Givaudan Net Profit Rises Despite Drop in Sales

January 25 2024 - 1:38AM

Dow Jones News

By Adria Calatayud

Givaudan reported a rise in net profit for last year, thanks to

cost controls that allowed it to increase profitability and offset

a drop in sales.

Net profit for 2023 was 893 million Swiss francs ($1.04 billion)

compared with CHF856 million a year before, the Swiss supplier of

chemicals to the food and cosmetics industries said Thursday.

Sales fell to CHF6.915 billion from CHF7.12 billion, dragged by

a decline in the company's taste-and-wellbeing segment, it said.

For the fourth quarter alone, sales fell 0.5% to CHF1.65

billion.

Full-year earnings before interest, taxes, depreciation and

amortization inched lower to CHF1.47 billion from CHF1.48 billion,

but Givaudan's Ebitda margin improved to 21.3% from 20.7%, which it

attributed to cost management across the business and a

performance-improvement program.

Analysts expected Givaudan's 2023 net profit, Ebitda and sales

at CHF842 million, CHF1.47 billion and CHF6.92 billion,

respectively, according to consensus estimates provided by the

company.

The company said it is on track for its 2025 targets, which

include average annual organic sales growth of 4% to 5% over a

five-year period.

It intends to propose a dividend of CHF68 a share for 2023, up

1.5% on year.

Write to Adria Calatayud at adria.calatayud@wsj.com

(END) Dow Jones Newswires

January 25, 2024 01:23 ET (06:23 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

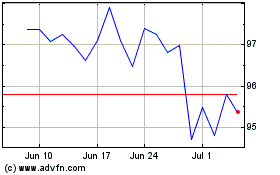

Givaudan (PK) (USOTC:GVDNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

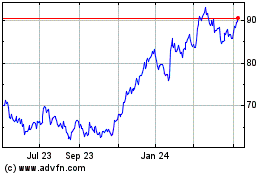

Givaudan (PK) (USOTC:GVDNY)

Historical Stock Chart

From Apr 2023 to Apr 2024