DWF Group PLC FY19 Trading Statement (8895A)

June 03 2019 - 2:00AM

UK Regulatory

TIDMDWF

RNS Number : 8895A

DWF Group PLC

03 June 2019

DWF Group plc

("DWF" or the "Company")

3 June 2019

FY19 Trading Statement

DWF, the global legal business providing complex, managed and

connected services, today issues the following trading update for

its financial year ended 30 April 2019, following the Company's IPO

on 15 March 2019.

DWF has continued to record strong revenue growth with FY19

revenue expected to grow by not less than 15%, delivering growth

across each of its divisions in line with the Company's medium term

targets. International has seen the strongest growth in the period

with revenue increasing by more than 70%, while Connected Services

saw growth in FY19 in excess of 20%. Insurance and Commercial

Services also delivered strong organic growth of in excess of 5%,

in line with guidance.

The Company's EBITDA margin (calculated on an adjusted proforma

basis)(1) was in line with management's expectations leading to

good profit growth, in absolute terms, year on year. This has been

driven from improvement in divisional gross profit margins and in

the cost to income ratio.

The Company's year-end net debt was in line with management's

expectations at GBP35.1m. This follows management's successful

actions in FY19 to improve cash collections. The Company is

therefore delivering good progress toward its medium term guidance

of an expected reduction of between 5-10 days in overall

lockup.

DWF increased its net partner headcount by 19 on a full-time

equivalent basis for the 12 months since 1 May 2018 through its

successful lateral partner hiring and promotion programme. The

Company also has a healthy potential lateral hire pipeline

demonstrating the attractiveness of its global platform to deliver

complex, managed and connected services, its remuneration model and

ability to offer equity participation across all career levels.

As detailed in its prospectus, the Company expects to pay a

full-year dividend of GBP3m, subject to shareholder approval, in

September 2019 and to pay further dividends thereafter in line with

its stated dividend policy.

The Company anticipates that it will announce its preliminary

full-year results on 31 July 2019.

Outlook

DWF has had a solid start to the new financial year and the

Company is confident that it will continue to deliver further

revenue and EBITDA growth in line with the Company's medium term

targets. The Company expects to deliver continued organic growth as

well as bolt on acquisition opportunities.

Andrew Leaitherland, CEO, commented: "This has been another year

of strong financial performance across our business, including good

organic growth rates in our insurance and commercial services

divisions and double-digit growth in Connected Services and

International, providing a firm foundation on which to begin life

as a public company. Our international business in particular has

shown extremely strong revenue growth. In this new financial year,

we have already built upon our success by delivering on an

international expansion opportunity highlighted in our prospectus,

through the transaction to acquire the legal services business of

K&L Gates Jamka in Poland. Since our IPO in March, we have also

further expanded in Australia through the acquisition of FT

Adjusting, a Connected Services business, and the hire of seven

principal lawyers from the Melbourne law firm, WARD Lawyers."

Note (1): Pro forma margin analysis based on an adjusted direct

cost measure, as if the Company had been a PLC with its revised

compensation structure for the full financial year, calculated

before exceptional items.

For further information:

DWF Group plc

James Igoe +44(0)20 7280 8929

Finsbury (public relations adviser to DWF)

Ed Simpkins, Charles O'Brien +44(0)20 7251 3801

About the Company

DWF is a global legal business providing complex, managed and

connected services, operating from 27 key locations with

approximately 3,200 people. The Company became the first Main

Market Premium Listed legal business on the London Stock Exchange

in March 2019. Pre-IPO, DWF recorded revenue of GBP236 million in

the year ended 30 April 2018. For more information visit:

www.dwf.law

Forward looking statements

This announcement contains certain forward-looking statements

with respect to the Company's current targets, expectations and

projections about future performance, anticipated events or trends

and other matters that are not historical facts. These

forward-looking statements, which sometimes use words such as

"aim", "anticipate", "believe", "intend", "plan" "estimate",

"expect" and words of similar meaning, include all matters that are

not historical facts and reflect the directors' beliefs and

expectations and involve a number of risks, uncertainties and

assumptions that could cause actual results and performance to

differ materially from any expected future results or performance

expressed or implied by the forward-looking statement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTGUGDLSBGBGCX

(END) Dow Jones Newswires

June 03, 2019 02:00 ET (06:00 GMT)

Dwf (LSE:DWF)

Historical Stock Chart

From Mar 2024 to Apr 2024

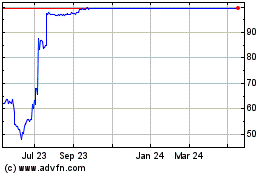

Dwf (LSE:DWF)

Historical Stock Chart

From Apr 2023 to Apr 2024