TIDMEDL

RNS Number : 8607N

Edenville Energy PLC

27 September 2019

27 September 2019

EDENVILLE ENERGY PLC

("Edenville" or the "Company")

Interim Results for the six months to 30 June 2019

Edenville Energy plc (AIM: EDL), the company developing a coal

project in southwest Tanzania, announces the Company's unaudited

interim results for the six months ended 30 June 2019.

Key Period Highlights

-- Executed equity placing to raise GBP510,000 (gross) in April

2019 to advance coal production

-- Coal wash plant upgraded and now fully operational; including

a Lamella water treatment plant, the introduction of a coal

sizer and installation of a pre-screening plant, thereby

enabling greater efficiency and productivity

-- Started to re-treat fine coal, recovering approximately 40%

of coal material above 8mm for either direct sale or subsequent

blending with existing coal stocks to increase saleable product

-- Completed the land compensation for the New Northern Mining

Area (the "Northern Area")

-- In June 2019 the Company established the new road to the

Northern Area and commenced stripping and exposing of coal

Post Period Highlights

-- Coal mining commenced in the Northern Area

-- Encouraging coal sampling results. Analysis of unwashed Northern

Area coal returned energy values averaging 6,200kcal/kg,

with the highest being over 6,800kcal/kg. These energy values

are significantly higher than those seen in previously mined

areas, which averaged approximately 5,000kcal/kg; the yielding

of +6,000 kcal/kg GCV from unwashed coal provides the opportunity

to sell coal without the requirement to put it through the

wash plant

-- Large coal measures of approximately 20m (and up to 40m)

in thickness, 4 metres from surface, have been exposed in

the Northern Area, compared to measures of approximately

3.5m in thickness in previously mined areas

-- Mining now focused in the Northern Area given lower strip

ratio, improved economics and better quality of coal

-- Purchased two 30 tonne trucks from TATA, to be used in mining

load and haul, moving away from contractor haulage to owner

operated haulage

-- In September 2019 the Company raised an additional GBP300,000

by way of a placing of 600,000,000 new ordinary shares, envisaged

to provide sufficient capital until the Company turns cash

flow positive from operations

-- Appointment of mining industry expert Alistair Muir as a

Non-Executive Director replacing Arun Srivastava

Jeff Malaihollo, Chairman of Edenville, commented: "During 2019

the Company has achieved encouraging operational progress at the

Rukwa coal project. The completion of the various upgrades to the

wash plant are already providing greater recoveries, a reduction in

consumables and should also enable greater throughput as mining

operations continue to expand. The opening up of the Northern

Mining Area has yielded materially positive results, with thicker

seams and higher quality coal than previously experienced at Rukwa.

As a consequence the Board believes both the economics and the

profitability of operations should improve further as we continue

to increase coal sales to new and historic customers.

"From a corporate perspective, the Company has recapitalised

itself and formed a solid foundation from which to further build

and achieve our primary short term objective, to become cash flow

positive from operations during H1 2020.

"Whilst additional work naturally remains to be done, we are

confident of reaching those value-enhancing milestones for

shareholders in the timeframes previously outlined. We would like

to thank all of our shareholders for their continuing support and

we look forward to the remainder of 2019 with confidence."

For further information please contact:

+44 (0) 20 3934

Edenville Energy Plc 6630

Jeff Malaihollo - Chairman

Rufus Short - CEO

SP Angel Corporate Finance +44 (0) 20 3470

LLP 0470

(Nominated Adviser and Joint

Broker)

David Hignell

Jamie Spotswood

Abigail Wayne

+44 (0) 20 7936

Brandon Hill Capital Limited 5200

(Joint Broker)

Oliver Stansfield

Jonathan Evans

+44 (0) 20 3934

IFC Advisory Limited 6630

(Financial PR and IR)

Tim Metcalfe

Graham Herring

Florence Chandler

CEO's report

Operational Report

Production of Coal

During the period the Company's primary focus was on the coal

mining operations at the Company's Rukwa Coal Project (the

"Project") in southwest Tanzania.

January 2019 got off to a good start with the addition of a

second excavator to open up the mine along with the existing

machine. The Lamella Plant was operational and the newly

constructed pre-screen plant started processing test material in

January 2019 and became fully operational in February.

In January 2019 the Company decided to carry out an Open Offer

to existing shareholders in order to raise the remaining capital

needed to open up the Northern Mining Area and subsequently

increase production. However, the Open Offer, at 0.12p per share,

was poorly received and only approximately 10% of the planned

GBP619,099 was eventually raised. This left the Company in a

challenging situation on how best to meet customers' orders and

expand the operation.

From February 2019 the Company took measures to conserve capital

and continue supply to key customers whilst seeking alternative

funding arrangements. As announced on 1 April 2019, production was

adversely impacted in H1 2019 with approximately 18,772 tonnes of

Run of Mine ("ROM") coal processed to produce 4,411 tonnes of

washed coal and 11,134 tonnes of fine coal between 1 January 2019

and 30 June 2019.

On 29 April 2019 the Company announced a conditional fundraising

of GBP510,000 along with certain cost saving measures and started

to make preparations to apply some of this funding to the Project

development. The main areas targeted were the opening up of the pit

in the Northern Area, which has higher quality coal and thicker and

easier to access coal seams. At the same time we made small

upgrades to the plant and infrastructure, such as an improved water

pumping system and installation of a coal sizer prior to the plant.

At the end of the period land compensation work and the building of

the road to the Northern Area were completed. In addition,

overburden stripping, which exposed coal, was undertaken in the

Northern Area and mining subsequently commencing in July 2019.

The Company's target is to firstly reach a steady state

production rate of 6,000 tonnes per month of washed coal product,

which we believe will enable the Tanzania operations to break even.

Following this the second target is to reach 10,000 tonnes of

washed coal produced per month which will provide positive cash

flow for the Company. The Directors believe the Company remains on

track to become cash flow positive from existing operations during

H1 2020.

The fine coal is effectively produced as a by-product and, to

that end, we are continuing discussions with the previously

outlined buyers of fine coal. The introduction of the pre-screen

means that some of the stockpiled fine coal can now be reprocessed.

During the period we targeted areas of stockpiled fine coal that

contained economically recoverable coal to feed through the

pre-screen. Approximately 4,500 tonnes of the fine stockpile have

been treated yielding 1,800 tonnes of sized coal.

Until recently, the Company had been relying on trucks supplied

by contractors, which had sometimes proved to be an expensive and

inefficient option. To this end, as announced on 21 August 2019,

Edenville took the decision to purchase two 30 tonnes trucks which

are now used to provide the backbone of load and haul operations at

the Project. The wash plant is currently operating on a two shift

basis, with the new trucks currently supplying the plant on one

shift with the other shift being used to process coal from

stockpiles. As the Northern Area continues to develop the focus of

mining is moving to this area and a double shift operation of

extracting coal from the Northern Area will start once training of

operators is completed by mid-October 2019.

Production in H2 2019 started well with the plant producing

1,134 tonnes of washed product, principally in the first half of

July 2019, as the effects of the upgrades began to show. The wash

plant was reaching production rates of over 100 tonnes per day from

a single shift during this period. However, during the second half

of July and the majority of August 2019, mining was adversely

affected by the lack of available contractor trucks and a delay on

the delivery of our own trucks, which in turn compromised the

plant's production ability. With the arrival of our own trucks in

late August 2019 this issue has now been resolved and the available

coal supply is steadily increasing, with further increases in

production rates anticipated in the short term. This will

subsequently enable increased sales to identified customers, many

of whom require a surety of supply, which the Company should now be

able to offer. As production of washed coal increases the Directors

expect unit sales costs to progressively fall. Post period end

approximately 1,510 tonnes of washed coal has been shipped between

1 July 2019 and 20 September 2019.

Coal to Power Project

In October 2018 the Company submitted a Request for

Qualification ("RFQ") for coal fired generation projects in

Tanzania to Tanzania Electric Supply Company ("Tanesco"), which

Tanesco officially accepted as being complete and complying with

their requirements. However, two weeks later, for reasons not given

by Tanesco, the RFQ was cancelled and subsequently reinstated for a

resubmission date in December 2018. Edenville resubmitted their RFQ

documents in line with the criteria set forward by Tanesco, which

appeared identical to the previous criteria. On 14 February 2019

Tanesco informed the Company that it had been unsuccessful in

moving through the RFQ process to supply power to Tanesco. No clear

explanation has been given for this decision to date. As far as the

Company is aware no other privately held coal projects in Tanzania

progressed successfully through the process.

The AFR RI-3A Tanzania - Zambia Transmission Interconnector

project, which is being part financed by the World Bank, is

continuing to move forward which we believe will have positive

implications for our proposed coal to power project. The financing

agreement for credit is now in place and the procurement plan is

continuing to progress. As previously stated the Company's long

term plan is to provide electricity to this transmission grid once

it is completed and we are continuing to work towards this goal.

Currently completion is stated as being in 2024.

However, in the short to medium term the focus of the Company is

on it coal mining operations and the sale of coal to Tanzanian and

other customers in East Africa.

Financial Results

For the six month period ended 30 June 2019 the Company had

revenue of GBP151,140 (H1 2018: GBP59,310).

The Group made a loss after taxation of GBP888,045 (H1 2018 loss

of GBP544,959). The net assets at 30 June 2019 amounted to

GBP6,367,559 (30 June 2018 GBP7,568,436).

The total comprehensive loss for the period was GBP887,339 (H1

2018 loss of GBP387,412), which included a gain of GBP706 (H1 2017

gain of GBP157,457) arising from the translation of the Tanzanian

subsidiary accounts from US Dollars to Sterling.

Rufus Short

Chief Executive Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

19 18 18

Unaudited Unaudited Audited

Note GBP GBP GBP

Revenue 151,140 59,310 337,125

Cost of sales (476,352) (54,663) (1,191,312)

Gross profit (325,212) 4,647 (854,187)

Administrative expenses (483,112) (526,648) (839,515)

Share based payments (16,077) (23,235) (76,319)

Written off intangible asset - - -

Group operating loss (824,401) (545,236) (1,770,021)

Finance income 56 277 529

Finance costs (63,700) (16,212)

Loss on operations before taxation (888,045) (544,959) (1,785,704)

Taxation - - -

Loss for the period after taxation (888,045) (544,959) (1,785,704)

Other comprehensive income/(loss):

Gain/(loss) on translation of

overseas subsidiary 706 157,547 (378,531)

Total comprehensive (loss)/income

for the period (887,339) (387,412) (1,407,173)

Attributable to:

Equity holders of the Company (886,401) (386,955) (1,404,725)

Non-controlling interest (938) (457) (2,448)

(887,339) (387,412) (1,407,173)

Loss per share

- basic and diluted (pence) 2 (0.04) (0.04) (0.12)

The income for the period arises from the Group's continuing

operations.

CONSOLIDATED statement of financial position

as at 30 june 2019

As at As at As at

30 June 30 June 31 Dec

19 18 18

Unaudited Unaudited Audited

Note GBP GBP GBP

Non-current assets

Property, plant and equipment 4 1,027,062 975,267 1,139,031

Intangible assets 5 5,779,973 5,664,122 5,775,829

6,807,035 6,639,389 6,914,860

Current assets

Inventories 329,559 163,184 256,082

Trade and other receivables 506,042 390,755 396,671

Cash and cash equivalents 75,843 537,478 160,042

911,444 1,091,417 812,795

Current liabilities

Trade and other payables (749,860) (162,370) (556,063)

Convertible loan notes (252,428) (288,118)

(1,002,280) (162,370) (844,181)

Current assets less current

liabilities (90,844) 929,047 (31,386)

Total assets less current liabilities 6,716,191 7,568,438 6,883,474

Non - current liabilities

Convertible loan notes (348,632) - (282,076)

6,367,559 7,568,436 6,601,398

Capital and reserves

Called-up share capital 6 3,294,935 2,722,036 2,722,036

Share premium account 18,631,157 18,566,642 18,566,642

Share based payment reserve 291,540 224,376 275,463

Foreign currency translation

reserve 934,202 712,512 933,496

Retained earnings (16,771,838) (14,647,974) (15,884,731)

Issued capital and reserves

attributable to owners of the

parent company 6,379,996 7,577,592 6,612,906

Non-controlling interest (12,437) (9,156) (11,508)

Total equity 6,367,559 7,568,436 6,601,398

CONSOLIDATED statement of changes in equity

----------------------------------Equity

Interests--------------------------------

Foreign

Share currency Non-

Share Share Retained option translation Controlling

capital premium Earnings reserve reserve Total interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2019 2,722,036 18,566,642 (15,884,731) 275,463 933,496 6,612,906 (11,508) 6,601,398

Issue of share

capital 572,899 64,515 - - - 637,414 - 637,414

Share based

payment

charge - - - 16,077 - 16,077 - 16,077

Foreign currency

translation - - - - 706 706 9 715

Loss for the

period - - (887,107) - - (887,107) (938) (888,045)

Balance at 30

June

2019 3,294,935 18,631,157 (16,771,838) 291,540 934,202 6,379,996 (12,437) 6,367,559

Balance at 1

January

2018 2,679,750 17,910,928 (14,212,274) 309,943 554,965 7,243,312 (8,464) 7,234,848

Issue of share

capital 42,286 697,714 - - - 740,000 - 740,000

Share issue costs - (42,000) - - - (42,000) - (42,000)

Share based

payment

charge - - - 23,235 - 23,235 - 23,235

Lapse of share

options - - 108,802 (108,802) - - - -

Foreign currency

translation - - - - 157,547 157,547 (235) 157,312

Loss for the

period - - (544,502) - - (544,502) (457) (544,959)

Balance at 30

June

2018 2,722,036 18,566,642 (14,647,974) 224,376 712,512 7,577,592 (9,156) 7,568,436

Foreign

Share currency Non-

Share Share Retained option translation Controlling

capital premium Earnings reserve reserve Total interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2018 2,679,750 17,910,928 (14,212,274) 309,943 554,965 7,243,312 (8,464) 7,234,848

Issue of share

capital 42,286 697,714 - - - 740,000 - 740,000

Cost of issue - (42,000) - - - (42,000) - (42,000)

Share

options/warrants

charge - - - 76,319 - 76,319 - 76,319

Cancellation of

share

options - - 110,799 (110,799) - - - -

Foreign currency

translation - - - - 378,531 378,531 (746) 377,785

Loss for the year - - (1,783,256) - - (1,783,256) (2,448) (1,785,704)

Non-controlling

interest

share of

goodwill - - - - - - 150 150

Balance at 31

December

2018 2,722,036 18,566,642 (15,884,731) 275,463 933,496 6,612,906 (11,508) 6,601,398

consolidated CASH FLOW STATEMENT

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

19 18 18

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating loss (824,401) (545,263) (1,770,021)

Depreciation 110,929 104,493 229,732

Amortisation 14,461 - 57,928

Share based payments 16,077 23,235 76,319

(Increase) in inventories (73,477) (163,184) (256,082)

(Decrease) in trade and other

receivables (108,496) (81,565) (77,196)

Increase in trade and other payables 191,590 13,527 390,069

Foreign exchange gain/(loss) (11,006) 4,323 37,584

Net cash used in operating activities (684,323) (644,434) (1,311,667)

Cash flows from investing activities

Purchase of exploration and evaluation

assets - (467,553) (468,145)

Purchase of property, plant and

equipment (706) - (259,601)

Finance income 56 277 529

Finance cost (16,884) - -

Net cash used in investing activities (17,494) (467,276) (727,217)

Cash flows from financing activities

Proceeds from issue of convertible

loan notes - - 548,853

Repayment of convertible loan (11,787) -

notes

Proceeds on issue of shares 630,214 740,000 740,000

Share issue costs - (42,000) (42,000)

Net cash generated from financing

activities 618,427 698,000 1,246,853

Net decrease in cash and cash

equivalents (83,430) (413,710) (792,031)

Cash and cash equivalents at beginning

of year 160,042 951,078 951,078

Exchange losses on cash and cash

equivalents (769) 110 995

Cash and cash equivalents at end

of year 75,843 537,478 160,042

NOTES TO THE INTERIM REPORT

1. Financial information and basis of preparation

The interim financial statements of Edenville Energy Plc are

unaudited consolidated financial statements for the six months

ended 30 June 2019 which have been prepared in accordance with

IFRSs as adopted by the European Union. They include unaudited

comparatives for the six months ended 30 June 2018 together with

audited comparatives for the year ended 31 December 2018.

The interim financial statements do not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. The statutory accounts for the year ended 31 December 2018

have been reported on by the company's auditors and have been filed

with the Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) contained a "Material uncertainty relating to

going concern paragraph and (iii) did not contain any statement

under section 498 of the Companies Act 2006.

The interim consolidated financial statements for the six months

ended 30 June 2019 have been prepared on the basis of accounting

policies expected to be adopted for the year ended 31 December

2019. These are anticipated to be consistent with those set out in

the Group's latest financial statements for the year ended 31

December 2018. These accounting policies are drawn up in accordance

with adopted International Accounting Standards ("IAS") and

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board and adopted by the

EU.

2. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

30 June 19 30 June 18 31 December

18

GBP GBP GBP

Loss after taxation (888,045) (544,959) (1,785,704)

Weighted average number

of shares in the period 2,311,584,263 1,412,667,005 1,476,497,888

Basic and diluted loss

per share (pence) (0.04) (0.04) (0.12)

The loss attributable to equity shareholders and weighted

average number of ordinary shares for the purposes of calculating

diluted earnings per ordinary share are identical to those used for

basic earnings per ordinary share. This is because the exercise of

share options and warrants would have the effect of reducing the

loss per ordinary share and is therefore anti-dilutive.

3. Dividends

No dividends are proposed for the six months ended 30 June 2019

(six months ended 30 June 2018: GBPnil, year ended 31 December

2018: GBPnil).

4. Tangible assets

Plant & Fixtures Motor vehicles

machinery & fittings Total

GBP GBP GBP GBP

Cost or valuation

As at 1 January

2019 1,435,541 7,360 93,946 1,536,847

Additions 706 - - 706

Foreign exchange

adjustment 4,600 10 249 4,859

At 30 June 2019 1,440,847 7,370 94,195 1,542,412

Accumulated depreciation

As at 1 January

2019 306,410 7,010 84,396 397,816

Charge for period 109,736 43 1,150 110,929

Foreign exchange

adjustment 6,325 10 270 6,605

As at 30 June 2019 422,471 7,063 85,816 515,350

Net book value

As at 30 June 2019 1,018,376 307 8,379 1,027,062

Plant & Fixtures Motor vehicles

machinery & fittings Total

GBP GBP GBP GBP

Cost or valuation

As at 1 January

2018 1,111,852 7,184 89,709 1,208,745

Additions - - - -

Foreign exchange

adjustment 25,679 70 1,697 27,446

At 30 June 2018 1,137,531 7,254 91,406 1,236,191

Accumulated depreciation

As at 1 January

2018 64,873 6,719 77,570 149,162

Charge for period 102,941 58 1,494 104,493

Foreign exchange

adjustment 5,687 70 1,512 7,269

As at 30 June 2018 173,501 6,847 80,576 260,924

Net book value

As at 30 June 2018 964,030 407 10,830 975,267

4. Tangible assets (continued)

Plant & Fixtures Motor vehicles

machinery & fittings Total

GBP GBP GBP GBP

Cost or valuation

As at 1 January

2018 1,111,852 7,184 89,709 1,208,745

Additions 259,601 - - 259,601

Foreign exchange

adjustment 64,088 176 4,237 68,501

At 31 December 2018 1,435,541 7,360 93,946 1,536,847

Accumulated depreciation

As at 1 January

2018 64,873 6,719 77,570 149,162

Charge for the year 226,551 115 3,066 229,732

Foreign exchange

adjustment 14,986 176 3,760 18,922

At 31 December 2018 306,410 7,010 84,396 397,816

Net book value

As at 31 December

2018 1,129,131 350 9,550 1,139,031

5. Intangible assets

Development Goodwill Total

and production

expenditure

GBP GBP GBP

Cost or valuation

As at 1 January

2019 5,501,291 1,572,197 7,073,488

Foreign exchange

adjustment 17,721 5,064 22,785

At 30 June 2019 5,519,012 1,577,261 7,096,273

Accumulated amortisation

and impairment

As at 1 January

2019 57,928 1,239,731 1,297,659

Charge for the

period 14,461 - 14,461

Foreign exchange

adjustment 187 3,993 4,180

As at 30 June

2019 72,576 1,243,724 1,316,300

Net book value

As at 30 June

2019 5,446,436 333,537 5,779,973

5. Intangible assets (continued)

Exploration

and evaluation

assets

Tanzanian Development

Licences and production Goodwill Total

expenditure

GBP GBP GBP

As at 1 January 2018 4,757,087 - 1,485,965 6,243,052

Additions 452,758 14,795 - 467,553

Foreign exchange

adjustment 117,944 - 34,552 152,496

Transfer (5,327,789) 5,327,789

At 30 June 2018 - 5,342,584 1,520,517 6,863,101

Accumulated amortisation

and impairment

As at 1 January 2018 - - 1,171,734 1,171,734

Foreign exchange

adjustment - - 27,245 27,245

As at 30 June 2018 - - 1,198,979 1,198,979

Net book value

As at 30 June 2018 - 5,342,584 321,538 5,664,122

Cost or valuation

As at 1 January 2018 4,757,087 1,485,965 6,243,052

Additions 468,145 - 468,145

Foreign exchange

adjustment 276,059 86,232 362,291

At 31 December 2018 5,501,291 1,572,197 7,073,488

Accumulated amortisation

and impairment

As at 1 January 2018 - 1,171,734 1,171,734

Depletion of development

and production assets 57,928 - 57,928

Foreign exchange

adjustment - 67,997 67,997

At 31 December 2018 57,928 1,239,731 1,297,659

Net book value

As at 31 December

2018 5,443,363 332,466 5,775,829

6. Share capital

No GBP No GBP GBP

Ordinary Ordinary Deferred Deferred Total

shares of shares shares of shares share

0.02p each of 0.02p 0.001p each of 0.001p capital

each each

Issued and fully paid

At 1 January 2019 1,547,746,369 309,551 241,248,512,346 2,412,485 2,722,036

On 20 February 2019

the company issued 36,000,000

shares at 0.02p 36,000,000 7,200 - - 7,200

On 20 February 2019

the Company issued 64,515,192

shares at 0.12p each 64,515,192 12,904 - - 12,904

On 2 May 2019 the Company

issued 500,000,000 shares

at 0.02p each 500,000,000 100,000 - - 100,000

On 20 May 2019 the Company

issued 2,263,980,200

shares at 0.02p each 2,263,980,200 452,795 - - 452,795

As at 30 June 2019 4,412,241,761 882,450 241,248,512,346 2,412,485 3,294,935

================ ========== ================ =========== ==========

No GBP No GBP GBP

Ordinary Ordinary Deferred Deferred Total

shares of shares shares of shares share

0.02p each of 0.02p 0.001p each of 0.001p capital

each each

Issued and fully paid

At 1 January 2018 1,336,317,797 267,265 241,248,512,346 2,412,485 2,679,750

On 3 May 2018 the Company

issued 211,428,572 shares

at 0.35p each 211,428,572 42,286 - - 42,286

As at 30 June 2018 1,547,746,369 309,551 241,248,512,346 2,412,485 2,722,036

============== ========== ================ =========== ==========

No GBP No GBP GBP

Ordinary Ordinary Deferred Deferred Total

shares of shares shares of shares share

0.02p each of 0.02p 0.001p each of 0.001p capital

each each

Issued and fully paid

At 1 January 2018 1,336,317,797 267,265 241,248,512,346 2,412,485 2,679,750

On 3 May 2018 the Company

issued 211,428,572 shares

at 0.35p each 211,428,572 42,286 - - 42,286

As at 31 December 2018 1,547,746,369 309,551 241,248,512,346 2,412,485 2,722,036

============== ========== ================ =========== ==========

7. Distribution on interim report to shareholders

The interim report will be available for inspection by the

public at the registered office of the company during normal

business hours on any weekday and from the Company's website

http://www.edenville-energy.com/. Further copies are available on

request.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BUGDCCSDBGCL

(END) Dow Jones Newswires

September 27, 2019 02:00 ET (06:00 GMT)

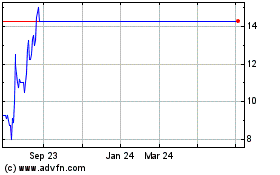

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Apr 2023 to Apr 2024