TIDMKIST

RNS Number : 0772S

Kistos PLC

12 March 2021

12 March 2021

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION CONTAINED IN IT, IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, OR THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE

OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018) ( " UK MAR " ). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN. PLEASE SEE THE IMPORTANT NOTICE WITHIN

THIS ANNOUNCEMENT.

For immediate release

Kistos plc

("Kistos", the "Company" or the "Group")

Proposed Acquisition of Tulip Oil Netherlands B.V.

Suspension of Trading on AIM

Kistos (AIM: KIST), the closed-ended investment company which

has been established with the objective of creating value for its

investors through the acquisition and management of companies or

businesses in the energy sector, is pleased to announce that it has

entered into a binding share purchase agreement, subject to

customary conditions precedent, to acquire the entire issued and

outstanding share capital of Tulip Oil Netherlands B.V. ("TON")

from Tulip Oil Holding B.V. (the "Seller" or "Tulip" or "TOH") (the

"Acquisition").

Proposed transaction

-- Kistos proposes the acquisition of TON, which, via its

wholly-owned subsidiary, Tulip Oil Netherlands Offshore B.V.

("TONO"), owns an operating interest in the Q10-A offshore gas

field and interests in other fields in the Dutch North Sea,

including the Q10-B, Q11-B and M10/M11 discoveries, and other

exploration and appraisal projects.

-- The total upfront consideration for the Acquisition, subject

to completion adjustments, is EUR 220 million. This consideration

will be satisfied through a combination of cash, the assumption by

Kistos of an existing bond instrument issued by TONO, the issue of

a new debt instrument and the issue to the Seller of equity in

Kistos. Kistos will also issue warrants over EUR 5 million of

ordinary shares at a premium of 30% to the price of any equity

placing to TOH. In addition, contingent consideration of up to EUR

163 million is payable on certain development milestones.

-- It is anticipated that the Company will carry out an equity

placing to existing and new investors in connection with the

Acquisition (the "Placing"). The Company is exploring how the

Placing can be accessed by retail shareholders. Both the Seller and

various Directors of the Company will participate in the

Placing.

-- The Company is working with debt advisors in Norway to explore the options for the new debt instrument which will be issued as part of the consideration.

-- The completion of the Acquisition is subject to, inter alia:

o certain regulatory consents and confirmations;

o finalisation of the Placing and the debt financing associated

with the Acquisition;

o the publication of an AIM admission document;

o shareholder approval of the Acquisition; and

o Admission of the enlarged share capital of Kistos to trading

on AIM.

-- Upon completion of the Acquisition, the Company expects to

cease to be an investing company under the AIM Rules for Companies

and instead become a trading company. The Group will continue to

review acquisition opportunities as they arise.

Andrew Austin, Chairman of Kistos, commented:

"We are very excited to be beginning the next phase of Kistos'

journey with the acquisition of these profitable and cash

generative assets, which have probably the lowest carbon footprint

of any production assets in the North Sea. To be producing gas, a

vital transition fuel, from normally unmanned platforms powered by

solar and wind is exactly what we set out to do. In addition, we

see potential for significantly increased production from

discovered hydrocarbons within the licences being acquired by

Kistos.

"The team at Tulip have done a fantastic job to date in getting

this low carbon production operation up and running and we are

looking forward to working with them and our partners at EBN in

replicating this success and being a model for future low impact

developments. "

Information on TON

-- The Acquisition comprises a controlling (60%) interest in the

Q10-A offshore gas field together with

interests in a suite of offshore exploration and production

licences in the Dutch North Sea.

-- The Q10-A field has 2P reserves of 19.5 mmboe [1] and

generated total net production of 5.47 mboe/d in 2020.

-- Q10-A is reliant on solar and wind power. Its carbon

emissions from production operations were <10g C0(2) e/boe(1) in

2020 and 17g C0(2) e/boe(1) in 2019. These are significantly below

the North Sea average of 21 kg C0(2) /boe [2] . The Acquisition is

consequently in line with the Company's strategy to acquire assets

with a role in the energy transition.

-- Plans for the future developments of the assets being

acquired by Kistos utilise wind and solar power, which will make

Kistos one of the lowest CO(2) /boe emitters of Scope 1 emissions

from upstream operations in North West Europe.

-- The group to be acquired recorded aggregated EBITDA(1) of EUR

30.60 million in the year to 31 December 2020 (2019: EUR 36.27

million) and profit before tax in the same period of EUR 16.27

million (2019: EUR 38.66 million).

-- The realised gas price in the year to 31 December 2020 was

EUR 11.58/mWh (2019: EUR 12.55/mWh). The realised prices and

forward curve imply an average 2021 gas price of EUR 18.30/mWh.

The Q10-B, Q11-B and M10a/M11 discoveries potentially have in

total 78.5 mmboe(1) of 2C resources, each with development plans

prepared, and provide material growth opportunities for Kistos

going forward. In addition to the contingent resource, TON holds

various exploration prospects and appraisal projects that provide

optionality and upside to investors across the portfolio.

Assets to be acquired

Licence Type Licence interest Operator

Q07/Q10-A Production 60% TONO

------------ ----------------- ---------

Q8, Q10-B, Q11 Exploration 60% TONO

------------ ----------------- ---------

M10a/M11 Exploration 60% TON

------------ ----------------- ---------

Donkerbroek (main) Production 60% TON

------------ ----------------- ---------

Donkerborek (West) Production 60% TON

------------ ----------------- ---------

Akkrum 11 Production 60% TON

------------ ----------------- ---------

Temporary suspension of trading

The Acquisition constitutes a reverse takeover in accordance

with Rule 14 of the AIM Rules for Companies. A further announcement

with full details of the Acquisition will be issued at the

appropriate time and an AIM admission document setting out, inter

alia, details of the Acquisition (including a competent person's

report on the material assets and liabilities of TON) will

published and sent to Kistos' shareholders with a notice of general

meeting. Accordingly, at the request of the Company, the Company's

ordinary shares will be suspended from trading on AIM with effect

from 7:30 a.m. today and will remain so until either the

publication of an AIM admission document or until confirmation is

given that the Acquisition is not proceeding.

The Company will release further announcements as and when

appropriate.

For the purposes of UK MAR, the person responsible for arranging

for the release of this announcement on behalf of Kistos is Andrew

Austin, Executive Chairman.

S

Enquiries:

Kistos plc

Andrew Austin c/o Camarco Tel: 0203 757

4983

Panmure Gordon

Nick Lovering / Atholl Tweedie / Tel: 0207 886 2500

Ailsa Macmaster

Camarco

Billy Clegg / James Crothers Tel: 0203 757 4983

IMPORTANT INFORMATION

This announcement does not constitute, or form part of, any

offer or invitation to sell or issue, or any solicitation of any

offer to purchase or subscribe for any securities in the United

States, Canada, Australia, Japan or the Republic of South Africa or

in any other jurisdiction in which such offer or solicitation is

unlawful, prior to registration, exemption from registration or

qualification under the securities laws of any jurisdiction. The

distribution of this announcement and other information in

connection with the placing and admission in certain jurisdictions

may be restricted by law and persons into whose possession this

announcement, any document or other information referred to herein

comes should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction. Neither this announcement nor any part of it nor the

fact of its distribution shall form the basis of or be relied on in

connection with or act as an inducement to enter into any contract

or commitment whatsoever.

Panmure Gordon (UK) Limited (" Panmure Gordon "), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting exclusively for the Company as

Nominated Adviser and Broker in connection with the placing and

admission, and will not be responsible to any other person for

providing the protections afforded to customers of Panmure Gordon

or advising any other person in connection with the placing and

admission. Panmure Gordon's responsibilities as the Company's

Nominated Adviser under the AIM Rules for Companies and the AIM

Rules for Nominated Advisers will be owed solely to the London

Stock Exchange and not to the Company, the directors or to any

other person in respect of such person's decision to subscribe for

or acquire ordinary shares. Apart from the responsibilities and

liabilities, if any, which may be imposed on Panmure Gordon by the

Financial Services and Markets Act 2000, as amended or the

regulatory regime established under it, Panmure Gordon does not

accept any responsibility whatsoever for the contents of this

announcement, and no representation or warranty, express or

implied, is made by Panmure Gordon with respect to the accuracy or

completeness of this announcement or any part of it and no

responsibility or liability whatsoever is accepted by Panmure

Gordon for the accuracy of any information or opinions contained in

this announcement or for the omission of any material information

from this announcement.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this announcement are based on

certain factors and assumptions, including the directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by applicable law or regulation, the Company undertakes no

obligation to release publicly the results of any revisions to any

forward-looking statements in this announcement that may occur due

to any change in the directors' expectations or to reflect events

or circumstances after the date of this announcement.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

[1] Source: Tulip Oil Holdings B.V.

[2] Source: OGA, 2018 Carbon Emissions Intensity

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQJTMFTMTIBMFB

(END) Dow Jones Newswires

March 12, 2021 02:00 ET (07:00 GMT)

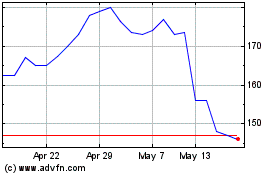

Kistos (LSE:KIST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kistos (LSE:KIST)

Historical Stock Chart

From Apr 2023 to Apr 2024