TIDMBPM

RNS Number : 1683W

B.P. Marsh & Partners PLC

07 February 2017

Date: 7(th) February 2017

On behalf of: B.P. Marsh & Partners Plc

Embargoed until: 0700hrs

B.P. Marsh & Partners Plc

("B.P. Marsh", the "Company" or the "Group")

Trading Update

Trading Update

B.P. Marsh, the niche venture capital provider to early stage

financial services businesses, is pleased to provide the market

with an update on trading for the Group's financial year ended 31

January 2017.

Highlights

- Realisation of Besso investment

- Follow-on investments in Nexus and LEBC

- Investment in Asia Reinsurance Brokerage Pte, Singapore

- Start-up MGA investments in UK (Fiducia) and Canada (SSRU)

- Return of GBP7.3m Equity & GBP6.04m Loans in cash from Hyperion

- Increase in upper limit for new investments to GBP5m

- Dividend of 3.76p for the year as part of a 3 year programme

- Increased opportunity pipeline

- GBP4.4m net cash available

The year has been one of strong performance and important

developments for the Group.

The Group will have significant cash to deploy going forward

following the return from the Hyperion disposal and, subject to

completion, the proceeds of the exit from Besso.

The portfolio businesses are performing well and the Group

increased its positions in Nexus and LEBC during the year.

The Group continued its geographic expansion with new

investments in Singapore and Canada and continues to see North

America as an area of interest.

The business also streamlined the portfolio by disposing of

non-core holdings in Randall & Quilter and Broucour.

The new opportunity pipeline remains strong and, in recognition

of the expected cash inflow from Besso, the Board has agreed an

increase in the upper limit for new investments from GBP3m to GBP5m

in first round funding.

The Board will continue to strike a balance between rewarding

shareholders by generating value through investing funds in

opportunities that will deliver long-term capital growth and a

sustainable ongoing dividend.

The Company's share price has increased by c. 35% from 1

February 2016 to the current date, and there has been a narrowing

in the discount to NAV at which the Company's shares trade in the

same period. The Board notes this improvement and intends to build

on this performance in the coming year.

Investment Activity

Disposals

Conditional Disposal of Besso

The Group announced on 4 January 2017 that it had reached

agreement to sell its entire 37.94% shareholding in Besso Insurance

Group Limited ("Besso") for cash, with completion subject to, inter

alia, regulatory approval. This is expected to result in estimated

proceeds to the Group of GBP20.6m net of transaction costs and

pre-tax. Additionally, the Group's outstanding loans with Besso

will be fully repaid on completion. BGC Partners Inc. ("BGC") has

agreed to acquire 100% of Besso, with ongoing management and

employees rolling over a proportion of their existing Besso

shareholdings into BGC shares.

Since the Company's announcement on 4 January 2017 the Besso

transaction continues to progress to completion, and the Group

expects to receive additional funds of approximately GBP18.37m

(after transaction costs and tax). All of the above calculations

are based on the August 2016 balance sheet, for illustrative

purposes. The adjustments will be calculated on the basis of a

completion balance sheet, and therefore these figures are subject

to change.

B.P. Marsh's investment in and exit from Besso demonstrates the

success of its strategy of investing for the long-term and working

with management teams to achieve a mutually desirable exit at the

optimum time.

Disposals of Broucour and R&Q

On 22 April 2016, the Group sold its 49% stake in The Broucour

Group Limited ("Broucour"). Additionally, on 4 May 2016, the Group

sold its 1.32% stake in Randall & Quilter Investment Holdings

("R&Q"). These decisions were made as the Group believed that

these investments were non-core holdings.

Follow-on Investments

Nexus Underwriting Management Limited ("Nexus")

The Group acquired an additional 6.87% in Nexus, the independent

specialty Managing General Agency (MGA) from two of the founding

shareholders for a total consideration of GBP4m on 15 December

2016.

The Company made an initial investment in Nexus in August 2014,

acquiring 5%, and since then has steadily built on this position

with a number of follow on investments. The Group's current

shareholding in Nexus stands at 18.8%.

Since investment in August 2014, Nexus has more than doubled in

size from a premium, commission and EBITDA standpoint.

LEBC

The Group acquired an additional 8.02% stake in LEBC Holdings

Limited ("LEBC") for GBP1.91m in June 2016, purchasing shares from

legacy shareholders and increasing its stake to 42.68%.

Additionally, in November 2016, the Group acquired a further 0.42%

for GBP0.11m and the Group's holding in LEBC now stands at

43.03%.

LEBC Group Ltd, the trading subsidiary, has finalised its 30

September 2016 year-end results declaring a turnover of GBP15.4m

and a trading profit of GBP2.1m for the year.

New Investments

Asia Re

The Group subscribed for a 20% shareholding in Asia Reinsurance

Brokers (Pte) Limited ("ARB"), the Singapore headquartered

independent specialist reinsurance and insurance risk solutions

provider, for a consideration of SGD 2.4m on 21 April 2016.

Fiducia

The Company announced its investment in The Fiducia MGA Company

("Fiducia"), a recently established UK Marine Cargo Underwriting

Agency, on 22 November 2016, subscribing for a 25% cumulative

preferred ordinary shareholding for total consideration of

GBP0.08m. In addition, the Company has agreed to provide Fiducia

with total loan funding of GBP1.75m, with GBP0.35m drawn down upon

completion.

SSRU

The Group's most recent investment, announced on 30 January

2017, was a subscription for a 30% Cumulative Preferred Ordinary

shareholding in Stewart Specialty Risk Underwriting Limited

("SSRU"), a start-up Specialty Casualty Underwriting Agency, based

in Toronto, Canada. The Company, alongside the nominal equity

investment, has provided a loan facility of CAD $0.85m (c.

GBP0.48m).

The investment represents the latest geographic expansion of

B.P. Marsh's investment portfolio, with the North American

continent now represented once again alongside Australia,

Singapore, South Africa, Europe and the UK.

Investment Strategy

The Board has approved an increase in the Group's upper limit

for new investments to GBP5m.

Having considered the Company's cash resources following the

return of funds from Hyperion and the anticipated inflow from the

disposal of Besso, the Board has agreed the Company should widen

its investment criteria to consider investments up to GBP5m in the

first round, an increase from the current GBP3m. This would apply

to investments in established businesses with a strong track

record. The Group will continue to look at start-ups, investing on

a thinly capitalised basis.

All other investment criteria remain the same:

-- To take minority positions in financial services intermediary businesses;

-- Investments being relationship-driven and long-term;

-- No set exit on investment; and

-- Average holding period is 5 years, however, the longest has been over 20 years.

Dividend

The Board has recommended a dividend of 3.76 pence per share

(GBP1.1m) for the financial year ending 31 January 2017.

This represents an increase of 10% over the dividend of 3.42p

per share (GBP1m) paid in respect of the prior year.

It is the Board's aspiration to maintain a dividend of at least

3.76p per share for the years ending 31 January 2018 and 31 January

2019. This is subject to ongoing review and approval by the Board

and the Shareholders.

When considering a dividend, the Board will continue to strike a

balance between rewarding shareholders by generating value through

investing available funds in opportunities that will deliver

long-term capital growth and providing a meaningful dividend.

Share Buy-Backs

The Board continues to pursue a strategy of undertaking low

volume share buy-backs at times when the Group's Share Price

represents a significant discount to Net Asset Value. The Board

considers that this is a useful stabilising mechanism during

periods of market volatility.

As such, following the EU Referendum decision, the Group

undertook a buyback of 5,726 ordinary shares of 10 pence each in

the Company ("Ordinary Shares") at a price of 153.78 pence per

Ordinary Share. These shares are held in Treasury.

New Business Opportunities and Outlook

The financial year closed with a total of 84 new opportunities

presented to the Group during the year, in comparison with 71 in

the previous year.

Having completed investment in two start-up MGAs and an

established broker in Singapore during the year, the Group's

attention is concentrated on investment in established businesses

in the UK and continuing focus on the North American continent. The

investment in Canada, SSRU, represents the first step back into the

North American continent, however, following the Group's policy of

expanding into territories where there is good opportunity for

growth in partnership with a London-based investor and a suitably

developed regulatory and compliance environment, North America

continues to represent a logical opportunity base.

Cash Balance

The net cash available for investment after provision for tax

and commitments currently stands at GBP4.4m before receipt of funds

from the sale of Besso, which is expected to add additional funds

of GBP18.37m net of transaction costs and tax.

Full year Results

The Group expects to report the results for the year to 31

January 2017 on Tuesday 6 June 2017.

Investments

As at 31 January 2017 the Group's equity interests were as

follows:

Asia Reinsurance Brokers Pte Limited

(www.arbrokers.asia)

In April 2016 the Group invested in Asia Reinsurance Brokers Pte

Limited ("ARB"), the Singapore headquartered independent specialist

reinsurance and insurance risk solutions provider. ARB was

established in 2008, following a management buy-out of the business

from AJ Gallagher, led by the CEO, Richard Austen.

Date of investment: April 2016

Equity stake: 20%

31 July 2016 valuation: GBP1,345,000

Bastion Reinsurance Brokerage (PTY) Limited

(www.bastionre.co.za)

In December 2014 the Group invested in Bastion Reinsurance

Brokerage (PTY) Limited ("Bastion"), a start-up Reinsurance Broker

based in South Africa. Established in May 2013 by its CEO and

Chairman, Bastion specialises in the provision of reinsurance

solutions over a number of complex issues, engaged by various

insurance companies and managing general agents.

Date of investment: December 2014

Equity stake: 35%

31 July 2016 valuation: GBP100,000

Besso Insurance Group Limited

(www.besso.co.uk)

In February 1995 the Group assisted a specialist team departing

from insurance broker Jardine Lloyd Thompson Group in establishing

Besso Holdings Limited. The company specialises in insurance

broking for the North American wholesale market and changed its

name to Besso Insurance Group Limited ("Besso") in June 2011.

Date of investment: February 1995

Equity stake: 37.94%

31 July 2016 valuation: GBP21,698,000(*)

(*) 31 July 2016 valuation calculated on the Group's then 42.02%

shareholding. On 9(th) September 2016 the Group sold GBP1.58m of

shares being held on behalf of Besso meaning the current Group

holding is now 37.94%.

Bulwark Investment Holdings (PTY) Limited

In April 2015 the Group, alongside its existing South African

Partners, established a new venture, Bulwark Investment Holdings

(PTY) Limited ("Bulwark"), a South African based holding company

which establishes Managing General Agents in South Africa. To date

Bulwark has established two new Managing General Agents: Preferred

Liability Underwriting Managers (PTY) Limited and Mid-Market Risk

Acceptances (PTY) Limited.

Date of investment: April 2015

Equity stake: 35%

31 July 2016 valuation: N/A

The Fiducia MGA Company Limited

(www.fiduciamga.co.uk)

In November 2016, the Group invested in a recently established

UK Marine Cargo Underwriting Agency. Established by its CEO Gerry

Sheehy, Fiducia is a registered Lloyd's Coverholder which

specialises in the provision of insurance solutions across a number

of Marine risks including, Cargo, Transit Liability, Engineering

and Terrorism Insurance. Gerry was a founding shareholder and

Executive Director of Northern Marine Underwriters ("NMU") and

played a pivotal role in building that business up significantly

before his departure in September 2015.

Date of investment: November 2016

Equity stake: 25%

31 July 2016 valuation: N/A

LEBC Holdings Limited

(www.lebc-group.com)

In April 2007 the Group invested in LEBC, an Independent

Financial Advisory company providing services to individuals,

corporates and partnerships, principally in employee benefits,

investment and life product areas.

Date of investment: April 2007

Equity stake: 43.03%

31 July 2016 valuation: GBP11,522,000(*)

(*) 31 July 2016 valuation calculated on the Group's then 42.63%

shareholding. On 18(th) November 2016 the Group purchased another

0.4% for cash consideration of GBP0.11m increasing the Group's

holding to 43.03%.

MB Prestige Holdings PTY Limited

(www.mbinsurance.com.au)

In December 2013 the Group invested in MB Prestige Holdings PTY

Ltd ("MB Group"), the parent Company of MB Insurance Group PTY a

Managing General Agent, headquartered in Sydney, Australia. MB

Group is recognised as a market leader in respect of prestige motor

vehicle insurance in all mainland states of Australia.

Date of investment: December 2013

Equity stake: 40%

31 July 2016 valuation: GBP1,746,000

Nexus Underwriting Management Limited

(www.nexusunderwriting.com)

In August 2014 the Group invested in Nexus Underwriting

Management Limited ("Nexus"), an independent specialty Managing

General Agency, founded in 2008. It now has five operating

subsidiaries. Nexus Underwriting Limited provides Directors &

Officers, Professional Indemnity, Financial Institutions and

Accident & Health and Nexus CIFS Limited specialises in Trade

Credit and Political Risks Insurance. In August 2015 EBA Insurance

Services Limited was acquired, an MGA which operates predominantly

in Italy and France and specialises in Surety, Bond and Latent

Defect Insurance. Similarly, in November 2015 Nexus expanded into

Asia, setting up Nexus Asia, and in December 2015 Nexus acquired

Millstream Underwriting Limited, expanding their reach to the

provision of bespoke Accident, Health, and Travel Insurance

products. Most recently, in July 2016, Nexus acquired Beacon

Underwriters Limited, a Hong Kong domiciled MGA that specialises in

Marine Insurance.

Date of investment: August 2014

Equity stake: 18.8%

31 July 2016 valuation: GBP6,952,000(*)

(*) 31 July 2016 valuation calculated on the Group's then 11.94%

shareholding. On 15 December 2016 the Group purchased another 6.87%

for cash consideration of GBP4m taking the holding up to 18.8%.

Property & Liability Underwriting Managers (PTY) Limited

(www.plumsa.co.za)

In June 2015 the Group completed an investment in Property And

Liability Underwriting Managers (PTY) Limited ("PLUM"), a Managing

General Agent based in Johannesburg, South Africa. PLUM specialises

in large corporate property insurance risks in South Africa and is

supported by both domestic South African insurance capacity and

A-rated international reinsurance capacity.

Date of investment: June 2015

Equity stake: 42.5%

31 July 2016 valuation: GBP950,000(*)

(*) 31 July 2016 valuation calculated on the Group's then 20%

shareholding. On 5 October 2016 the Group purchased another 22.5%

for cash consideration of GBP0.61m taking the holding up to

42.5%.

Sterling Insurance PTY Limited

(www.sterlinginsurance.com.au)

In June 2013, in a joint venture enterprise alongside Besso,

(Neutral Bay Investments Limited) the Group invested in Sterling

Insurance PTY Limited, an Australian specialist underwriting agency

offering a range of insurance solutions within the Liability

sector, specialising in niche markets including mining,

construction and demolition.

Date of investment: June 2013

Equity stake: 19.7%

31 July 2016 valuation: GBP2,332,000

Stewart Specialty Risk Underwriting Ltd

In January 2017, the Group invested in a recently established

Specialty Casualty Underwriting Agency, based in Toronto, Canada.

Established in 2016, by its CEO Stephen Stewart, SSRU provides

specialist insurance products to a wide array of clients in the

Construction, Manufacturing, Onshore Energy, Public Entity and

Transportation sectors. SSRU's CEO, Stephen Stewart, has over 25

years' experience in the insurance industry.

Date of investment: January 2017

Equity stake: 30%

31 July 2016 valuation: N/A

Summa Insurance Brokerage, S. L.

(www.grupo-summa.com)

In January 2005 the Group provided finance to a Madrid-based

Spanish management team with the objective of acquiring and

consolidating regional insurance brokers in Spain. Through

acquisition Summa is able to achieve synergistic savings, economies

of scale and greater collective bargaining thereby increasing

overall value.

Date of investment: January 2005

Equity stake: 77.25%

31 July 2016 valuation: GBP3,735,000

Trireme Insurance Group Limited

(www.oxfordinsurancebrokers.co.uk)

(www.jhinternational.co.uk)

(www.abrax.ch)

In July 2010 the Group completed an investment in Trireme

Insurance Group Limited (formerly known as US Risk (UK) Ltd), the

parent company of Oxford Insurance Brokers Ltd and James Hampden

International Insurance Brokers Ltd, London-based Lloyd's

specialist international reinsurance and insurance intermediaries.

Trireme Insurance Group Limited is also the parent company of

Abraxas Insurance AG, a Swiss-based underwriting agency

specialising in Directors & Officers Liability Insurance,

Professional Liability Insurance, Insurance for Financial

Institutions, Medical malpractice Insurance, Property Insurance and

Event Insurance.

Date of investment: July 2010

Equity stake: 29.94%

31 July 2016 valuation: GBP2,529,000

Walsingham Motor Insurance Limited

(www.walsinghamunderwriting.com)

In December 2013 the Group invested in Walsingham Motor

Insurance Limited ("WMIL"), a niche UK Motor Managing General

Agency. WMIL was established in August 2012 and commenced trading

in July 2013. In 2015 the Group acquired a further 10.5% equity,

taking the current shareholding to 40.5%, and subsequently WMIL

launched a GBP15m fleet facility with capacity from New India.

Date of investment: December 2013

Equity stake: 40.5%

31 July 2016 valuation: GBP200,000

For further information:

B.P. Marsh & Partners Plc www.bpmarsh.co.uk

Brian Marsh OBE / Camilla Kenyon +44 (0)20 7233 3112

Nominated Adviser & Broker

Panmure Gordon

Atholl Tweedie / Adam James / Charles Leigh-Pemberton +44 (0)20 7886 2500

Notes to Editors:

About B.P. Marsh & Partners Plc

B.P. Marsh's current portfolio contains fourteen companies. More

detailed descriptions of the portfolio can be found at

www.bpmarsh.co.uk.

Since formation over 25 years ago, the Company has assembled a

management team with considerable experience both in the financial

services sector and in managing private equity investments. Many of

the directors have worked with each other in previous roles, and

all have worked with each other for at least five years.

Prior to Brian Marsh's involvement in the Company, he spent many

years in insurance broking and underwriting in Lloyd's as well as

the London and overseas market. He has over 30 years' experience in

building, buying and selling financial services businesses,

particularly in the insurance sector.

Alice Foulk joined B.P. Marsh in September 2011 having started

her career at a leading Life Assurance company. In 2014 she took

over as Executive Assistant to the Chairman, running the Chairman's

Office and established herself as a central part of the management

team.

In February 2015 she was appointed as a Director of B.P. Marsh

and a member of the Investment Committee. In January 2016 Alice was

appointed Managing Director of B.P. Marsh.

In her position as Managing Director, Alice is responsible for

the overall performance of the Company and monitoring the Company's

overall progress towards achieving the objectives and goals of the

Company, as set by the Board.

Dan Topping is the Chief Investment Officer of B. P. Marsh,

having been appointed as a Director in 2011. He joined the Company

in February 2007, following two years at an independent London

accountancy practice. Dan is the Senior Executive with overall

responsibility for the portfolio and investment strategy of B.P.

Marsh.

Dan graduated from the University of Durham in 2005 and is a

member of the Securities and Investment Institute and the Institute

of Chartered Secretaries and Administrators.

Dan is a standing member of the B.P. Marsh Investment and

Valuation Committees and currently serves as a Board Director

across the portfolio.

Camilla Kenyon was appointed as Head of Investor Relations at

B.P. Marsh in February 2009, having four years' prior experience

with the Company. She was appointed to the main board in 2011.

Camilla is Chair of the New Business Committee evaluating new

investment opportunities. She has a number of nominee directorships

over two investee companies and is a standing member of the

Investment Committee. She is a Member of the Investor Relations

Society.

Jonathan Newman is a Chartered Management Accountant and is the

Group Director of Finance and has over 17 years' experience in the

financial services industry. Jon graduated from the University of

Sheffield with an honours degree in Business Studies and joined the

Group in November 1999, following two years at Euler Trade

Indemnity and two years at a Chartered Accountants. Jon is a Member

of the Chartered Global Management Accountants, the Chartered

Management Accountants and the Chartered Institute of Securities

and Investment.

Jon was appointed a Director of B.P. Marsh & Company Limited

in September 2001, and Group Finance Director in December 2003 and

was instrumental in the admission of the Group to AIM in February

2006. Jon is a member of the B.P. Marsh Investment and Valuation

Committees and currently serves as a Board Director for Walsingham

Motor Insurance Limited, and provides senior financial support and

advice to all companies within the Group's portfolio as well as

evaluating new investment opportunities.

'ends'

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFVTFSIRIID

(END) Dow Jones Newswires

February 07, 2017 02:00 ET (07:00 GMT)

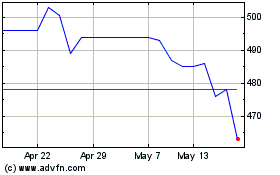

B.p. Marsh & Partners (LSE:BPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

B.p. Marsh & Partners (LSE:BPM)

Historical Stock Chart

From Apr 2023 to Apr 2024