Cantex Receives Completed Analogs

June 13 2007 - 12:44PM

Business Wire

Cantex Energy Corp. (Pink Sheets: CTXE) announced today that the

Company has received an extensive review and analogs from its chief

geophysicist regarding the Ouachita Thrust facies of its Big Canyon

Project located in the Val Verde Basin, Terrell County, Texas

leasehold where Cantex currently controls 12,000 acres. The

information provided shows that within approximately 43 miles of

the Big Canyon Ranch prospect there are three regions of particular

interest. The Pinon Field, discovered in 1998, is a Thrusted

Dimple/Caballos. Since 1998, 112 wells have been drilled in the

Pinon field to a depth of approximately 8,500 feet with total

production of 90bcf of gas produced to date. The Thistle Field,

another Thrusted Caballos, was discovered in 1984. Fifteen wells

have been completed to a depth of 5,000 feet with approximately

4.6bcf of gas produced. In 1979, McKay Creek, a subsequent Thrusted

Caballos, was discovered and 10 wells were drilled to a depth of

7,000 feet, producing approximately 13.2bcf of gas. Cantex�s

geophysicist recently completed the Pinon Field Analog Study and

has reported the findings look promising. Cumulative and average

production by formations in the Pinon Field is as follows: In the

Dimple, there have been 95 completions drilled to a depth of 5,000

feet with a cumulative production of 33,243,639 and an average

production per well of 349,933mcf. In the Caballos, there have been

10 wells completed to a depth of 7,000 feet with a cumulative

production of 54,893,080 and an average production per well of

5,489,308mcf. In the Tesnus, there have also been 10 wells

completed to a depth of 8,500 feet with a cumulative production of

1,025,938 and an average production per well of 102,594mcf. As

stated in Cantex�s earlier releases, the Company has targeted four

drillable structures that it believes offer the most promising

results for exploration activities. With the recently received

analogs, the Company has a more thorough understanding of the

structures that lie within its 12,000-acre leasehold. Historic

analysis and results from the region lend credence to Cantex�s

future drilling prospects. The Company is currently examining the

most cost-effective means by which to execute on its business plan

and proceed with the drilling of its initial four targeted

exploration opportunities. Spacing configurations encompassing the

12,000-acre leasehold allow for approximately 160 wells to be

drilled on the Big Canyon Project. Additional information regarding

the Company�s projects will be forthcoming as developments warrant.

About Cantex Energy Cantex Energy Corp. is an independent, managed

risk, oil and gas exploration, development, and production company

headquartered in San Antonio, Texas. The Company's additional focus

is the optimal exploitation and development of approximately 1,200

acres known as the West Ant Hills Prospect located in Niobrara

County Wyoming. Cantex Energy Corp. is a Non-Reporting Company,

quoted on the Pink Sheets, having filed a Form 211 pursuant to Rule

15c211 under the Exchange Act, with the NASD Compliance Unit. For

real-time quotes, how to trade pink sheet stocks, how to protect

yourself and additional stock information, please see

www.pinksheet.com. Purchasing shares in Cantex Energy Corp.

involves a speculative investment with substantial risks, and

although the Company intends to use its best efforts to enhance the

value of the shares, there is no assurance that the Company's

operations will be successful. For more information about Cantex

Energy Corp. (Pink Sheets: CTXE) please contact Barry Gross, Phone:

361-949-4999, or visit the Company�s website at

www.cantexenergy.com. EXCEPT FOR HISTORICAL INFORMATION CONTAINED

HEREIN, THE STATEMENTS IN THIS PRESS RELEASE ARE FORWARD-LOOKING

STATEMENTS THAT ARE MADE PURSUANT TO THE SAFE HARBOR PROVISIONS IN

THE PRIVATE SECURITIES LEGISLATION REFORM ACT OF 1995.

FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS AND

UNCERTAINTIES, WHICH MAY CAUSE CANTEX ENERGY'S ACTUAL RESULTS IN

FUTURE PERIODS TO DIFFER MATERIALLY FROM FORECASTED RESULTS. THESE

RISKS AND UNCERTAINTIES INCLUDE, AMONG OTHER THINGS: THE POTENTIAL

THAT NO COMMERCIAL QUANTITIES OF OIL ARE FOUND OR RECOVERABLE, THE

PRICE OF OIL AND GAS, GEOLOGICAL PROBLEMS THAT PREVENT US FROM

REACHING DRILLING TARGETS AND SPECIFIC RISKS SUCH AS THE COMPANY'S

ABILITY TO RAISE FINANCING AND RISKS INHERENT IN CANTEX ENERGY'S

OPERATIONS. THESE AND OTHER RISKS ARE DESCRIBED IN CANTEX ENERGY'S

FORM 15C211 AND OTHER FILINGS WITH THE NASD AND SECURITIES AND

EXCHANGE COMMISSION.

Arkose Energy (CE) (USOTC:RKOS)

Historical Stock Chart

From May 2024 to Jun 2024

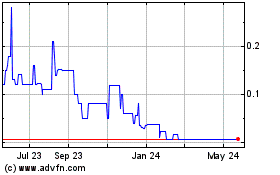

Arkose Energy (CE) (USOTC:RKOS)

Historical Stock Chart

From Jun 2023 to Jun 2024