TIDMABM

RNS Number : 2549H

African Battery Metals PLC

14 November 2018

African Battery Metals plc / EPIC: ABM / Market: AIM

14 November 2018

African Battery Metals plc ("ABM" or the "Company")

Update on Exploration Activities

African Battery Metals plc, the AIM listed African focused

exploration company developing projects in strategic battery

metals, is pleased to provide an update on its exploration

activities in Cameroon and the Democratic Republic of Congo, (the

"DRC").

Overview

Commenced exploration work on the licences in Cameroon acquired

-- as part of the purchase of Cobalt Blue Holdings Ltd (see

release of 8(th) August 2018), ("ABM's Cameroon Licences"

or "Cobalt Blue Permits" in figures 1, 2 & 3)), which are

close to and in part contiguous with the Nkamouna cobalt-nickel-manganese

project(1) which was historically majority owned by Geovic

Mining Corporation ("Geovic"). Nkamouna hosts one of the

world's largest undeveloped cobalt resource outside the

DRC(2) :

ABM has acquired key geophysical data, which helps

identify the source of cobalt-nickel mineralisation

observed in the region of the ABM Cameroon Licences;

Commissioned desk top report and site visit to AMB

Cameroon Licences by Sahara Natural Resources Ltd ("Sahara"),

a highly qualified independent group specialist in

African exploration; and

Identified a series of targets on ABM's Cameroon Licences

for follow-up work, which exhibit the same geological

signature displayed by the cobalt-nickel licences historically

held by Geovic.

Received assay results from the auger programme on ABM's

-- part owned Kisinka licence in the DRC, which provide minimal

evidence of cobalt or copper mineralisation.

References to figures relate to the version visible in PDF

format by clicking the link below:

http://www.rns-pdf.londonstockexchange.com/rns/2549H_1-2018-11-13.pdf

ABM CEO, Roger Murphy, said,

"I am very excited by the opportunity we have acquired in

Cameroon. We know from Geovic's past exploration work at Nkamouna,

that this area hosts one of the world's largest non-DRC cobalt

resources(2) , and that we are in 'elephant country' for cobalt and

nickel. We believe we understand why the mineralisation is where it

is in the licences historically held by Geovic and, as the charts

in this release show, we have similar areas within ABM's Cameroon

Licences. I look forward to implementing an exploration programme,

which I believe should confirm the presence of cobalt and nickel on

ABM's Cameroon Licences.

At the same time, I'm disappointed that our work so far on

Kisinka in the DRC has not yet provided significant evidence of

cobalt or copper mineralisation. However, Kisinka is a large

licence area in the right area on mapped Roan geology, with large

copper-cobalt mines nearby. Our work to date has only covered a

small fraction of the licence so we therefore cannot rule anything

out yet. We will assess our next steps on Kisinka relative to those

for our licences in Ivory Coast and Cameroon."

CAMEROON - DATA ACQUISITION

ABM has studied the geological work undertaken by Geovic, and NI

43-101 Technical Report commissioned by Geovic, to locate

economically viable cobalt-nickel mineralisation in the region, and

used it to identify targets on ABM's Cameroon Licences. ABM used

two strands of evidence, viz:

1. Geophysical data. According to Geovic's geological work, the

source of the cobalt-nickel mineralisation in the region is a

series of ultramafic intrusions into the country rock. Ultramafic

rocks are highly magnetic and so stand out on aeromagnetic maps. To

help identify the ultramafic source rocks, ABM acquired

aeromagnetic data for the area which is illustrated in figure 2

below. It is apparent that Messea, one of the cobalt-nickel

licences historically held by Geovic, has a very strong magnetic

signature. As figure 2 also illustrates, there are large areas of

magnetic highs across the ABM Cameroon Licences.

2. Topography. All the seven historically Geovic-owned

cobalt-nickel targets represent topographic highs or plateaus in an

area incised by rivers. Areas where these topographic highs

coincide with aeromagnetic highs provide the strongest likelihood

of preservation of the cobalt-nickel mineralisation. Figure 3 below

shows regional topography. On the ABM Cameroon Licences, it is

evident that the northern end of Ngoila North (which is a

continuation of the Messea cobalt-nickel block), and much of Ekok

and Ntam East all have elevated areas which coincide with

aeromagnetic anomalies.

As figures 2 & 3 below illustrate, the ABM Cameroon Licences

have several areas where topographic highs overlie areas of

elevated aeromagnetic intensity. It is these areas where ABM's

anticipated next stage of exploration will focus. Given that

mineralisation at Nkamouna is found from around 5m to 22m in depth,

ABM will need to devise an exploration approach which involves

either deep pitting or use of a man-portable auger. ABM looks

forward to updating the market as it designs an exploration

programme for these licences.

SITE VISIT

A team of Sahara geologists visited ABM's Cameroon licences

during July 2018. The primary purpose of the visit was to assess

the work necessary for a systematic exploration programme focused

on the targets identified by the topographic and aeromagnetic data,

but whilst on the licences, a series of shallow soil samples were

collected on transects across each licence. Expectations from this

shallow sampling were limited as all the cobalt and nickel

mineralisation at the licences historically held by Geovic were

found at depths of greater than 5m. In order to penetrate down to

the anticipated depth of mineralisation, either hand-dug pits of

over 5m depth will need to be excavated across the licences or a

man-portable mechanical auger will need to be utilised.

GEOVIC - HISTORY & ECONOMIC GEOLOGY

Geovic was listed on the Toronto Stock Exchange in 2006 to

follow up on nickel-cobalt mineralisation reported by a United

Nations Exploration Programme in Cameroon in the 1980s. Geovic,

through its 60.5% owned subsidiary Geovic Cameroon, conducted an

extensive exploration programme over several years over its licence

area, see figure 1. This work identified seven plateaus in the

region where cobalt and nickel mineralisation was recorded. These

plateaus, named Nkamouna, Mada, Rapodjombo, North Mang, South Mang,

Messia and Kondong are illustrated in figure 2.

The cobalt and nickel mineralisation was found at between 5m -

20m depth in the deeply weathering profile or laterite that overlay

areas with underlying ultramafic intrusions. The ultramafics acted

as the source of the metals and the laterite concentrated them to

economic levels. Laterites are frequently sources of cobalt and

nickel mineralisation in equatorial regions of the world, including

SE Asia, Australia and Latin America as well as Africa. Over time,

this laterite profile has been eroded away by the rivers with

transect the area and is only preserved in a series of plateaus

between the rivers.

Although every plateau was explored and cobalt-nickel

mineralisation was reported, given the very large scale of the

licence area and its inaccessibility, Geovic concentrated

exploration work on Nkamouna and Mada. The final NI 43-101

compliant Mineral Resource declared by Geovic totalled 323.2

million tonnes at 0.21% Cobalt, 0.63% Nickel and 1.36% Manganese,

see Table 1 below. A full NI 43-101 compliant Technical Report was

completed by SRK in June 2011(3) with an Ore Reserve of 54.7million

tonnes grading 0.25% Cobalt, 0.69% Nickel and 1.33% Manganese.

Table 1 Geovic 43-101 Resource dated 02 June 2011

Category kt Co % Ni % Mn % Co (t) Ni (t) Mn (t)

Measured 59,806 0.24 0.68 1.37 143,532 406,674 819,329

-------- ----- ----- ----- -------- ---------- ----------

Indicated 60,794 0.22 0.62 1.35 133,747 376,923 802,481

-------- ----- ----- ----- -------- ---------- ----------

Total M&I 120,599 0.23 0.65 1.35 277,279 783,597 1,621,810

-------- ----- ----- ----- -------- ---------- ----------

Inferred 202,551 0.20 0.59 1.20 405,102 1,195,051 2,430,612

-------- ----- ----- ----- -------- ---------- ----------

Total M,

I & I 323,150 0.21 0.61 1.26 682,381 1,978,648 4,052,421

-------- ----- ----- ----- -------- ---------- ----------

Source: NI 43-101 Technical Report, Geovic Mining Corp by SRK

Consulting, 02 June 2011(3)

Geovic explored several means to raise the significant finance

necessary to fund construction of a mine at Nkamouna, including a

partial sale to a Chinese Company looking to offtake production

from the project. But cobalt fell from a peak of $50/lb

($110,000/t) in 2008 to trade between $10/lb - $15/lb ($22,000/t to

$33,000/t) from mid 2012 to end 2015. At these low prices Geovic

failed to raise finance and the Company was subsequently delisted

from the Toronto Stock Exchange in June 2014.

KISINKA ASSAYS

After significant delays due to a variety of factors including

changes to the Mining Code in the DRC, and administrative delays,

also in part due to those changes, assays on the samples submitted

following ABM's auger programme of two transects across the Kisinka

licence in DRC have now been returned. The results are

disappointing, with cobalt grades of 0.002% to 0.021% and copper of

up to 0.058%. These are disappointing given that the licence is on

the Roan rocks, which host most of DRC's cobalt, and also given the

licence is within 30km of seven producing cobalt and copper mines.

As previously noted, however, the licence is over 50sq.km. and in

excess of seven kilometres long. Additionally the licence is

covered with up to 30 metres of soil cover, which is why augering

was attempted. These results do not invalidate Kisinka as an

exploration target. Further work on the licence will be assessed in

the context of the opportunities ABM management sees in its

projects in Ivory Coast (see release of 16(th) October 2018) and in

Cameroon.

Footnotes:

(1) Geovic Mining Corporation released a Feasibility Study on

its Nkamouna Co-Ni-Mn project in 2011, via www.sedar.com. The total

Measured, Indicated & Inferred Resource totalled 323.15 million

tonnes at 0.21% cobalt, 0.61% nickel and 1.26% manganese - see

Table 1 below for more detail

(2) Core Consultants described Celsius Resources Ltd.'s Opowu

Resource in Namibia as the largest outside the DRC. Nkamouna's

historic resource is significantly larger than Opowu's. Source:

https://www.coreconsultantsgroup.com/largest-cobalt-copper-resource-outside-drc/

(3)

https://sedar.com/FindCompanyDocuments.do?lang=EN&page_no=2&company_search=Geovic&document_selection=0&industry_group=A&FromDate=01&FromMonth=01&FromYear=2010&ToDate=31&ToMonth=12&ToYear=2012&Variable=Issuer

**Ends**

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No.596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

For further information please visit https://www.abmplc.com/ or

contact:

African Battery Metals plc

Roger Murphy (CEO) +44 (0) 20 7583 8304

SP Angel Corporate Finance (Nomad

and Broker)

Ewan Leggat +44 (0) 20 3470 0470

Notes to Editors:

ABM is an AIM listed, Africa focused, resource company exploring

for the key metals used in next generation batteries that fuel the

new electric vehicle revolution. The Board and team of advisors,

who have proven expertise in African exploration, mining and

project generation, have identified an opportunity to utilise the

Company's position to become a leader in the London market for

investors to gain exposure to the battery metal commodity suite,

particularly cobalt, lithium, copper and nickel.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDGGGGAGUPRGMW

(END) Dow Jones Newswires

November 14, 2018 02:00 ET (07:00 GMT)

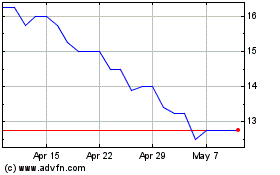

Power Metal Resources (LSE:POW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Power Metal Resources (LSE:POW)

Historical Stock Chart

From Apr 2023 to Apr 2024