Stock Futures Edge Higher Ahead of Jobless Claims Data

February 11 2021 - 4:15AM

Dow Jones News

U.S. stock futures edged higher Thursday, ahead of data on

applications for unemployment benefits made last week.

S&P 500 futures ticked up 0.2%. The gauge closed 0.1% lower

on Wednesday.

Data on applications for unemployment benefits, due at 8:30 a.m.

ET, are expected to show that claims fell for the fourth week in a

row, a sign that layoffs are easing following an unwelcome spike in

early January.

The 10-year U.S. Treasury yield edged up to 1.138%, from 1.133%

on Wednesday. Yields move inversely to prices.

Overseas, the Stoxx Europe 600 gained 0.1%. The U.K.'s FTSE 100,

which is dominated by large international businesses, gained

0.2%.

Among individual European stocks, Coca-Cola HBC added 5.1% and

Rexel rose 7.2%.

The Swiss franc, the euro and the British pound traded flat

against the U.S. dollar.

In commodities, Brent crude fell 0.7% to $61.05 a barrel.

German 10-year bund yields was recently minus 0.460%, and the

yield on 10-year U.K. government debt known as gilts was

0.462%.

In Asia, Hong Kong's Hang Seng climbed 0.5% after falling as

much as 0.7% during the session. Markets in mainland China, Japan

and South Korea were closed on Thursday.

-- An artificial-intelligence tool was used in creating this

article.

(END) Dow Jones Newswires

February 11, 2021 04:00 ET (09:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

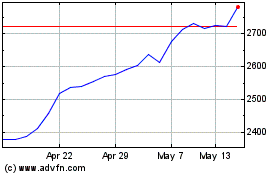

Coca-cola Hbc (LSE:CCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

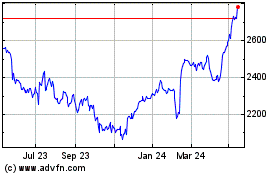

Coca-cola Hbc (LSE:CCH)

Historical Stock Chart

From Apr 2023 to Apr 2024