FirstGroup PLC Sale completion and increase in proposed return of value

July 22 2021 - 2:00AM

UK Regulatory

TIDMFGP

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Thursday 22 July 2021

FirstGroup plc

Sale completion and increase in proposed return of value

* Sale of First Student and First Transit to EQT Infrastructure completed

yesterday evening

* Proposed return of value in autumn increased to £500m (c.41p per share)

from £365m

* Estimated pro forma net debt of c.£100m following the Sale and the use of

proceeds is unchanged, as the increase in proposed return of value

reflects:

+ $58m increase in cash proceeds received at completion due to final

working capital and debt and debt-like balances

+ Increased clarity for First Rail resulting from agreement of SWR and

TPE National Rail Contracts and final rail franchise termination sums

+ Cashflows of the continuing Group anticipated to be better than was

assumed in April

FirstGroup plc ('FirstGroup' or the 'Group') is pleased to announce that it has

completed the sale of First Student and First Transit to EQT Infrastructure

(the 'Sale'), which was approved by FirstGroup shareholders on 27 May 2021.

Completion follows the satisfaction of the conditions precedent to the Sale, as

outlined in the circular to FirstGroup shareholders published on 10 May 2021.

The net disposal proceeds of $3,123m received by FirstGroup at completion is an

increase of $58m over the base amount previously announced, due to the final

adjustments for working capital and debt and debt-like items as described in

the circular.

The Board intends to increase the proposed return of value to shareholders to £

500m (equivalent to c.41p per share) from £365m. The increased quantum reflects

the higher cash proceeds received from the Sale, the increased clarity for

First Rail resulting from agreement in May 2021 of SWR and TPE National Rail

Contracts and the TPE final rail franchise termination sum being c.£50m lower

than anticipated, and improving cash flow expectations for the continuing Group

as a result of further easing of pandemic restrictions in our core UK bus and

rail markets. The estimated pro forma net debt of c.£100m for the ongoing Group

following the Sale, and the other uses of net disposal proceeds set out in the

circular, are therefore unchanged. The proposed return of value is expected to

be undertaken in the autumn of 2021, with the distribution mechanism to be

announced in due course in consultation with shareholders.

In addition to the cash consideration received at completion of the Sale, the

First Transit earnout worth up to $240m was also agreed as part of the Sale

consideration, under which the Group will receive 62.5% of First Transit's

value above $380m, either in three years (following an independent valuation)

or sooner in the event that it is sold by EQT Infrastructure to a third party.

The Board is committed to keeping the balance sheet position of the ongoing

Group under review and will consider the prospects for making further

additional distributions to shareholders in due course, following

crystallisation of the First Transit earnout noted above, resolution of the

legacy liabilities related to Greyhound and the potential release of monies

from pension escrow (up to £117m). The Board also notes the capacity to

increase gearing over time, as end market conditions and hence business

performance improves.

First Student and First Transit will be reported as discontinued operations in

the Group's annual results to the end of March 2021, which will be announced on

27 July.

Commenting, FirstGroup Chairman David Martin said:

"We are pleased to announce the completion of the sale of First Student and

First Transit and a significant increase in the proposed return of value to

shareholders this autumn. This delivers on our strategic objective and creates

a focused and stronger business with a bright future. The vital role of public

transport in the UK has never been clearer, and with the most supportive policy

backdrop in decades coupled with our strong credentials, FirstGroup is in prime

position to deliver on its goals with a well-capitalised balance sheet and an

operating model that will support attractive dividends."

Commenting, FirstGroup Chief Executive Matthew Gregory said:

"We have delivered this transformational sale which resolves the Group's

long-standing legacy liabilities, puts the Group in a strong position to

benefit from its many opportunities, and releases £500m of value to return to

shareholders. I would like to thank everyone in First Student and First Transit

for the pivotal role they play in their communities. As part of the FirstGroup

family for many years, they have gone from strength to strength, and I am

confident that they will continue to flourish as part of EQT Infrastructure."

Contacts at FirstGroup: Contacts at Brunswick PR:

Faisal Tabbah, Head of Investor Andrew Porter / Simone Selzer

Relations Tel: +44 (0) 20 7404 5959

Stuart Butchers, Group Head of

Communications

corporate.comms@firstgroup.com

Tel: +44 (0) 20 7725 3354

Notes

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 2.2. This announcement contains inside information. The person

responsible for arranging the release of this announcement on behalf of

FirstGroup is David Isenegger, Group General Counsel and Company Secretary.

END

(END) Dow Jones Newswires

July 22, 2021 02:00 ET (06:00 GMT)

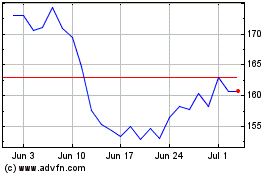

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

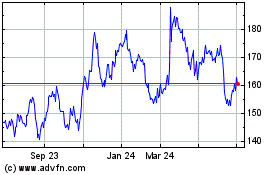

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024