Anglesey Mining PLC Labrador Iron Mines - Preliminary Economic Assessment

October 30 2020 - 3:00AM

UK Regulatory

TIDMAYM

Labrador Iron Mines - Houston Preliminary Economic Assessment

Anglesey Mining plc is pleased to report that Labrador Iron Mines Holdings

Limited ("LIM") in which Anglesey has a 12% holding, has announced the

commencement of a Preliminary Economic Assessment on its Houston project in

Labrador, Canada. This represents the first major development of LIM's assets

since the last production in 2014.

In light of persistently stronger iron ore prices over the past two years, and

with increased inquiries and expressions of interest from potential off-takers

seeking iron ore supply and with encouragement from local indigenous

stakeholders, LIM is now working to advance Stage 2 of its planned direct

shipping ore mining operations, which involves the development of its Houston

deposits, located about 25 km south of Schefferville.

Anglesey Chief Executive, Bill Hooley, said: "As a director of both Anglesey

and LIM, I am very pleased with the news that LIM is, after a number of years

of low iron prices, now taking positive steps to move its Stage 2 operations

forward. The recent sustained increases in worldwide iron ore prices and the

market expectations of continuing price support based on global economic

recovery bode well for the future of LIM's projects and for Anglesey's

investment."

Preliminary Economic Assessment

Advancement of the Houston Project will require development financing, and to

assist in securing such financing and as the appropriate next step to advance

the project, LIM has engaged Roscoe Postle Associates Inc. (RPA), now part of

SLR Consulting Ltd (SLR), to complete an independent Preliminary Economic

Assessment (PEA) and a current technical report on the Houston deposit to be

used for consideration of possible financing options to advance the Houston

Project.

RPA is a world-leading mining advisory business with offices in Toronto,

Denver, and London. RPA is uniquely qualified to carry out this work as it has

extensive relevant iron ore experience on many projects in Canada (including

Schefferville and Labrador) and in other parts of the world. In 2019, RPA was

acquired by SLR, a global leader in environmental and advisory solutions.

The Houston property is situated in Labrador about 20 km southeast of the town

of Schefferville. Together with the Malcolm Deposit, considered to be its

northwest extension, the Houston deposits are estimated to contain a resource

of 40 million tonnes grading 57.6% iron ("Fe"). LIM has identified a

higher-grade component of this resource on which the initial mine plan will

focus.

Four open pits would be developed sequentially to produce 2 million tonnes per

year of direct shipping iron ore (lump, sinter) over a 10 year mine-life

period. The current development plan for Houston is based on dry crushing and

screening only and envisages an anticipated mining rate of 10,000 tonnes per

day. The Houston deposits also contain harder ore than the prior James mine and

are anticipated to produce a larger proportion of premium lump product.

The PEA is expected to be completed before the end of 2020.

Stronger Iron Ore Markets

For the past two years the iron ore price has persistently exceeded US$100 per

tonne (62% Fe/CFR China). This has been a function of both supply disruptions

but also steady and increasing demand from China, which shows no signs of

declining.

At the beginning of 2019 the iron ore price stood at around US$70 per tonne,

and rose to a 5 year high of US$126 per tonne in early July 2019, before

falling back in the second half of the year to a US$85-US$90 per tonne range.

In January 2020, the price temporarily declined to approximately US$80 per

tonne, due to the initial impact of the Covid-19 pandemic, which caused a

short-term curb in China's steel production due to public health measures.

By mid-February 2020, however, China's steel production began to increase

again, based on significant government stimulus programmes and an improving

domestic public health situation. By July 2020, China was on track to break

its previous annual record of steel production and associated iron ore

imports. China's industrial output in September surpassed all expectations,

with daily run-rates for steel and aluminium hitting all-time highs as state

spending accelerated and the nation's producers fed rising demand in sectors

like construction and automobiles.

On the supply side in 2020, Brazil was particularly hard-hit by Covid-19, which

interrupted the country's iron ore production resulting in a tight supply in

the global iron ore market. This has been exacerbated by the tailings dam

problems that came to a head in 2019.

The cumulative impact of robust demand in China and tight supply led to a

significant increase in the price of iron ore during the first three quarters

of 2020. In September 2020, the price reached US$130 per tonne, the highest in

more than six years, representing a more than 40% increase during the year.

Although the price has eased somewhat in October, market commentators are

generally confident that continuing strong China demand and tighter supply will

support a robust iron ore market. Going forward, a significant global economic

recovery driven by Covid recovery stimulus programmes expected in 2021 should

create strong demand for steel production and a supportive price floor for iron

ore above US$100 per tonne.

About Anglesey Mining plc

Anglesey is in evaluation work at its 100% owned Parys Mountain

copper-zinc-lead deposit in North Wales, UK with a 2012 reported resource of

2.1 million tonnes at 6.9% combined base metals in the indicated category and

4.1 million tonnes at 5.0% combined base metals in the inferred category.

Micon International is currently preparing a PEA on the Parys Mountain project.

Anglesey holds a 10% interest, and management rights to the Grangesberg Iron

project in Sweden, together with a right of first refusal to increase its

interest by a further 50.1%. Anglesey also holds 12% of Labrador Iron Mines

Holdings Limited which holds direct shipping iron ore deposits in Labrador and

Quebec.

Anglesey is also currently and actively reviewing other compatible base metal

projects at advanced stages suitable for incorporation into the Anglesey Group.

For further information, please contact:

Bill Hooley, Chief Executive +44 (0)7785 572517

Danesh Varma, Finance Director +44 (0)7740 932766

END

(END) Dow Jones Newswires

October 30, 2020 03:00 ET (07:00 GMT)

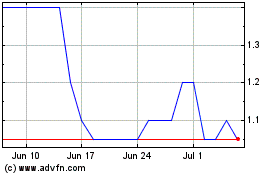

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024