Notification That Quarterly Report Will Be Submitted Late (nt 10-q)

August 14 2015 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

|

SEC File Number 333-193058 |

|

|

CUSIP Number 74255T |

NOTIFICATION OF LATE FILING

|

(Check one): |

☐ Form 10-K |

☐ Form 20-F |

☒ Form 10-Q |

☐ Form 10-D |

☐ Form N-SAR |

|

|

|

|

|

|

|

|

|

For Period Ended: June 30, 2015 |

|

|

|

☐ Transition Report on Form 10-K |

|

|

|

|

|

☐ Transition Report on Form 20-F |

|

|

|

|

|

☐ Transition Report on Form 11-K |

|

|

|

|

|

☐ Transition Report on Form 10-Q |

|

|

|

|

|

☐ Transition Report on Form N-SAR |

|

|

|

|

|

For the Transition Period Ended: |

|

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type. |

| Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates:

PART I -- REGISTRANT INFORMATION

|

Principal Solar, Inc. |

|

Full Name of Registrant |

|

|

|

Former Name if Applicable |

|

211 N. Ervay, Suite 300 |

|

Address of Principal Executive Office (Street and Number) |

|

Dallas, TX 75201 |

|

City, State and Zip Code |

PART II -- RULE 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25 (b), the following should be completed. (Check box if appropriate)

|

|

|

(a) The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

|

☒ |

|

(b) The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

|

|

|

(c) The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III -- NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, or the transition report or portion thereof, could not be filed within the prescribed time period.

The Registrant will be unable to file its quarterly report on Form 10-Q within the prescribed time period because of additional time required to address accounting and disclosure issues surrounding its recent reverse stock split (effective May 6, 2015), and its previously announced financings including a Series A Preferred offering with warrants (filed with the SEC on Form 8-K on May 12, 2015), and a Senior Secured Convertible Debenture with Warrants (filed with the SEC on Form 8-K on July 8, 2015) that has since been reclassified from temorary equity to liabilities.

PART IV -- OTHER INFORMATION

|

(1) |

Name and telephone number of person to contact in regard to this notification |

|

David N. Pilotte |

|

214 |

|

681-0828 |

|

(Name) |

|

(Area Code) |

|

(Telephone Number) |

|

(2) |

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). |

|

|

☒ Yes ☐ No |

|

(3) |

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? |

|

|

☒ Yes ☐ No |

| |

|

| |

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. |

| |

|

Three Months Ended |

|

|

(Unaudited and Preliminary) |

|

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

Power generation |

|

$ |

287,813 |

|

|

$ |

283,316 |

|

|

Total cost of revenues |

|

|

127,271 |

|

|

|

147,019 |

|

|

Gross profit |

|

|

160,542 |

|

|

|

136,297 |

|

|

General and administrative expenses |

|

|

1,414,148 |

|

|

|

563,597 |

|

|

Operating loss |

|

|

(1,253,606 |

) |

|

|

(427,300 |

) |

|

Other expense |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

772,944 |

|

|

|

111,338 |

|

|

Gain on derivative liability warrants |

|

|

(1,074,008 |

) |

|

|

(7,011 |

) |

|

Total other expense |

|

|

(301,064 |

) |

|

|

104,327 |

|

|

Loss before provision for income taxes |

|

|

(952,542 |

) |

|

|

(531,627 |

) |

|

Provision for state income taxes |

|

|

1,300 |

|

|

|

- |

|

|

Net loss |

|

|

(953,842 |

) |

|

|

(531,627 |

) |

|

Income attributable to noncontrolling interest in subsidiary |

|

|

(18,051 |

) |

|

|

(9,752 |

) |

|

Net loss before preferred stock accretion and dividends |

|

|

(971,893 |

) |

|

|

(541,379 |

) |

|

Redeemable Series A preferred stock accretion and dividends |

|

|

(184,896 |

) |

|

|

- |

|

|

Net loss attributable to common stockholders |

|

$ |

(1,156,789 |

) |

|

$ |

(541,379 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic and diluted |

|

|

5,604,181 |

|

|

|

4,857,178 |

|

Three Months Ended June 2015 and 2014

(Unaudited and Preliminary)

Power generation revenue was $288 thousand in 2015 compared to $283 thousand in 2014.

Direct operating costs declined $23 thousand in 2015 compared to 2014. Repairs and maintenance decreased by $15 thousand reflecting 2014 costs incurred to clear trees and perform additional preventative maintenance. Insurance and lease expense each decreased by $5 thousand as 2014 reflecting a cumulative adjustment from prior periods. Property taxes increased by $5 thousand as 2015 included cumulative adjustments from prior periods. Other direct costs netted to a decrease of $3 thousand.

The increase in general and administrative expenses of approximately $850 thousand was comprised of:

Increases

| |

● |

an increase in equity compensation (non-cash) expense of $154 thousand resulting from option grants to members of the Board of Directors, and $21 thousand resulting from options granted to executives and Board members in the intervening periods |

| |

● |

an increase in consulting costs of $99 thousand resulting from two additional individuals supporting our fundraising efforts |

| |

● |

an increase of $46 thousand stemming from the engagement of an investor relations firm in connection with a public offering |

| |

● |

an increase of $700 thousand for accounting, legal, offering expenses and filing fees resulting from a public offering that was ultimately withdrawn |

Decreases

| |

● |

a decrease of $29 thousand in public relations expenses as we renegotiated the contract to better reflect our level of activity and a shift to investor relations |

| |

● |

a decrease of $21 thousand in the Delaware franchise tax as 2014 included a cumulative full year adjustment for 2013 whereas the expense is now recorded and paid quarterly |

| |

● |

a reclassification of $100 thousand in advisory and engineering expenses to construction in progress. |

| |

● |

other changes netting to a decrease of $20 thousand |

Interest expense increased by $662 thousand including an increase of $676 thousand ($44 thousand in cash and $632 thousand non-cash reflecting the amortization of the debt discount attributed to the warrants) resulting from the March 2, 2015, issuance of debentures to Alpha Capital Anstalt; offset by a $12 thousand decrease resulting from the cessation at December 31, 2014, of the interest accrual for legacy liabilities; and other insignificant changes.

Due to movements in the price of the Company's stock, the withdrawal of a public offering, and changes in the Company's future prospects, our independent valuation firm estimated a decline at June 30, 2015, in the value of the warrants issued in connection with the March 2, 2015, issuance of debentures to Alpha Capital Anstalt. As a result, the derivative liability was reduced and the Company recorded a gain of $1.1 million in the three months ended June 30, 2015.

Six Months Ended June 2015 and 2014

Power generation revenue was $472 thousand in 2015 compared to $501 thousand in 2014, a decrease of $29 thousand. The decrease is due to protracted snows in the northeastern U.S. during the last winter (the location of our SunGen Mill 77 facility) and extended periods of rain in the Midwest in the spring (the location of our Powerhouse One facility).

Direct operating costs declined $23 thousand in 2015 compared to 2014. Repairs and maintenance decreased by $15 thousand reflecting 2014 costs incurred to clear trees and perform additional preventative maintenance. Insurance and lease expense each decreased by $5 thousand as 2014 reflecting a cumulative adjustment from prior periods. Property taxes increased by $5 thousand as 2015 included cumulative adjustments from prior periods. Other direct costs netted to a decrease of $3 thousand.

The increase in general and administrative expenses of approximately $1.3 million was comprised of:

Increases

| |

● |

an increase in equity compensation (non-cash) expense of $535 thousand including $341 thousand resulting from option grants to members of the Board of Directors, $110 thousand resulting from option grants to advisors, $37 thousand resulting from options granted to a business partner; and $47 thousand resulting from option granted in prior periods |

| |

● |

an increase in consulting costs of $128 thousand resulting from two additional individuals supporting our fundraising efforts |

| |

● |

an increase of $32 thousand in legal fees stemming from financings including the March 2, 2015, including $30 thousand stemming from the issuance of debentures with Alpha Capital Anstalt, $10 thousand stemming from the May 6, 2015, issuance of Series A Preferred stock, offset by decreases in other legal fees |

| |

● |

an increase of $93 thousand stemming from the engagement of an investor relations firm in connection with a public offering |

| |

● |

an increase of $741 thousand for accounting, legal, offering expenses and filing fees resulting from a public offering that was ultimately withdrawn |

Decreases

| |

● |

a decrease of $67 thousand in public relations expenses as we renegotiated the contract to better reflect our level of activity and a shift to investor relations |

| |

● |

a decrease of $25 thousand in the Delaware franchise tax as 2014 included a cumulative full year adjustment for 2013 whereas the expense is now recorded and paid quarterly |

| |

● |

a reclassification $100 thousand of advisory and engineering expenses to construction in progress. |

| |

● |

other changes netting to a decrease of $20 thousand |

Interest expense increased by $885 thousand including an increase of $866 thousand ($33 thousand in cash and $833 thousand non-cash reflecting the amortization of the debt discount attributed to the warrants) resulting from the March 2, 2015, issuance of debentures to Alpha Capital Anstalt; an increase of $44 thousand incurred for the convertible notes (related parties and others); offset by a $25 thousand decrease resulting from the cessation at December 31, 2014, of the interest accrual for legacy liabilities; and other insignificant changes.

Due to movements in the price of the Company's stock, the withdrawal of a public offering, and changes in the Company's future prospects, our independent valuation firm estimated a decline at June 30, 2015, in the value of the warrants issued in connection with the March 2, 2015, issuance of debentures to Alpha Capital Anstalt. As a result, the derivative liability was reduced and the Company recorded a gain of $1.1 million in the six months ended June 30, 2015.

|

Principal Solar, Inc. |

|

(Name of Registrant as Specified in Charter) |

has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: |

August 14, 2015 |

|

By: |

/s/ David N. Pilotte, Chief Financial Officer |

INSTRUCTION: The form may be signed by an executive officer or the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative's authority to sign on behalf of the registrant shall be filed with the form.

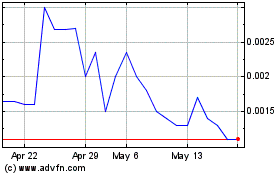

Principal Solar (PK) (USOTC:PSWW)

Historical Stock Chart

From May 2024 to May 2024

Principal Solar (PK) (USOTC:PSWW)

Historical Stock Chart

From May 2023 to May 2024