TIDMCWR

RNS Number : 2157A

Ceres Power Holdings plc

28 September 2020

Ceres Power Holdings plc

Interim Results for the 12 months ended 30 June 2020

strategic partnerships continue to deliver commercial GROWTH

Ceres Power Holdings plc ("Ceres Power", "Ceres", the "Company"

or the "Group") (AIM: CWR.L), a global leader in fuel cell and

electrochemical technology, announces its second set of interim

results for the 12 months ended 30 June 2020, following the change

of year end to 31 December.

Financial Highlights

* Strong progress on major contracts has driven a 21%

increase in revenue and other operating income to

GBP19.9m (2019: GBP16.4m)

* Increased gross profit of GBP13.8m (2019: GBP11.5m)

at sector leading gross margin of 73% (2019: 75%)

* Adjusted EBITDA loss increased slightly to GBP6.5m

(2019: GBP5.9m) due to further investment in growth

area of electrolysis for hydrogen

* Increased equity investment by Bosch and Weichai, of

GBP49m, supports strong cash and short-term

investments of GBP108m at 30 June 2020

* Order book* of GBP14m and strong pipeline* of GBP54m

as at 30 June 2020

Operating and Corporate Highlights

* Bosch has commenced manufacturing of Ceres' core cell

technology at its pilot facility in Germany

* Weichai 30kW range extender system for electric buses

targeting the Chinese market moving into field

trials. Some delays in timing due to Covid-19 means

establishment of a joint venture in China is now

likely to be H1 2021

* Wider deployment of the Group's combined heat and

power ("CHP") system in the Japanese market by Miura

Co.

* Hydrogen Electrolysis R&D delivering positive results

triggers further investment in the technology

* Successful development of Ceres' first zero-emission

CHP system designed for exclusive use with hydrogen

fuel

* 2MW advanced manufacturing pilot facility built,

commissioned and running in Redhill, UK

* Appointment of Warren Finegold as Chairman and Uwe

Glock and Qinggui Hao as Non-executive Directors

Covid-19

The disruption from Covid-19, coinciding with the commissioning

of our new facility at Redhill, has meant that some revenues

have been deferred from this reporting period. Nonetheless,

we have delivered a solid set of results, with continued revenue

growth through good progress with our customer programmes

and increased manufacturing output; a huge credit to the entire

Ceres team.

Phil Caldwell, CEO of Ceres Power commented:

"The urgency for climate action continues to drive the global

demand for clean energy technologies, and our strategy of licensing

to global partners, with a leading position in their products and

markets, continues to be highly successful. "Despite the disruption

from Covid we have delivered a solid set of results, with continued

revenue growth and sector leading margins. This is driven by good

progress with our customer programmes and increased manufacturing

output thanks to the hard work of the entire Ceres team.

"Trading since the period end has remained strong with good

commercial progress with our partners globally. Bosch has now

installed prototype products of its 10kW system utilising Ceres'

technology at five locations in Germany while, despite an initial

delay in the early part of 2020 due to the pandemic, good progress

is now being made to validate Ceres' technology for transportation

applications with Weichai's SOFC team in China.

"These developments, combined with the opportunities from our

new, long term growth areas of electrolysis for hydrogen, mean that

Ceres is very well positioned to build on the strong momentum

generated during the period as we look to play our part in

delivering clean energy technology to enable a net zero

future."

(*Order book refers to confirmed contracted revenue and other

income while pipeline is contracted revenue and other income which

management estimate is contingent upon options not under the

control of Ceres.)

Financial Summary: 12 months

ended 30 Year ended

June 2020 30 June 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- --------------

Total revenue and other operating income,

comprising: 19,942 16,365

Licence fees 5,841 7,412

Engineering services revenue and provision

of technology hardware 13,056 7,888

Other operating income 1,045 1,065

Gross margin % 73% 75%

Adjusted EBITDA loss (1) (6,519) (5,881)

Operating loss (10,081) (7,924)

Net cash used in operating activities (5,442) (3,058)

Net cash and short-term investments 107,981 71,267

1 Adjusted EBITDA loss is calculated as the operating loss for

the 12 months ended 30 June 2020 of GBP10,081k (2019 - GBP7,924k)

excluding depreciation charges of GBP2,683k (2019 - GBP1,025k),

share-based payment charges of GBP873k (2019 - GBP909k), unrealised

gains on forward contracts of GBP40k (2019 - GBP42k loss) and

exchange losses of GBP46k (2019 - GBP67k). Management believes that

adjusted EBITDA loss provides a better understanding of the

underlying performance of the Group by removing non-recurring,

irregular and one-off costs.

Analyst Presentation

Ceres Power Holdings plc will be hosting a live webcast for

analysts and investors today at 09.30 (GMT). A link to the webcast

will be made available on the Ceres website www.ceres.tech or can

be accessed directly here:

https://kvgo.com/IJLO/CERES_Interim_Results_2020

Conference Call:

To access the conference call, please use the following details

5-10 minutes prior to the start time:

Dial: +44 (0) 20 3003 2666

For further information please visit www.ceres.tech or

contact:

Ceres Power Holdings plc Tel: +44 (0)1403 273

Elizabeth Skerritt 463

Investec Bank PLC (NOMAD & Joint Tel: +44 (0)207 597 5970

Broker)

Jeremy Ellis / Patrick Robb / Ben

Griffiths

Berenberg (Joint Broker) Tel: +44 (0) 203 207

Ben Wright / Mark Whitmore 7800

Powerscourt (Financial PR) Tel: +44 (0) 20 7250

Peter Ogden / James White 1446

About Ceres Power

Ceres is a world-leading developer of fuel cell and electrochemical

technology that enables its partners to deliver clean energy

at scale and speed. Its asset-light, licensing model has seen

it embed its technology in some of the world's most progressive

companies - such as Weichai in China, Bosch in Germany, Miura

in Japan, and Doosan in South Korea - to develop systems and

products that address climate change and air quality challenges

for transportation, industry, data centres and everyday living.

Ceres is listed on the AIM market of the London Stock Exchange

("LSE") (AIM: CWR.L) and was awarded the Green Economy Mark

by the LSE, which recognises listed companies that derive more

than 50% of their revenues from the green economy.

Chief Executive's Statement

I am very proud of our continued progress in 2020 and the way

our people and the business as a whole have responded to the social

and economic shock of Covid-19. While employees' health and safety

remains our priority, the day-to-day challenges have only

highlighted the resilience and adaptability of our business and we

are focused on our purpose of developing clean energy technologies

that address climate change. We are convinced more than ever that

Ceres has the technology, the people and the capability to

commercialise technology that the world needs to realise a net zero

future. Hence, this year we are continuing to invest in our core

fuel cell business that helps to decarbonise power generation and

transportation, and also expanding into new areas such as

electrolysis for the production of hydrogen which are key to

decarbonise society.

Despite the challenging business environment, we continue to

deliver top line growth with revenue and other operating income up

21% to GBP19.9m (2019: GBP16.4m) reflecting strong progress in

major contracts and delivering sector leading gross margins of 73%

supported by our licensing business model. A f urther equity

injection of GBP49m from Bosch and Weichai since January has

supported a strong cash position of GBP108m at 30 June 2020, giving

us confidence to increase strategic investment in the business to

grow future value. We are pleased to have Bosch alongside Weichai

as commercial partners as well as significant strategic

investors.

It is testament to the talents and hard work of our teams, and

to the support of our partners and suppliers, that we have

continued to progress customer programmes and to ramp up

manufacturing output at our new Redhill facility, despite the

impact of Covid-19. We have reduced the number of people on site to

only those essential to maintain operations while those employees

who are able to do so continue to work remotely. We have not needed

to make use of the government furlough scheme and indeed we have

continued to recruit new employees throughout 2020 to meet the

increased demand for Ceres' technology. Notwithstanding current

restrictions on travel, we continue to find ways to work

effectively with commercial partners. There has been some impact on

the supply chain due to market disruption and the speed at which

Ceres and our customers are able to work. However, we are managing

these well and continue to monitor and remain responsive to the

changing dynamics of the situation.

If anything, the pandemic has brought into sharp focus the need

for strong and sustainable growth to drive the global recovery and

the EU and Germany have followed the lead of countries such as

Japan and South Korea in setting out ambitious targets around

hydrogen and fuel cell deployment. Ceres is well-placed, with a

scalable technology and strong commercial relationships in these

key markets, to deliver significant value over the coming months

and years.

Commercial

As at 30 June 2020 our order book stood at GBP14m and we had a

further GBP54m pipeline, being a combination of staged licensing

payments and engineering services. As an asset-light, licensing

business we have historically signed around one to two new licenses

per year with a blend of upfront license payments and engineering

revenues delivering strong gross margins.

Bosch

During the last 12 months, it has been very encouraging to see

Bosch's progress with the deployment and profiling of Ceres'

technology. Bosch has become the first partner to successfully

manufacture our core cell technology under licence and is now

manufacturing cells for its own stacks and systems in Germany. We

view Bosch's decision to increase its investment in Ceres in

January 2020, from 4% to 18% of the enlarged issued share capital,

as a strong signal of its intention to move towards future scale up

to high volume manufacture of the SteelCell(R).

Bosch started trialling its 10kW units in 2020 and in July this

year officially opened a fuel cell power installation, consisting

of three solid oxide fuel cell (SOFC) devices utilising Ceres'

technology, to meet most of the energy requirements of one of the

buildings at Bosch's Wernau training centre in Germany. Additional

SOFC pilot schemes for testing and validation are located at other

Bosch locations in Germany. Bosch has stated its intention that the

Group's locations will no longer leave a carbon footprint worldwide

from 2020.

The 10kW Bosch 'power station', based on two 5kW SteelCell(R)

stacks, was showcased to more than 10,000 attendees at Bosch

Connected World in February 2020. The 10kW unit, which can operate

biogas or natural gas and blends of hydrogen, provides a technology

that is highly complementary to today's energy infrastructure, is

hydrogen ready for the future, and can form a critical building

block of a future zero carbon economy. In April, Bosch announced

that it anticipates the market for the fuel cell power stations to

be worth more than 20 billion euros by 2030.

In June, we were pleased to announce the appointment of Mr. Uwe

Glock as a Non-Executive Director on the Board of Ceres. Mr. Glock

is Chairman of the Board of Management of Bosch Thermotechnik GmbH

and brings over 35 years of experience from across Bosch Mobility

Solutions and Energy and Building Technology - Worcester Bosch in

the UK is part of the Bosch Thermotechnik division. His appointment

increases Ceres' exposure to the Bosch organisation and brings

significant value through Mr. Glock's leading role in the wider

German and European energy and building industry.

Weichai

Having successfully developed a world-first 30kW solid oxide

fuel cell ("SOFC") prototype range extender for electric city buses

running on compressed natural gas, the team moved on to the second

iteration of the design at the end of 2019. This is currently being

built into a fleet of five buses which are undergoing trials in

China. There were some delays to the project in the early part of

2020 due to the pandemic which will delay completion of these

trials by up to six months, but Weichai's SOFC team with support

from Ceres has been back at full capacity for some time and good

progress is now being made to validate the Ceres technology for

automotive applications.

The delay in completing these trials means there will be some

impact to the timing of the establishment of a fuel cell

manufacturing company in Shandong Province, China, to manufacture

SteelCell(R) SOFC systems. As previously disclosed, the joint

venture is intended to provide a staged path to high volume

manufacturing potentially for buses, commercial vehicles and other

markets in China.

Following the decision in January 2020 by Bosch to increase its

stake in Ceres to 18%, Ceres viewed it very positively that Weichai

exercised its own non-dilution rights and has invested a further

GBP11 million to maintain its equity stake at 20%. We have also

welcomed a new Weichai representative to the Board of Ceres, the

Investment Director of Weichai Power's parent company Shandong

Heavy Industry Group Co., Ltd., Mr. Qinggui Hao.

Doosan

In July 2019, Ceres signed a collaboration and licensing

agreement with Doosan, to jointly develop SOFC distributed power

systems, initially targeting the South Korean commercial building

market. The agreement, worth GBP8 million over two years, includes

licensing, technology transfer and engineering services to develop

a low carbon 5-20kW power system.

South Korea is an important market for Ceres and Doosan boasts

the number one position in the stationary fuel cell market

globally. We are looking to expand our collaboration with them to

access broader applications within South Korea and internationally.

South Korea benefits from extremely progressive regulation and

targets that encourage the deployment of hydrogen and fuel cell

technology.

Miura

Following a successful initial market launch of its combined

heat and power (CHP) product using Ceres' technology in October

2019, Miura has since announced the establishment of a specialist

maintenance team to support its wider deployment in the Japanese

market. The system, which is aimed at the commercial building

sector, operates on the mains gas supply and captures heat as hot

water with an overall efficiency of up to 90%, delivering both

major energy savings and a lower carbon footprint. Its long-term

deployment will be supported through specialist maintenance teams

in metropolitan areas such as Tokyo, Osaka, Nagoya and Fukuoka, to

enable quick and quality service to customers. We continue to

provide low volumes of stacks to Miura for its commercial product

and first products have been running successfully for over a

year.

Others

We continue to make good progress with other partners including

continuing our collaboration with Honda and will provide further

updates as they progress. We are also close to successfully

completing our joint development with Cummins and the US DoE of a

10 kW SOFC power system which is undergoing final testing in the

USA. However, there are no plans for further collaboration with

Cummins at this time.

In order to grow our business at pace we are intending to form a

strategic relationship with a global engineering consultancy with

engineering services and business development capability, which can

enable further opportunities for the Ceres technology in a variety

of applications globally. We believe partnering in this way will

increase Ceres' ability to scale the business and to enhance the

long-term value created from our licensing model.

Manufacturing

Having successfully completed the build of the new advanced

manufacturing facility in Redhill in January 2020, the production

ramp up was impacted by the timing of Covid-19. A reduced team

remained onsite throughout the period and continued to deliver fuel

cells to support our customers globally. From early May the full

onsite team returned, delivering an outstanding effort to ramp up

cell manufacturing output, with record production achieved in June.

Further investment in manufacturing capacity is underway at Ceres'

R edhill facility which will increase annual production capacity

from 2MW to 3MW in 2021.

This facility is a key asset for Ceres in enabling technology

transfer of our advanced manufacturing processes and know-how to

licensee partners as well as delivering near term volume to

customer programmes.

A great example of this was the successful technology transfer

to Bosch earlier this year. This was made possible through the

close working relationship between the Ceres and Bosch

manufacturing teams first in the UK at our new facility at Redhill

and then transferring this knowledge to Bosch in establishing its

parallel pilot manufacturing plant in Germany, which successfully

started production in Q1 this year. This was a key milestone for

both companies as it is the first time a third-party partner has

manufactured Ceres cell and stack technology under license.

Technology

Fuel cells

As a licensing company, it is imperative that Ceres remains at

the leading-edge of its unique solid oxide fuel cell technology,

continually maturing existing products and furthering R&D into

new applications for customers.

At the beginning of the year, we announced further investment in

the development of higher power systems, and the associated

investment in capital for test capability, to meet increased

customer demand for high power applications moving from 30kW to

100s of kW in the next few years.

We also continue to focus R&D spend on improving our

competitive advantage in power density, cost and product lifetime

and remain on track to release the next generation (V6) of our core

technology in 2021.

In November 2019, Ceres announced the successful development of

its first zero-emission combined heat & power (CHP) system,

designed exclusively for use with hydrogen fuel. In initial

testing, the system has achieved greater than 50% electrical

efficiency, with an overall efficiency of 90% achievable in

combined heat & power mode. Ceres' hydrogen CHP is simpler than

its existing fuel-flexible system, delivering an equivalent

performance with fewer components, a reduced size and up to a 40%

unit cost reduction.

Electrolysis

Over the past 18 months there has been significant momentum

around the potential for hydrogen and Ceres believes its extremely

efficient solid oxide technology has a crucial part to play in a

future clean energy economy. Today, around 80% of the cost of

producing green hydrogen, that is hydrogen generated from splitting

water with renewable sources of electricity, is the cost of input

electricity. Ceres believes its unique solid oxide electrochemical

technology can deliver tangible value - through the same advantages

of robustness, cost, and crucially efficiency, that make it a

leader in fuel cells.

In January, we announced that early stage testing on the

application of Ceres' technology as a solid oxide electrolyser

(SOEC), essentially the process of reversing fuel cells to produce

hydrogen and e-fuels from renewable energy, has delivered

encouraging results. We believe that it could deliver significant

future business opportunities for Ceres and in July, we announced

further R&D investment of GBP5 million in the period to 2021 to

develop the deployment of our SOEC technology for hydrogen.

Ceres has a credible path to participate, not only in delivering

hydrogen at scale but, also due to the characteristics of higher

temperature electrolysers, in utilising waste heat making this

technology particularly useful in decarbonising industrial

processes such as steel and refineries. Over a quarter of the

patents on Ceres' core technology apply equally to its use in SOEC

and we have existing manufacturing and test capability that can be

deployed to progress SOEC stacks as well as a leading team of

electrochemical scientists with over a decade of intimate working

knowledge of Ceres' technology. We look forward to providing

updates on our progress in due course.

Financial

Following the extension of the Group's accounting period to the

18 months ended 31 December 2020, these interim financial

statements are the second set of interim results that the Group has

reported in this period.

The business continues to achieve solid commercial growth and we

delivered revenue and other income in the 12 months to June 2020 of

GBP19.9m, up from GBP16.4m in the previous year. The Group

delivered an increased gross profit of GBP13.8m (2019: GBP11.5m) at

a gross margin of 73% (2019: 75%). The gross margin achieved

depends primarily on the mix between licence fees and engineering

services, and we continue to anticipate that this mix will vary

going forwards, based on deal flow.

Adjusted EBITDA loss of (GBP6.5m) increased from the prior year

(GBP5.9m), reflecting the higher gross profit offset by continued

investment in additional resources to support the company's growth.

Operating loss increased from GBP7.9m to GBP10.1m reflecting the

movement in adjusted EBITDA loss as well as increased depreciation,

as the new manufacturing plant came onstream during the period.

Loss after tax increased to (GBP7.3m), from (GBP4.8m), broadly

mirroring the change in operating loss. The tax credit of GBP2.4m

(2019: GBP2.5m) includes a Research and Development tax credit

("R&D tax credit") of GBP2.4m which we received in early 2020

and is presented net of withholding tax suffered on foreign

revenues of GBP0.2m.

Net cash used in operating activities (GBP5.4m) increased from

the prior year (GBP3.1m) primarily reflecting the movement in

EBITDA loss and movements in working capital. During the 12-month

period we invested GBP5.6m in capex (2019: GBP7.7m), mainly

relating to enhancing our manufacturing facility. We also invested

GBP2.5m (2019: GBP1.3m) in intangible assets, primarily in respect

of development costs, which we capitalised reflecting our

confidence in the commercialisation potential of the technology. As

a result, equity-free cash outflow(1) was (GBP13.4m) (2019:

(GBP11.9m)).

Following the Group's adoption of IFRS 16 from 1 July 2019,

right-of-use assets of GBP4.2m (2019: GBPnil) have been recognised

as at 30 June 2020, relating to lease liabilities of GBP4.8m,

primarily relating to leases of premises. Net contract assets and

liabilities increased to GBP4.3m (2019: GBP3.2m) primarily due to

timing differences between raising invoices and recognising revenue

on the Group's long-term contracts.

The Group is well-financed, holding GBP108m of cash, cash

equivalents and short-term investments at 30 June 2020 (at 30 June

2019: GBP71m). During the last 12 months, our strategic partners

Bosch and Weichai invested GBP49m of new equity shares in Ceres,

through the issue of 15.4 million new ordinary shares, reinforcing

our existing strong financial position.

(1) Equity-free cash flow is defined as the net change in cash

and cash equivalents in the relevant period less net cash generated

from financing activities plus the movement in short-term

reserves.

Principal risks and uncertainties

There are a number of risks and uncertainties that have the

potential to impact the execution of the Group's strategy, as well

as its short-term results. The Board regularly reviews the risks

facing the Group and these risks are set out in the Annual Report

along with mitigations to reduce the likelihood of them occurring

and to manage any possible impact. The Directors consider the

following risks have emerged or changed since the publication of

the 2019 Annual Report.

Covid-19 has emerged and remains a risk to future manufacturing

output and the timing of partner programmes principally if in the

future our people are not able to access our facilities or our

supply chain is disrupted. So far, we have put mitigations in place

which have limited any impact to our operations and we have managed

the impact on the Group's results for the 12 months ended 30 June

2020 to be relatively small. The risk of a hard Brexit remains and

the potential impact to the business is disruption to supply chain

and shipments around the end of 2020. We are mitigating this by

increasing inventory levels.

An increasing operational risk is that, given recent commercial

progress, the Group may be unable to support the scale up of

production in our licence partners through supply chain issues,

short term supply of stacks or the ability to access key skills and

resources. The Company is mitigating these risks by near term

expansion of its manufacturing capacity, bringing on new employees

ahead of demand and working closely with suppliers. As we progress

to mass manufacture, the financial and reputational impact of any

issues with product performance at scale are also increasing and we

are putting significant focus on product design and maturity.

Similarly, as our technology becomes available in multiple

applications and geographies there is an increased risk of IP loss

or infringement and we are continuing to increase the protection of

our IP.

Finally, due to our significant cash reserves following the

recent equity investments from our strategic partners, the risk of

access to capital is considered to have further reduced as our need

for further capital has fallen. This strong financial position,

combined with a review of stress-tested cashflow forecasts, provide

the Directors with confidence supporting the Group's continued

ability to operate as a going concern for the foreseeable

future.

Strategy and Outlook

The urgency for climate action continues to drive the global

demand for clean and flexible sources of energy. Leading power

system and engineering companies are increasing their investments

in new and complementary technologies to orientate their businesses

towards this purpose. Ceres' strategy of focusing on these

blue-chip OEMs, with a leading position in their products and

markets, has been highly successful and we continue to build on

strong foundations established in Japan, South Korea, Germany and

China.

The past 12 months has provided important validation of Ceres'

asset-light, licensing model in power generation. We have assembled

one of the world's best teams of engineers and scientists working

in solid oxide technology, which has allowed us to grow our

portfolio of global licensees and applications.

In tandem, we are committed to adapting our technology for

further and future applications and at the beginning of the year we

announced our initial plan to position the business to include

electrolysis. More bullish reports from the Hydrogen Council

estimate the market for hydrogen could reach $2.5 trillion by 2050.

We believe that the Ceres' SteelCell(R), when used as an SOEC,

could deliver significant future value for Ceres and we are

beginning to invest to ensure we are well-positioned to capitalise

on these opportunities.

In the period, we have invested in our organisational structure,

research and development activities and in the expansion of pilot

manufacturing at Redhill. We see a clear path to mass

commercialisation of our fuel cell technology with our partners,

and with over GBP100 million of cash reserves available we have the

financial strength to deploy our technology in further applications

and geographies.

Despite the current turmoil in the global economy, Ceres has

delivered a strong performance in the last 12 months and continued

positive trading gives us significant optimism for the outlook and

future success of the business. We are proud to be a UK high growth

clean technology business and view our purpose, to deliver clean

energy for a clean world, as being closely aligned with momentum

around the green recovery and as a path to deliver value to our

shareholders, our employees and customers, and to the benefit of

society as a whole.

Philip Caldwell

Chief Executive Officer

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME

For the 12 months ended 30 June 2020

12 months

ended Year ended

30 June 30 June

2020 (Unaudited) 2019 (Audited)

Note GBP'000 GBP'000

Revenue 3 18,897 15,300

Cost of sales (5,095) (3,804)

Gross profit 13,802 11,496

Other operating income (1) 1,045 1,065

Operating costs 4 (24,928) (20,485)

Operating loss (10,081) (7,924)

Finance income 5 846 552

Finance expense (451) -

Loss before taxation (9,686) (7,372)

Taxation credit 6 2,418 2,538

Loss for the financial period/year

and total comprehensive loss (7,268) (4,834)

================== ================

Loss per GBP0.10 ordinary share

expressed in pence per share:

Basic and diluted loss per share 7 (4.60)p (3.43)p

The accompanying notes are an integral part of these

consolidated financial statements.

(1) (Other operating income relates to grant income.)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2020

30 June 30 June

2020 (Unaudited) 2019 (Audited)

Note GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 8 12,970 9,769

Right-of-use assets 9 4,232 -

Intangible assets 10 3,800 1,322

Other receivables 12 741 741

Total non-current assets 21,743 11,832

Current assets

Inventories 11 2,055 1,403

Contract assets 3 1,821 722

Trade and other receivables 12 4,643 4,204

Prepayments and accrued income 13 987 1,497

Derivative financial instrument 2 28

Current tax receivable 6 2,450 2,292

Short-term investments 14 90,782 63,700

Cash and cash equivalents 14 17,199 7,567

------------------ ----------------

Total current assets 119,939 81,413

Liabilities

Current liabilities

Trade and other payables 15 (2,560) (2,365)

Contract liabilities 3 (1,014) (3,061)

Accruals and deferred income 16 (3,667) (1,838)

Lease liabilities 17 (1,026) -

Derivative financial instrument (1) (66)

Provisions 18 (308) (158)

Total current liabilities (8,576) (7,488)

------------------ ----------------

Net current assets 111,363 73,925

Non-current liabilities

Accruals and deferred income - (323)

Lease liabilities 17 (3,823) -

Provisions 18 (1,117) (992)

Total non-current liabilities (4,940) (1,315)

Net assets 128,166 84,442

================== ================

Equity attributable to the owners

of the parent

Share capital 19 17,082 15,277

Share premium 227,430 179,116

Capital redemption reserve 3,449 3,449

Merger reserve 7,463 7,463

Accumulated losses (127,258) (120,863)

Total equity 128,166 84,442

================== ================

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED CASH FLOW STATEMENT

For the 12 months ended 30 June 2020

Note 12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

-------------

Cash flows from operating activities

Loss before taxation (9,686) (7,372)

Adjustments for:

Finance income (846) (552)

Finance expense 451 -

Depreciation of property, plant

and equipment 2,167 1,025

Depreciation of right-of-use assets 515 -

Amortisation of intangible assets 55 13

Share-based payments charge 873 909

Net foreign exchange (gains)/losses 46 67

Net change in fair value of financial

instruments at fair value through

profit and loss (40) 42

------------- -----------

Operating cash flows before movements

in working capital (6,465) (5,868)

Increase in trade and other receivables (492) (1,412)

Increase in inventories (652) (3)

Increase/(decrease) in trade and

other payables 2,578 (559)

Increase in contract assets (1,099) (722)

(Decrease)/increase in contract

liabilities (2,047) 3,061

Increase in provisions 275 299

------------- -----------

Net cash used in operations (7,902) (5,204)

------------- -----------

Taxation received 2,460 2,146

------------- -----------

Net cash used in operating activities (5,442) (3,058)

------------- -----------

Investing activities

Purchase of property, plant and

equipment (5,554) (7,693)

Investment in intangible assets (2,533) (1,288)

Increase in short-term investments (27,082) (63,700)

Finance income received 743 193

Net cash used in investing activities (34,426) (72,488)

------------- -----------

Financing activities

Proceeds from issuance of ordinary

shares 50,462 77,926

Net expenses from issuance of

ordinary shares (344) (1,141)

Repayment of lease liabilities (121) -

Finance interest paid (451) -

Net cash generated from financing

activities 49,546 76,785

Net increase in cash and cash

equivalents 9,678 1,239

Exchange gains/(losses) on cash

and cash equivalents (46) (67)

Cash and cash equivalents at beginning

of period/ year 7,567 6,395

------------- -----------

Cash and cash equivalents at end

of period/ year 14 17,199 7,567

============= ===========

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 12 months ended 30 June 2020

Capital

Share Share redemption Merger Accumulated

capital premium reserve reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- ------------ --------- ------------ --------

At 1 July 2018 10,163 107,445 3,449 7,463 (116,938) 11,582

Comprehensive

income

Loss for the

financial year - - - - (4,834) (4,834)

Total comprehensive

loss - - - - (4,834) (4,834)

--------- --------- ------------ --------- ------------ --------

Transactions

with owners

Issue of shares,

net of costs 5,114 71,671 - - - 76,785

Share-based

payments charge - - - - 909 909

------------

Total transactions

with owners 5,114 71,671 - - 909 77,694

--------- --------- ------------ --------- ------------ --------

At 30 June 2019 15,277 179,116 3,449 7,463 (120,863) 84,442

--------- --------- ------------ --------- ------------ --------

Comprehensive

income

Loss for the

financial period - - - - (7,268) (7,268)

Total comprehensive

loss - - - - (7,268) (7,268)

Transactions

with owners

Issue of shares,

net of costs 1,805 48,314 - - - 50,119

Share-based

payments charge - - - - 873 873

Total transactions

with owners 1,805 48,314 - - 873 50,992

--------- --------- ------------ --------- ------------ --------

At 30 June 2020 17,082 227,430 3,449 7,463 (127,258) 128,166

========= ========= ============ ========= ============ ========

The accompanying notes are an integral part of these

consolidated financial statements.

1. Basis of preparation

On 2 April 2020, the Group announced that it was extending its

current accounting period from the twelve months ended 30 June 2020

to the 18 months ended 30 December 2020. As a result, these interim

financial statements are the second set of interim results that the

Group has reported during this period, following the half-year

report for the six months ended 31 December 2019 that the Group

announced on 16 March 2020.

The condensed interim financial statements have been prepared in

accordance with the requirements of the AIM Rules for Companies and

should be read in conjunction with the annual financial statements

for the year ended 30 June 2019. They have been prepared on a

historical cost basis except that the following assets and

liabilities are stated at their fair value: derivative financial

instruments and financial instruments classified as fair value

through the profit or loss.

The interim financial information has been prepared in

accordance with the recognition and measurement requirements of

International Financial Reporting Standards (IFRS) and IFRIC

interpretations issued by the International Accounting Standards

Board (IASB) adopted by the European Union. This report is not

prepared in accordance with IAS 34.

The principal accounting policies adopted in the preparation of

the interim financial statements are unchanged from those applied

in the Group's financial statements for the year ended 31 December

2019. The accounting policies applied are consistent with those

expected to be applied in the financial statements for the year

ended 31 December 2020.

The financial information contained in the condensed interim

financial statements is unaudited and does not constitute statutory

financial statements as defined by in Section 434 of the Companies

Act 2006. The financial statements for the year ended 30 June 2019,

on which the auditors gave an unqualified audit opinion, and did

not draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006, have been filed with the Registrar of Companies.

The consolidated interim financial information for the twelve

months ended 30 June 2020 has been reviewed by the Company's

Auditor, BDO LLP in accordance with International Standard of

Review Engagements 2410, Review of Interim Financial Information

Performed by the Independent Auditor of the Entity.

Going Concern

The Group has reported a loss after tax for the 12 month period

ended 30 June 2020 of GBP7,268,000 and net cash used in operating

activities of GBP5,442,000. At 30 June 2020, it held cash and cash

equivalents and short-term investments of GBP107,981,000. The

directors have prepared annual budgets and cash flow projections

that extend beyond 12 months from the date of approval of this

report. These projections were supported by stress testing forecast

cash flows considering the impact of different scenarios including

the Group's expectation of the potential future impact of Covid-19

and Brexit. In each case the projections demonstrated that the

Group will have sufficient cash reserves to meet its liabilities as

they fall due and to continue as a going concern. For the above

reasons, the directors continue to adopt the going concern basis in

preparing the financial statements. The financial statements do not

include the adjustments that would result if the Group was unable

to continue as a going concern .

2. Changes in accounting policies and standards

Except as described below the accounting policies adopted are

consistent with those of the financial statements for the year

ended 30 June 2019, as described in those financial statements.

New standards and amendments applicable as of 1 July 2019

The Group has adopted the following new standard with a date of

initial application of 1 July 2019.

-- IFRS 16 'Leases'

IFRS 16 - 'Leases'

IFRS16 specifies how to recognise, measure, present and disclose

leases. The standard provides a single lessee accounting model,

requiring lessees to recognise assets and liabilities for all

leases unless the lease term is 12 months or less or the underlying

asset has a low value. The adoption of this standard is mandatory

for accounting periods starting after 1 January 2019.

The Group has applied IFRS 16 using the modified retrospective

approach and therefore the comparative information has not been

restated and continues to be reported under IAS 17 and IFRIC

14.

2. Changes in accounting policies and standards (continued)

The group holds leases for premises and IT equipment with lease

terms ranging from 6 months - 10 years.

As a lessee, the Group previously classified leases as operating

or finance leases based on its own assessment of whether the lease

transferred significantly all the risks and rewards incidental to

ownership of the underlying asset to the Group. Under IFRS 16, the

Group recognises right-of-use assets and lease liabilities for most

leases. i.e. these leases are on balance sheet.

The Group decided to apply recognition exemptions to short term

leased plant and machinery. For leases of other assets, which were

classified as operating under IAS 17, the Group has recognised

right-of use assets and lease liabilities.

Leases classified as operating leases under IAS 17

At transition, lease liabilities were measured at the present

value of the remaining lease payments discounted at the Group's

incremental borrowing rate as at 1 July 2019. The associated

right-of-use asset for property leases and other assets was

measured at the amount equal to the lease liability adjusted for

the amount of any prepaid or accrued lease payments relating to

that lease.

The Group used the following practical expedients when applying

IFRS 16 to leases previously classified as operating leases under

IAS 17:

- Applied a single discount rate to a portfolio of leases with similar characteristics; and

- Excluded initial direct costs from measuring the right-of-use

asset at the date of initial application.

When measuring lease liabilities, the Group discounted lease

payments using the incremental borrowing rate as at the 1 July

2019. This is estimated by management to be 10%.

Impact on the financial statements.

On transition to IFRS 16 the Group recognised GBP4,747,000 of

right-to-use assets and a lease liability of GBP4,971,000.

Prepayments and accruals were decreased by GBP122,000 and

GBP346,000 respectively.

As at 30 June 2020 the Group held right-of use assets of

GBP4,232,000 and a lease liability of GBP4,849,000 (GBP3,823,000 of

which is non-current). The impact on the consolidated statement of

profit and loss and other comprehensive income for the 12 months

ended 30 June 2020 was an increase to the loss for the financial

period of GBP143,000. Operating costs were decreased by GBP308,000,

relating to additional charges of GBP515,000 for depreciation and a

reduction to rental charges on operating leases of GBP823,000.

Finance expenses of GBP451,000 were incurred during the period.

Reconciliation of lease commitments in the prior year to lease

liability recognised under IFRS 16

Land

and

Buildings Other

GBP'000 GBP'000

----------- --------

Operating lease commitments

at 30 June 2019 as disclosed

in the Group's consolidated

financial statements 3,812 29

Recognition of period from 3,469 -

break clause to lease end(1)

Discounted using the incremental

borrowing rate at 1 July

2019 (2,328) (2)

Less short-term leases recognised

as an expense on a straight-line

basis - (9)

----------- --------

Lease liabilities recognised

1 July 2019 4,953 18

(1) Under the previous accounting policy the lease commitment

was disclosed for the non-cancellable element of the lease, that

is, until the first break clause. IFRS 16 requires companies to

calculate the initial liability on the full lease term, if it is

considered to be reasonably certain the break will not be

exercised.

3. Revenue

The Group's revenue is disaggregated by geographical market,

major product/service lines, and timing of revenue recognition:

Geographical market

12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

-------------

Europe 8,438 10,553

Asia 9,669 4,441

North America 790 306

------------- -----------

18,897 15,300

------------- -----------

Major product/service lines

12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- -----------

Engineering services and provision

of technology hardware 13,056 7,888

Licenses 5,841 7,412

-----------

18,897 15,300

------------- -----------

Timing of transfer of goods and services

12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- -----------

Products and services transferred

at a point in time 6,600 7,057

Products and services transferred

over time 12,267 8,243

-----------

18,897 15,300

------------- -----------

The contract assets and liabilities are as follows:

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- -----------

Trade receivables 12 3,787 2,404

Contract assets - accrued income 1,559 306

Contract assets - deferred costs 262 416

-----------

5,608 3,126

------------- -----------

Contract liabilities - deferred

income (1,014) (3,061)

Provision for loss making contracts (86) (65)

Provision for warranties (222) (93)

-----------

(4,286) (3,219)

------------- -----------

4. Operating costs

Operating costs are split as follows:

12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- -----------

Research and development costs 16,754 13,799

Administrative expenses 6,529 4,618

Commercial 1,645 2,068

-----------

24,928 20,485

------------- -----------

5. Finance income

12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- -----------

Interest received 646 552

Foreign exchange gain on cash,

cash equivalents and short-term

deposits 200 -

846 552

------------- -----------

6.Taxation

12 months

ended

Year ended

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

------------- -----------

UK corporation tax (2,450) (2,292)

Adjustment in respect of prior periods (168) (246)

Withholding tax 200 -

-----------

(2,418) (2,538)

------------- -----------

No UK corporation tax liability has arisen (2019: GBPnil) due to

the losses incurred.

A tax credit has arisen as a result of expenditure surrendered

and claimed under the SME and large company R & D tax credit

regimes in the current and prior years.

Withholding tax has arisen on license income from China and

South Korea.

7. Loss per share

12 months

ended

Year ended

30 June

30 June 2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

--------------- ------------

Loss for the financial period/year

attributable to shareholders (7,268) (4,834)

--------------- ------------

Weighted average number of shares

in issue 158,072,531 140,956,490

--------------- ------------

Loss per GBP0.10 ordinary share

(basic and diluted) (4.60)p (3.43)p

8. Property, plant and equipment

Assets

Leasehold Plant Computer Fixtures under Motor

improvements and machinery equipment and fittings construction vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- --------------- ----------- -------------- ---------------- ---------- ---------

Cost

At 1 July 2018

(audited) 2,090 9,311 995 69 348 - 12,813

Additions

(audited) 132 1,535 463 - 6,455 12 8,597

------------- --------------- ----------- -------------- ---------------- ---------- ---------

At 30 June 2019

(audited) 2,222 10,846 1,458 69 6,803 12 21,410

Additions

(unaudited) 542 3,318 320 34 1,154 - 5,368

Transfers

(unaudited) 2,958 4,659 - 210 (7,827) - -

Disposals

(unaudited) (5) - - - - - (5)

------------- --------------- ----------- -------------- ---------------- ---------- ---------

At 30 June 2020

(unaudited) 5,717 18,823 1,778 313 130 12 26,773

------------- --------------- ----------- -------------- ---------------- ---------- ---------

Accumulated

depreciation

At 1 July 2018

(audited) 2,028 7,680 839 69 - - 10,616

Charge for the

year

(audited) 68 798 159 - - - 1,025

------------- --------------- ----------- -------------- ---------------- ---------- ---------

At 30 June 2019

(audited) 2,096 8,478 998 69 - - 11,641

Charge for the

period

(unaudited) 375 1,520 227 42 - 3 2,167

Disposals

(unaudited) (5) - - - - - (5)

------------- --------------- ----------- -------------- ---------------- ---------- ---------

At 30 June 2020

(unaudited) 2,466 9,998 1,225 111 - 3 13,803

------------- --------------- ----------- -------------- ---------------- ---------- ---------

Net book value

------------- --------------- ----------- -------------- ---------------- ---------- ---------

At 30 June 2020

(unaudited) 3,251 8,825 553 202 130 9 12,970

At 30 June 2019

(audited) 126 2,368 460 - 6,803 12 9,769

------------- --------------- ----------- -------------- ---------------- ---------- ---------

'Assets under construction' represents the cost of purchasing,

constructing and installing property, plant and equipment ahead of

their productive use. The category is temporary, pending completion

of the assets and their transfer to the appropriate and permanent

category of property, plant and equipment. As such, no depreciation

is charged on assets under construction.

Assets under construction primarily consist of plant and

machinery and leasehold improvements relating to the new

manufacturing site which started production in January 2020.

Leasehold improvements of GBP2,958k, Plant and Machinery of

GBP4,659k and Office equipment of GBP210k relating to the new

factory have been transferred to the relevant categories within the

period. Leasehold improvements are being depreciated over the life

of the lease and other assets relating to the factory are being

depreciated over the expected useful life of 7 years.

9. Right of use assets

Land and Computer

Buildings equipment Total

(Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

------------- ------------- -------------

Cost

At 1 July 2019 - - -

Additions as a result of IFRS16 4,728 19 4,747

------------- ------------- -------------

At 30 June 2020 4,728 19 4,747

Accumulated depreciation

At 1 July 2019 - - -

Charge for the period/ year 507 8 515

------------- ------------- -------------

At 30 June 2020 507 8 515

Net book value

------------- ------------- -------------

At 30 June 2020 4,221 11 4,232

At 30 June 2019 - - -

------------- ------------- -------------

10. Intangible assets

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

-------------- ------------

Cost

At 1 July 1,335 47

Additions from internal developments

in relation to manufacturing site 178 187

Additions from customer and internal

development programmes 2,355 1,101

--------------

At 30 June 3,868 1,335

-------------- ------------

Accumulated amortisation

At 1 July 13 -

Charge for the period/year 55 13

-------------- ------------

At 30 June 68 13

-------------- ------------

Net book value

-------------- ------------

At 30 June 3,800 1,322

-------------- ------------

Capitalised development costs are amortised over their useful

economic lives of 2-7 years.

The development intangible primarily relates to the design,

development and configuration of the Company's core fuel cell and

system technology and manufacturing processes. Amortisation of

capitalised development commences once the development is complete

and is available for use.

11. Inventory

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

-------------- ------------

Raw materials and finished goods 2,055 1,403

-------------- ------------

Inventories in raw materials and finished goods have increased

in line with the Group's increased manufacturing capacity in the

period and management's decision to hold a greater volume of some

raw materials as the UK moves closer to a withdrawal from the

EU.

12. Trade and other receivables

30 June 30 June

2020 2019

(Unaudited) (Audited)

Current: GBP'000 GBP'000

-------------- ------------

Trade receivables 3,787 2,404

Other receivables 856 1,800

-------------- ------------

4,643 4,204

-------------- ------------

Non-current:

Other receivables 741 741

-------------- ------------

13. Prepayments and accrued income

30 June 30 June

2020 2019

(Unaudited) (Audited)

Current: GBP'000 GBP'000

-------------- ------------

Prepayments 548 523

Prepayments of capital expenditure - 409

Accrued grant income 439 565

-------------- ------------

987 1,497

-------------- ------------

14. Net cash and cash equivalents, short-term investments and

financial assets

30 June 30 June

2020 2019

(Unaudited) (Audited)

GBP'000 GBP'000

-------------- ------------

Cash at bank and in hand 5,431 1,502

Money market funds 11,768 6,065

-------------- ------------

Cash and cash equivalents 17,199 7,567

Short-term investments (bank deposits

> 3 months) 90,782 63,700

-------------- ------------

Short-term investments 107,981 71,267

-------------- ------------

The Group typically places surplus funds into pooled money

market funds with durations of up to 3 months and bank deposits

with durations of up to 12 months. The Group's treasury policy

restricts investments in short-term sterling money market funds to

those which carry short-term credit ratings of at least two of AAAm

(Standard & Poor's), Aaa/MR1+ (Moody's) and AAA V1+ (Fitch) and

deposits with banks with minimum long-term rating of A-/A3/A and

short-term rating of A-2/P-2/F-1 for banks which the UK Government

holds less than 10% ordinary equity.

15. Trade and other payables

30 June 30 June

2020 2019

(Unaudited) (Audited)

Current: GBP'000 GBP'000

-------------- ------------

Trade payables 2,332 2,255

Taxation and social security 16 -

Other payables 212 110

-------------- ------------

2,560 2,365

-------------- ------------

16. Accruals and deferred income

30 June 30 June

2020 2019

(Unaudited) (Audited)

Current: GBP'000 GBP'000

-------------- ------------

Accruals 2,546 1,838

Deferred grant income 1,121 -

-------------- ------------

3,667 1,838

-------------- ------------

Non-current:

Accruals - 323

-------------- ------------

17. Lease Liabilities

GBP'000

--------

Balance as at 1 July 2019 -

Finance leases recognised as a result

of IFRS16 4,971

Lease payments (573)

Interest expense 451

Balance as at 30 June 2020 4,849

Current 1,026

Non-current 3,823

--------

18. Provisions

Property Contract

Dilapidations Warranties Losses Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- ----------- --------

At 1 July 2019 992 93 65 1,150

Movements in the Consolidated

Statement of Profit and Loss

and Other Comprehensive income:

Unused amounts reversed - - (38) (38)

Increase in provision 125 129 59 313

--------------- ------------- ----------- --------

At 30 June 2020 1,117 222 86 1,425

Current - 222 86 308

Non-current 1,117 - - 1,117

--------------- ------------- ----------- --------

At 30 June 2020 1,117 222 86 1,425

--------------- ------------- ----------- --------

19. Share capital

2020 2019

--------------------------- -------------------------------------------

Number Number Number

of GBP0.10 of GBP0.01 of GBP0.10

Ordinary (Unaudited) Ordinary Ordinary (Audited)

shares GBP'000 shares shares GBP'000

------------ ------------- ---------------- ------------ -----------

Allotted and fully paid

At 1 July 152,769,812 15,277 1,016,269,193 - 10,163

Allotted GBP0.01 Ordinary

shares on exercise of share

options - - 6,041,441 - 60

27 July 2018 - Allotted

GBP0.01 Ordinary shares

on cash placing - - 260,952,296 - 2,609

7 August 2018 - 1-for-10

share consolidation - - (1,283,262,930) 128,326,293 -

Allotted GBP0.10 Ordinary

shares on exercise of employee

share options 2,668,580 267 - 926,155 93

Allotted GBP0.10 Ordinary

shares on cash placing

(see below) 15,377,050 1,538 - 23,517,364 2,352

------------ ------------- ---------------- ------------ -----------

At 30 June 170,815,442 17,082 - 152,769,812 15,277

------------ ------------- ---------------- ------------ -----------

During the period 2,668,580 ordinary GBP0.10 shares were

allotted for cash consideration of GBP1,255,791 on the exercise of

employee share options. On the 12 March 2020, the Company completed

an allotment of 11,888,070 ordinary GBP0.10 shares in respect of

the Bosch strategic investment, announced via the Regulatory News

Service (RNS) on the 22 January 2020 for GBP38,041,824 and on the

15 April 2020 the Company completed an allotment of 3,488,980

ordinary GBP0.10 shares for GBP11,164,736 in respect of Weichai

exercising its anti-dilution rights, this was announced via the RNS

on the 23 March 2020.

20. Contingent liabilities

Contingent liabilities are potential future cash outflows which

are either not probable or cannot be measured reliably.

Grants received of GBP705,000 (2019: GBP705,000), or an element

thereof, may require repayment if the Group generates revenue (net

of expenses and reasonable overheads) from the intellectual

property created from the grant. In such case,

the Group may be liable to pay back the grant at a rate of 5% of

the net revenue generated in any one year. The Directors of the

Group believe it is unlikely that any of the grants received will

need to be repaid.

21. Capital commitments

Capital expenditure that has been contracted for but has not

been provided for in the financial statements amounts to

GBP2,072,000 as at 30 June 2020 (2019: GBP1,116,000), in respect of

the acquisition of property, plant and equipment.

22. Related party transactions

As at 30 June 2019, the Group's related parties were its

Directors and IP Group plc, through IP2IPO Ltd, which held 19.8% of

the Group's issued share capital. On 21 May 2020, IP Group plc

reduced its holding to 5.1% of the issued share capital, and on 11

June 2020 Alan Aubrey stepped down from his role as Chairman. As a

result of Alan stepping down as Chairman, Ceres determined that IP

Group plc ceased to be a related party from 11 June 2020.

Subsequent to the period end, IP Group plc further reduced its

holding to 0.02%.

Alan Aubrey and Robert Trezona will continue to serve in their

roles as Non-Executive Directors until 28 September 2020.

Transactions with IP Group plc during the period 1 July 2019 until

11 June 2020 amounted to GBP60,978 (2019: GBP83,000) comprising

primarily of Non-Executive Director fees of GBP37,912 (2019:

GBP40,000), disbursements and other expenses of GBP8,065 (2019:

GBP3,000), recruitment fees GBP15,000 (2019: GBP20,000), and

corporate finance fees of GBPnil (2019: GBP20,000).

INDEPENDENT REVIEW REPORT TO Ceres power holdings plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the interim financial report for the

twelve months ended 30 June 2020 which comprises the Consolidated

Statement of Profit and Loss and Comprehensive Income, Consolidated

Statement of Financial Position, Consolidated Cash Flow Statement

and the Consolidated Statement of Changes in Equity.

We have read the other information contained in the interim

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the interim report be presented and prepared in a form consistent

with that which will be adopted in the Company's annual accounts

having regard to the accounting standards applicable to such annual

accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the interim financial

report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim financial report for the twelve months ended 30 June

2020 is not prepared, in all material respects, in accordance with

the rules of the London Stock Exchange for companies trading

securities on AIM.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability

BDO LLP

Chartered Accountants

Guildford

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAANXADKEEFA

(END) Dow Jones Newswires

September 28, 2020 02:00 ET (06:00 GMT)

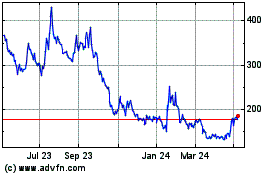

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

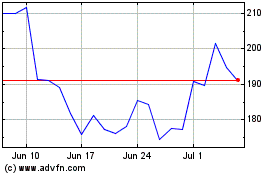

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024