TIDMBEG

Begbies Traynor Group PLC

24 October 2016

24 October 2016

UK businesses remain resilient in the face of Brexit

Levels of financial distress fell 6% in three months following

the Brexit vote

Construction and professional services sectors saw biggest

reduction in financial distress

UK businesses across nearly every sector of the economy were

showing positive signs of stability following the EU Referendum,

new research from Begbies Traynor, the UK's leading independent

insolvency firm, reveals.

According to Begbies Traynor's Red Flag Alert research for Q3

2016, which monitors the financial health of UK companies, in the

three months following the EU Referendum, levels of 'Significant'

financial distress among UK businesses fell as the economy showed

resilience in the face of Brexit.

The research reveals that levels of 'Significant' distress fell

by 6% during the past three months, from 263,517 struggling

businesses in Q2 2016 down to 248,916 companies in Q3 2016. 92% of

these companies, or 229,620, were SMEs in Q3 2016.

Meanwhile, year-on-year the number of UK businesses suffering

'Significant' financial distress fell 2% across the economy as a

whole. This new data chimes with recent ONS data which reported

that Brexit has had no major effect on the UK economy thus far.

Ric Traynor, Executive Chairman at Begbies Traynor says:

"Overall, the UK economy appears to be in a stronger position

than expected following the EU Referendum result. While we wait to

see whether the Government opts for a 'hard' or 'soft' Brexit

strategy, businesses at least appear to be better placed to tackle

any new challenges on the horizon ahead of the Government's

imminent negotiations.

"However, given that the details of the future Brexit deal are

as yet unknown, it is still too early to tell what longer term

impact the 'Leave' decision might have on the UK economy. Clearly

though, the stronger the UK economy becomes pre-Brexit, the better

it will be able to withstand any post-Brexit shocks."

According to Begbies Traynor's research, the most marked

improvement in financial health during Q3 2016 was within the UK

construction sector, where the number of companies experiencing

'Significant' distress fell by 11% to 28,917 (Q2 2016: 32,311

companies).

The findings echo the recent construction PMI, which was 52.3 in

September, up from 49.2 in August, indicating that the sector is

expanding.

Julie Palmer, Partner at Begbies Traynor says:

"Our data shows that UK construction firms appear to be bouncing

back after the initial Brexit shock, when in July construction

activity initially shrank at its fastest pace since 2009. The good

news for this sector is that these businesses can also expect a

further boost following recent policy announcements including the

GBP3 billion Home Builders Fund, plans to accelerate construction

on public land and the unlocking of brownfield sites across the

country.

"All eyes now turn to the upcoming Autumn Statement where

further announcements are expected in support of SME developers and

increased infrastructure spending. If implemented, these measures

should put UK construction firms in an even better position to

survive any potential fallout from the Brexit negotiations."

Begbies Traynor's research also found that professional services

firms had the second most improved levels of 'Significant'

financial distress during Q3 2016, falling by 10% to 11,745

companies (Q2 2016: 13,031 companies).

Julie Palmer, Partner at Begbies Traynor says:

"Professional services firms have been in high demand following

the Referendum result, contributing to lower financial distress

across the sector. Law firms and management consultancies are

benefitting most thanks to an influx of new projects from clients

looking for help in navigating the current Brexit uncertainty and

the potential legislative changes that may come into force once the

UK leaves the EU.

"However, challenges still remain for the sector over the long

term, as any negative impact on the UK economy following a Brexit

deal could dampen future transactional activity - one of the most

lucrative sources of income for many large professional services

firms."

- Ends -

For further information contact:

MHP Communications

Katie Hunt / Jade Neal / Giles Robinson / Hannah Winter

Tel: 0203 128 8193

Email: Begbiescorporate@mhpc.com

About Begbies Traynor Group

Begbies Traynor Group plc operates from over 40 UK locations

through two operating divisions:

Begbies Traynor is the UK's leading independent business

recovery practice handling the largest number of corporate

appointments, principally serving the mid-market and smaller

companies. We provide a range of specialist professional services

primarily to businesses, their professional advisors and the major

banks covering insolvency, restructuring and risk management

activities.

Eddisons is a leading UK firm of chartered surveyors, offering a

wide range of specialist services to banks, insolvency

practitioners, and owners and occupiers of commercial property. The

core services offered are valuation and disposal of property

including fixed charge property receiverships; valuation and

disposal of machinery and business assets; auctions; insolvency

insurance brokerage; property and facilities management; and

building consultancy and ratings valuations.

Information on Begbies Traynor Group can be accessed via the

Group's website at www.begbies-traynorgroup.com

About Red Flag Alert

Red Flag Alert measures corporate distress signals through a

comprehensive and complex methodology, drawing on factual legal and

financial data from a wide range of relevant sources for companies

that have been trading for over a year.

The release refers to the numbers of companies experiencing

'Significant' problems, which are those with minor CCJs (of less

than GBP5k) filed against them or which have been identified by Red

Flag's proprietary credit risk scoring system which screens

companies for a sustained or marked deterioration in key financial

ratios and indicators including those measuring working capital,

contingent liabilities, retained profits and net worth.

Red Flag Alert is commercially available to all businesses, on

an annual subscription basis, to help them better understand risk

and exposure and help prepare them for the future. Further

information about Red Flag Alert can be found at:

www.redflagalert.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAQFLFLQBFZFBB

(END) Dow Jones Newswires

October 24, 2016 02:00 ET (06:00 GMT)

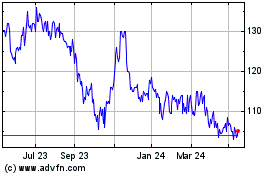

Begbies Traynor (LSE:BEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

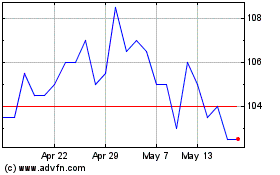

Begbies Traynor (LSE:BEG)

Historical Stock Chart

From Apr 2023 to Apr 2024