TIDMAEO

RNS Number : 1132H

Aeorema Communications Plc

23 March 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Aeorema Communications plc / Index: AIM / Epic: AEO / Sector:

Media

23 March 2020

Aeorema Communications plc ('Aeorema' or 'the Company')

Interim Report

Aeorema Communications plc, the AIM-traded live events agency,

announces its unaudited results for the six months ended 31

December 2019.

Overview

-- Revenues of GBP 2,913,290 (2018: GBP1,997,303)

-- Operating loss pre-exceptional items of GBP89,978 (2018: loss of GBP141,765)

-- Robust cash position of GBP1,393,243 (31 December 2018: GBP1,030,956)

-- Coronavirus continues to impact on full financial year

Chairman's Statement

The six months ended 31 December 2019 demonstrated robust

trading, with exciting projects being created and a pipeline of new

business wins, resulting in strong revenues up 46% against the

previous year. This contributed to our loss before tax narrowing to

GBP(89,978). Since then, Aeorema, like many other companies, has

been significantly impacted by COVID-19, as clients postpone

events. These unprecedented times have sadly meant that immediate

action was required to ensure the safety of the business including

several cost-cutting initiatives, which have been implemented with

a heavy heart.

I'll start with the good news with recent wins including an

event for a global tech company in Chicago, activations at Euro

2020 for a major newspaper brand and new tech clients for Cannes

Lions. Whilst all these events are now postponed into the next

financial year, we are confident that we are in a strong position

to work through this crisis, not least because we know that we have

an excellent reputation, a strong value proposition and a unique

selling proposition in the marketplace. Notably, this proposition

includes, in tandem with events, a leading moving image department,

which continues to work with clients and help global teams

communicate through traditional video and digital technologies.

Importantly, the quality of our work has been highlighted by

several recent award wins, including the most Creative Agency, the

most Innovative Agency and the delivery of the Best Visual

Spectacular. These have helped further build our reputation and led

us to being shortlisted for several new potential client wins,

which we anticipate will be finalised once the crisis abates.

Furthermore, our existing clients are very supportive and have

indicated that they want to work with us when the crisis

subsides.

Unfortunately, as mentioned, the Company took the decision to

make immediate significant reductions in overheads, including,

regrettably, reducing our workforce by 25%. Additionally,

Non-executive Chairman and our largest and supportive shareholder,

Mike Hale, will not be taking any salary payments from the PLC

until further notice.

Looking ahead, COVID-19 continues to impact on our anticipated

full financial year's figures. The Directors therefore envisage a

loss before tax for FY20 of between GBP150,000 and GBP250,000. As

mentioned in the recent trading update, the Directors consider it

appropriate for market forecasts to be suspended at this time.

The Directors remain confident that the revenue and profit from

postponed events will now fall into

the financial year ending 30 June 2021. Aeorema has maintained

its strong cash position with GBP1,393,243 in the bank as at 31

December 2019 (31 December 2018: GBP1,030,956). As at the date of

this announcement, cash in bank is circa. GBP1,700,000. Our

dividend policy will be reviewed later in the year when we have a

clearer picture of FY 20 results and the economic climate.

We remain vigilant about opportunities that may emerge where we

can use our strong position to offer companies with less resources

join our group and remain well positioned to win new business

across our divisions including within our moving image

department.

Finally, I would like to thank our employees for their hard work

and commitment, as well as our shareholders for their continued

support and wish them all health above all else over the coming

months.

M Hale

Chairman

20 March 2020

**S**

For further information visit www.aeorema.com or contact:

Mike Hale Aeorema Communications Tel: +44 (0) 20

plc 7291 0444

John Depasquale Allenby Capital Limited Tel: +44 (0)20

/ Liz Kirchner (Nominated Adviser 3328 5656

and Broker)

Catherine Leftley St Brides Partners Tel: +44 (0) 20

Ltd 7236 1177

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the period ended 31 December 2019

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2019 2018 2019

As restated As restated

Notes GBP GBP GBP

Continuing Operations

Revenue 2,913,290 1,997,303 6,765,280

Cost of sales (2,044,591) (1,298,421) (4,665,032)

Gross profit 868,699 698,882 2,100,248

Administrative expenses (958,677) (837,580) (1,718,615)

Operating profit / (loss) (89,978) (138,698) 318,633

Finance income 328 287 611

Profit / (loss) before taxation (89,650) (138,411) 382,244

Taxation 5 32,629 26,939 (86,687)

Profit / (loss) for the period

from continuing operations (57,021) (111,472) 295,557

Basic and diluted earnings

per share from continuing

operations

Basic (pence) 6 (0.63003) (1.23166) 3.26564

Diluted (pence) 6 (0.56621) (1.13979) 3.22011

================ ================ ============

There are no other comprehensive income items.

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the period ended 31 December 2019

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2019 2018 2019

As restated As restated

GBP GBP GBP

Non-current assets

Intangible assets 365,154 365,154 365,154

Property, plant and equipment 98,070 54,848 58,070

Right-to-use assets 425,070 53,943 13,486

Deferred taxation 25,100 29,193 -

913,394 503,138 436,710

Current assets

Trade and other receivables 1,480,984 806,122 1,612,345

Cash and cash equivalents 1,393,243 1,030,956 2,211,161

---------------- ---------------- ------------

2,874,227 1,837,078 3,823,506

Total assets 3,787,621 2,340,216 4,260,216

Current liabilities

Trade and other payables 1,497,323 714,512 2,247,214

Lease liabilities 82,973 61,100 16,475

Dividends payable - 67,879 -

Current tax payable 74,616 9,412 74,616

---------------- ---------------- ------------

1,654,912 852,903 2,338,305

Non-current liabilities

Deferred taxation - - 7,529

Lease liabilities 343,756 - -

---------------- ---------------- ------------

343,756 - 7,529

Total liabilities 1,998,668 852,903 2,345,834

Net assets 1,788,953 1,487,313 1,914,382

================ ================ ============

Equity attributable to equity

holder:

Share capital 1,131,313 1,131,313 1,131,313

Share premium 7,063 7,063 7,063

Merger reserve 16,650 16,650 16,650

Other reserve 56,358 14,221 34,261

Capital contribution reserve 257,812 257,812 257,812

Retained earnings 319,757 60,254 467,283

Total equity 1,788,953 1,487,313 1,914,382

================ ================ ============

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 31 December 2019

Share capital Share Merger Other Capital Retained Total

premium reserve reserve contribution earnings equity

reserve

GBP GBP GBP GBP GBP GBP GBP

At 1 July 2018 1,131,313 7,063 16,650 - 257,812 249,829 1,662,667

IFRS 16 adjustments - - - - - (10,224) (10,224)

Adjusted balance

at 1 July 2018 1,131,313 7,063 16,650 - 257,812 239,605 1,652,443

Payment of dividends - - - - - (67,879) (67,879)

Comprehensive

income for the

period - - - - - (114,539) (114,539)

Share-based

payments - - - 14,221 - - 14,221

IFRS 16 adjustments - - - - - 3,067 3,067

At 31 December

2018 1,131,313 7,063 16,650 14,221 257,812 60,254 1,487,313

At 1 January

2019 1,131,313 7,063 16,650 14,221 257,812 60,254 1,487,313

Payment of dividends - - - - - - -

Comprehensive

income for the

period - - - - - 402,862 402,862

Share-based

payments - - - 20,040 - - 20,040

IFRS 16 adjustments - - - - - 4,167 4,167

At 30 June 2019 1,131,313 7,063 16,650 34,261 257,812 467,283 1,914,382

At 1 July 2019 1,131,313 7,063 16,650 34,261 257,812 467,283 1,914,382

Payment of dividends - - - - - (90,505) (90,505)

Comprehensive

income for the

period - - - - - (57,021) (57,021)

Share-based

payments - - - 22,097 - - 22,097

At 31 December

2019 1,131,313 7,063 16,650 56,358 257,812 319,757 1,788,953

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 31 December 2019

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2019 2018 2019

As restated As restated

GBP GBP GBP

Cash flow from operating activities

Profit/(loss) before taxation (89,650) (138,411) 382,244

Adjustments for:

Depreciation of property, plant

and equipment 14,064 10,687 21,525

Depreciation of right-of-use assets 43,848 40,458 80,915

Loss on disposal of fixed assets 1,424 - 6,179

Share-based payment 22,097 14,221 34,261

Interest on lease liabilities 10,222 1,975 2,851

Finance income (327) (286) (611)

---------------- ---------------- ------------

Operating cash flow before movement

in working capital 1,678 (71,356) 527,364

Increase/(decrease) in trade and

other payables (755,036) (560,467) 972,235

(Increase)/decrease in trade and

other receivables 131,361 300,170 (506,053)

Cash (used in) / generated from

operating activities (621,997) (331,653) 993,546

Taxation paid - - (11,700)

Cash flow from investing activities

Finance income 327 286 611

Purchase of property, plant and

equipment (55,710) (28,491) (48,731)

Disposal of property, plant and 224 - -

equipment

Net cash used in investing activities (55,159) (28,205) (48,120)

Cash flow from financing activities

Dividends paid (90,505) - (67,879)

Repayment of leasing liabilities (50,257) (45,500) (91,000)

---------------- ---------------- ------------

Net cash used in financing activities (140,762) (45,500) (158,879)

Net increase / (decrease) in cash

and cash equivalents (817,918) (405,358) 774,847

---------------- ---------------- ------------

Cash and cash equivalents at beginning

of period 2,211,161 1,436,314 1,436,314

Cash and cash equivalents at end

of period 1,393,243 1,030,956 2,211,161

================ ================ ============

AEOREMA COMMUNICATIONS PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 31 December 2019

1. General information

Aeorema Communications plc is a public limited company

incorporated within the United Kingdom. The company is domiciled in

the United Kingdom and its principal place of business is 23-31

Great Titchfield Street, London, W1W 7PA. The Company's ordinary

shares are traded on the AIM market of the London Stock

Exchange.

These condensed consolidated interim financial statements for

the period ending 31 December 2019 (including comparatives for the

periods ended 31 December 2018 and 30 June 2019) were approved by

the board of directors on 20 March 2020.

The financial information set out in this interim report does

not constitute statutory accounts for the purposes of section 434

of the Companies Act (2006). The Group's statutory financial

statements for the year ended 30 June 2019, prepared under

International Financial Reporting Standards (IFRS), have been filed

with the Registrar of Companies. The auditor's report for those

financial statements was unqualified and did not contain a

statement under section 498 (2) or section 498 (3) of the Companies

Act (2006).

The interim financial statements have been prepared using the

accounting policies set out in the Group's 2019 statutory accounts

and have not been audited.

Copies of the annual statutory financial statements and the

interim report can be found on our website at www.aeorema.com or

can be requested from the Company Secretary at the Company's

registered office: 64 New Cavendish Street, London, W1G 8TB.

2. Basis of preparation

These condensed consolidated interim financial statements for

the period ended 31 December 2019 have been prepared in accordance

with IAS 34, 'Interim Financial Reporting' as adopted by the

European Union. The interim condensed consolidated financial

statements should be read in conjunction with the annual financial

statements for the year ended 30 June 2019, which have been

prepared in accordance with IFRS as adopted by the European

Union

3. Summary of significant accounting policies

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 June 2019, as

described in those annual financial statements, with the exception

of IFRS 16 Leasing which was effective from 1 July 2019. Aside from

IFRS 16 there has been no impact on the Group's financial position

or performance from new and amended IFRS and IFRIC interpretations

mandatory as of 1 July 2019.

AEOREMA COMMUNICATIONS PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

For the period ended 31 December 2019

4. Revenue and segmental results

The Company uses several factors in identifying and analysing

reportable segments, including the basis of organisation such as

differences in products and geographical areas. The Board of

Directors, being the chief operating decision makers, has

determined that for the period ended 31 December 2019 there is only

one reportable operating segment.

5. Income tax charge

Income period tax is accrued based on the estimated average

annual effective income tax rate of 19 per cent. (2018: 19 per

cent).

6. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Diluted earnings per share are calculated by dividing the profit

attributable to ordinary owners of the parent by the weighted

average number of ordinary shares outstanding during the year plus

the weighted average number of ordinary shares that would have been

issued on the conversion of all dilutive potential ordinary shares

into ordinary shares.

The following reflects the income and share data used and

dilutive earnings per share computations:

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2019 2018 2019

Profit/(loss) for the year

attributable to owners of

the Company (57,021) (111,472) 295,557

Number of shares

Basic weighted average number

of shares 9,050,500 9,050,500 9,050,500

Effect of dilutive share

options 1,020,000 729,508 127,987

Diluted weighted average

number of shares 10,070,500 9,780,008 9,178,487

7. Dividends

During the interim period a dividend of 1 pence (2018: 0.75

pence) per share was declared to holders of the Company's ordinary

shares in respect of the full year ended 30 June 2019.

AEOREMA COMMUNICATIONS PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

For the period ended 31 December 2019

8. Related party transactions

The Group has a related party relationship with its subsidiaries

and its directors. Transactions between Group companies, which are

related parties, have been eliminated on consolidation and are

therefore not included in these consolidated interim financial

statements.

Unaudited Unaudited

6 months 6 months

to 31 December to 31 December

2019 2018

GBP GBP

Subsidiaries

Amounts owed by/(to) subsidiaries 1,027,839 1,042,080

---------------- ----------------

Amounts owed by/(to) subsidiaries 1,027,839 1,042,080

Harris & Trotter LLP is a firm in which S Haffner is a

member. The following was charged to the Group in respect of

professional services.

Unaudited Unaudited

6 Months 6 Months

to 31 December to 31 December

2019 2018

Harris & Trotter LLP GBP GBP

Aeorema Communications plc 7,500 7,500

Aeorema Limited 11,750 7,950

---------------- ----------------

19,250 15,450

Fees charged to Aeorema Communications plc include GBP7,500

(2018: GBP7,500) for the services of S Haffner as a non-executive

director of that company.

The compensation of key management (including directors) of the

Group is as follows:

Unaudited Unaudited

6 Months 6 Months

to 31 December to 31 December

2019 2018

GBP GBP

Short-term employee benefits 110,667 105,000

Post-employment benefits 5,024 892

115,691 105,892

During the period A Harvey received an interest-free loan of

GBP10,000. At the 31 December 2019 GBP10,000 (2018: GBPNil) was

outstanding.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR KKBBBKBKDBNB

(END) Dow Jones Newswires

March 23, 2020 03:00 ET (07:00 GMT)

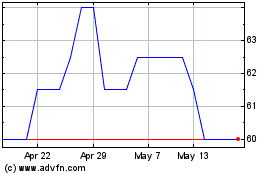

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024