TIDMECEL

RNS Number : 5192O

Eurocell plc

07 November 2016

PUBLICATION OF ANNUAL REPORT AND FINANCIAL STATEMENTS

Eurocell plc has, in accordance with LR 9.6.1R of the Listing

Rules, submitted to the Financial Conduct Authority's National

Storage Mechanism copies of the following:

-- the Annual Report and Financial Statements 2015

-- Notice of 2016 Annual General Meeting

-- Form of Proxy for the 2016 Annual General Meeting

In accordance with LR 9.6.2R of the Listing Rules, the Company

has submitted a copy of the resolutions passed at the Annual

General Meeting (other than resolutions concerning ordinary

business) to the UK Listing Authority via the National Storage

Mechanism.

The documents will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM.

The Annual Report and Financial Statements, Notice of Annual

General Meeting and Form of Proxy are also available on the

Eurocell plc website at www.eurocell.co.uk/investors.

A condensed set of the Group's financial statements and

information on important events that occurred during the financial

year ended 31 December 2015 and their impact on the financial

statements were included in Eurocell plc's Final Results

announcement on 16 March 2016. That information together with the

information set out below, which is extracted from the Annual

Report and Financial Statements for the year ended 31 December

2015, constitute the material required by DTR 6.3.5 of the

Disclosure Guidance and Transparency Rules which is required to be

communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full Annual Report and Financial

Statements. To view the Annual Report and Financial Statements, the

Final Results announcement and the slides of the Final Results

presentation please visit www.eurocell.co.uk/investors.

PRINCIPAL RISKS

1. Market risk

Risk: Our products are used in the residential and commercial

building and construction markets including within the RMI sector.

Wider economic conditions and government policy can have an impact

on demand in the construction sector and levels of disposable

income can impact activity in the RMI market.

Impact: Uncertainty over the economic climate makes it difficult

to predict accurately levels of demand for our products.

Mitigation: There is greater risk in the new build sector where

we are less exposed. Our service driven strategy means that we are

well able to withstand short term economic pressures on our

business.

2. Severe weather

Risk: Our business can be severely affected by unexpected or

prolonged periods of severe weather in the UK.

Impact: Severe weather has an impact on the housing sector

generally which drives demand for our products and it will also

affect our ability to deliver products to our branches and our

customers.

Mitigation: We expect some inclement weather in December and

January and plan accordingly. It is unusual for severe weather to

extend to two weeks or more.

3. Raw Materials cost fluctuations

Risk: We depend on the supply of PVC resin to be able to

manufacture our products. PVC resin is an indirect derivative of

the oil market and prices are therefore subject to fluctuation on a

monthly basis.

Impact: There can be a delay in passing on our cost increase to

our customers in the form of selling price increases which can

affect our margins. Whilst customers expect selling price

reductions when the price of resin falls, they are reluctant to

accept selling price increase when the price of PVC resin

rises.

Mitigation: We ensure that our supply contracts with major

customers contain mechanisms to deal with significant variations in

the PVC resin price. We aim to increase the amount of post-consumer

waste we use in our product.

4. Changes in laws and regulations pertaining to our products

Risk: We are high users of energy and we use various polymers

and chemicals in our manufacturing processes. There is a risk that

the laws pertaining to the usage of these resources could change

which would in turn would increase our cost base.

Impact: Any increases in our cost base would affect margin if we

were unable to pass these increases on to customers in the form of

price increases.

Mitigation: We monitor policy so that we are prepared for any

legislative changes well before they are introduced.

5. Changes in laws and regulations pertaining to the environment

Risk: Given the nature of the Company's manufacturing activities

there is an inherent risk of environmental liability.

Impact: We could be held liable for environmental damage as a

result of hazardous materials.

Mitigation: We ensure that we comply with all current

legislation pertaining to the environment and adopt best practice

wherever possible.

6. Failure of products to perform

Risk: Customers or end users could receive inferior quality

products either due to manufacturing issues or due to issues at our

customers.

Mitigation: Given the nature of modern communications a

perception could be circulated quickly that our products fail to

perform adequately.

Impact: We have robust quality control processes which minimise

the risk of inferior products being shipped to our customers. Where

end users have complaints we have a team of dedicated technical

service people who will visit the end user on site with a view to

resolving all problems.

7. Recoverability of trade receivables

Risk: The company does not insure the credit it extends to its

customers and there is an inherent risk that customers could

default on the amounts they owe.

Mitigation: There is a risk of material bad debt charges in the

event of customer defaults.

Impact: We have rigorous credit control procedures and monitor

larger exposures at all times. We adopt a prudent approach towards

provisioning.

8. Dilapidation Costs

Risk: Most of the property we use is under lease. When these

leases come to an end there is likely to be dilapidations to the

properties which need to be rectified.

Mitigation: The inherent uncertainty in assessing future charges

relating to dilapidations means that the provisions we make could

be misstated.

Impact: Our methodology for fitting out buildings minimises the

structural impact we have on our buildings. This together with

training our people means that we reduce our exposure to

dilapidations costs as much as we can. We provide for future

dilapidations costs on a prudent yet commercially realistic

basis.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report,

the Directors' Remuneration Report and the Financial Statements in

accordance with applicable law and regulations.

Company law requires the Directors to prepare Group and Company

financial statements for each financial year. Under that law, the

Directors are required to prepare the Group financial statements in

accordance with applicable law and International Financial

Reporting Standards (IFRSs) as adopted by the European Union (EU)

and have elected to prepare the Company financial statements in

accordance with applicable law and United Kingdom (UK) Accounting

Standards (UK Generally Accepted Accounting Practice) including

Financial Reporting Standard 101 Reduced Disclosure Framework (FRS

101).

Under company law the directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and the Company and of

the profit or loss of the Group for that period. In preparing these

Financial Statements, the directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether IFRSs as adopted by the European Union and

applicable UK Accounting Standards have been followed, subject to

any material departures disclosed and explained in the Group and

Company Financial Statements respectively; and

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and the Group and enable them to

ensure that the Financial Statements and the Directors'

Remuneration Report comply with the Companies Act 2006 and, as

regards the Group Financial Statements, Article 4 of the IAS

Regulation. They are also responsible for safeguarding the assets

of the Company and the Group and hence for taking reasonable steps

for the prevention and detection of fraud and other

irregularities.

The directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

The directors consider that the Annual Report and Accounts,

taken as a whole, is fair, balanced and understandable and provides

the information necessary for Shareholders to assess the Company's

performance, business model and strategy.

Each of the directors, whose names and functions are listed on

pages 51 to 52, confirm that, to the best of their knowledge:

-- the Group Financial Statements, which have been prepared in

accordance with IFRSs as adopted by the EU, give a true and fair

view of the assets, liabilities, financial position and profit of

the Group; and

-- the Directors' Report includes a fair review of the

development and performance of the business and the position of the

Group, together with a description of the principal risks and

uncertainties that it faces.

The directors also confirm that:

-- so far as they are aware, there is no relevant audit

information of which the Company's auditors are unaware; and

-- they have taken all the steps that they ought to have taken

as a director in order to make themselves aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

The Directors' Responsibilities Statement was approved by a duly

authorised Committee of the Board of Directors on 16 March 2016 and

signed on its behalf by Matthew Edwards, Chief Financial Officer

and Patrick Bateman, Chief Executive Officer.

Enquiries

Teneo Strategy

Tel: 020 7240 2486

Ben Foster

Camilla Cunningham

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSXDLFBQFFZFBV

(END) Dow Jones Newswires

November 07, 2016 08:50 ET (13:50 GMT)

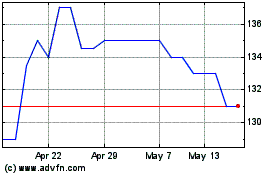

Eurocell (LSE:ECEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

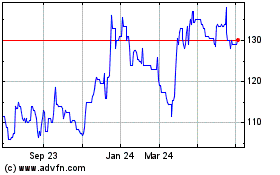

Eurocell (LSE:ECEL)

Historical Stock Chart

From Apr 2023 to Apr 2024