TIDMMAFL

RNS Number : 6232C

Mineral & Financial Invest. Limited

22 June 2021

MINERAL AND FINANCIAL INVESTMENTS LIMITED

US$1.0 Million Cash Payment Received from Ascendant

Resources

George Town, Cayman Islands - 22 June 2021 - Mineral and

Financial Investments Limited (LSE-AIM: MAFL) ("M&FI" or the

"Company") is pleased to provide an update on its earn-in agreement

with Ascendant Resources in Redcorp Empreedimentos Mineiros Lda and

its 25Mt volcanic massive sulphide (VMS) polymetallic

Zinc/Lead/Copper/Silver/Gold Lagoa Salgada deposit located in South

Central Portugal. Today M&FI received a US$1.0 million payment

as part of the earn-in agreement it has with Ascendant Resources

Ltd.

M&FI President and CEO Jacques Vaillancourt stated

"Ascendant Resources have been an outstanding partner meeting every

payment and significantly expanding the projects size and scope

during a challenging time globally. We continue to believe that

this project will grow from its current size"

Summary of Ascendant Agreement

The following is a summary of the earn-in agreement (extracted

from the announced dated 2 August 2018):

"TH Crestgate (now MAFL's 100% subsidiary) and Ascendant

Resources Inc have entered into an agreement for the sale of 25% of

its 100% owned subsidiary Recdorp Empreedimentos Mineiros Lda and

to simulataneously enter into an Earn-in Option agreement.

In the first part of the transaction Ascendant acquired an

initial effective 25% interest for an upfront payment of US$2.45

million composed of US$800,000 in cash (US$400,000 on closing of

the transaction and US$400,000 on July 15, 2018) and US$1.65

million in Ascendant shares. The second part of the Agreement is an

Earn-in Option which has a minimum total value, if fully exercised,

of US$15.0 million. Earn-in transaction terms are as follows:

-- Ascendant has the right to earn a further effective 25%

interest via staged payments and funding obligations as outlined

below:

o Investing a minimum of US$9.0 million directly in the

operating company, Redcorp within 48 months of the closing date, to

fund exploration drilling, metallurgical test work, economic

studies and other customary activities for exploration and

development, and

o Making payments totaling US$3.5 million to Crestgate according

to the following schedule or earlier:

-- 6 months after the closing date: US$0.25 million (Dec 22,

2018 - Received)

-- 12 months after the closing date: US$0.25 million (June 22,

2019 - Received)

-- 18 months after the closing date: US$0.5 million (Dec. 22,

2019 - Received)

-- 24 months after the closing date: US$0.5 million (June 22,

2020 - Received)

-- 36 months after the closing date: US$1.0 million (June 22,

2021 - Received)

-- 48 months after the closing date: US$1.0 million (June 22,

2022)

-- Ascendant then has the option to earn an additional 30%,

totaling an 80% interest in Redcorp, the operating subsidiary, by

completing a Feasibility study within 54 months (Dec 22, 2022) and

making a further payment of US$2.5 million to Crestgate.

-- Ascendant will fund all development and future construction

costs and recoup Crestgate's share of investment through cash flow

until repaid.

-- First-Right of refusal, 'tag-along', 'drag-along' and other sale and exit provisions.

-- Additional terms as standard in such transactions.

-- The Redcorp board composition will be 50/50 to the full earn-in of 80%

-- Redcorp's operations will be led by an operating committee

composed by Ascendant Resources reporting to the Redcorp Board of

Directors."

For further information please see the announcement of 2 August

2018.

FOR MORE INFORMATION:

Jacques Vaillancourt, Mineral & Financial Investments Ltd. +44 780 226 8247

Katy Mitchell and Matt Chan, WH Ireland Limited +44 207 220 1666

Jon Belliss, Novum Securities Limited +44 207 382 8300

ABOUT MINERAL AND FINANCIAL INVESTMENTS LIMITED:

Mineral and Financial Investments Limited is a Swiss and Cayman

Island based investment company quoted on AIM, a market of the

London Stock Exchange. M&FI has in excess of 20 investments in

the natural resource sector with the majority in the metals and

minerals. M&FI's Net Asset Value per share (NAVPS) is 17.1p, as

of March 30, 2021. M&FI's NAVPS has risen at a Compound Annual

Growth Rate (CAGR) of 26.7% since December 31, 2016.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLFLLLFQLLBBK

(END) Dow Jones Newswires

June 22, 2021 02:00 ET (06:00 GMT)

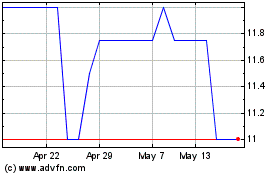

Mineral & Financial Inve... (LSE:MAFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mineral & Financial Inve... (LSE:MAFL)

Historical Stock Chart

From Apr 2023 to Apr 2024