Infrastructure India plc Loan Extensions (4344M)

January 08 2019 - 2:00AM

UK Regulatory

TIDMIIP TIDMTTM

RNS Number : 4344M

Infrastructure India plc

08 January 2019

8 January 2019

Infrastructure India plc

("IIP", the "Company" and together with its subsidiaries the

"Group")

Loan Extensions

Infrastructure India plc, an AIM quoted infrastructure fund

investing directly into assets in India, announces that it has

agreed the extensions to the maturity of: (i) an existing US$48.4

million unsecured bridging loan facility (the "Bridging Loan")

originally provided to the Company in June 2017 by Cedar Valley

Financial ("Cedar Valley"); and (ii) an existing US$21.5 million

working capital loan (the "Working Capital Loan") originally

provided to the Company in April 2013 by GGIC, Ltd ("GGIC").

IIP announced on 31 July 2018, that it had entered into

conditional proposed financing agreements for up to US$125 million

with PSA International, a global port group, and Gateway Partners

(the "Proposed Financing"). The transaction includes the issue of

convertible preference shares in Distribution Logistics

Infrastructure India, Distribution Logistics Infrastructure

Limited's ("DLI") parent company, for a consideration of US$75

million and the sale of 24% of DLI by the Group for a consideration

of US$50 million (the "Proposed Financing").

Following IIP shareholder approval of the Proposed Financing at

an extraordinary general meeting on 24 August 2018, the parties

continue to progress towards completion of that transaction, with

several conditions precedent to the closing having been met and the

remainder, including key governmental approvals, expected to be met

in the coming weeks.

Ahead of completion of the Proposed Financing, IIP has agreed an

extension to the maturity date of the Bridging Loan (the "Bridging

Loan Extension") and an extension to the maturity date of the

Working Capital Loan (the "Working Capital Loan Extension") to 21

January 2019.

The Company remains in discussions with Cedar Valley and GGIC in

relation to the possible partial repayment of the Bridging Loan

and/or the Working Capital Loan following the completion of the

Proposed Financing and with a view to further extending the

maturity of both the Bridging Loan and the Working Capital

Loan.

As a result of the continued delays in completion of the

Proposed Financing and IIP's current inability to commit additional

funding to DLI (IIP's unaudited cash balances as at 31 December

2018 were approximately GBP0.25m), DLI has recently entered into

short term borrowing facilities in India and, in part, has begun to

divert cash from operations in order to service DLI debt

facilities. This latter action could affect DLI's operational

performance in the short term.

Bridging Loan Extension

The Bridging Loan was originally provided to the Company in June

2017 by Cedar Valley in an amount of US$8.0 million and was

subsequently increased in multiple tranches, most recently to

US$48.4 million in October 2018.

The Bridging Loan currently carries an interest rate of 12.0%

per annum on its fully drawn US$48.4 million principal and had been

due for repayment by the Company on the earlier of: (i) 15 days

following the completion of the Proposed Financing; or (ii) 7

January 2019.

Pursuant to the Bridging Loan Extension, the Company and Cedar

Valley have agreed to extend the maturity of the Bridging Loan such

that the Bridging Loan will now mature on the earlier of: (i) 15

days following the completion of the Proposed Financing; or (ii) 21

January 2019. The other terms of the Bridging Loan remain

unchanged.

Working Capital Loan Extension

The Working Capital Loan was originally provided to the Company

in April 2013 by GGIC in an amount of US$17 million in April 2013

and increased to US$21.5 million in September 2017.

The Working Capital Loan currently carries an interest rate of

7.5% per annum on its fully drawn down US$21.5 million principal

and had been due for repayment by the Company on 7 January

2019.

Pursuant to the Working Capital Loan Extension, the Company and

GGIC have agreed to extend the maturity of the Working Capital Loan

such that the Working Capital Loan will now mature on 21 January

2019. The other terms of the Working Capital Loan remain

unchanged.

There are no arrangement or commitment fees payable by IIP in

connection with the Bridging Loan Extension or the Working Capital

Loan Extension.

Related Party Transactions

GGIC is, directly and indirectly, interested in 75.4% of the

Company's issued share capital and Cedar Valley is an affiliate of

GGIC. Under the AIM Rules for Companies ("AIM Rules") GGIC and

Cedar Valley are, therefore, deemed to be a related parties of the

Company and the Bridging Loan Extension and the Working Capital

Loan Extension are related party transactions pursuant to Rule 13

of the AIM Rules. The independent directors of IIP, M.S.

Ramachandran and Timothy Walker, consider, having consulted with

Cenkos Securities plc in its capacity as the Company's nominated

adviser, that the terms of the Bridging Loan Extension and the

Working Capital Loan Extension are fair and reasonable insofar as

the shareholders of IIP are concerned.

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

Enquiries:

Infrastructure India plc www.iiplc.com

Sonny Lulla

Cenkos Securities plc

Nominated Adviser & Joint Broker

Azhic Basirov / Ben Jeynes +44 (0) 20 7397 8900

Nplus1 Singer Advisory LLP

Joint Broker

James Maxwell - Corporate Finance

James Waterlow - Investment Fund Sales +44 (0) 20 7496 3000

Novella +44 (0) 20 3151 7008

Financial PR

Tim Robertson / Toby Andrews

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBDLLBKFFBBBL

(END) Dow Jones Newswires

January 08, 2019 02:00 ET (07:00 GMT)

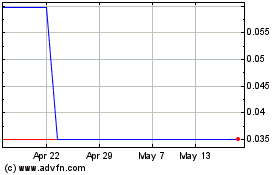

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

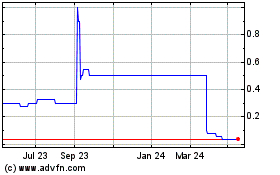

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Apr 2023 to Apr 2024