Armadale Capital Plc Proposed Sale of the non-core Mpokoto Gold Project

October 24 2018 - 4:08AM

UK Regulatory

TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

24 October 2018

Armadale Capital Plc ('Armadale' or 'the Company')

Proposed Sale of the non-core Mpokoto Gold Project

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is pleased to announce that it has

entered into new heads of agreement with Arrow Mining which

provides for the sale of the Mpokoto Gold Project in the DRC

("MpokotoProject"). Previous negotiations with parties for the sale

of the Project, as referred to in Armadale's 12 January 2018

announcement, have ceased. This new transaction is intended to

crystallise the value of the Mpokoto Project with a company capable

of obtaining the funding to bring the mine into production. The new

transaction allows Armadale to focus on advancing its primary value

driver, the high grade Mahenge Liandu Graphite Project in Tanzania,

whilst ensuring the Company retains exposure to the development

upside of the Mpokoto Project.

Sale Terms

Arrow Mining will take over the operations on the Mpokoto

Project and is obliged to pay Armadale a 1.5% royalty on gold sales

achieved once in production. The Mpokoto Project has a feasibility

study based on a 720,000 tpa operation over 4.5 year producing an

average of 24,900oz pa with a substantial sulphide resource that

could further extend the mine life.

Sale of the Mpokoto Project under the heads of agreement is

conditional upon entry into a formal sale agreement, due diligence

by Arrow Mining and other standard conditions for regulatory

approvals.

Further Information

1. Funds from the Mpokoto Project royalty will be used to

support development the high grade Mahenge Liandu Graphite Project

in Tanzania, and Armadale will consider other investment

opportunities in line with its existing investing policy.

2. Armadale had previously entered into a joint venture

agreement with Kisenge Mining Pty Ltd ('Kisenge Mining') for the

Project. Kisenge Mining has agreed to withdraw from the joint

venture agreement to allow the new heads of agreement to

proceed.

About Arrow

Arrow Mining is a privately owned South African based gold

mining and exploration company with its principal activities

focused on advanced projects in the DRC, South Africa and Zimbabwe.

The CEO of Arrow Mining, Jason Brewer, who has extensive experience

in Africa's mining and exploration sectors and in particular in

successfully raising debt and equity capital and developing mining

projects in the DRC. Arrow's shareholders include a number of

Australian, Asian and South African based investment groups.

Nick Johansen, Director of Armadale said, "The Board of Armadale

is confident that the Arrow Mining team, which has significant

experience of operating in the DRC, represents the best opportunity

for Armadale to crystallise the value of the Mpokoto Project and

begin receiving returns through the agreed royalty payments on gold

sales. We appreciate this process has been more protracted than

originally envisaged, but Arrow Mining comes with it a proven track

record in raising debt and equity capital and developing mining

projects in the DRC which places it in a strong position to quickly

progress development at the Mpokoto Project and work towards

delivering first gold production. We look forward to reporting

further news in due course."

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

For further information, please visit the Company's website

www.armadalecapitalplc.com, follow Armadale on Twitter

@ArmadaleCapital or contact:

Enquiries:

Armadale Capital Plc +44 20 7236 1177

Tim Jones, Company Secretary

Nomad and broker: finnCap Ltd +44 20 7220 0500

Christopher Raggett / Max Bullen-Smith

Joint Broker: SVS Securities +44 20 3700 0093

Tom Curran / Ben Tadd

Press Relations: St Brides Partners Ltd +44 20 7236 1177

Susie Geliher / Juliet Earl

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant inferred mineral resource estimate of 51.1Mt @ 9.3% TGC.

Marking the project one of the largest high-grade resources in

Tanzania, and work to date has demonstrated Mahenge Liandu's

potential as a commercially viable deposit with significant

tonnage, high-grade coarse flake and near surface mineralisation

(implying a low strip ratio) contained within one contiguous ore

body.

Other assets Armadale has an interest in include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20181024005304/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

October 24, 2018 04:08 ET (08:08 GMT)

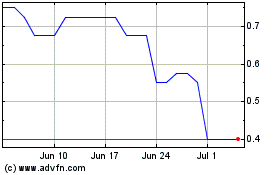

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Apr 2023 to Apr 2024