TIDMGABI

RNS Number : 7683U

GCP Asset Backed Income Fund Ltd

20 January 2017

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, TO US PERSONS OR IN OR INTO

AUSTRALIA, CANADA, JAPAN OR THE UNITED STATES OF AMERICA OR ANY

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

This announcement is an advertisement and does not constitute a

prospectus or offering memorandum or an offer in respect of any

securities. Neither the issue of this announcement nor any part of

its contents constitutes an offer to sell or invitation to purchase

any securities of the Company. Investors should not subscribe for

or purchase any transferable securities referred to in this

announcement except on the basis of information in the Prospectus

published by the Company today in connection with the proposed

admission of C shares of no par value to trading on the main market

for listed securities of the London Stock Exchange and to listing

on the premium segment of the Official List of the UK Listing

Authority.

20 January 2017

GCP Asset Backed Income Fund Limited (the "Company" or "GCP

Asset Backed Income")

C Share Issue and publication of prospectus

Further to the announcement by the Company on 5 January 2017,

the Directors of GCP Asset Backed Income, which invests in asset

backed loans, are pleased to announce that the Company has today

published a prospectus ("Prospectus") setting out details of a

fully pre-emptive offer of C Shares targeting Gross Proceeds of

GBP100 million in February 2017.

The Issue will be by way of an Open Offer, Placing and Offer for

Subscription. To ensure that any demand from Shareholders on the

Company's register as at the Record Date (being 18 January 2017)

takes priority, the Issue will include a pre-emptive offering

through the Open Offer on the basis of one C Share for each

Ordinary Share held by Shareholders as at that date.

The net proceeds of the Issue will be used to take advantage of

attractive investment opportunities. The Investment Manager has

identified a pipeline of c. GBP168million of investments in respect

of which it is in discussion with the relevant borrowers.

Terms used and not defined in this announcement shall have the

meaning given to them in the Prospectus.

A copy of the Prospectus has today been posted to Shareholders

and submitted to the National Storage Mechanism, and will shortly

be available for inspection at www.morningstar.co.uk/uk/NSM and on

the Company's website at

www.gcpuk.com/gcp-asset-backed-income-fund-ltd.

Copies of the Prospectus will also be available from the

Company's registered office and the offices of Gowling WLG (UK)

LLP, 4 More London Riverside, London SE1 2AU during normal business

hours.

Expected timetable

2017

18 January Record Date for entitlements under the Open Offer (5pm)

23 January Ex-entitlement date for the Open Offer (8am)

3 February Latest date to deposit Basic Entitlements and Excess

CREST Open Offer entitlements into CREST (3pm)

8 February Latest date for receipt of completed Open Offer

Application Forms and payment in full under the Open Offer or

settlement of relevant CREST instructions (as appropriate)

(11am)*

9 February Placing (3pm) and Offer for Subscription (1pm) close*

10 February Publication of results of the Issue

14 February Admission and dealings in the C Shares commence

* The Directors may, with the prior approval of Cenkos alter

such date and thereby shorten or lengthen the Placing, Open Offer

and/or Offer for Subscription period, to a date or dates no later

than 31 March 2017.

The above times and/or dates may be subject to change and, in

the event of such change, the revised times and/or dates will be

notified to Shareholders by an announcement through a Regulatory

Information Service. All references to times in this document are

to London time unless otherwise stated.

For further information, please contact:

Gravis Capital Partners +44 (0)20

LLP 7518 1490

David Conlon david.conlon@gcpuk.com

Philip Kent philip.kent@gcpuk.com

Dion Di Miceli dion.dimiceli@gcpuk.com

Cenkos Securities +44 (0)20

plc 7397 8900

Tom Scrivens tscrivens@cenkos.com

Oliver Packard opackard@cenkos.com

Sapna Shah sshah@cenkos.com

+44 (0)20

Buchanan 7466 5000

Charles Ryland charlesr@buchanan.uk.com

Vicky Watkins victoriaw@buchanan.uk.com

Notes to Editors

The Company

GCP Asset Backed Income is a closed ended investment company

traded on the London Stock Exchange's main market for listed

securities. Its investment objective is to generate attractive

risk-adjusted returns primarily through regular, growing

distributions and modest capital appreciation over the long

term.

The Company seeks to meet its investment objective through a

diversified portfolio of investments secured against contracted,

predictable medium to long term cash flows and/or physical assets

which are predominantly UK based.

Additional information

The distribution of this announcement and the Issue in certain

jurisdictions may be restricted by law. Other than in the United

Kingdom, no action has been taken by the Company or Cenkos that

would permit an offering of the C Shares or possession or

distribution of this announcement or any other offering or

publicity material relating to such shares in any jurisdiction

where action for that purpose is required.

Persons into whose possession this announcement comes are

required by the Company and Cenkos to inform themselves about, and

to observe, such restrictions.

The C Shares are being offered and issued outside the United

States in reliance on Regulation S promulgated under the U.S.

Securities Act of 1933, as amended (the "U.S. Securities Act"). The

C Shares have not been nor will be registered under the U.S.

Securities Act or with any securities regulatory authority of any

state or other jurisdiction of the United States and may not be

offered or sold within the United States except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the U.S. Securities Act and in

compliance with any applicable securities law of any state or other

jurisdiction in the United States. In addition, the Company has not

registered and will not register under the U.S. Investment Company

Act of 1940, as amended. The C Shares have not been approved or

disapproved by the U.S. Securities and Exchange Commission, any

state securities commission in the United States or any other U.S.

regulatory authority, nor have any of the foregoing authorities

passed upon or endorsed the merits of the offering or the issue of

the C Shares or the accuracy or adequacy of the Prospectus. Any

representation to the contrary is a criminal offence in the United

States and the re-offer or resale of any of the C Shares in the

United States may constitute a violation of U.S. law.

Recipients of this announcement are reminded that applications

for C Shares may be made solely on the basis of the information and

opinions contained in the Prospectus. No representation or

warranty, express or implied, is made or given by or on behalf of

the Company, Cenkos or the Investment Manager or any of their

respective directors, partners, officers, employees, agents or

advisers or any other person (whether or not referred to in this

announcement) as to the accuracy, completeness or fairness of the

information contained herein and no responsibility or liability is

accepted by any of them for any such information or opinions.

No offer or invitation to subscribe for or acquire shares in the

Company is being made by or in connection with this

announcement.

Cenkos, which is authorised and regulated in the United Kingdom

by the Financial Conduct Authority, is acting as sponsor, sole

placing agent and financial adviser to the Company and is acting

for no-one else in connection with the Issue, Admission and the

contents of this announcement and will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of Cenkos nor for providing advice in connection with the

Issue, Admission and the contents of this announcement or any other

matter referred to herein.

This information is provided by RNS

The company news service from the London Stock Exchange

END

PDISEFFMSFWSESF

(END) Dow Jones Newswires

January 20, 2017 11:05 ET (16:05 GMT)

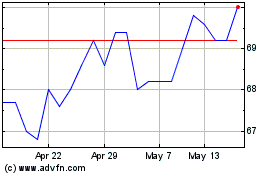

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Apr 2023 to Apr 2024