TIDMLTG

RNS Number : 3638M

Learning Technologies Group PLC

16 September 2019

Learning Technologies Group plc

HALF YEAR RESULTS 2019

Strong sales and margin expansion drives EBIT and cash

generation

Learning Technologies Group plc ("LTG" or the "Company"), the

provider of services and technologies for digital learning and

talent management, is pleased to announce its half year results for

the six months ended 30 June 2019.

Strategic highlights

-- Strong Group EBIT margin performance and cash generation

-- Cross-selling initiatives driving sales momentum

-- PeopleFluent progressing well - confident of return to growth in 2020

-- Content & Services displaying significant improvement

versus H2 2018, with momentum in LEO and Preloaded, reflecting

focussed investment in sales

-- Launch of Instilled Learning Experience Platform ('LXP')

-- Successful acquisition of BreezyHR, integrated swiftly and

now delivering impressive revenue growth

Financial highlights

-- Revenue up 85% to GBP62.6m (H1 2018: GBP33.8m), 74% recurring revenue (H1 2018: 51%)

-- Software & Platforms (68% of Group revenue)

o Organic revenue up 7%, excluding PeopleFluent

o PeopleFluent successfully managing retention rates to

stabilise revenues

o Growth across Rustici, gomo and Watershed

o BreezyHR integration completed and growing strongly

-- Content & Services (32% of Group revenue)

o Organic revenue (excluding CSL contract) down 3% but confident

of strong organic growth for FY 2019

o Excellent sales momentum supports expectation of strong H2 for

LEO and Preloaded

o Cross-selling supporting recent wins

-- Adjusted EBIT ahead of expectations, up 134% to GBP19.4m (H1 2018: GBP8.3m)

-- Strong margin progression, with EBIT margins up 660 basis points to 31.1%

-- Adjusted diluted EPS of 2.228 pence, up 117%

-- Proposed interim dividend of 0.25 pence, up 67%

-- Good cash generation, resulting in net debt of GBP13.9m

following $12.7m acquisition of Breezy and net debt : EBITDA of

0.3x (H1 2018: 0.8x)

-- Robust balance sheet and debt facility supports strong acquisition pipeline

Current trading and outlook

-- FY2019 in line with upgraded expectations, as announced on 22 July 2019

-- Software & Platforms performing well aided by high growth

acquisitions and new product developments

-- Content & Services expected to deliver organic growth of c.8% in FY2019

-- Strong cash generation since period end; net debt at end August 2019 down to GBP7.8m

-- Active pipeline of strategic acquisition opportunities with significant funding capacity

-- Sales pipeline and high proportion of recurring revenue

underpins the Board's confidence for 2019 performance

Jonathan Satchell, CEO of LTG, said:

"In the first half of 2019 both our divisions have delivered a

strong performance, with Software & Platforms delivering an

increasing proportion of high margin recurring revenues from

software licenses, and organic sales momentum greatly increasing in

Content & Services.

"The Group continues to deliver excellent shareholder value by

efficiently transforming recently acquired businesses, with

PeopleFluent successfully integrated and expected to return to

growth in 2020 and BreezyHR, acquired in April 2019, achieving

significant growth and showing great promise.

"Our first half performance increased recurring revenues and

robust current trading provides great confidence for the year ahead

to deliver further organic growth, strong margins and excellent

cash generation. On the back of this momentum, we are investing in

H2 2019 to drive sales further, as well as supporting organic

growth initiatives into 2020."

Financial summary:

GBPm unless otherwise stated H1 2019 H1 2018 Change

-------------------------------

Revenue 62.6 33.8 +85%

-------- -------- -------

Recurring Revenue % 74% 51%

-------- -------- -------

Revenue Outside UK % 79% 59%

-------- -------- -------

Adjusted EBIT (pre IFRS16 and

SBP adjustments) 20.0 8.9 +125%

-------- -------- -------

Adjusted EBIT 19.4 8.3 +134%

-------- -------- -------

Adjusted EBIT margin 31.1% 24.5%

-------- -------- -------

Statutory PBT 6.8 1.3

-------- -------- -------

Adj. Diluted EPS (pence) 2.228p 1.028p +117%

-------- -------- -------

Proposed Interim Dividend per

share (pence) 0.25p 0.15p +67%

-------- -------- -------

Net Debt (13.9) (15.7)

-------- -------- -------

Analyst and investor presentation

LTG will host an analyst and investor presentation at 8.30 a.m.

today, Monday 16 September 2019, at LTG's offices.

Enquiries:

Learning Technologies Group plc

Jonathan Satchell, Chief Executive +44 (0)20 7402

Neil Elton, Chief Financial Officer 1554

Numis Securities Limited (NOMAD and Corporate

Broker)

Stuart Skinner, (Nomad), Nick Westlake, Ben +44 (0)20 7260

Stoop 1000

Goldman Sachs International (Joint Corporate

Broker) +44 (0)20 7774

Bertie Whitehead, Adam Laikin 1000

FTI Consulting (Public Relations Adviser) +44 (0)20 3727

Jamie Ricketts, Chris Birt, Jamille Smith 1000

About LTG

LTG is a leader in the growing workplace digital learning and

talent management market. The Group offers end-to-end learning and

talent solutions ranging from strategic consultancy, through a

range of content and platform solutions to analytical insights that

enable corporate and government clients to close the gap between

current and future workforce capability.

LTG is listed on the London Stock Exchange's Alternative

Investment Market (LTG.L) and headquartered in London. The Group

has offices in Europe, North America and Asia-Pacific.

Chairman's Statement

Introduction

The Board is delighted to report that Learning Technologies

Group plc ('LTG') has made excellent progress over the period,

particularly with its ongoing transition towards a software licence

model delivering high margin, recurring revenues. The integration

of the transformational acquisition of PeopleFluent Holdings Corp

('PeopleFluent') in May 2018 has been completed successfully and,

as planned, the acquired business is on track to return to growth

in 2020. It is pleasing to see a significant improvement in Content

& Services' performance compared to H2 2018, driven by a

greater focus on sales and a number of large contract wins. At the

same time the Group has delivered continuing strong operating

margins, enabling management to invest further in R&D and

incremental sales initiatives, resulting in some notable successes

in cross-selling.

Results

With effect from 1 January 2019 LTG has adopted the new

accounting standard IFRS16 - Leases. In addition, Adjusted EBIT*

has been restated to include the impact of share based payments.

Further details of these adjustments are provided below.

In the six months ended 30 June 2019, revenues increased by 85%

to GBP62.6 million (H1 2018: GBP33.8 million) with like-for-like

revenues on a constant currency basis (excluding the

post-acquisition contribution of BreezyHR, the acquired

PeopleFluent businesses, and excluding the exceptional contribution

from the Civil Service Learning ('CSL') contract) increased by 2%

to GBP27.0 million. The acquired PeopleFluent businesses

contributed GBP35.1 million of revenue for H1 2019, compared to

GBP36.0 million (3% decline) of revenue had they been owned for the

entirety of H1 2018.

With the acquisition of PeopleFluent, Watershed and BreezyHR, as

well as the strong organic growth in the Group's other software

licencing businesses, recurring licence fee and support contract

revenues increased from GBP16.5 million in H1 2018 to GBP41.3

million in H1 2019, an increase of 150%.

Adjusted EBIT grew by 134% to GBP19.4 million (H1 2018: GBP8.3

million) with margins increasing from 24.5% in H1 2018 to 31.1% in

H1 2019, primarily as a result of the inclusion of PeopleFluent for

the full period and operational synergies achieved ahead of

plan.

Operating profit of GBP8.2 million (H1 2018: GBP0.9 million) is

stated after amortisation of acquired intangibles, various

acquisition earnout charges, share-based payments, and integration

costs. Following the acquisition of PeopleFluent, amortisation of

acquired intangibles increased to GBP10.2 million (H1 2018: GBP5.7

million). The share based payment charge increased to GBP1.0

million (H1 2018: GBP0.6 million) as a result of increased grants

following the acquisition of PeopleFluent. Acquisition-related

deferred consideration and earnout charges declined to GBP1.1

million (H1 2018: GBP1.5 million) and relate primarily to the

anticipated earnout resulting from Watershed's and BreezyHR's

incremental revenue growth during the first year of their

respective three-year earnout agreements. There were no integration

costs of note in H1 2019 (H1 2018: GBP0.1 million).

Transaction costs relating to the acquisition of BreezyHR were

GBP0.3 million (H1 2018: GBP2.6 million) and interest on

borrowings, was GBP0.9 million (H1 2018: GBP0.5 million). A finance

charge of GBP0.2 million (H1 2018: GBPnil) relates to the Group's

leases following adoption of IFRS16 (see Note 12).

The Group reported a net profit of GBP6.8 million for the six

months ended 30 June 2019 attributable to the owners of the parent

company (H1 2018: profit of GBP1.3 million).

The basic earnings per share in H1 2019 was 1.012 pence (H1

2018: 0.221 pence). Adjusted diluted earnings per share as set out

in Note 5 increased by 117% to 2.228 pence (H1 2018: 1.028

pence).

At the time of the acquisition of PeopleFluent in May 2018, LTG

entered into a new debt facility with Silicon Valley Bank ('SVB')

and Barclays Bank for $63 million. The facility comprises a $42

million term loan repayable in quarterly instalments of $2.1

million, and a $21 million multi-currency revolving credit

facility, both available for five years. The facility is subject to

various financial covenants and interest is charged at between 160

and 210 basis points above LIBOR based on the covenant results.

LTG maintained strong operating cash flows in the period. Net

cash flow from operating activities (excluding deferred

consideration payments relating to 2018) was GBP15.5 million (H1

2018: GBP11.0 million). Excluding the transaction costs relating to

the acquisition of BreezyHR and acquisition related deferred

consideration payments, operating cash flow conversion was 79% (H1

2018: 91%).

In H1 2019 approximately 79% of LTG's business was undertaken

for customers outside of the UK and a growing percentage of the

Group's revenues are denominated in USD. Net USD cash inflows are

used as an internal hedge against the USD loan capital and interest

repayments helping to reduce the business' overall exposure to

exchange rate volatility. At 30 June 2019 gross cash was GBP21.1

million and net debt was GBP13.9 million (31 December 2018: gross

cash was GBP26.8 million and net debt was GBP11.5 million).

Following the period end net debt as at 31 August 2019 had reduced

further to GBP7.8 million and the Group is on track to be

unleveraged by the end of the year.

Overall net assets increased to GBP172.8 million at 30 June 2019

(31 December 2018: GBP168.8 million) and shareholders' funds

increased from 25.3 pence per share to 25.9 pence per share.

Impact of adoption of new accounting policies

With effect from 1 January 2019 the Group has adopted a new

accounting standard: IFRS16 - Leases. As a result the Group has

recognised lease liabilities in relation to leases which had

previously been classified as 'operating leases' under the

principles of IAS 17 Leases. These liabilities are measured at the

present value of the remaining lease payments, discounted using the

lessee's incremental borrowing rate as of 1 January 2019.

Further, with effect from 1 January 2019 the Board has resolved

to report Adjusted EBIT inclusive, rather than exclusive, of the

share based payment charge. This is to align the Group with

guidance from the FRC's Corporate Reporting Thematic Review and to

recognise that share based payment charges are a valid cost of the

business and relieve the Group of an alternative cash expense.

The financial comparatives used for prior periods in this report

are restated to reflect the impact on the financial results for the

Group as if the new accounting policy with regards share based

payments had been adopted in the prior year. The modified

retrospective approach has been applied to the prior period changes

in respect of IFRS16 with a net charge to retained earnings as at 1

January 2019 of GBP2.3 million. There was a net credit to retained

earnings in H1 2019 of GBP0.2 million.

The table below sets out the effect of these adjustments on

Adjusted EBIT:

H1 2018 H2 2018 FY 2018 H1 2019

GBP'000 GBP'000 GBP'000 GBP'000

-------- -------- -------- --------

Adjusted EBIT pre accounting

policy changes 8,885 18,360 27,245 20,012

-------- -------- -------- --------

Adjusted EBIT margin (%) 26.3% 30.6% 29.0% 32.0%

-------- -------- -------- --------

Share Based Payment charge adjustment (588) (666) (1,254) (997)

-------- -------- -------- --------

IFRS16 adjustment - - - 433

-------- -------- -------- --------

Revised Adjusted EBIT 8,297 17,694 25,991 19,448

-------- -------- -------- --------

Revised Adjusted EBIT margin

(%) 24.5% 29.4% 27.7% 31.1%

-------- -------- -------- --------

Further details are provided in Note 12.

The full-year 2019 share based payment charge is expected to be

approximately GBP2.8 million as a result of performance related

share option grants made to the extended management team following

the acquisition of PeopleFluent in May 2018, and the launch of a

new Employee Stock Purchase Plan in the US with effect from May

2019.

Operational Review

Following the acquisition and successful integration of

PeopleFluent, we have made a number of structural improvements to

LTG to support our long-term prospects and performance.

PeopleFluent's talent software solutions business has been combined

with the NetDimensions' LMS software business (acquired in March

2017) to create a leading best-of-breed integrated platform,

operating under the PeopleFluent brand. Together this combined

business represents approximately half of LTG's revenue.

PeopleFluent's workforce compliance and diversity business has been

renamed 'Affirmity' and the company's contingent workforce

management solutions provider has been renamed 'VectorVMS'. Both

these businesses operate under their own management teams. KZO, an

exciting video curation tool, was incorporated into the gomo

business and rebranded 'gomo video'.

The acquired PeopleFluent business had experienced declining

revenues for a number of years mainly as a result of low client

retention rates on some of their products. LTG management guided in

H1 2018 that the acquired business was anticipated to deliver

annual revenues of c$98.0 million in 2018, declining to c$91.0

million in 2019 (as restated under IFRS15), and that management had

the objective to return the acquired business to net sales and

revenue growth by 2020. As a result of higher-than-expected

retention rates in H1 2019, the substantial improvements being made

to the software products, and encouraging new sales, the Board is

increasingly confident that the acquired PeopleFluent business will

deliver on its revenue targets in 2019 and return to growth in

2020.

Management have sought to address client churn firstly by

transferring PeopleFluent's existing LMS customers to the industry

leading NetDimensions LMS, and secondly by focussed investment in

the talent acquisition platform. LTG has committed significant

R&D investment to the acquired and integrated PeopleFluent

talent acquisition platform. The acquisition of BreezyHR (see below

for further details) whose award winning product features will be

incorporated into the PeopleFluent enterprise solution, is further

evidence of investment to support long-term organic growth.

PeopleFluent will shortly launch the new updated talent acquisition

functionality which we are confident will enhance the candidate

experience on our platforms. PeopleFluent has invested heavily in

developing new product features across its range of products.

VectorVMS has also invested substantially in its product features

and will launch a new mobile solution this month.

LTG's Software & Platforms division (excluding the acquired

PeopleFluent business referenced above) continues to deliver good

growth with revenue up 6.8% from GBP13.0 million in H1 2018 to

GBP14.6 million in H1 2019. Watershed, acquired in November 2018,

has grown revenues by 28.5% on a like-for-like basis and its

software solutions are increasingly sold as part of integrated

sales with other Group companies. The Group launched 'Instilled' in

May 2019, a 'Learning Experience Platform' ('LXP') that leverages

the capabilities of a number of LTG's software solutions including

gomo video, Watershed, and Rustici's SCORM Engine. This LXP places

the user experience at its heart, enabling learners to create,

share and recommend content, empowering them to create their own

'learning journeys'.

Content & Services division (excluding the acquired

PeopleFluent business referenced above and the CSL contract)

revenues of GBP12.5 million were up 15.2% on H2 2018 and declined

by 2.6% against tough prior year comparators. Content &

Services projects are typically run on a fixed price, non-recurring

basis, with a relatively short sales cycle.

Strong sales momentum from LEO and Preloaded has continued from

Q4 2018 into H1 2019, with H1 2018 to H1 2019 sales growth of

approximately 19% giving confidence that full-year organic revenue

growth will be above trend at approximately 8%. Notable sales

successes include a large multi-million dollar contract win for LEO

in the US which in turn has resulted in a further substantial

multi-year contract for the 3 products from the Software &

Platforms division.

Recurring revenues have increased from GBP17.3 million (51.0%)

in H1 2018 to GBP46.5 million (74.3%) in H1 2019. As well as high

visibility of revenues, the Software & Platforms division

generated adjusted EBIT margins of 35.6% in H1 2019 (H1 2018:

32.1%) primarily as a result of the inclusion of the PeopleFluent

business for a full period and the successful integration of the

business into LTG during the second half of 2018. Content &

Services saw adjusted EBIT margins also increase from 16.7% in H1

2018 to 21.1% in H1 2019. Adjusted EBIT margins for both periods

are stated inclusive of the share based payment charge.

Acquisition and integration of BreezyHR

On 17 April 2019, LTG announced that the Company had entered

into an agreement to acquire the entire issued and outstanding

shares of capital stock of BreezyHR Inc. ('BreezyHR') for cash

consideration of $12.7 million. Further performance based payments

capped at $18.0 million are payable in cash to BreezyHR management

and equity investors based on ambitious revenue growth targets in

each of the years ending 31 December 2019, 2020 and 2021. Deferred

contingent consideration will be charged to the income statement as

the qualifying conditions are met.

BreezyHR is a fast-growing talent acquisition software business,

providing small to medium sized businesses ('SMB') with

feature-rich, intuitive and user-friendly recruitment software to

optimise their recruitment processes and maximise productivity. The

addition of BreezyHR to LTG's best-of-breed talent and learning

businesses is expected to enhance the Group's position in the

talent acquisition market. The acquisition extends the Group's

existing enterprise client-base to include a new SMB audience, with

typically faster self-service sales-cycles. Since its founding in

2014, BreezyHR's software has managed the recruitment of 15 million

candidates across 10,000 companies in 72 countries.

We are delighted with the revenue growth rate of BreezyHR and

expect it to achieve the full amount for the first year of the

deferred consideration.

BreezyHR is now a business within PeopleFluent, part of LTG's

Software & Platforms division. The post-acquisition results for

BreezyHR are reported in line with LTG's accounting policies. Prior

to acquisition, BreezyHR prepared accounts on a cash accounting

basis and did not capitalise R&D. Further details are provided

in Note 11.

Dividend

On 28 June 2019, the Company paid a final dividend of 0.35 pence

per share, giving a total dividend for 2018 of 0.50 pence per

share. This represented a 67% increase on the dividend paid

compared to 2017. Given its confidence in the continuing success of

the Group, the Board is pleased to announce that it has approved an

interim dividend of 0.25 pence per share (2018: 0.15 pence per

share), representing a 67% increase. This will be paid on 8

November 2019 to shareholders on the register at 18 October

2019.

Current Trading and outlook

The Board is delighted with the progress that the Group has made

in the first half of 2019, in particular the acquisition and

successful integration of BreezyHR and the launch of 'Instilled'.

The Group's recurring software revenue base continues to grow

alongside strong operating margin performance and cash generation

and we are seeing the increasing success of cross-selling

initiatives. Whilst we have not yet completed Q3, we are seeing

evidence of this excellent trading momentum into the second half.

This, together with retention rates in PeopleFluent and expected

progress in Content & Services, underpins confidence in the

outlook for the rest of the 2019 financial year.

The Board continues to actively pursue acquisition

opportunities, particularly in the US, and in sectors that will

extend LTG's domain specific expertise and broaden and increase its

scale in markets in which LTG already has a leading presence. With

continuing robust operating margins and a strong balance sheet the

Board considers LTG well placed to achieve our strategic goal of

run-rate revenues of GBP200 million and run-rate Adjusted EBIT** of

at least GBP55 million by the end of 2021.

Andrew Brode

Chairman

16 September 2019

* 'Adjusted EBIT' is defined as the Group profit or loss before

tax, excluding the amortisation of acquisition-related intangible

assets, acquisition related deferred consideration and earn-outs,

finance expenses, the Group's share of profits or losses in

associates and joint ventures and other specific items including

exceptional foreign exchange movements.

** 'Adjusted EBIT' target prior to accounting policy changes

referenced in Note 12.

Consolidated statement of

comprehensive income Six months Six months

to to Year to

30 June 2019 30 June 2018 31 Dec 2018

Note GBP'000 GBP'000 GBP'000

Revenue 3 62,628 33,805 93,891

Operating expenses (excluding

acquisition-related deferred

consideration and earn-outs

and share based payment charge) (52,360) (30,765) (84,917)

Operating profit (before acquisition-related

deferred consideration and

earn-outs) 10,268 3,040 8,974

Acquisition-related deferred

consideration and earn-outs (1,055) (1,504) (3,761)

Share based payment charge (997) (588) (1,254)

Operating profit 8,216 948 3,959

Adjusted EBIT 19,448 8,297 25,991

Amortisation of acquired intangibles (10,177) (5,745) (15,193)

Acquired intangibles written

down - - (681)

Acquisition-related deferred

consideration and earn-outs (1,055) (1,504) (3,761)

Integration costs - (100) (2,397)

--------------------

Operating profit 8,216 948 3,959

----------------------------------------------- ------- -------------------- ------------------

Fair value movement on contingent

consideration - - 183

Costs of acquisition (270) (2,628) (2,621)

Share of losses of associates/joint

ventures - (69) (132)

Profit/(loss) on disposal (2) - -

of fixed assets

Finance expenses:

Charge on contingent consideration - (15) (54)

Unwinding onerous lease - - -

Interest on borrowings (921) (530) (1,512)

Net foreign exchange differences - 3,591 3,608

Finance Charge (235)

Interest receivable 30 9 10

Profit before taxation 6,818 1,306 3,441

Income tax credit/(expense) 4 (61) 43 730

Profit after taxation 6,757 1,349 4,171

Profit for the period/year

attributable to the owners

of the parent 6,757 1,349 4,171

Profit for the period/year - - -

attributable to non-controlling

interests

Earnings per share attributable

to owners of the parent:

Basic, (pence) 5 1.012 0.221 0.655

Diluted, (pence) 5 0.996 0.216 0.641

Other comprehensive income:

Exchange differences on translating

foreign operations 460 2,001 6,231

Total comprehensive profit

for the period 7,217 3,350 10,402

Attributable to:

The owners of the parent 7,217 3,350 10,402

Non-controlling interests - - -

Consolidated statement

of financial position 30 June

2019 30 June 2018 31 Dec 2018

Note GBP'000 GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 1,910 2,352 2,144

Right of use assets 12 10,871 - -

Intangible assets 6 244,237 238,851 242,458

Deferred tax assets 3,398 2,605 2,858

Investments accounted for - 1,619 -

under the equity method

Other receivables, deposits

and prepayments 421 173 161

Amounts recoverable on

contracts - - 421

--------------- -------------------- ---------------

260,837 245,600 248,042

CURRENT ASSETS

Trade receivables 30,971 21,205 34,314

Other receivables, deposits

and prepayments 7 4,217 5,335 3,897

Amounts recoverable on

contracts 5,282 4,561 3,397

Amounts due from related

parties 12 6 7

Cash and bank balances 8 21,067 32,062 26,794

Restricted cash balances 215 323 336

61,764 63,492 68,745

TOTAL ASSETS 322,601 309,092 316,787

--------------- -------------------- ---------------

CURRENT LIABILITIES

Lease liabilities 12 2,905 - -

Trade and other payables 9 63,573 68,182 72,470

Net restricted cash from 335 - -

the consolidation invoice

process (CIP)

Borrowings 10 6,587 6,499 6,602

Corporation tax 2,377 526 1,631

Amounts owing to related - - -

parties

--------------- -------------------- ---------------

75,777 75,207 80,703

NON-CURRENT LIABILITIES

Lease liabilities 12 10,181 - -

Deferred tax liabilities 25,229 26,338 26,299

Other long-term liabilities 9,515 3,117 9,008

Borrowings 10 28,333 41,304 31,657

Provisions 803 273 301

--------------- -------------------- ---------------

74,061 71,032 67,265

TOTAL LIABILITIES 149,838 146,239 147,968

--------------- -------------------- ---------------

NET ASSETS 172,763 162,853 168,819

-------- -------- --------

EQUITY

Share capital 2,506 2,498 2,501

Share premium account 147,998 147,517 147,560

Merger relief reserve 31,983 31,983 31,983

Reverse acquisition reserve (22,933) (22,933) (22,933)

Share-based payment reserve 2,442 983 1,608

Foreign exchange translation

reserve 4,401 (289) 3,941

Accumulated retained earnings/(losses) 6,366 3,094 4,159

--------- --------- ---------

TOTAL EQUITY ATTRIBUTABLE

TO THE OWNERS OF THE PARENT 172,763 162,853 168,819

--------- --------- ---------

Non-controlling interests - - -

--------- --------- ---------

TOTAL EQUITY 172,763 162,853 168,819

--------- --------- ---------

Consolidated statement of changes in equity

Share Share Merger Reverse Share Foreign Retained Total

capital Premium relief acquisition based exchange profits/(losses) equity

reserve reserve payments reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2018 2,145 64,208 31,983 (22,933) 1,092 (2,290) 1,220 75,425

Profit for

period - - - - - - 1,349 1,349

Exchange

differences on

translating

foreign

operations - - - - - 2,001 - 2,001

---------- -------- --------- ------------ --------- --------- ----------------- ----------

Total

comprehensive

income

for the period - - - - - 2,001 1,349 3,350

Issue of shares

net of share

issue costs 353 83,309 - - - - - 83,662

Share based

payment charge

/ credited to

equity - - - - 588 - - 588

Tax credit on

share options - - - - - - 1,224 1,224

Transfer on

exercise and

lapse of

options - - - - (697) - 697 -

Dividends

payable - - - - - - (1,396) (1,396)

Balance at 30

June 2018 2,498 147,517 31,983 (22,933) 983 (289) 3,094 162,853

Profit for

period - - - - - - 2,822 2,822

Exchange

differences on

translating

foreign

operations - - - - - 4,230 - 4,230

---------- -------- --------- ------------ --------- --------- ----------------- ----------

Total

comprehensive

income

for the period - - - - - 4,230 2,822 7,052

Issue of shares

net of share

issue costs 3 43 - - - - - 46

Share based

payment charge

/ credited to

equity - - - - 666 - - 666

Tax credit on

share options - - - - - - (799) (799)

Transfer on

exercise and

lapse of

options - - - - (41) - 41 -

Dividends paid - - - - - - (999) (999)

Balance at 31

December 2018 2,501 147,560 31,983 (22,933) 1,608 3,941 4,159 168,819

1 January 2019

restatement

due to IFRS 16 - - - - - - (2,314) (2,314)

Profit for

period - - - - - - 6,757 6,757

Exchange

differences on

translating

foreign

operations - - - - - 460 - 460

---------- -------- --------- ------------ --------- --------- ----------------- ----------

Total

comprehensive

income

for the period - - - - - 460 6,757 7,217

Issue of shares

net of share

issue costs 5 438 - - - - - 443

Share based

payment charge

/ credited to

equity - - - - 997 - - 997

Tax credit on

share options - - - - - - (62) (62)

Transfer on

exercise and

lapse of

options - - - - (163) - 163 -

Dividends

payable - - - - - - (2,337) (2,337)

Balance at 30

June 2019 2,506 147,998 31,983 (22,933) 2,442 4,401 6,366 172,763

---------- -------- --------- ------------ --------- --------- ----------------- ----------

Consolidated statement of cash flows

Note Six months Six months Year to

to to 31 Dec 2018

30 June 2019 30 June

2018

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Profit before taxation 6,818 1,306 3,441

Adjustments for:-

Loss on disposal of PPE 2 - -

Share options charge 997 588 1,254

Amortisation of intangible

assets 11,175 6,162 16,300

Depreciation of plant and

equipment 1,841 263 1,000

Share of losses of investments - 69 132

Finance expense - 15 54

Finance expense - interest 235 - -

portion of lease liabilities

(IFRS 16)

Finance interest on borrowings 921 530 1,512

Net foreign exchange difference - 17 -

on bank loan

Fair value movement on contingent

consideration - - (183)

Acquisition-related deferred

consideration and earn-outs 1,055 1,504 3,761

Payment of acquisition-related

deferred consideration and

earn-outs (2,321) (2,613) (3,166)

Impairment of acquired intangibles - - 681

Interest income (30) (9) (10)

--------------- ------------ -------------

Operating cash flow before

working capital changes 20,693 7,832 24,776

(Increase)/decrease in trade

and other receivables 4,098 1,208 (9,740)

(Increase) in amount recoverable

on contracts (1,886) (182) 424

(Decrease)/increase in payables (7,171) (559) 5,064

15,734 8,299 20,524

--------------- ------------ -------------

Interest paid (837) (235) (1,224)

Interest received 30 9 10

Income tax received/(paid) (1,700) 299 422

--------------- ------------ -------------

Net cash flow from operating

activities 13,227 8,372 19,732

--------------- ------------ -------------

Cash flow used in investing

activities

Purchase of property, plant

and equipment (731) (262) (778)

Development of intangible

assets (2,793) (1,195) (3,304)

Acquisition of subsidiaries,

net of cash acquired (8,764) (106,585) (107,436)

Net cash flow used in investing

activities (12,288) (108,042) (111,518)

--------------- ------------ -------------

Cash flow used in financing

activities

Dividends paid (2,337) - (2,395)

Cash generated from issue

of shares, net of share issue

costs 443 83,662 83,708

Proceeds from borrowings - 47,219 47,110

Repayment of bank loans (3,248) (14,871) (25,803)

Contingent consideration payments

in the period - (193) (193)

Cash payments for the principal (1,655) - -

portion of lease liabilities

(IFRS 16)

Net cash flow from/(used in)

in financing

activities (6,797) 115,817 102,427

--------------- ------------ -------------

Net (decrease)/increase in

cash and cash equivalents (5,858) 16,147 10,641

Cash and cash equivalents

at beginning of the year 26,794 15,662 15,662

Effects of foreign exchange

rate changes 131 253 491

------------ -------------

Cash and cash equivalents

at end of the year 8 21,067 32,062 26,794

=============== ============ =============

Notes to the consolidated financial statements for the six

months to 30 June 2019

1. General information

Learning Technologies Group plc ("the Company") and its

subsidiaries (together, "the Group") provide a range of learning

and talent software and services to corporate customers. The

principal activity of the Company is that of a holding company for

the Group, as well as performing all administrative, corporate

finance, strategic and governance functions of the Group.

The Company is a public limited company, which is listed on the

AIM Market of the London Stock Exchange and domiciled in England

and incorporated and registered in England and Wales. The address

of its registered office is 15 Fetter Lane, London, England, EC4A

1BW. The registered number of the Company is 07176993.

2. Basis of preparation

The unaudited consolidated interim financial information has

been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union (IFRSs as adopted by the

EU).

The interim results for the six months to 30 June 2019 are

neither audited nor reviewed by our auditors and the accounts in

this interim report do not therefore constitute statutory accounts

in accordance with Section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2018 have been

filed with the Registrar of Companies and the auditor's report was

unqualified, did not contain any statement under Section 498(2) or

498(3) of the Companies Act 2006 and did not contain any matters to

which the auditors drew attention without qualifying their

report.

The accounting policies used in preparing the interim results

are the same as those applied to the latest audited annual

financial statements except for the adoption of new and amended

standards as set out in Note 12.

3. Segment analysis

Geographical information

The Group's revenue from external customers and non-current

assets by geographical location are detailed below. The six months

to 30 June 2019 include the geographical location of the right of

use assets identified as a result of adoption of IFRS 16 from 1

January 2019. These are not included in the prior period

comparatives as a result of the use of the modified retrospective

approach in application (see Note 12 for detail).

United Asia

UK Europe States Pacific Canada Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months to 30

June 2019

Revenue 13,216 5,713 37,864 1,693 2,322 1,820 62,628

-------- ---------- -------- --------- -------- -------- ---------

Non-current assets 32,829 - 206,615 17,488 86 - 257,018

-------- ---------- -------- --------- -------- -------- ---------

Six months to 30

June 2018

Revenue 14,025 3,132 13,928 1,006 812 902 33,805

-------- ---------- -------- --------- -------- -------- ---------

Non-current assets 31,751 - 191,446 19,530 95 - 242,822

-------- ---------- -------- --------- -------- -------- ---------

Year to 31 December

2018

Revenue 24,859 7,263 52,912 2,253 3,766 2,838 93,891

-------- ---------- -------- --------- -------- -------- ---------

Non-current assets 28,412 - 197,969 18,735 68 - 245,184

-------- ---------- -------- --------- -------- -------- ---------

Information about reported segment revenue, profit or loss and

assets

Software & Platforms Content & Services Other

On-premise Support

Software Hosting and Platform Consulting Rental Grand

Licenses & SaaS Maintenance Total Content development and other Total Income Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months to 30 June 2019

Recurring

revenue 7,484 30,827 2,991 41,302 - 868 4,311 5,179 59 46,540

Non-recurring

revenue 796 226 404 1,426 9,111 3,239 2,312 14,662 - 16,088

----------- -------- ------------ --------- -------- ------------ ----------- --------- -------- ---------

Revenue 8,280 31,053 3,395 42,728 9,111 4,107 6,623 19,841 59 62,628

----------- -------- ------------ --------- -------- ------------ ----------- --------- -------- ---------

Depreciation

and

amortisation (2,256) (583) - (2,839)

EBIT 15,203 4,186 59 19,448

Amortisation

of acquired

intangibles (8,047) (2,130) - (10,177)

Profit before

tax 5,061 1,698 59 6,818

Additions to

intangible

Assets 12,723 - - 12,723

Total assets 257,888 61,315 - 319,203

Six months to 30 June 2018

Recurring

revenue 6,333 8,992 1,138 16,463 - 793 - 793 - 17,256

Non-recurring

revenue 441 2 298 741 11,311 2,584 1,913 15,808 - 16,549

----------- -------- ------------ --------- -------- ------------ ----------- --------- -------- ---------

Revenue 6,774 8,994 1,436 17,204 11,311 3,377 1,913 16,601 - 33,805

----------- -------- ------------ --------- -------- ------------ ----------- --------- -------- ---------

Depreciation

and

amortisation (557) (122) - (679)

EBIT 5,525 2,772 - 8,297

Amortisation

of acquired

intangibles (4,890) (855) - (5,745)

Share of

losses

of associates (69) - - (69)

Profit/(Loss)

before tax (2,136) 3,442 - 1,306

Investments

accounted for

under the

equity

method 1,619 - - 1,619

Additions to

intangible

Assets 121,285 37,395 - 158,680

Total assets 215,132 93,960 - 309,092

Year to 31 December 2018

Recurring

revenue 12,572 41,328 4,088 57,988 - 1,071 4,963 6,034 58 64,080

Non-recurring

revenue 1,166 4 676 1,846 19,262 5,765 2,938 27,965 - 29,811

----------- -------- ------------ --------- -------- ------------ ----------- --------- -------- ---------

Revenue 13,738 41,332 4,764 59,834 19,262 6,836 7,901 33,999 58 93,891

----------- -------- ------------ --------- -------- ------------ ----------- --------- -------- ---------

Depreciation

and

amortisation (1,746) (361) - (2,107)

EBIT 18,997 6,936 58 25,991

Amortisation

of acquired

intangibles (11,873) (3,320) - (15,193)

Share of

losses

of associates (132) - - (132)

Profit/(Loss)

before tax (274) 3,657 58 3,441

Additions to

intangible

Assets 162,071 3,972 - 166,043

Total assets 279,928 36,859 - 316,787

EBIT is the main measure of profit reviewed by the Chief

Operating Decision Maker.

The total assets figure for 30 June 2019 is exclusive of

deferred tax assets.

Information about major customers

In the six months to 30 June 2019 no customer accounted for more

than 10 percent of reported revenues (H1 2018: no customer

accounted for more than 10 percent of reported revenues).

4. Taxation

Taxation for the six months to 30 June 2019 has been calculated

by applying the estimated tax rate for the current financial year

ending 31 December 2019 to an estimated tax adjusted profit

figure.

5. Earnings per share

Six months Six months Year to

to to

30 June 2019 30 June 2018 31 Dec 2018

GBP'000 GBP'000 GBP'000

Profit after tax attributable

to owners of the Group: 6,757 1,349 4,171

Weighted average number of

shares:

Basic 667,503,571 609,427,992 637,325,890

Diluted 678,469,771 623,998,444 650,592,819

Basic earnings per share

(pence) 1.012 0.221 0.655

Diluted earnings per share

(pence) 0.996 0.216 0.641

Adjusted diluted earnings

per share (pence) 2.228 1.028 3.040

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has share options that are dilutive potential ordinary shares.

In order to give a better understanding of the underlying

operating performance of the Group, an adjusted earnings per share

comparative has been included. Adjusted earnings per share is

stated after adjusting the profit after tax attributable to equity

holders of the Group for certain charges as set out in the table

below.

Adjusted EBIT in the adjusted earnings per share calculation is

now inclusive, rather than exclusive, of the share based payment

charge. The prior period comparatives have also been restated on a

consistent basis, with share based payment charges included within

the adjusted EBIT figure.

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 Dec 2018

Profit Weighted Pence Profit Weighted Pence Profit Weighted Pence per

after average per after average per after average share

tax number share tax number share tax number

of of of

shares shares shares

GBP'000 '000 GBP'000 '000 GBP'000 '000

Basic earnings

per ordinary

share 6,757 667,504 1.012 1,349 609,428 0.221 4,171 637,326 0.655

--------- --------- --------- --------- --------- --------- --------- --------- ----------

Effect of

adjustments:

Amortisation of

acquired

intangibles 10,177 5,745 15,193

Acquired

intangibles

written down - - 681

Integration costs - 100 2,397

Cost of

acquisitions 270 2,628 2,621

Fair value

movement on

contingent

consideration - - (183)

Acquisition

earnout 1,055 1,504 3,761

Net foreign

exchange

differences on

financing

activities - (3,591) (3,608)

Interest

receivable (30) (9) (10)

Finance expense

on contingent

consideration - 15 54

Finance expense 235 - -

on lease

liabilities (IFRS

16)

Income tax

(credit)/expense 61 (43) (730)

--------- --------- --------- --------- --------- --------- --------- --------- ----------

Effect of

adjustments 11,768 - 1.763 6,349 - 1.042 20,176 - 3.166

--------- --------- --------- --------- --------- --------- --------- --------- ----------

Adjusted profit

before tax 18,525 - - 7,698 - - 24,347 - -

--------- --------- --------- --------- --------- --------- --------- --------- ----------

Tax impact after

adjustments (3,408) - (0.510) (1,285) - (0.211) (4,572) - (0.717)

--------- --------- --------- --------- --------- --------- --------- --------- ----------

Adjusted basic

earnings per

ordinary share 15,117 667,504 2.265 6,413 609,428 1.052 19,775 637,326 3.103

Effect of

dilutive

potential

ordinary shares:

Share options - 10,966 (0.037) - 14,061 (0.023) - 13,267 (0.063)

Deferred - - - - - - - - -

consideration

payable

(conditions met)

Deferred

consideration

payable

(contingent) - - - - 509 (0.001) - - -

Adjusted diluted

earnings per

ordinary share 15,117 678,470 2.228 6,413 623,998 1.028 19,775 650,593 3.040

6. Intangible assets

Goodwill Customer Branding Acquired Internal Total

contracts IP software

and relationships development

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2018 46,050 45,020 1,788 1,445 3,410 97,713

Additions on acquisition 79,009 43,280 1,723 33,473 - 157,485

Additions - - - - 1,195 1,195

Foreign exchange differences 1,351 1,143 39 339 52 2,924

At 30 June 2018 126,410 89,443 3,550 35,257 4,657 259,317

Additions on acquisition 1,959 1,355 - 1,940 - 5,254

Additions - - - - 2,109 2,109

Disposals/Impairment - - (1,048) - (178) (1,226)

Foreign exchange differences 3,889 1,941 75 1,235 101 7,241

---------- ------------------- --------- --------- ------------- ----------

At 31 December 2018 132,258 92,739 2,577 38,432 6,689 272,695

Additions on acquisition 6,232 1,454 - 2,244 - 9,930

Additions - - - - 2,793 2,793

Foreign exchange differences 209 (64) (2) 19 69 231

---------- ------------------- --------- --------- ------------- ----------

At 30 June 2019 138,699 94,129 2,575 40,695 9,551 285,649

Accumulated

amortisation

At 1 January 2018 - 11,813 590 464 1,437 14,304

Amortisation charged -

in period - 5,004 192 533 433 6,162

---------- ------------------- --------- --------- ------------- ----------

At 30 June 2018 - 16,817 782 997 1,870 20,466

Amortisation charged

in period - 6,952 255 2,257 674 10,138

Disposals/Impairment - - (367) - - (367)

At 31 December 2018 - 23,769 670 3,254 2,544 30,237

Amortisation charged

in period - 7,433 153 2,590 999 11,175

---------- ------------------- --------- --------- ------------- ----------

At 30 June 2019 - 31,202 823 5,844 3,543 41,412

Carrying amount

At 30 June 2018 126,410 72,626 2,768 34,260 2,787 238,851

========== =================== ========= ========= ============= ==========

At 31 December 2018 132,258 68,970 1,907 35,178 4,145 242,458

========== =================== ========= ========= ============= ==========

At 30 June 2019 138,699 62,927 1,752 34,851 6,008 244,237

========== =================== ========= ========= ============= ==========

7. Other receivables, deposits and prepayments

30 June 2019 30 June 2018 31 Dec 2018

GBP'000 GBP'000 GBP'000

Sundry receivables 1,099 1,368 1,118

Prepayments 3,118 3,967 2,779

4,217 5,335 3,897

============= ============= ============

8. Cash and cash equivalents

For the purpose of the statement of cash flows, cash and cash

equivalents comprise the following:-

30 June 2019 30 June 2018 31 Dec 2018

GBP'000 GBP'000 GBP'000

Cash and bank balances 21,067 32,062 26,794

============= ============= ============

9. Trade and other payables

30 June 2019 30 June 2018 31 Dec 2018

GBP'000 GBP'000 GBP'000

Trade payables 1,322 1,597 924

Payments received on account 54,048 52,919 56,417

Tax and social security 597 1,437 2,109

Contingent consideration - 182 8

Acquisition-related deferred

consideration and earn-outs - 1,219 3,205

Accruals and others 7,606 10,828 9,807

------------- ------------- --------------

63,573 68,182 72,470

============= ============= ==============

10. Borrowings

On the acquisition of PeopleFluent Holdings Corp. the existing

debt facility with Silicon Valley Bank was repaid and a new debt

facility with Silicon Valley Bank was entered into for a total of

$63 million. This is made up of a $42 million multicurrency term

loan and a $21 million multicurrency revolving credit facility,

both available to the Group for 5 years. The facility attracts

variable interest between 1.6% and 2.1%, based on the Group's

leverage, above LIBOR for the currency of the loan. The term loan

is repaid with quarterly instalments of $2.1 million with the

balance repayable on the expiry of the loan in April 2023.

The bank loan is secured by a fixed and floating charge over the

assets of the Group and is subject to various financial

covenants.

30 June 30 June 31 Dec

2019 2018 2018

GBP'000 GBP'000 GBP'000

Current interest-bearing

loans and borrowings 6,587 6,499 6,602

Non-current interest-bearing

loans and borrowings 28,333 41,304 31,657

------------------- ------------------- -------------------

34,920 47,803 38,259

=================== =================== ===================

11. Acquisitions

On 17 April 2019, LTG announced the acquisition of Breezy HR

('BreezyHR') for initial cash consideration of $12.7 million funded

by the Group's existing cash and bank facilities. The acquisition

supported LTG's strategic goal to achieve run-rate EBIT** of at

least GBP55 million by the end of 2021.

BreezyHR is a fast-growing talent acquisition software business,

providing small to medium sized businesses (SMB) with feature-rich,

intuitive and user-friendly recruitment software to optimise their

recruitment processes and maximise productivity. Breezy will become

a business within PeopleFluent, part of LTG's Software &

Platforms division.

The following table summarises the consideration paid for

BreezyHR, the fair value of assets acquired and liabilities assumed

at the acquisition date.

11. Acquisitions (continued)

Consideration Fair Value

GBP'000

------------------------------------------------------------------------------ ----------------------------------

Cash paid 9,726

Total consideration 9,726

------------------------------------------------------------------------------ ----------------------------------

Recognised amounts of identifiable assets acquired Fair value

and liabilities assumed GBP'000

------------------------------------------------------------------------------ ------------------------------------

Cash and cash equivalents 962

Property, plant and equipment 20

Trade and other receivables 147

Trade and other payables (572)

Net deferred tax assets/liabilities on acquisition (751)

Intangible assets identified on acquisition 3,698

Impact of IFRS 16 adjustments on acquisition (9)

Total identifiable net assets 3,495

------------------------------------------------------------------------------ ------------------------------------

Goodwill 6,231

Total 9,726

------------------------------------------------------------------------------ ----------------------------------

The total consideration and fair value adjustments to the assets

and liabilities assumed are provisional and are management's best

estimates at this time.

BreezyHR contributed GBP923,000 of revenue for the period

between the date of acquisition and the balance sheet date and

GBP114,000 of profit before tax attributable to equity holders of

the parent. As a preliminary assessment, had the acquisition of

BreezyHR been completed on the first day of the financial year

Group revenues would have been approximately GBP1,036,000 higher

and group profit before tax attributable to equity holders of the

parent would have been approximately GBP25,000 lower.

12. Changes in accounting policies

i. IFRS 16 - Leases

The Group has adopted IFRS 16 Leases from 1 January 2019.

On adoption of IFRS 16, the Group recognised lease liabilities

in relation to leases which had previously been classified as

'operating leases' under the principles of IAS 17 Leases. These

liabilities were measured at the present value of the remaining

lease payments, discounted using the lessee's incremental borrowing

rate as of 1 January 2019. The lessee's weighted average

incremental borrowing rate applied to the lease liabilities on 1

January 2019 was 3.5%.

The incremental borrowing rate used is based on the 3 month

LIBOR rates in the respective asset territories (98% US and UK)

plus a 1.6% margin included in the Group's current banking facility

as at 1 January 2019.

In applying IFRS 16 for the first time, the Group has used the

following practical expedients permitted by the standard:

i) The use of a single discount rate to a portfolio of leases

with reasonably similar characteristics

ii) Reliance on previous assessments on whether leases are onerous

iii) The accounting for operating leases with a remaining lease

term of less than 12 months as at 1 January 2019 as short-term

leases

iv) The exclusion of initial direct costs for the measurement of

the right-of-use asset at the date of initial application

v) The use of hindsight in determining the lease term where the

contract contains options to extend or terminate the lease.

A modified retrospective approach has been used meaning

comparatives have not been restated but an adjustment has been made

to opening equity. The Group has taken the accounting policy choice

to measure the right of use assets as if IFRS 16 had applied since

the inception of the lease.

The change in accounting policy affected the following items in

the balance sheet on 1 January 2019:

GBP'000

Right of use assets increase 11,847

Lease liabilities increase 14,161

Of which:

Current Liability 2,806

Non-Current Liability 11,355

The net impact on retained earnings on 1 January 2019 was a

decrease of GBP2.3 million.

ii. Share Based Payment Charge

The Share based payment charge is now included within the

Group's EBIT figure. Prior year results, including the Earnings per

share calculation have been restated to provide a consistent

comparative.

13. Events since the reporting date

No significant events noted since the reporting date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DGGDCDUBBGCU

(END) Dow Jones Newswires

September 16, 2019 02:01 ET (06:01 GMT)

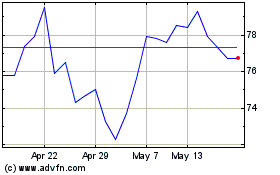

Learning Technologies (LSE:LTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Learning Technologies (LSE:LTG)

Historical Stock Chart

From Apr 2023 to Apr 2024