Current Report Filing (8-k)

November 03 2022 - 4:38PM

Edgar (US Regulatory)

false000158848900015884892022-10-292022-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 29, 2022 |

Grayscale® Bitcoin Trust (BTC)

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-56121 |

46-7019388 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Grayscale Investments, LLC 290 Harbor Drive, 4th Floor |

|

Stamford, Connecticut |

|

06902 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 668-1427 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Grayscale Bitcoin Trust (BTC) Shares |

|

GBTC |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

CoinDesk Indices, Inc. (the “Index Provider”) announced a change to the Constituent Exchanges used to derive the Index Price for Grayscale Bitcoin Trust (BTC) (the “Trust”). Effective October 29, 2022, the Index Provider removed Bitstamp from the CoinDesk Bitcoin Price Index (XBX) (the “Index”) due to the exchange failing the minimum liquidity requirement, and added Binance.US as a Constituent Exchange due to the exchange meeting the minimum liquidity requirement as part of its scheduled quarterly review. As of the date of this current report, the Digital Asset Exchanges included in the Index are Coinbase Pro, Binance.US, Kraken, and LMAX Digital.

The Index Provider may change the trading venues that are used to calculate the Index Price or otherwise change the way in which an Index Price is calculated at any time. The Index Provider has scheduled quarterly reviews in which it may add or remove Constituent Exchanges that satisfy or fail the criteria described in “Overview of the Bitcoin Industry and Market—Bitcoin Value—The Index and the Index Price” in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the Securities and Exchange Commission on February 25, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Grayscale Investments, LLC as Sponsor of Grayscale Bitcoin Trust (BTC) |

|

|

|

|

Date: |

November 3, 2022 |

By: |

/s/ Michael Sonnenshein |

|

|

|

Michael Sonnenshein

Chief Executive Officer |

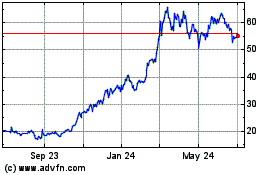

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

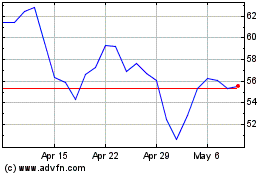

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Apr 2023 to Apr 2024