TIDMMIG

RNS Number : 0369L

Mobeus Income & Growth 2 VCT PLC

08 September 2021

Mobeus Income & Growth 2 VCT plc

("the Company")

LEI: 213800LY62XLI1B4VX35

INTERIM MANAGEMENT STATEMENT

For the quarter ended 30 June 2021

Mobeus Income & Growth 2 VCT plc presents an Interim

Management Statement for the quarter ended 30 June 2021. The

statement also includes relevant financial information between the

end of the period and the date of this statement.

NET ASSET VALUE AND TOTAL RETURN PER SHARE

At 30 June At 31 March 2021

2021

(unaudited) (audited)

Net assets attributable to GBP79.50 million GBP73.90 million

shareholders

Shares in issue 73,230,275 73,230,275

Net asset value (NAV) per 108.56 pence 100.91 pence

share

Cumulative dividends paid 116.00 pence 116.00 pence

to date per share

Cumulative Total return (net 224.56 pence 216.91 pence

asset value basis) per share

since inception

The NAV per share has increased by 7.65 pence in the quarter (an

increase of 7.6% upon the opening NAV per share). This positive

performance is principally due to a continued rise in unrealised

portfolio valuations.

DIVIDENDS

After the period end, on 30 July 2021, an Interim dividend of

6.00 pence per ordinary share in respect of the year ended 31 March

2021 was paid to all Shareholders whose names were on the Register

on 9 July 2021. Payment of this dividend has reduced the NAV per

share at 30 June 2021 of 108.56 pence to 102.56 pence and increased

cumulative dividends paid to 122.00 pence per share.

SHARE BUY-BACKS

After the period end, on 9 July 2021, the Company purchased

299,932 of its own ordinary shares at a price of 90.16 pence per

share for cancellation.

Following this purchase, the Company has 72,930,343 ordinary

shares of 1 penny each in issue.

INVESTMENT ACTIVITY DURING THE PERIOD

New investments during the period

On 22 June 2021, a new investment of GBP0.61 million was made

into Legatics, a SaaS LegalTech software business.

On 25 June 2021, a new investment of GBP0.56 million was made

into Pets' Kitchen (trading as Vet's Klinic), a veterinary clinics

business and pet food provider.

Follow-on investments during the period

On 16 April 2021 and 18 May 2021, follow-on investments

totalling GBP0.18 million were made into Caledonian Leisure, a

provider of UK leisure and experience breaks.

On 26 May 2021, a follow-on investment of GBP0.61 million was

made into Bella & Duke, a premium frozen raw dog food

provider.

On 27 June 2021, a follow-on investment of GBP0.05 million was

made into Spanish Restaurant Group Limited (trading as Tapas

Revolution), a Spanish restaurant chain.

Loan repayments during the period

On 1 April 2021, a loan repayment of GBP0.19 million was

received by the Company from Vian Marketing Limited (trading as Red

Paddle).

On 28 May 2021, a loan repayment of GBP0.27 million was received

by the Company from MPB Group Limited.

Other proceeds received during the period.

On 12 April 2021, the Company received further proceeds of

GBP0.05 million in respect of Vectair Holdings Limited, an

investment realised in a previous year.

INVESTMENT ACTIVITY AFTER THE PERIOD END

Follow-on investments after the period end

On 5 August 2021, a follow-on investment of GBP0.52 million was

made into MyTutor, a digital tutoring marketplace.

Partial Realisation after the period-end

On 6 August 2021, the Company sold part of its original equity

holding in MyTutor to a large strategic investor generating

proceeds of GBP0.52 million and a GBP0.38 million realised gain for

the Company over the original cost of the equity shares sold. In

isolation, the impact of this partial sale is a 0.09 pence uplift

in NAV per share compared to the 30 June 2021 NAV per share of

108.56 pence, referred to above.

Please note that all of the above information is unaudited.

Other than as described above, there were no material events

during the period and to the date of this announcement.

For further information, please contact :

Mobeus Equity Partners LLP, Company Secretary: 020 7024

7600.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKOBQABKDOCK

(END) Dow Jones Newswires

September 08, 2021 02:00 ET (06:00 GMT)

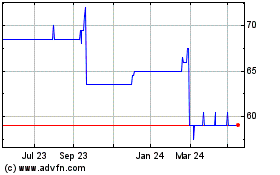

Mobeus Income & Growth 2... (LSE:MIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

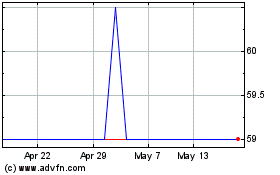

Mobeus Income & Growth 2... (LSE:MIG)

Historical Stock Chart

From Apr 2023 to Apr 2024