Kenmare Resources Q1 2018 Production Report

April 11 2018 - 2:00AM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

11 April 2018

Q1 2018 Production Report

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to provide a trading update for the quarter ending 31 March

2018.

Statement from Michael Carvill, Managing Director:

"Product shipments have started the year strongly, the markets for our

products have tightened and we have agreed higher ilmenite and zircon

prices for Q2 2018. Due to a planned 180 degree turn at WCP A and some

unforeseen stoppages, production in Q1 2018 was below our expected

average for the year. However, we are expecting higher production

volumes for the following quarters and still anticipate achieving the

mid-range of 2018 guidance."

Overview

-- Heavy Mineral Concentrate ("HMC") production decreased by 12% to 311,000

tonnes (Q1 2017: 353,500 tonnes)

-- Ilmenite production decreased by 18% to 211,000 tonnes (Q1 2017: 256,500

tonnes)

-- Zircon production decreased by 9% to 16,900 tonnes (Q1 2017: 18,500

tonnes)

-- Total shipments of finished products were up 4% to 267,200 tonnes (Q1

2017: 256,100 tonnes)

-- Ilmenite markets tightened in Q1 2018, increased spot prices agreed for

Q2 2018

-- The zircon market continued to strengthen, with further price rises

agreed from the beginning of Q2 2018

Production

Production from the Moma Mine in Q1 2018 was as follows:

Q1-2018 Q1-2017 Variance Q4-2017 Variance

tonnes tonnes % tonnes %

Excavated Ore * 7,805,600 8,407,000 -7% 8,414,300 -7%

Grade* 4.51% 4.86% -7% 4.34% 4%

Production

HMC 311,000 353,500 -12% 337,800 -8%

Ilmenite 211,000 256,500 -18% 235,900 -11%

Zircon 16,900 18,500 -9% 18,100 -7%

of which primary 11,300 12,800 -12% 10,900 4%

of which secondary 5,600 5,700 -2% 7,300 -23%

Rutile 2,100 2,200 -5% 2,500 -16%

Shipments 267,200 256,100 4% 296,300 -10%

* Excavated Ore and grade prior to any floor losses.

During Q1 2018, Kenmare mined 7.8 million tonnes of ore, down 7% on Q1

2017, at an average grade of 4.51%, producing 311,000 tonnes of HMC, a

12% decrease on Q1 2017. Finished product volumes for the period

included 211,000 tonnes of ilmenite, down 18%, and 16,900 tonnes of

zircon (including 5,600 tonnes of a lower grade secondary zircon

product), down 9%.

HMC production was impacted by lower mining capacity through the quarter

due to planned and unplanned stoppages, and lower grades mined. WCP A

experienced difficult mining conditions and executed a planned 180

degree turn in the dredge path, which slowed advancement at the mine

face. Supplementary dry mining operations at WCP A and WCP B were

subject to major relocations in the quarter, further reducing mining

capacity.

Additional supplementary dry mining capacity is being added at WCP A and

WCP B, which will help to increase mined tonnes for the rest of the

year. However, WCP A will remain in a higher slimes zone for Q2 2018.

The 20% upgrade of WCP B remains on track and on budget for

commissioning in H2 2018.

Ilmenite production decreased, principally as a result of lower HMC

production from the mine. The lower throughput allowed time for

maintenance at the Mineral Separation Plant, including a dryer shutdown

for a refractory refurbishment and automation. This will deliver higher

levels of utilisation and control, to aid ilmenite recovery going

forward.

Total zircon production includes a 12% decrease in primary zircon

production to 11,300 tonnes (Q1 2017: 12,800 tonnes), while secondary

zircon volumes declined by 2% to 5,600 tonnes (Q1 2017: 5,700 tonnes).

Zircon production was also affected by lower HMC tonnes produced and

lower utilisation as new circuits were commissioned in Q1 2018.

During Q1 2018, Kenmare shipped 267,200 tonnes of finished products, up

4% on Q1 2017, comprised of 252,700 tonnes of ilmenite, 13,500 tonnes of

zircon (including 3,200 tonnes of secondary grade zircon) and 1,000

tonnes of rutile.

Closing stock of HMC at the end of Q1 2018 was 24,200 tonnes, compared

with 16,800 tonnes at the start of the year. Closing stock of finished

products at the end of Q1 2018 was 194,200 tonnes, while all product

being held for a customer, as previously disclosed, was shipped during

Q1 2018.

Market

Kenmare saw steady demand for ilmenite products in Q1 2018 in all

regional markets, despite the seasonal slowdown in the pigment industry

over the winter months. The outlook for the pigment industry is positive

for 2018 as global GDP is expected to grow strongly.

Demand for ilmenite has increased in China, following Lunar New Year

(mid-February) and we successfully secured price increases for spot

sales in Q2 2018. The ilmenite market is expected to tighten as we enter

the northern hemisphere painting season and inventories of low quality

ilmenite and concentrates that accumulated in H2 2017 continue to be

drawn down. Supply from southern India and Vietnam continues to be

restricted. Further consolidation of ilmenite production in China is

expected in the coming months, which may have a favourable impact on

pricing.

Market conditions for zircon were favourable during the quarter due to a

combination of solid demand growth and tight global supply. Kenmare has

successfully implemented further significant price increases for its

zircon products in Q2 2018, in line with the prevailing movement of the

market.

For further information, please contact:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray

Joe Heron / Aimee Beale

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse / Chris Judd

Tel: +44 207 466 5000

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control, actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

http://www.kenmareresources.com/

(END) Dow Jones Newswires

April 11, 2018 02:00 ET (06:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

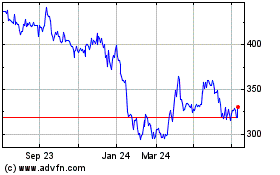

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2023 to Apr 2024