TIDMGSS

RNS Number : 3508X

Genesis Emerging Markets Fund Ld

20 February 2017

GENESIS EMERGING MARKETS FUND LIMITED

(The 'Company'; the 'Fund')

Registered in Guernsey

(Registration Number: 20790)

STOCK EXCHANGE ANNOUNCEMENT

HALF YEAR REPORT

The Directors of Genesis Emerging Markets Fund Limited announce

the Fund's results for the six months ended 31(st) December 2016.

The Half Year Report will shortly be available from the Manager's

website www.giml.co.uk and also for inspection on the National

Storage Mechanism, which is located at www.morningstar.co.uk/uk/NSM

where users can access the regulated information provided by listed

entities.

INVESTMENT APPROACH

The investment approach is to identify companies which are able

to take advantage of growth opportunities in emerging markets and

invest in them when they are trading at an attractive discount to

the Manager's assessment of their intrinsic value.

NEW SHARES

Shares may be issued twice monthly subject to the following

conditions:

i) the Fund is invested as to at least 75% in emerging market securities;

ii) the Fund will only issue new shares if it is unable, on

behalf of the new subscriber, to acquire shares in the secondary

market at a price equivalent to or below the price at which new

shares would be issued; and

iii) the issued share capital of the Fund is not increased by

more than 10% in any twelve month period.

RESULTS

31(st) 30(th)

December June

2016 2016 % change

--------------------------------- --------- --------- --------

Published net asset value* GBP921.0m GBP838.7m 9.8

Published net asset value* $1,138.2m $1,121.3m 1.5

Published net asset value per

Participating Preference Share* GBP6.82 GBP6.21 9.8

Published net asset value per

Participating Preference Share* $8.43 $8.31 1.5

Share price GBP6.03 GBP5.40 11.6

* Figures are based on the last traded price for investments.

CHAIRMAN'S STATEMENT

Recent periods have generally presented a challenging

environment to investors in emerging markets, but 2016 as a whole

has provided some respite with the MSCI EM (TR) Index (the "Index")

rising 11.6% in US dollar terms over the calendar year. This

headline figure, however, hides significant underlying volatility:

in the six-month period under review in this report, markets rose

substantially during the summer before falling towards the end of

the year in the wake of the US presidential election. Over the six

months to December the Index gained 4.7%.

The steady weakening of sterling against the US dollar following

the UK's EU referendum in June has enhanced returns for UK-based

investors: in sterling terms the Index was up 13.3% over the

six-month period (and up 33.1% over 2016 as a whole).

Against this backdrop, the Fund's NAV per share increased from

GBP6.21 to GBP6.82 over the half year, representing a return of

9.8%. (The Fund's share price rose by 11.6%; the associated

narrowing of the discount meant it ended 2016 at 11.7%). The Fund's

underperformance relative to the Index during the period largely

related to the portfolio's Indian holdings; this and other reasons

- as well as comments on the current environment and investment

outlook for emerging markets - are covered in more detail in the

Manager's Report that follows this Statement.

The Fund held its Annual General Meeting on 8th November; as

ever, we appreciate shareholders' support and thank them for their

approval of all proposals presented at the Meeting. The Fund's

subsequent Shareholder Information Meeting on 10th November

provided shareholders an opportunity to hear from, and ask

questions of, representatives of the Manager. My fellow Directors

and I continue to make every effort to engage with shareholders in

order to hear your comments and understand any concerns you may

have, and ultimately ensure the Fund meets your expectations and

requirements as investors.

Returning to the investment outlook, a number of challenges

remain in place. Looking over the remainder of the financial year,

the pronouncements and actions of the new US government with

respect to international trade and commerce could impact near-term

sentiment towards many emerging markets. And over the longer term,

investors should remain aware of the reality that developing

countries are now in a period of lower growth compared with much of

their recent history.

That said, the Manager's Report below notes some optimistic

signs in the medium-to long-term, and these remain underpinned by

the continued fundamental attractions of investing in emerging

market equities. The Fund is active in markets where levels of

household income are steadily converging with those in developed

countries and where the quality of local institutions continues to

improve - but also where significant pricing inefficiencies can

still be discovered.

In practice, as we have noted on previous occasions, we believe

the employment of an appropriate investment approach is the key to

success: in particular, in a slower-growth and lower-return

environment, higher-quality companies should have more scope to

differentiate themselves and outperform their peers. The ability to

identify these company-specific opportunities therefore remains

crucial, and we believe the Manager's investment team and process

provide an effective framework to seek out these mispriced

businesses in emerging markets; and thus allocate shareholders'

capital profitably.

Hélène Ploix

Chairman

February 2017

DIRECTORS' REPORT

CAPITAL VALUES

At 31(st) December 2016, the value of Equity Shareholders' Funds

was $1,138,160,000 (30th June 2016: $1,121,318,000) and the Equity

per Participating Preference Share was $8.43 (30(th) June 2016:

$8.31), or in sterling terms, GBP6.82 (30th June 2016:

GBP6.21).

PRINCIPAL RISKS AND UNCERTAINTIES

The main risks to the value of its assets arising from the

Fund's investment in financial instruments (principally equity

securities) are unanticipated adverse changes in market prices and

foreign currency exchange rates and an absence of liquidity. The

Board reviews and agrees with the Manager policies for managing

each of these risks and they are summarised below. These policies

have remained unchanged since the beginning of the period to which

these financial statements relate.

Volatility of emerging markets and market risk

The economies, the currencies and the financial markets of a

number of developing countries in which the Fund invests may be

extremely volatile. To manage the risks posed by adverse price

fluctuations the Fund's investments are geographically diversified,

and will continue to be so. The Fund will not normally invest more

than 25% of its assets (at the time the investment is made) in any

one country. While exposure to any one company or group (other than

an investment company, unit trust or mutual fund) is formally

limited to 10% of the Fund's net assets, this exposure is unlikely

to exceed 5% at the time the investment is made.

Foreign currency exposure

The Fund's assets will be invested in securities of companies in

various countries and income will be received by the Fund in a

variety of currencies. However, the Fund will compute its net asset

value in US dollars. The value of the assets of the Fund as

measured in US dollars may be affected favorably or unfavorably by

fluctuations in currency rates and exchange control regulations.

Further, the Fund may incur costs in connection with conversions

between various currencies.

Lack of liquidity

Trading volumes on the stock exchanges of developing countries

can be substantially less than in the leading stock markets of the

developed world. This lower level of liquidity exaggerates the

fluctuations in the value of investments described previously. The

restrictions on concentration and the diversification requirements

detailed above also serve normally to protect the overall value of

the Fund from the risks created by the lower level of liquidity in

the markets in which the Fund operates.

Custody risk

The Fund's key operational risk is custody risk. Custody risk is

the risk of loss of securities held in custody occasioned by the

insolvency or negligence of the custodian. Although an appropriate

legal framework is in place that eliminates the risk of loss of

value of the securities held by the custodian, in the event of its

failure, the ability of the Fund to transfer the securities might

be temporarily impaired. The day to day management of these risks

is carried out by the Manager under policies approved by the

Board.

Manager

In the opinion of the Directors, in order to achieve the

investment objective of the Fund, and having taken into

consideration the performance of the Fund, the continuing

appointment of the Manager is in the interests of the shareholders

as a whole.

A more detailed commentary of important events that have

occurred during the period and their impact on these financial

statements and a description of the principal risks and

uncertainties for the remaining six months of the financial year

are contained in the Manager's Review.

Directors

The following directors served throughout the period under

review (except where noted otherwise): Hélène Ploix, Sujit Banerji,

Russell Edey, Michael Hamson, Saffet Karpat and Dr John Llewellyn.

Michael Hamson did not offer himself for re-election and

accordingly resigned from the Board at the Annual General Meeting

in November 2016.

As at 31(st) December 2016, Participating Preference Shares were

held by Sujit Banerji (10,000), Saffet Karpat (20,000) and Hélène

Ploix (15,000).

Related Party Transactions

During the reporting period, there were no transactions with

related parties which materially affected the financial position or

performance of the Fund. However, details of related party

transactions are contained in the Annual Financial Report for the

year ended 30(th) June 2016 which should be read in conjunction

with this Half Year Report.

Going Concern

The Directors believe that the Fund has adequate resources to

continue in operational existence for twelve months from the

approval date of the Half Year Report. This is based on various

factors including the Fund's forecast expenditure, its ability to

meet its current liabilities, the highly liquid nature of its

assets, its market price volatility and its closed-ended legal

structure. For these reasons, the Directors continue to adopt the

going concern basis in preparing these Financial Statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

In accordance with Chapter 4 of the Disclosure and Transparency

Rules the Directors confirm that to the best of their

knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' and gives a

true and fair view of the assets, liabilities, financial position

and return of the Fund;

-- the Half Year Report includes a fair review of important

events that have occurred during the first six months of the

financial year, their impact on the condensed financial statements,

and a description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- the Half Year Report includes a fair review of the

information concerning related party transactions.

Approved by the Board

Hélène Ploix Russell Edey

Director Director

February 2017

MANAGER'S REVIEW

INVESTMENT ENVIRONMENT

After three weak years, it is pleasing to report stronger

performance in 2016 resulting from a recovery in several areas that

had suffered previously: sectors including energy and materials and

countries such as Brazil and Russia. We suspect that two main

factors - a surprising re-acceleration in Chinese credit growth and

fewer-than-anticipated US interest rate increases - underlie this

performance. The sterling based returns of the Fund also benefitted

from the continued weakening of the pound following the UK's EU

referendum in June 2016. Despite markedly different underlying

constituents the Fund's net asset value performed in line with the

MSCI Emerging Markets (TR) Index over the 12 month period, gaining

32.7% in sterling terms. However, over the half year the Fund's NAV

failed to match that of the Index, gaining 9.8% versus an Index

return of 13.3%.

PERFORMANCE

From a country perspective, holdings in Russia added the most

value on a relative basis, largely due to the Fund's overweight

position. Energy company Novatek (up 39%) and diamond miner Alrosa

(up 64%) benefitted from both an appreciation of the ruble and a

recovery in commodity prices. Elsewhere stock selection in South

Korea added substantial value, with Shinhan Financial rising 26%.

These gains were more than offset by the Fund's overweight position

in India. Generic drug manufacturers Sun and Lupin struggled

through both delayed product launches following increased scrutiny

by the US Food and Drug Administration and increasing competition.

The Fund's overweight position in Turkey and underweight position

in Brazil also had a negative impact on the portfolio. In the

latter the prices of certain highly-indebted commodity-producing

businesses that are heavily weighted in the Index - but are not

owned in the portfolio - substantially increased, including

national oil company Petrobras (up 63%) and miner Vale (up

82%).

From a sector perspective, value was added through stock

selection in industrials, materials and consumer companies, where

the Russian retailer Magnit rose 41% and Chinese instant noodle

firm Tingyi gained 40%. These gains were partially offset by stock

selection in the banking sector where Axis Bank (India) fell by

8%.

Looking at individual stocks, contributors were dominated by

Novatek, Alrosa and Anglo American (up 60%), with the latter

continuing to recover following a difficult period in 2015. On the

negative side, Caribbean telecoms company LiLAC (down 28%)

struggled to find a natural investor base following its spin-off

from Liberty Global. Looking ahead, we think the Fund's holding in

LiLAC is an undervalued investment in a competitively-advantaged

telecom business with both revenue growth and cost efficiency

opportunities.

RELATIVE PERFORMANCE ATTRIBUTION IN GBP -

SIX MONTHS TO 31(st) DECEMBER 2016

GEMF vs. MSCI Emerging Markets (TR) Index

Top 10 Stock Contributors % Top 10 Stock Detractors %

-------------------------- ---- ------------------------------ ------

Novatek (Russia) 0.46 LiLAC (United Kingdom) (0.67)

Alrosa (Russia) 0.45 Universal Robina (Philippines) (0.48)

Anglo American (South Sun Pharmaceutical

Africa) 0.39 (India) (0.45)

Sberbank (Russia) 0.37 Axis Bank (India) (0.36)

First Quantum Minerals Pidilite Industries

(Zambia) 0.33 (India) (0.34)

Magnit (Russia) 0.31 Heineken (Netherlands) (0.31)

Tingyi (China) 0.21 Garanti Bank (Turkey) (0.30)

Bidvest (South Africa) 0.20 Petrobras (Brazil) (0.29)

CP All (Thailand) 0.16 Thai Beverage (Thailand) (0.25)

Richemont (Switzerland) 0.16 Vale (Brazil) (0.25)

-------------------------- ---- ------------------------------ ------

Stocks in italics are omissions at end of period

Top 5 Country Top 5 Country

Sector % Contributors % Detractors %

----------------------- ------ ------------- ---- ------------- ------

Industrials 0.68 Russia 1.11 India (1.78)

Consumer Discretionary 0.60 South Korea 0.61 Turkey (0.61)

Materials 0.33 Malaysia 0.40 Brazil (0.59)

Utilities 0.29 Zambia 0.33 Thailand (0.43)

Consumer Staples 0.20 Mexico 0.18 Taiwan (0.40)

Telecoms (0.13)

Real Estate (0.17)

Investment Companies (0.22)

Energy (0.35)

IT (0.69)

Health Care (0.85)

Financials (2.31)

Source: FactSet treating Genesis' affiliated investment company

on a look-through basis

PORTFOLIO ACTIVITY

In terms of activity, the six-month period, was unusually busy

with turnover approaching 28% on an annualised basis. The largest

purchase was the introduction of the South African internet and

entertainment group Naspers - it ended the period as a top five

holding with a weight of 2.3%. The underlying driver of this

investment is to gain exposure to Tencent, the Chinese internet

service provider, at a reduced price.

Elsewhere there was significant activity in the banking sector

with the purchase of Bank Central Asia, the third-largest

Indonesian bank by assets but the largest private bank, and Banca

Transilvania (Romania), while the Indian banks HDFC and Kotak

Mahindra saw their positions added to. Sales in the sector were

dominated by ICBC, which was sold on macro concerns in China,

including continued excessive credit growth and policy makers'

failure to implement needed reforms. The majority of the holding in

Alior Bank was sold in December while Kbank (Thailand) and Saudi

British Bank exited the portfolio along with Santander Brasil and

United Bank for Africa (Nigeria). Away from the banking sector,

some profits were taken in TSMC after its share price rose

significantly over the six-month period. Despite these sales it

remains one of the largest positions in the portfolio. Two other

tech companies- Samsung Electronics and MediaTek-also saw their

positions trimmed while ASM Pacific exited the portfolio.

Other purchasing activity saw a number of recent initiations

from the last year being taken to higher weights including

Heineken, Bangkok Dusit, Jeronimo Martins and LiLAC. Weakness in

the Indian market saw several names added to, most notably Sun

Pharmaceutical and the IT service companies Cognizant and Infosys.

These purchases were partly funded by a reduction in Novatek

(Russia), whose share price had almost doubled from its lows

earlier in the year, while the positions in the mining companies

Anglo American and First Quantum Minerals were further reduced as

commodities continued to rebound.

OUTLOOK

We remain optimistic on expected returns based on both an

improved operating environment and the characteristics of the Fund.

Emerging market economic growth has finally begun to stabilise

after five years of sequential declines and we expect less downward

pressure on emerging market currencies given past real exchange

rate depreciation and significant current account improvements.

In the near term, threats to our constructive view include China

and protectionism. We think Chinese policymakers have a clear

preference for near-term growth over long-run economic reform and

the credit build-up continues unabated. Beyond China, globalisation

has undoubtedly led to huge wealth creation in emerging markets and

much of Asia's success over the past three decades has been built

on export-led growth. President Trump's campaign rhetoric included

renegotiation of trade deals and unilateral protectionist measures

on emerging markets from Mexico to China which, if implemented,

would likely have a negative impact on growth and exchange

rates.

Notwithstanding these short-term challenges, we believe the

long-term emerging markets investment opportunity remains bright.

Growing incomes in developing countries are expected to create

local demand growth for emerging market businesses, against a

background of improvement not only in corporate governance but also

in the quality of the institutional framework in which they

operate.

Genesis Asset Managers, LLP

February 2017

UNAUDITED STATEMENT OF FINANCIAL POSITION

as at 31(st) December 2016 and 30(th) June 2016

(Audited)

31(st) 30(th)

December June

2016 2016

$'000 $'000

------------------- -------------------

ASSETS

Current Assets

Financial assets at fair value

through profit or loss 1,120,312 1,099,567

Amounts due from brokers 397 4,261

Dividends receivable 2,267 4,001

Other receivables and prepayments 211 204

Cash and cash equivalents 17,414 20,245

TOTAL ASSETS 1,140,601 1,128,278

------------------- -------------------

LIABILITIES

Current Liabilities

Amounts due to brokers 494 4,941

Capital gains tax payable 271 141

Payables and accrued expenses 1,676 1,878

TOTAL LIABILITIES 2,441 6,960

------------------- -------------------

TOTAL NET ASSETS 1,138,160 1,121,318

=================== ===================

EQUITY

Share premium 134,349 134,349

Capital reserve 962,192 946,972

Revenue account 41,619 39,997

TOTAL EQUITY 1,138,160 1,121,318

=================== ===================

NET ASSET VALUE PER PARTICIPATING

PREFERENCE SHARE* $8.43 $8.31

=================== ===================

* Calculated on an average number of 134,963,060 Participating

Preference Shares outstanding (30(th) June 2016: 134,963,060).

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 31(st) December 2016 and 31(st)

December 2015

2016 2015

$'000 $'000

----------------------- ------------------------------------

INCOME

Net change in financial assets

at fair value

through profit or loss 15,423 (191,042)

Net exchange losses (203) (136)

Dividend income 12,170 9,816

Securities lending income 45 -

Interest income 46 5

27,481 (181,357)

----------------------- ------------------------------------

EXPENSES

Management fees (7,276) (6,565)

Transaction costs (925) (443)

Custodian fees (551) (460)

Directors' fees and expenses (162) (294)

Administration fees (137) (132)

Audit fees (32) (42)

Legal and Professional fees (49) (45)

Other expenses (113) (105)

TOTAL OPERATING EXPENSES (9,245) (8,086)

----------------------- ------------------------------------

OPERATING PROFIT/(LOSS) 18,236 (189,443)

Finance Costs (3) -

PROFIT/(LOSS) BEFORE TAX 18,233 (189,443)

Capital gains tax (130) 110

Withholding taxes (1,261) (1,049)

PROFIT/(LOSS) AFTER TAX 16,842 (190,382)

----------------------- ------------------------------------

Other Comprehensive Income - -

TOTAL COMPREHENSIVE INCOME/(LOSS)

ATTRIBUTABLE TO PARTICIPATING

PREFERENCE SHARE 16,842 (190,382)

======================= ====================================

EARNINGS/(LOSS) PER PARTICIPATING

PREFERENCE SHARE* $0.12 $(1.41)

======================= ====================================

* Calculated on an average number of 134,963,060 Participating

Preference Shares outstanding

(31(st) December 2015: 134,963,060).

UNAUDITED STATEMENT OF CHANGES IN EQUITY

for the six months ended 31(st) December 2016 and 31(st)

December 2015

For the six months ended

31(st) December 2016

Share Capital Revenue

Premium Reserve Account Total

$'000 $'000 $'000 $'000

------- --------- --------- ---------

Balance at the beginning

of the period 134,349 946,972 39,997 1,121,318

Total Comprehensive Income - - 16,842 16,842

Transfer to Capital Reserves* - 15,220 (15,220) -

------- --------- --------- ---------

Balance at the end of

the period 134,349 962,192 41,619 1,138,160

======= ========= ========= =========

For the six months ended

31(st) December 2015

Share Capital Revenue

Premium Reserve Account Total

$'000 $'000 $'000 $'000

------- --------- --------- ---------

Balance at the beginning

of the period 134,349 1,045,055 33,910 1,213,314

Total Comprehensive Loss - - (190,382) (190,382)

Transfer from Capital

Reserves* - (191,178) 191,178 -

------- --------- --------- ---------

Balance at the end of

the period 134,349 853,877 34,706 1,022,932

======= ========= ========= =========

* Calculated by summing the 'Net change in financial assets at

fair value through profit or loss' and 'Net exchange losses' in the

Unaudited Statement of Comprehensive Income.

UNAUDITED STATEMENT OF CASH FLOWS

for the six months ended 31(st) December 2016 and 31(st)

December 2015

2016 2015

$'000 $'000

--------- --------

OPERATING ACTIVITIES

Dividends received 13,995 12,470

Taxation paid (1,261) (1,154)

Purchase of investments (163,194) (82,836)

Proceeds from sale of investments 157,289 73,205

Interest paid (3) -

Operating expenses paid (9,454) (8,592)

--------- --------

NET CASH OUTFLOW FROM OPERATING ACTIVITIES (2,628) (6,907)

--------- --------

Effect of exchange losses on cash

and cash equivalents (203) (136)

--------- --------

(2,831) (7,043)

Net cash and cash equivalents at the

beginning of the period 20,245 23,729

--------- --------

NET CASH AND CASH EQUIVALENTS AT THE OF THE PERIOD 17,414 16,686

========= ========

Comprising:

Cash and cash equivalents 17,414 16,686

========= ========

1. BASIS OF PREPARATION

The Interim Financial Information for the six months ended

31(st) December 2016 has been prepared in accordance with

International Accounting Standards 34, 'Interim Financial

Reporting'. The Interim Financial Information should be read in

conjunction with the Annual Financial Statements for the year ended

30(th) June 2016, which have been prepared in accordance with

International Financial Reporting Standards ('IFRS').

The unaudited financial statements have been prepared under the

historical cost convention, as modified by the revaluation of

financial assets and financial liabilities at fair value through

profit or loss.

2. COST OF INVESTMENT TRANSACTIONS

31(st)

31(st) December December

2016 2015

During the period, expenses were

incurred in acquiring or disposing

of investments. $'000 $'000

---------------- ----------

Acquiring 456 273

Disposing 469 170

---------------- ----------

925 443

================ ==========

3. SEGMENT INFORMATION

The Directors, after having considered the way in which internal

reporting is provided to them, are of the opinion that the Fund

continues to be engaged in a single segment of business, being the

provision of a diversified portfolio of investments in emerging

markets.

All of the Funds' activities are interrelated, and each activity

is dependent on the others. Accordingly, all significant operating

decisions are based upon analysis of the Fund operating in one

segment.

The financial positions and results from this segment are

equivalent to those per the financial statements of the Fund as a

whole, as internal reports are prepared on a consistent basis in

accordance with the measurement and recognition principles of

IFRS.

As at 31(st) December 2016 and 30(th) June 2016, the Fund has no

assets classified as non-current assets. A full breakdown of the

Fund's financial assets at fair value through profit and loss is

shown in the Country exposure of the Fund's portfolio.

The Fund is domiciled in Guernsey. All of the Fund's income from

investment is from entities in countries or jurisdictions other

than Guernsey.

For Genesis Emerging Markets Fund Limited

J.P. Morgan Administration Services (Guernsey) Limited

February 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR OKKDQQBKDCBB

(END) Dow Jones Newswires

February 20, 2017 09:53 ET (14:53 GMT)

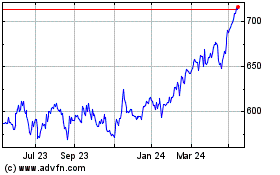

Fidelity Emerging Markets (LSE:FEML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fidelity Emerging Markets (LSE:FEML)

Historical Stock Chart

From Apr 2023 to Apr 2024