UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

PROVECTUS

BIOPHARMACEUTICALS, INC.

(Name of Subject Company and Filing Person (Issuer))

Warrants to Purchase Common Stock

(Title of Class of Securities)

74373P108

(CUSIP Number

of Common Stock Underlying Warrants)

Peter R. Culpepper

Provectus Biopharmaceuticals, Inc.

7327 Oak Ridge Highway, Suite A

Knoxville, TN 37931

(866) 594-5999

(Name,

Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With

copies to:

Tonya Mitchem Grindon, Esq.

Lori B. Metrock, Esq.

Baker Donelson Bearman Caldwell & Berkowitz PC

211 Commerce St., Suite 800

Nashville, TN 37201

Telephone: (615) 726-5600

CALCULATION

OF FILING FEE

|

|

|

| Transaction Valuation(1) |

|

Amount of Filing Fee(2) |

| $15,531,092.37 |

|

$1,563.98 |

| |

| (1) |

Estimated for purposes of calculating the amount of the filing fee only. Provectus Biopharmaceuticals, Inc. (the “Company”) is offering, until February 15, 2016 (unless the offer is extended), to holders

of the Company’s 59,861,601 unregistered warrants to purchase 59,861,601 shares of common stock, which were issued between January 6, 2011 and November 1, 2015 (the “Existing Warrants”), to temporarily modify the terms of

such Existing Warrants so that each Existing Warrant holder who tenders Existing Warrants during the offering period for early exercise in accordance with the terms of the offer (i) may exercise such Existing Warrants at a discounted exercise

price of $0.75 per share and (ii) will receive, in addition to the shares of common stock purchased upon such exercise of the Existing Warrants, new warrants to purchase the same number of shares of the Company’s common stock at an

exercise price of $0.85 per share that will expire June 19, 2020. The transaction valuation is calculated pursuant to Rule 0-11(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as the product of 59,861,601

and $0.25945. The transaction valuation assumes the tender of 59,861,601 Existing Warrants by the Existing Warrant holders as a result of this tender offer and was determined by using the average of the high and low prices of the Company’s

warrants reported on the NYSE MKT as of December 28, 2015, which was $0.25945. |

| (2) |

The amount of filing fee is calculated pursuant to Rule 0-11(d) of the Exchange Act. The filing fee equals $100.70 for each $1,000,000 of the value of the transaction, and was calculated as the product of the

transaction valuation of $15,531,092.37 multiplied by 0.0001007. |

| x |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: $11,212.20. |

|

Filing Party: Provectus Biopharmaceuticals, Inc. |

| Form or Registration No.: Registration Statement on Form S-4. |

|

Date Filed: December 31, 2015. |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

¨ |

third-party tender offer subject to Rule 14d-1. |

| |

x |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going-private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

This Tender Offer Statement on Schedule TO (this “Schedule TO”) is being filed by

Provectus Biopharmaceuticals, Inc. (the “Company”), a Delaware corporation. This Schedule TO relates to an offer by the Company until February 15, 2016 (unless the offer is extended). The Offer (as defined below) is being made to

holders of our 59,861,601 unregistered warrants to purchase common stock that were issued between January 6, 2011 and November 1, 2015 (the “Existing Warrants”).

The Offer is to temporarily modify the terms of such Existing Warrants so that each holder who tenders Existing Warrants during the offering

period for early exercise will be able to do so at a discount on the exercise price equal to $0.75 per share (Existing Warrants currently have exercise prices ranging from $1.00 to $3.00 per share), and will receive, in addition to the shares of

common stock purchased upon such exercise, new warrants to purchase an equal number of shares of the Company’s common stock at an exercise price of $0.85 per share that will expire June 19, 2020 (the “Replacement Warrants”), upon

the terms and conditions set forth in the (x) offer letter/prospectus, dated December 31, 2015 (the “Offer Letter/Prospectus”), which is set forth as Exhibit (a)(1)(i) hereto, and (y) the related Letter of Transmittal, which

is set forth as Exhibit (a)(1)(ii) hereto (the offer reflected by such terms and conditions, as they may be amended or supplemented from time to time, constitutes the “Offer”). The Offer is not made to those holders who reside in states or

other jurisdictions where an offer, solicitation or sale would be unlawful.

On December 31, 2015, the Company filed a registration

statement on Form S-4, of which the Offer Letter/Prospectus forms a part. This Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

All information contained in the Offer Letter/Prospectus and the Letter of Transmittal, and any prospectus supplement or other supplement

thereto related to the Offer, is hereby expressly incorporated herein by reference in response to all items in this Schedule TO, as more precisely set forth below.

| ITEM 1. |

SUMMARY TERM SHEET. |

The information set forth in the Offer Letter/Prospectus under the

section entitled “Prospectus Summary—Exchange Offer” is incorporated herein by reference.

| ITEM 2. |

SUBJECT COMPANY INFORMATION. |

(a) Name and Address. The name of the subject

company (and the issuer of the Existing Warrants to which this Schedule TO relates) is Provectus Biopharmaceuticals, Inc., a Delaware corporation.

The Company’s principal executive office is located at 7327 Oak Ridge Hwy., Suite A, Knoxville, Tennessee 37931, and its telephone number

is (866) 594-5999.

2

The information set forth in the Offer Letter/Prospectus under the section entitled

“Prospectus Summary—Overview—Corporate Contact Information” is incorporated herein by reference.

(b)

Securities. As of December 28, 2015, the Company had a total of 80,121,595 warrants to purchase common stock outstanding, of which 59,861,601 Existing Warrants are subject to the Offer. The Existing Warrants are exercisable for an

aggregate of 59,861,601 shares of the Company’s common stock.

(c) Trading Market and Price. The information set forth in the

Offer Letter/Prospectus under the sections entitled “The Exchange Offer—Price Range of June 2015 Warrants” and “The Exchange Offer—Price Range of Common Stock” regarding the trading markets and prices of the

Company’s warrants and the Company’s common stock is incorporated herein by reference.

| ITEM 3. |

IDENTITY AND BACKGROUND OF FILING PERSON. |

(a) Name and Address. The filing

person is the subject company, Provectus Biopharmaceuticals, Inc. The information set forth under Item 2(a) above is incorporated herein by reference.

Pursuant to Instruction C to Schedule TO, the following persons are directors and executive officers of the Company, and the address for each

person is c/o Provectus Biopharmaceuticals, Inc., 7327 Oak Ridge Hwy., Suite A, Knoxville, Tennessee 37931 and the telephone number is (866) 594-5999. No single person or group of persons controls the Company.

|

|

|

|

|

| Name |

|

Position with the Company |

|

|

| H. Craig Dees |

|

Chief Executive Officer and Chairman of the Board |

|

|

| Peter R. Culpepper |

|

Chief Financial Officer, Chief Accounting Officer and Chief Operating Officer |

|

|

| Timothy C. Scott |

|

President |

|

|

| Eric A. Wachter |

|

Chief Technology Officer |

|

|

| Alfred E. Smith, IV |

|

Director |

|

|

| Kelly M. McMasters |

|

Director |

|

|

| Jan Koe |

|

Director |

|

|

| ITEM 4. |

TERMS OF THE TRANSACTION. |

(a) Material Terms. The information set forth in the

Offer Letter/Prospectus under the section entitled “The Exchange Offer” is incorporated herein by reference. There will be no material differences in the rights of the Existing Warrant holders as a result of the Offer.

(b) Purchases. The information set forth in the Offer Letter/Prospectus under the section entitled “The Exchange

Offer—Interests of Directors, Officers and Affiliates” is incorporated herein by reference. Refer to Item 8(a) for additional information.

| ITEM 5. |

PAST CONTRACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS. |

(e) Agreements Involving

the Subject Company’s Securities. The information set forth in the Offer Letter/Prospectus under the section entitled “The Exchange Offer—Transactions and Agreements Concerning Our Securities” and “—Interests of

Directors, Officers and Affiliates,” and in Item 12(d) below is incorporated herein by reference.

3

| ITEM 6. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. |

(a) Purposes. The

information about the purpose of the Offer set forth in the Offer Letter/Prospectus under the sections entitled “The Exchange Offer—Background and Purpose of the Exchange Offer” and “—Interests of Directors, Officers and

Affiliates” is incorporated herein by reference.

(b) Use of Securities Acquired. Any Existing Warrants acquired pursuant to

the Offer will be cancelled.

(c) (1-10) Plans. Not applicable.

| ITEM 7. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION. |

(a) Source of Funds. The

Company will receive cash from the Existing Warrant holders who elect to participate in the Offer. The information set forth in the Offer Letter/Prospectus under the sections entitled “The Exchange Offer—Source and Amount of Funds”

and “—Interests of Directors, Officers and Affiliates” is incorporated herein by reference.

(b) Conditions. Not

applicable.

(d) Borrowed Funds. Not applicable.

| ITEM 8. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY. |

(a) Securities Ownership. The

Company does not beneficially own any of the Existing Warrants. The information set forth in the Offer Letter/Prospectus under the section entitled “The Exchange Offer—Interests of Directors, Officers and Affiliates” is incorporated

herein by reference.

(b) Securities Transactions. The information set forth in the Offer Letter/Prospectus under the section

entitled “The Exchange Offer—Interests of Directors, Officers and Affiliates” is incorporated herein by reference.

| ITEM 9. |

PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED. |

(a) Solicitations or

Recommendations.

The Company has retained Maxim Group LLC (“Maxim”) to serve as its co-dealer manager in connection with the

Offer pursuant to the terms of that certain Letter of Engagement, dated December 14, 2015 (the “LOE”). As compensation for services rendered by Maxim under the LOE, the Company has agreed to: (i) pay to Maxim a

solicitation/dealer-manager fee consisting of a cash payment equal to four percent (4.0%) of the total proceeds received from the exchange of the Existing Warrants participating in the Offer; (ii) pay Maxim an investment banking advisory

fee consisting of a cash payment equal to two percent (2.0%) of the total proceeds received by the Company in the Offer; (iii) pay Maxim $25,000 as an advance to be applied toward Maxim’s anticipated out-of-pocket expenses; and

(iv) issue to Maxim (or its designated affiliates) warrants to purchase shares of Common Stock covering such number of shares of Common Stock equal to six percent (6.0%) of the total number of shares of the Common Stock underlying the

Existing Warrants exercised in connection with the Offer, other than Existing Warrants exercised pursuant to the Offer by clients of Network 1 Financial Securities, Inc. (“Network 1”), as discussed below. The Company provided

customary representations and indemnification to Maxim under the LOE. The LOE is effective for a period of one hundred and eighty (180) business days from December 14, 2015 and will continue to be in effect for a period of thirty

(30) business days subsequent to the Company’s filing of a Form 8-K, which will be filed upon closing of the Offer.

In

connection with any Existing Warrants tendered by clients of Network 1 in the Offer, the Company will (i) issue Maxim (or its designated affiliates) warrants to purchase shares of Common Stock covering such number of shares of Common Stock

equal to three percent (3.0%) of the total number of shares of the Common Stock underlying the Existing Warrants exercised by clients of Network 1 in the Offer; and (ii) issue Network 1 warrants to purchase shares of Common Stock covering

such number of shares of Common Stock equal to three percent

4

(3.0%) of the total number of shares of the Common Stock underlying the Existing Warrants exercised by clients of Network 1 in the Offer. Maxim will pay to Network 1 a cash fee equal to 100% of

Maxim’s dealer manager fee for any Existing Warrants that are tendered by clients of Network 1 in the Offer.

The Company has also

retained Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”) to act as the depositary for the Offer. Broadridge will receive reasonable and customary compensation for its services in connection with the Offer, plus reimbursement for

out-of-pocket expenses, and will be indemnified by the Company against certain liabilities and expenses in connection therewith.

Additionally, the Company’s officers may contact Existing Warrant holders by mail, telephone, facsimile or other electronic means, and

may request brokers, dealers, commercial banks, trust companies and other nominee warrant holders to forward material relating to the Offer to beneficial owners. The Company’s officers will not receive any additional compensation for performing

this function.

| ITEM 10. |

FINANCIAL STATEMENTS. |

(a) Financial Information. Incorporated by reference are

the Company’s financial statements for the fiscal years ended December 31, 2014, 2013 and 2012 that were furnished in its Annual Report on Form 10-K and filed with the SEC on March 12, 2015, and its financial statements for the three

and nine months ended September 30, 2015 that were furnished in its Quarterly Report on Form 10-Q and filed with the SEC on November 5, 2015. The full text of all such filings with the SEC referenced above, as well as the other documents

the Company has filed with the SEC prior to, or will file with the SEC subsequent to, the filing of this Schedule TO relating to this Offer can be accessed electronically on the SEC’s website at www.sec.gov.

(b) Pro Forma Information. The information set forth in the Offer Letter/Prospectus under the section entitled “Selected Financial

Data” is incorporated herein by reference.

| ITEM 11. |

ADDITIONAL INFORMATION. |

(a) Agreements, Regulatory Requirements and Legal

Proceedings. Except as described in Item 5, there are no present or proposed contracts, arrangements, understandings or relationships between the Company or any of its executive officers, directors or affiliates relating, directly or

indirectly, to the Offer. There are no applicable regulatory requirements which must be complied with or approvals which must be obtained in connection with the Offer. There are no antitrust laws applicable to the Offer. The margin requirements

under Section 7 of the Exchange Act, and the related regulations thereunder are inapplicable. There are no pending legal proceedings relating to the Offer.

(c) Other Material Information. The information set forth in the Offer Letter/Prospectus and the related Letter of Transmittal, copies

of which are filed as Exhibits (a)(1)(i) and (a)(1)(ii) hereto, respectively, as each may be amended or supplemented from time to time, is incorporated herein by reference. The Company will amend this Schedule TO to include documents that the

Company may file with the SEC after the date of the Offer pursuant to Sections 13(a), 13(c) or 14 of the Exchange Act and prior to the expiration of the tender offer to the extent required by Rule 13e-4(d)(2) promulgated under the Exchange Act. The

information contained in all of the exhibits referred to in Item 12 below is incorporated herein by reference.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| (a)(l)(i) |

|

Offer Letter/Prospectus, dated December 31, 2015 (incorporated by reference to the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(1)(ii) |

|

Form of Letter of Transmittal (incorporated by reference to Exhibit 99.1 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

5

|

|

|

|

|

| (a)(1)(iii) |

|

Form of Notice of Guaranteed Delivery (incorporated by reference to Exhibit 99.2 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(1)(iv) |

|

Form of letter to Warrant holders (incorporated by reference to Exhibit 99.3 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(2) |

|

None. |

|

|

| (a)(3) |

|

None. |

|

|

| (a)(4)(A) |

|

Exhibit (a)(1)(i) is incorporated by reference. |

|

|

| (b) |

|

Not applicable. |

|

|

| (d)(i) |

|

Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed June 19, 2015). |

|

|

| (d)(ii) |

|

Form of First Amendment to Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.3 of the Company’s Registration Statement on Form

S-4 filed on December 31, 2015). |

|

|

| (d)(iii) |

|

Specimen Replacement Warrant. |

|

|

| (g) |

|

None. |

|

|

| (h) |

|

Tax opinion of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC (incorporated by reference to Exhibit 8.1 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

| ITEM 13. |

INFORMATION REQUIRED BY SCHEDULE 13E-3 |

Not applicable.

6

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

| PROVECTUS BIOPHARMACEUTICALS, INC. |

|

|

| By |

|

/s/ Peter R. Culpepper |

|

|

Peter R. Culpepper |

|

|

|

|

Chief Financial Officer, Chief Accounting

Officer and Chief Operating Officer |

Dated: December 31, 2015

7

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| (a)(l)(i) |

|

Offer Letter/Prospectus, dated December 31, 2015 (incorporated by reference to the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(1)(ii) |

|

Form of Letter of Transmittal (incorporated by reference to Exhibit 99.1 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(1)(iii) |

|

Form of Notice of Guaranteed Delivery (incorporated by reference to Exhibit 99.2 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(1)(iv) |

|

Form of letter to Warrant holders (incorporated by reference to Exhibit 99.3 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

|

|

| (a)(2) |

|

None. |

|

|

| (a)(3) |

|

None. |

|

|

| (a)(4)(A) |

|

Exhibit (a)(1)(i) is incorporated by reference. |

|

|

| (b) |

|

Not applicable. |

|

|

| (d)(i) |

|

Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.1 to current report on Form 8-K filed June 19, 2015). |

|

|

| (d)(ii) |

|

Form of First Amendment to Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.3 of the Company’s Registration Statement on Form

S-4 filed on December 31, 2015). |

|

|

| (d)(iii) |

|

Replacement Warrant. |

|

|

| (g) |

|

None. |

|

|

| (h) |

|

Tax opinion of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC (incorporated by reference to Exhibit 8.1 of the Company’s Registration Statement on Form S-4 filed on December 31, 2015). |

Exhibit (d)(iii)

[FORM OF COMMON STOCK WARRANT CERTIFICATE]

[Number]

Common Stock Warrants

THIS WARRANT SHALL BE VOID IF NOT EXERCISED PRIOR TO

THE EXPIRATION OF THE EXERCISE PERIOD PROVIDED FOR

IN THE WARRANT AGREEMENT DESCRIBED BELOW

PROVECTUS BIOPHARMACEUTICALS, INC.

Incorporated Under the Laws of the State of Delaware

CUSIP 74373P 116

Warrant Certificate

This

Warrant Certificate certifies that , or registered assigns, is the registered holder of warrant(s) (the

“Warrants” and each, a “Warrant”) to purchase shares of common stock, par value $0.001 per share (“Common Stock”), of Provectus Biopharmaceuticals, Inc., a Delaware corporation (the

“Company”). Each Warrant entitles the holder, upon exercise during the period set forth in the Warrant Agreement referred to below, to receive from the Company that number of fully paid and nonassessable shares of Common Stock as

set forth below, at the exercise price (the “Exercise Price”) as determined pursuant to the Warrant Agreement, payable in lawful money (or through “cashless exercise” as provided for in the Warrant Agreement) of the

United States of America upon surrender of this Warrant Certificate and payment of the Exercise Price at the office or agency of the Warrant Agent referred to below, subject to the conditions set forth herein and in the Warrant Agreement. Defined

terms used in this Warrant Certificate but not defined herein shall have the meanings given to them in the Warrant Agreement (as defined on the reverse hereof).

Each Warrant is initially exercisable for one fully paid and non-assessable share of Common Stock. The number of the shares of Common Stock

issuable upon exercise of the Warrants is subject to adjustment upon the occurrence of certain events set forth in the Warrant Agreement.

The initial Exercise Price per share of Common Stock for any Warrant is equal to $0.85 per share. The Exercise Price is subject to adjustment

upon the occurrence of certain events set forth in the Warrant Agreement.

Subject to the conditions set forth in the Warrant Agreement,

the Warrants may be exercised only during the Exercise Period and to the extent not exercised by the end of such Exercise Period, such Warrants shall become void.

Reference is hereby made to the further provisions of this Warrant Certificate set forth on the

reverse hereof and such further provisions shall for all purposes have the same effect as though fully set forth at this place.

This

Warrant Certificate shall not be valid unless countersigned by the Warrant Agent, as such term is used in the Warrant Agreement.

This

Warrant Certificate shall be governed by and construed in accordance with the internal laws of the State of New York, without regard to conflicts of laws principles thereof.

|

|

|

| Provectus Biopharmaceuticals, Inc., |

| a Delaware corporation |

|

|

| By: |

|

|

| Name: |

|

Peter R. Culpepper |

| Title: |

|

Chief Financial Officer |

|

Broadridge Corporate Issuer Solutions, Inc.,

as Warrant Agent |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

[Form of Common Stock Warrant Certificate]

[Reverse]

The Warrants

evidenced by this Warrant Certificate are part of a duly authorized issue of Warrants entitling the holder on exercise to receive shares of Common Stock and are issued or to be issued pursuant to a Warrant Agreement dated as of June

, 2015 (the “Warrant Agreement”), duly executed and delivered by the Company to Broadridge Corporate Issuer Solutions, Inc., as warrant agent (the “Warrant Agent”), which Warrant Agreement is

hereby incorporated by reference in and made a part of this instrument and is hereby referred to for a description of the rights, limitation of rights, obligations, duties and immunities thereunder of the Warrant Agent, the Company and the holders

(the words “holders” or “holder” meaning the Registered Holders or Registered Holder) of the Warrants. A copy of the Warrant Agreement may be obtained by the holder hereof upon written request to the Company.

Defined terms used in this Warrant Certificate but not defined herein shall have the meanings given to them in the Warrant Agreement.

Warrants may be exercised at any time during the Exercise Period set forth in Section 3.3 of the Warrant Agreement.

The Warrant Agreement provides that upon the occurrence of certain events the number of shares of Common Stock issuable upon exercise of the

Warrants set forth on the face hereof may, subject to certain conditions, be adjusted. If, upon exercise of a Warrant, the holder thereof would be entitled to receive a fractional interest in a share of Common Stock, the Company shall, upon

exercise, round up to the nearest whole number of shares of Common Stock to be issued to the holder of the Warrant.

Warrant Certificates,

when surrendered at the principal corporate trust office of the Warrant Agent by the Registered Holder thereof in person or by legal representative or attorney duly authorized in writing, may be exchanged, in the manner and subject to the

limitations provided in the Warrant Agreement, but without payment of any service charge, for another Warrant Certificate or Warrant Certificates of like tenor evidencing in the aggregate a like number of Warrants.

Upon due presentation for registration of transfer of this Warrant Certificate at the office of the Warrant Agent a new Warrant Certificate or

Warrant Certificates of like tenor and evidencing in the aggregate a like number of Warrants shall be issued to the transferee(s) in exchange for this Warrant Certificate, subject to the limitations provided in the Warrant Agreement, without charge

except for any tax or other governmental charge imposed in connection therewith.

The Company and the Warrant Agent may deem and treat the

Registered Holder(s) hereof as the absolute owner(s) of this Warrant Certificate (notwithstanding any notation of ownership or other writing hereon made by anyone), for the purpose of any exercise hereof, of any distribution to the holder(s) hereof,

and for all other purposes, and neither the Company nor the Warrant Agent shall be affected by any notice to the contrary. Neither the Warrants nor this Warrant Certificate entitles any holder hereof to any rights of a stockholder of the Company.

Election to Purchase

(To Be Executed Upon Exercise of Warrant)

The undersigned hereby irrevocably elects to exercise the right, represented by this Warrant Certificate, to receive shares of Common Stock

and herewith tenders payment for such shares to the order of Provectus Biopharmaceuticals, Inc. (the “Company”) in the amount of $ in accordance with the terms hereof. The undersigned

requests that a certificate for such shares be registered in the name of , whose address is and that such shares be delivered to

whose address is . If said number of shares is less than all of the shares of Common Stock purchasable hereunder, the undersigned

requests that a new Warrant Certificate representing the remaining balance of such shares be registered in the name of , whose

address is , and that such Warrant Certificate be delivered to

, whose address is

.

In the event

that the Warrant is to be exercised on a “cashless” basis pursuant to Section 3.3.7 of the Warrant Agreement, the number of shares that this Warrant is exercisable for shall be determined in accordance with

Section 3.3.7 of the Warrant Agreement.

|

|

|

|

|

|

|

|

|

a “Cash Exercise” with respect to Warrant Shares; |

|

|

|

|

|

|

|

and/or |

|

|

|

|

|

|

|

a “Cashless Exercise” with respect to Warrant Shares, resulting in a delivery obligation by the Company to the Holder

of shares of Common Stock representing the applicable Net Number, subject to adjustment. |

In the event that the Warrant may be exercised, to the extent allowed by the Warrant Agreement, through

cashless exercise (i) the number of shares that this Warrant is exercisable for would be determined in accordance with the relevant section of the Warrant Agreement which allows for such cashless exercise and (ii) the holder hereof shall

complete the following: The undersigned hereby irrevocably elects to exercise the right, represented by this Warrant Certificate, through the cashless exercise provisions of the Warrant Agreement, to receive shares of Common Stock. If said number of

shares is less than all of the shares of Common Stock purchasable hereunder (after giving effect to the cashless exercise), the undersigned requests that a new Warrant Certificate representing the remaining balance of such shares be registered in

the name of , whose address is

, and that such Warrant Certificate be delivered to

, whose address is

.

|

|

|

|

|

| Date: , 20 |

|

|

|

(Signature) |

|

|

|

|

|

|

|

(Address) |

|

|

|

|

|

|

|

(Tax Identification Number) |

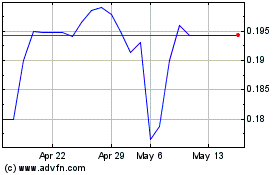

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024