equivalents at end

of period 10.3 9.1 6.6

-------------------------------------------- ------------- ------------- -----------

RENOLD PLC

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 September 2014

Share Share Retained Currency Other Attributable Non-controlling Total

capital premium earnings translation reserves to equity interests equity

account reserve holders

of parent GBPm

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Balance at 1 April 2013 26.5 29.6 (34.8) 6.1 1.2 28.6 2.4 31.0

(Loss)/profit for the

year - - (10.9) - - (10.9) 0.2 (10.7)

Other comprehensive income - - 5.0 (7.8) 0.2 (2.6) (0.1) (2.7)

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Total comprehensive income/(expense)

for the year - - (5.9) (7.8) 0.2 (13.5) 0.1 (13.4)

Share-based payment credit - - 0.1 - - 0.1 - 0.1

Exercise of share warrants:

* release of share warrant reserve - - 0.2 - (0.2) - - -

* proceeds from share issue 0.1 0.3 - - - 0.4 - 0.4

Balance at 31 March 2014 26.6 29.9 (40.4) (1.7) 1.2 15.6 2.5 18.1

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Profit for the period - - 3.4 - - 3.4 0.1 3.5

Other comprehensive income - - (4.9) 0.4 (0.2) (4.7) - (4.7)

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Total comprehensive income/(expense)

for the period - - (1.5) 0.4 (0.2) (1.3) 0.1 (1.2)

Balance at 30 September

2014 26.6 29.9 (41.9) (1.3) 1.0 14.3 2.6 16.9

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Balance at 1 April 2013 26.5 29.6 (34.8) 6.1 1.2 28.6 2.4 31.0

(Loss)/profit for the

year - - (0.1) - - (0.1) 0.1 -

Other comprehensive income - - 1.5 (5.7) 0.3 (3.9) (0.1) (4.0)

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Total comprehensive income/(expense)

for the year - - 1.4 (5.7) 0.3 (4.0) - (4.0)

Share-based payment credit - - 0.1 - - 0.1 - 0.1

Exercise of share warrants:

* release of share warrant reserve - - 0.2 - (0.2) - - -

* proceeds from share issue 0.1 0.3 - - - 0.4 - 0.4

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Balance at 30 September

2013 26.6 29.9 (33.1) 0.4 1.3 25.1 2.4 27.5

--------------------------------------------- -------- -------- --------- ------------ --------- ------------- ---------------- -------

Notes to the Interim Condensed Consolidated Financial

Statements

1 Corporate information

The interim condensed consolidated financial statements for the

six months to 30 September 2014 were approved by the Board on 25

November 2014. These statements have not been audited or reviewed

by the Group's auditor pursuant to the Auditing Practices Board

guidance on the Review of Interim Financial Information.

Renold plc is a limited liability company, incorporated and

registered under the laws of England and Wales, whose shares are

publicly traded. The principal activities of the Company and its

subsidiaries are described in Note 3 and the performance in the

half year is set out in the Interim Management Report.

These interim condensed consolidated financial statements do not

constitute statutory accounts of the Group within the meaning of

Section 434 of the Companies Act 2006. The statutory accounts for

the year ended 31 March 2014 have been filed with the Registrar of

Companies. The auditor's report on those accounts was unqualified,

did not contain an emphasis of matter paragraph and did not contain

any statement under Section 498(2) or Section 498(3) of the

Companies Act 2006.

2 Accounting policies

Basis of preparation

The interim condensed consolidated financial statements for the

six months ended 30 September 2014 have been prepared in accordance

with the Disclosure and Transparency Rules of the Financial

Services Authority and with IAS 34 "Interim Financial Reporting" as

adopted by the European Union. It does not include all the

information and disclosures required in the annual consolidated

financial statements, and should be read in conjunction with the

Group's annual consolidated financial statements for the year ended

31 March 2014.

Except as described below, the accounting policies, presentation

and methods of computation applied by the Group in these interim

condensed consolidated financial statements are the same as those

applied in the Group's latest audited annual consolidated financial

statements for the year ended 31 March 2014.

Changes in accounting policy

The Group has adopted all applicable amendments to standards

with an effective date from 1 April 2014.

The Group has adopted IFRS 10, IFRS 12 and IAS 27 Separate

Financial Statements, IAS 32 Offsetting Financial Assets and

Financial Liabilities, IAS 36 Recoverable Amount Disclosures for

Non-Financial Assets, IAS 39 Novation of Derivatives and

Continuation of Hedge Accounting and IFRIC 21 Levies all effective

from 1 January 2014.

Adoption of these standards did not have any material impact on

financial performance or position of the Group.

Going concern

The directors have a reasonable expectation that the business

has adequate resources to continue in operational existence for the

foreseeable future. Thus they continue to adopt the going concern

basis in preparing the condensed consolidated interim financial

information.

Significant accounting judgements, estimates and assumptions

The preparation of these interim condensed consolidated

financial statements, the significant judgements made by management

in applying the Group's accounting policies and the key sources of

estimation uncertainty were of the same type as those applied to

the annual consolidated financial statements for the year ended 31

March 2014, namely;

-- assumptions used to evaluate potential impairment of non-financial assets;

-- recognition of deferred tax assets; and

-- assumptions used in the valuation of retirement benefit obligations.

Financial risk management

The Group's financial risk management objectives and policies

are consistent with those disclosed in the consolidated financial

statements for the year ended 31 March 2014.

3 Segment information

The Group is organised into business units according to the

nature of their products and services. Having considered the

management reporting and organisational structure of the Group, the

directors have concluded that Renold plc has two reportable

operating segments as follows:

-- The Chain segment manufactures and sells power transmission

and conveyor chain and also includes sales of Torque Transmission

product through Chain National Sales Centres; and

-- The Torque Transmission segment manufactures and sells Torque

Transmission products such as gearboxes and couplings used in power

transmission.

No operating segments have been aggregated to form the above

reportable segments. Management monitors the operating results of

its business units separately for the purpose of making decisions

about resource allocation and performance assessment.

The segment results for the period ended 30 September 2014 were

as follows:

Chain Torque Head office Consolidated

Transmission costs and

eliminations

Period ended 30 September GBPm GBPm GBPm

2014 GBPm

---------------------------------- ------ -------------- -------------- -------------

Revenue

External revenue 69.3 21.2 - 90.5

Inter-segment 0.1 2.4 (2.5) -

---------------------------------- ------ -------------- -------------- -------------

Total revenue 69.4 23.6 (2.5) 90.5

---------------------------------- ------ -------------- -------------- -------------

Adjusted operating profit/(loss) 7.1 3.4 (3.0) 7.5

Pension administration

costs - - (0.3) (0.3)

Exceptional items (0.5) (0.1) - (0.6)

---------------------------------- ------ -------------- -------------- -------------

Segment operating profit/(loss) 6.6 3.3 (3.3) 6.6

Net financing costs (2.2)

---------------------------------- ------ -------------- -------------- -------------

Profit before tax 4.4

---------------------------------- ------ -------------- -------------- -------------

Other disclosures

Working capital 27.4 9.2 (5.7) 30.9

Capital expenditure 1.3 0.3 1.1 2.7

Depreciation and amortisation 1.4 0.6 0.6 2.6

The segment results for the period ended 30 September 2013 were

as follows:

Chain Torque Head office Consolidated

Transmission costs and

eliminations

Period ended 30 September GBPm GBPm GBPm GBPm

2013

--------------------------------- ------ -------------- -------------- -------------

Revenue

External revenue 72.2 23.4 - 95.6

Inter-segment 0.1 2.7 (2.8) -

--------------------------------- ------ -------------- -------------- -------------

Total revenue 72.3 26.1 (2.8) 95.6

--------------------------------- ------ -------------- -------------- -------------

Operating profit/(loss)

before pension administration

costs and exceptional

items 4.3 2.9 (2.1) 5.1

Pension administration

costs - - (0.4) (0.4)

Exceptional items (0.4) (0.3) (0.3) (1.0)

--------------------------------- ------ -------------- -------------- -------------

Segment operating profit/(loss) 3.9 2.6 (2.8) 3.7

Net financing costs (2.6)

--------------------------------- ------ -------------- -------------- -------------

Profit before tax 1.1

--------------------------------- ------ -------------- -------------- -------------

Other disclosures

Working capital 21.2 10.5 0.2 31.9

Capital expenditure 1.7 0.3 1.0 3.0

Depreciation and amortisation 2.1 0.7 - 2.8

The Board also reviews the performance of the business using

information presented at consistent exchange rates. The prior year

results have been restated using this year's exchange rates as

follows:

Chain Torque Head office Consolidated

Transmission costs and

eliminations

Period ended 30 September GBPm GBPm GBPm

2013 GBPm

-------------------------------- ------ -------------- -------------- -------------

Revenue

External revenue 72.2 23.4 - 95.6

Foreign exchange (5.0) (1.4) - (6.4)

-------------------------------- ------ -------------- -------------- -------------

Underlying external sales 67.2 22.0 - 89.2

-------------------------------- ------ -------------- -------------- -------------

Operating profit/(loss)

before pension administration

costs and exceptional

items 4.3 2.9 (2.1) 5.1

Foreign exchange (0.5) (0.1) - (0.6)

-------------------------------- ------ -------------- -------------- -------------

Underlying profit/(loss)

before pension administration

costs and exceptional

items 3.8 2.8 (2.1) 4.5

-------------------------------- ------ -------------- -------------- -------------

The segment results for the year ended 31 March 2014 were as

follows:

Chain Torque Head office Consolidated

Transmission costs and

eliminations

Year ended 31 March 2014 GBPm GBPm GBPm

GBPm

--------------------------------- ------- -------------- -------------- -------------

Revenue

External revenue 139.6 44.4 - 184.0

Inter-segment 0.3 5.0 (5.3) -

--------------------------------- ------- -------------- -------------- -------------

Total revenue 139.9 49.4 (5.3) 184.0

--------------------------------- ------- -------------- -------------- -------------

Operating profit/(loss)

before pension administration

costs and exceptional

items 9.9 5.8 (4.6) 11.1

Pension administration

costs - - (0.6) (0.6)

Exceptional items (11.5) (0.3) - (11.8)

--------------------------------- ------- -------------- -------------- -------------

Segment operating (loss)/profit (1.6) 5.5 (5.2) (1.3)

Net financing costs (4.6)

--------------------------------- ------- -------------- -------------- -------------

Loss before tax (5.9)

--------------------------------- ------- -------------- -------------- -------------

Other disclosures

Working capital 22.6 8.6 (1.1) 30.1

Capital expenditure 4.8 1.3 1.0 7.1

Depreciation and amortisation 3.1 1.1 1.2 5.4

The Board also reviews the performance of the business using

information presented at consistent exchange rates. The prior year

results have been restated using this year's exchange rates as

follows:

Chain Torque Head office Consolidated

Transmission costs and

eliminations

Year ended 31 March 2014 GBPm GBPm GBPm

GBPm

-------------------------------- ------ -------------- -------------- -------------

Revenue

External sales 139.6 44.4 - 184.0

Foreign exchange (6.2) (1.7) - (7.9)

-------------------------------- ------ -------------- -------------- -------------

Underlying external sales 133.4 42.7 - 176.1

-------------------------------- ------ -------------- -------------- -------------

Operating profit/(loss)

before pension administration

costs and exceptional

items 9.9 5.8 (4.6) 11.1

Foreign exchange (0.6) - - (0.6)

-------------------------------- ------ -------------- -------------- -------------

Underlying adjusted operating

profit/(loss) 9.3 5.8 (4.6) 10.5

-------------------------------- ------ -------------- -------------- -------------

4 Exceptional items

First half Full year

2014/15 2013/14 2013/14

GBPm GBPm GBPm

--------------------------------- -------- -------- ----------

Included in operating costs:

ERP licence impairment 0.2 - -

Bredbury factory closure costs 0.3 - 4.7

Bredbury site onerous lease

provision - - 5.7

Chain business model review

asset impairment - - 0.6

Reorganisation and redundancy

costs 0.1 0.8 0.8

Pension merger and asset backed - 0.2 -

funding costs

Net exceptional costs 0.6 1.0 11.8

--------------------------------- -------- -------- ----------

During the period the Board concluded a review of the Group's

Strategy for a single integrated Enterprise Resource Planning

('ERP') system. While the merits of a single ERP remain a

compelling business case, the Board concluded that a successful

global implementation could best be achieved by changing to a

different system whose logic and functionality was already better

understood in the business. As a result, a number of licences for

the previous ERP of choice will now no longer come into use and

they have therefore been written off.

Those sites where the previous ERP of choice has already been

implemented will continue to use that system in the medium term and

the carrying value of expenditure to date is supported by the cash

flows of those business units. The already installed ERP system is

expected to continue in use for four to five years which is

approximately one year less than the originally assessed useful

economic life. Therefore, future periods will include approximately

GBP0.2m per annum of accelerated depreciation to reflect the

shorter useful economic life.

The Bredbury factory closure costs incurred in the period

primarily result from operational decisions to upgrade to new

equipment or new processes following production transfers and these

resulted in the write off of some additional machinery and stock.

The project and its charges completed during the first quarter.

Details of the exceptional Bredbury closure and site onerous

lease provision costs as reported in the full year 2013/14 can be

found in the Group's annual consolidated financial statements for

the year ended 31 March 2014.

5 Net financing costs

First half Full year

2014/15 2013/14 2013/14

GBPm GBPm GBPm

-------------------------------- -------- -------- ----------

Financing costs:

Interest payable on bank loans

and overdrafts 0.8 1.0 1.5

Amortised financing costs 0.1 0.1 0.3

Discount on provisions 0.1 - -

Total financing costs 1.0 1.1 1.8

-------------------------------- -------- -------- ----------

IAS 19 financing costs 1.2 1.5 2.8

Net financing costs 2.2 2.6 4.6

-------------------------------- -------- -------- ----------

6 Taxation

First half Full

year

2014/15 2013/14 2013/14

GBPm GBPm GBPm

-------------------- -------- -------- --------

Current tax:

- UK - - -

- Overseas 0.7 0.6 1.2

-------------------- -------- -------- --------

0.7 0.6 1.2

Deferred tax:

- UK (0.1) 0.3 3.0

- Overseas 0.3 0.2 0.6

-------------------- -------- -------- --------

0.2 0.5 3.6

-------------------- -------- -------- --------

Income tax expense 0.9 1.1 4.8

-------------------- -------- -------- --------

The UK Finance Act 2013 reduced the main rate of UK corporation

tax from 23% to 21% from 1 April 2014 and then 20% from 1 April

2015. The effect of these reductions have been incorporated into

the closing deferred tax balances in the periods ended 30 September

2013, 31 March 2014 and 30 September 2014.

The Group's tax charge in future years will be affected by the

profit mix, effective tax rates in the different countries where

the Group operates and utilisation of tax losses. No deferred tax

is recognised on the unremitted earnings of overseas

subsidiaries.

7 Earnings/(loss) per share

Basic earnings per share is calculated by dividing the

profit/(loss) for the period by the weighted average number of

shares in issue during the period. Diluted earnings per share takes

into account the dilutive effect of the options and awards

outstanding under the Group's employee share schemes. The

calculation of earnings per share is based on the following

data:

First half Full year

2014/15 2013/14 2013/14

Pence per Pence per Pence per

share share share

------------------------------------- ----------- ----------- -----------

Basic EPS 1.5 - (4.9)

Diluted EPS 1.5 - (4.9)

Adjusted EPS 2.3 1.1 3.2

Diluted adjusted EPS 2.3 1.1 3.2

------------------------------------- ----------- ----------- -----------

GBPm GBPm GBPm

------------------------------------- ----------- ----------- -----------

Profit/(loss) for calculation

of adjusted EPS

Profit/(loss) for the financial

period 3.4 - (10.9)

Adjusted for exceptional items,

after tax:

- Exceptional items in operating

costs 0.6 1.0 11.4

- Exceptional tax charge - - 3.5

- Pension administration costs

included in operating costs 0.3 0.4 0.6

- Net pension financing costs 0.9 1.1 2.4

Profit for the calculation of

adjusted EPS 5.2 2.5 7.0

------------------------------------- ----------- ----------- -----------

Thousands Thousands Thousands

Weighted average number of ordinary

shares

For calculating basic earnings

per share 223,065 221,350 222,398

Inclusion of the dilutive securities, comprising 6,528,000

(2013: 3,249,000) additional shares due to share options and nil

(2013: 417,000) additional shares due to warrants over shares, in

the calculation of adjusted EPS has the impact shown above (2013:

no change).

The adjusted earnings per share numbers have been provided in

order to give a useful indication of the underlying performance of

the business by the exclusion of exceptional items. Due to the

existence of unrecognised deferred tax assets, there was no

associated tax credit on some of the exceptional charges and in

these instances exceptional costs are added back in full.

8 Retirement benefit obligations

The Group's retirement benefit obligations are summarised as

follows:

At 30 At 30 At 31

September September March

2014 2013 2014

GBPm GBPm GBPm

-------------------------------------- ----------- ----------- --------

Funded plan obligations (206.4) (198.6) (200.3)

Funded plan assets 162.6 157.2 159.0

-------------------------------------- ----------- ----------- --------

Net funded plan obligations (43.8) (41.4) (41.3)

Unfunded obligations (24.8) (23.9) (23.6)

-------------------------------------- ----------- ----------- --------

Total retirement benefit obligations (68.6) (65.3) (64.9)

-------------------------------------- ----------- ----------- --------

Analysed as follows:

Non-current assets

Retirement benefit surplus 0.5 - 0.4

Current assets

Retirement benefit surplus - 0.1 -

Non-current liabilities

Retirement benefit obligations (69.1) (65.4) (65.3)

----------------------------------- ------- ------- -------

Net retirement benefit obligation (68.6) (65.3) (64.9)

Net deferred tax asset 16.8 10.8 15.6

Retirement benefit obligation

net of deferred tax (51.8) (54.5) (49.3)

----------------------------------- ------- ------- -------

The increase in the Group's pre-tax liability from GBP64.9m at

31 March 2014 to GBP68.6m at 30 September 2014 primarily reflects

the reduction in yields on corporate bonds which in turn have led

to lower discount rates being applied to the future pension

liabilities. In the UK (which represents 82% of the total

liabilities), the discount rate has fallen by 0.5% from 4.5% at 31

March 2014 to 4.0% at 30 September 2014. This was partially offset

by strong asset performance in the period generating returns at

more than double the expected rate. In addition, there was a small

reduction in the assumed rate of UK inflation (CPI) at 30 September

2014 (3.0% compared to 31 March 2014: 3.2%). The retirement benefit

surplus is all in Australia.

9 Cash generated by operations

First half Full year

2014/15 2013/14 2013/14

GBPm GBPm GBPm

------------------------------------ -------- -------- ----------

Operating profit/(loss) 6.6 3.7 (1.3)

Depreciation and amortisation 2.6 2.8 5.4

Impairment of intangible assets 0.2 - -

Proceeds from plant and equipment

disposals 0.1 - 0.2

Equity share plans - 0.1 0.1

(Increase)/decrease in inventories (2.4) 0.1 1.8

Decrease in receivables 0.5 1.5 0.8

Increase/(decrease) in payables 1.0 (1.6) (1.8)

(Decrease)/increase in provisions (1.9) (0.5) 5.8

Movement on pension plans (2.1) (1.1) (3.8)

Movement on derivative financial

instruments - (0.2) (0.2)

------------------------------------ -------- -------- ----------

Cash generated by operations 4.6 4.8 7.0

------------------------------------ -------- -------- ----------

10 Reconciliation of the movement in cash and cash equivalents to movement in net debt

First half Full year

2014/15 2013/14 2013/14

GBPm GBPm GBPm

-------------------------------- --------- --------- ----------

Increase/(decrease) in cash

and cash equivalents 3.8 0.3 (2.1)

Change in net debt resulting

from cash flows (3.2) 0.4 -

Other non-cash movement (0.2) (0.1) (0.3)

Foreign currency translation

differences - 0.2 0.4

-------------------------------- ------- ---------- ----------

Change in net debt during the

period 0.4 0.8 (2.0)

Net debt at start of period (24.8) (22.8) (22.8)

-------------------------------- ------- ---------- ----------

Net debt at end of period (24.4) (22.0) (24.8)

-------------------------------- ------- ---------- ----------

11 Net Debt

At 30 At 30 At 31

September September March

2014 2013 2014

GBPm GBPm GBPm

-------------------------------- ----------- ----------- -------

Cash and cash equivalents 10.6 9.2 6.7

Borrowings:

Bank overdrafts (0.3) (0.1) (0.1)

Bank loans - current (0.4) - -

Sub-total - current borrowings (0.7) (0.1) (0.1)

Bank loans - non-current (33.8) (30.6) (30.9)

Preference stock (0.5) (0.5) (0.5)

-------------------------------- ----------- ----------- -------

Net debt (24.4) (22.0) (24.8)

-------------------------------- ----------- ----------- -------

12 Called-up share capital

At 30 At 30 At 31

September September March

2014 2013 2014

GBPm GBPm GBPm

----------------------------- ----------- ----------- -------

Ordinary shares of 5p each 11.2 11.2 11.2

Deferred shares of 20p each 15.4 15.4 15.4

26.6 26.6 26.6

----------------------------- ----------- ----------- -------

At 30 September 2014, the issued ordinary share capital

comprised 223,064,703 ordinary shares of 5p each (31 March 2014 -

223,064,703) and 77,064,703 deferred shares of 20p each (31 March

2014 - 77,064,703).

[1] Throughout these interim results "adjusted" means after

eliminating the effects of exceptional items, IAS 19 pensions

charges (which include financing charges and scheme administration

costs included in operating charges), and any associated tax

thereon.

[2] Calculated as net debt divided by rolling 12 month adjusted

earnings before interest, tax, depreciation and amortisation.

[3] "Underlying" adjusts prior year figures to the current year

exchange rates to give a like for like comparison.

[4] See reconciliation of reported, underlying and adjusted

figures.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGGRPGUPCUQA

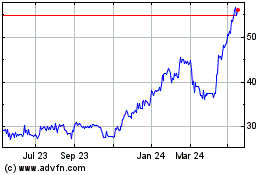

Renold (LSE:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

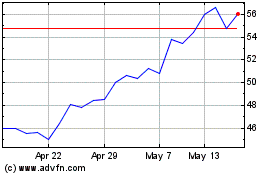

Renold (LSE:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024