UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

☒

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material under §240.14a-12

|

CARBON ENERGY CORPORATION

(Name of Registrant as Specified in Its

Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee

(Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

CARBON ENERGY CORPORATION

1700 Broadway, Suite 1170

Denver, CO 80290

July __, 2020

To the Stockholders of Carbon Energy Corporation:

You are cordially

invited to attend a Special Meeting of stockholders of Carbon Energy Corporation, a Delaware corporation (the “Company”),

to be held on August __, 2020, at _____ a.m. local time. The Special Meeting will be held at the offices of the Company which

are located at 1700 Broadway, Suite 1170, Denver, CO 80290.

At the Special Meeting,

you will be asked to consider and vote upon a proposal to amend the Company’s Amended and Restated Certificate of Incorporation,

to reverse split the Company’s common stock, (the “Reverse Stock Split”) at a ratio of 4-for-1. If the Reverse

Stock Split is approved, the Company will file with the Delaware Secretary of State a certificate of amendment to its Amended and

Restated Certificate of Incorporation, at which date (the “effective time”) a stockholder owning fewer than four shares

immediately prior to the effective time, would only be entitled to a fraction of a share of common stock and will be paid cash

in lieu of such fraction of a share, on the basis of $1.00, (the “Cash Payment”) for each share of common stock held

by the stockholder (the “Cashed Out Stockholders”) immediately prior to the effective time and the Cashed Out Stockholders

will no longer be stockholders of the Company.

The purpose of the

Reverse Stock Split is to enable the Company to reduce the number of record holders of its common stock below 300, which is the

level below which the Company can suspend its duty to file periodic and current reports and other information with the Securities

and Exchange Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As described in

the accompanying proxy statement, the Company’s Board of Directors has determined that the costs of being a public reporting

company outweigh the benefits of being a public company. The actions the Company would take to suspend, and events that occur as

a result of such actions that would have the effect of suspending the Company’s reporting obligations under the Exchange Act, and the registration

of the Company’s common stock under Section 12(g) of the Exchange Act, are collectively referred to as the “Transaction”.

After giving effect to the Transaction, the Company will no longer be subject to the reporting requirements under the Exchange

Act or other requirements applicable to a public company, including requirements under the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”).

The Company anticipates

that after the Reverse Stock Split its common stock will continue to trade on the Pink Non-Current platform of the OTC Markets

Group.

Furthermore, after

giving effect to the Transaction and as necessary to maintain the Company’s suspension of its SEC reporting obligations,

the Company reserves the right to take additional actions that may be permitted under Delaware law, including further reverse stock

splits.

The Board of Directors

has determined (by a unanimous vote) that the Reverse Stock Split is in the best interests of the Company’s stockholders

and the specific terms of the Reverse Stock Split are fair to Cashed Out Stockholders.

The Board recommends

(by a unanimous vote of directors) that you vote “FOR” the adoption of the Reverse Stock Split. Please read the accompanying

proxy statement carefully.

Your vote is important. Whether

or not you plan to attend the Special Meeting, the Company urges you to please vote by proxy as soon as possible. If you do attend

the Special Meeting and desire to vote in person, you may do so, even though you have previously voted by proxy.

Sincerely,

Patrick R. McDonald

Chief Executive Officer

CARBON ENERGY CORPORATION

1700 Broadway, Suite 1170

Denver, CO 80290

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST ____, 2020

To the Stockholders of Carbon Energy Corporation:

Notice is hereby given

that a special meeting of stockholders of Carbon Energy Corporation (the “Company”), will be held on August __, 2020,

at ______ a.m. local time. The Special Meeting will be held at the offices of the Company which are located at 1700 Broadway,

Suite 1170, Denver, CO 80290. The Special Meeting is being held for the following purposes:

|

|

●

|

to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation

to reverse split the Company’s common stock on a 4-for-1 basis; and

|

|

|

|

to transact such other business as may properly come before the Meeting.

|

July 15, 2020 is the

record date for the determination of stockholders entitled to notice of and to vote at the Special Meeting (the “Record

Date”).

A copy of the proposed

form of amendment to the Company’s Amended and Restated Certificate of Incorporation is attached as Appendix A to

the accompanying proxy statement.

|

|

Carbon Energy Corporation

|

|

|

|

|

|

Patrick R. McDonald

|

|

|

Chief Executive Officer

|

July __, 2020

PLEASE INDICATE YOUR VOTING INSTRUCTIONS

ON THE ATTACHED PROXY CARD,

AND SIGN, DATE AND RETURN THE PROXY CARD.

TO SAVE THE COST OF FURTHER SOLICITATION,

PLEASE VOTE PROMPTLY.

CARBON ENERGY CORPORATION

1700 Broadway, Suite 1170

Denver, CO 80290

The accompanying proxy

is solicited by the Company’s directors for voting at the Special Meeting of shareholders to be held on August __, 2020

and at all adjournments of the Special Meeting. If the proxy is executed and returned, it will be voted at the Special Meeting

in accordance with any instructions, and if no specification is made, the proxy will be voted for the proposal set forth in the

accompanying notice of the Special Meeting. Shareholders who execute proxies may revoke them at any time before they are voted,

either by writing to the Company at the address shown above or in person at the time of the Special Meeting. Additionally, any

later dated proxy will revoke a previous proxy from the same shareholder. This proxy statement was posted on the Company’s

website on or about July __, 2020.

As of July 15, 2020,

the Company had:

|

|

●

|

8,304,781 outstanding shares of common stock, with each common share entitled to

one vote at the Special Meeting, and

|

|

|

●

|

50,000 outstanding shares of Series B preferred stock with each share entitled to 12.5 votes at

the Special Meeting.

|

Provided a quorum consisting

of a majority of the shares entitled to vote is present at the meeting, in person or represented by proxy, the adoption of the

proposal to come before the Special Meeting will be approved if the affirmative vote of the majority of shares present in person

or represented by proxy at the Special Meeting approve the proposal. The approval of at least a majority of the Company’s

unaffiliated security holders is not required to adopt the Reverse Stock Split.

Shares of the Company’s

common stock represented by properly executed proxies that reflect abstentions or “broker non-votes” will be counted

as present for purposes of determining the presence of a quorum at the special meeting. “Broker non-votes” represent

shares held by brokerage firms in "street-name" with respect to which the broker has not received instructions from the

customer or otherwise does not have discretionary voting authority. Abstentions and broker non-votes will not be counted as having

voted against the proposal to be considered at the Special Meeting.

THE REVERSE STOCK

SPLIT AND OTHER ASPECTS OF THE TRANSACTION HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR

ANY STATE SECURITIES COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON

THE FAIRNESS OR MERITS OF THE REVERSE STOCK SPLIT, ANY OTHER ASPECTS OF TRANSACTION, OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION

IN THE ATTACHED PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

SUMMARY TERM SHEET

The following summary

term sheet highlights certain information about the Reverse Stock Split and other aspects of the Transaction, but may not contain

all of the information that is important to you. For a more complete description of the Reverse Stock Split and other aspects of

the Transaction, we urge you to carefully read this proxy statement.

At the Special Meeting,

you will be asked to consider and vote upon a proposal to amend the Company’s Amended and Restated Certificate of Incorporation,

to reverse split the Company’s common stock at a ratio of 4-for-1, (the “Reverse Stock Split”). If the Reverse

Stock Split is approved, the Company will file with the Delaware Secretary of State a certificate of amendment to its Amended and

Restated Certificate of Incorporation, at which date (the “effective time”) a stockholder owning fewer than four shares

immediately prior to the effective time, would only be entitled to a fraction of a share of common stock and will be paid cash

in lieu of such fraction of a share, on the basis of $1.00, (the “Cash Payment”) for each share of common stock held

by the stockholder (the “Cashed Out Stockholder”) immediately prior to effective time and the Cashed Out Stockholders

will no longer be a stockholder of the Company. As of July __, 2020, 90 shareholders that collectively owned 191 shares of the

Company’s common stock owned less than four shares of common stock. If the Reverse Stock Split is approved, the Company would

pay $191.00 to these Cashed Out Shareholders. The Company will use its own funds to pay the Cashed Out Stockholders.

The purpose of the

Reverse Stock Split is to enable the Company to reduce the number of record holders of its common stock below 300, which is the

level below which the Company can suspend its duty to file periodic and current reports and other information with the SEC under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As described in this proxy statement, the Company’s

Board of Directors has determined that the costs of being a public reporting company outweigh the benefits of being a public company.

The actions the Company would take to suspend, and events that occur as a result of such actions that would have the effect of

suspending its reporting obligations under the Exchange Act, and the registration of its common stock under Section 12(g) of the

Exchange Act, are collectively referred to as the “Transaction”. After giving effect to the Transaction, the Company

will no longer be subject to the reporting requirements under the Exchange Act or other requirements applicable to a public company,

including requirements under the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”).

The Company anticipates

that after the Reverse Stock Split its common stock will trade on the Pink Non-Current platform of the OTC Markets Group.

PROPOSAL TO APPROVE A REVERSE SPLIT OF

THE

COMPANY’S COMMON STOCK

Special Factors

At the Special Meeting,

you will be asked to consider and vote upon a proposal to amend the Company’s Amended and Restated Certificate of Incorporation,

to reverse split the Company’s common stock at a ratio of 4-for-1, (the “Reverse Stock Split”). If the Reverse

Stock Split is approved the Company will file with the Delaware Secretary of State a certificate of amendment to its Amended and

Restated Certificate of Incorporation, at which date (the “effective time”) a stockholder owning fewer than four shares

immediately prior to the effective time, would only be entitled to a fraction of a share of common stock and will be paid cash

in lieu of such fraction of a share on the basis of $1.00, (the “Cash Payment”) for each share of common stock held

by the stockholder (the “Cashed Out Stockholder”) immediately prior to the effective time and the Cashed Out Stockholder

will no longer be a stockholder of the Company. As of July __, 2020, 90 shareholders that collectively owned 191 shares of the

Company’s common stock owned less than four shares of common stock. If the Reverse Split is approved, the Company would

pay $191.00 to these Cashed Out Shareholders. The Company will use its own funds to pay the Cashed Out Stockholders. Each Cashed

Out Stockholder will receive a check by mail at such Cashed Out Stockholder’s registered address as soon as practicable

after the effective time. None of the Cashed Out Stockholders are officers, directors or affiliates of the Company.

The purpose of the

Reverse Stock Split is to enable the Company to reduce the number of record holders of its common stock below 300, which is the

level below which the Company can suspend its duty to file periodic and current reports and other information with the SEC under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As described in the accompanying proxy statement,

the Company’s Board of Directors has determined that the costs of being a public reporting company outweigh the benefits

of being a public company. The actions the Company would take to suspend, and events that occur as a result of such actions that

would have the effect of suspending its reporting obligations under the Exchange Act, and the registration of its common stock

under Section 12(g) of the Exchange Act, are collectively referred to as the “Transaction”. After giving effect to

the Transaction, the Company will no longer be subject to the reporting requirements under the Exchange Act or other requirements

applicable to a public company, including requirements under the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”).

Based upon the closing

price of the Company’s common stock on July 14, 2020 three shares of its common stock were worth approximately $3.00. The

Company does not know any securities broker which would accept securities worth $3.00 for deposit or which would sell securities

worth $3.00 for any customer. Since a stockholder of record owning fewer than four shares immediately prior to the Reverse Stock

Split will be paid $1.00 for each share held by the stockholder, the Company’s Board of Directors has determined (by a unanimous

vote) that the Reverse Stock Split is in the best interests of the Company’s stockholders and the specific terms of the Reverse

Stock Split are fair to the Cashed Out Stockholders.

Neither the Company

nor any other person (to the knowledge of the Company) has received any report, opinion or appraisal from an outside party that

is materially related to the Reverse Stock Split.

Advantages of the Reverse Stock Split

If the Reverse Stock

Split occurs, there will be certain advantages to the Company’s stockholders, including the following:

|

|

●

|

After giving effect to the Reverse Stock Split, the Company’s

compliance obligations under the Exchange Act and the Sarbanes-Oxley Act will be suspended and the Company expects to realize

recurring savings of approximately $675,000 per year.

|

|

|

|

|

|

|

●

|

The Company will also save the significant amount of time

and effort expended by its management and employees on the preparation of SEC filings and compliance with the Exchange Act and

the Sarbanes-Oxley Act.

|

Potential Disadvantages of the Reverse

Stock Split

If the Reverse

Stock Split occurs, there will be certain potential disadvantages to the Company’s stockholders, including the following:

|

|

●

|

Cashed Out Stockholders will no longer have any ownership

interest in the Company.

|

|

|

●

|

The Company will, after giving effect to the Reverse Stock

Split, cease to file annual, quarterly, current, and other reports and documents with the SEC. As a result, the Company’s

stockholders will have significantly less information about its business, operations, and financial performance than they have

currently.

|

|

|

●

|

The Company will no longer be subject to the liability provisions of the Exchange Act or the provisions

of the Sarbanes-Oxley Act.

|

|

|

●

|

The Company’s officers, directors and 10% stockholders will no longer be subject to the reporting

requirements of Section 16 of the Exchange Act or be subject to the prohibitions against retaining short-swing profits for trading

our common stock. Persons acquiring 5% of the Company’s common stock will no longer be required to report their beneficial

ownership under the Exchange Act.

|

Other Matters

The Reverse Stock Split

is being undertaken as part of the Company’s plan to suspend its duty to file periodic and current reports and other information

with the SEC under the Securities Exchange Act of 1934. Since the cost to the Company of reducing the record holders below 300

is $191.00 (exclusive of legal, printing and mailing costs associated with this proxy statement) the Company did not consider any

alternatives to the Reverse Stock Split as a means of reducing the number of record holders of its common stock below 300.

Only the Company’s

officers and directors intend to solicit votes with respect to the Reverse Stock Split.

Generally, a Cashed

Out Stockholder who receives cash for a fractional share as a result of the Reverse Stock Split will recognize capital gain or

loss for United States federal income tax purposes based upon the amount the Cashed Out Stockholder paid for the fractional share.

A stockholder who does not receive cash for a fractional share as a result of the Reverse Stock Split generally will not recognize

any gain or loss for United States federal income tax purposes. The Company believes that the Reverse Stock Split generally should

be treated as a tax-free “recapitalization” or other non-recognition event for federal income tax purposes in which

case the Reverse Stock Split should have no material federal income tax consequences to the Company.

No ruling from the

IRS or opinion of counsel has been or will be obtained regarding the United States federal income tax consequences to stockholders

in connection with the Reverse Stock Split. Accordingly, each stockholder is encouraged to consult their own tax advisor as to

the particular federal, state, local, foreign, and other tax consequences of the Reverse Stock Split in light of their individual

circumstances.

Under Delaware law,

no appraisal or dissenters’ rights are available to the Company’s stockholders in connection with the Reverse Stock

Split.

No provision has been

made by the Company in connection with the Reverse Stock Split to grant any of the holders of Company’s common stock or Series

B preferred stock access to the corporate files of the Company or to obtain counsel or appraisal services at the expense of the

Company.

A majority of the Company’s

directors who are not employees of the Company have not retained an unaffiliated representative to act solely on behalf of unaffiliated

security holders for purposes of negotiating the Reverse Stock Split and/or preparing a report concerning the fairness of the Reverse

Stock Split.

The Company’s

officers, directors and affiliates intend to vote in favor of the Reverse Stock Split since these persons believe the Reverse Stock

Split is in the best interest of the Company and its stockholders.

The Company anticipates

that after the Reverse Stock Split its common stock will trade on the Pink Non-Current platform of the OTC Markets Group.

The Company’s

Amended and Restated Certificate of Incorporation provides that the Company is presently authorized to issue 35,000,000 shares

common stock. The Reverse Stock Split, if adopted, would not change the number of shares of common stock which the Company is authorized

to issue. A reverse split would reduce the number of the Company’s outstanding shares, which would enable the Company to

issue more shares than it would be able to issue if the Reverse Stock Split was not adopted.

After giving effect

to the Reverse Stock Split and as necessary to maintain the Company’s suspension of its SEC reporting obligations, the Company

reserves the right to take additional actions that may be permitted under Delaware law, including further reverse stock splits.

The Company’s

Board of Directors may abandon the proposed Reverse Stock Split at any time prior to its completion, whether prior to or following

the Special Meeting, if it believes the Reverse Stock Split is no longer in the best interests of the Company or its stockholders.

The Company’s

Board of Directors recommends that stockholders vote FOR the Reverse Stock Split.

INFORMATION CONCERNING CARBON ENERGY

CORPORATION

Carbon Energy Corporation

was incorporated in Delaware in 2007.

The Company’s

address and telephone number are: 1700 Broadway, Suite 1170, Denver, Colorado, 80290, (720) 407-7043.

The Company is an independent

oil and natural gas company engaged in the acquisition, exploration, development and production of oil, natural gas and natural

gas liquids in the United States. The Company currently develops and operates oil and gas properties in California’s Ventura

Basin.

For purposes of Schedule

13E-3 and Regulation M-A of the Securities and Exchange Commission, the Company is the “Filing Person” and the “Subject

Company”.

Management

The names, titles,

and ages of our executive officers and directors are shown below.

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Patrick R. McDonald

|

|

63

|

|

Chief Executive Officer, Director

|

|

|

|

|

|

|

|

Erich W. Kirsch

|

|

35

|

|

Principal Financial and Accounting Officer, Secretary and Treasurer

|

|

|

|

|

|

|

|

James H. Brandi

|

|

71

|

|

Chairman of the Board

|

|

|

|

|

|

|

|

John A. Bailey

|

|

50

|

|

Director

|

|

|

|

|

|

|

|

David H. Kennedy

|

|

70

|

|

Director

|

|

|

|

|

|

|

|

Peter A. Leidel

|

|

63

|

|

Director

|

|

|

|

|

|

|

|

Edwin H. Morgens

|

|

78

|

|

Director

|

The following information

pertains to our executive officers and directors and their principal occupations and other public company directorships for at

least the last five years.

Patrick R. McDonald. Mr. McDonald

is Chief Executive Officer and Director of the Company and has been Chief Executive Officer since 2004. From 1998 to 2003, Mr.

McDonald was Chief Executive Officer and Director of Carbon Energy Corporation, an oil and gas exploration and production company.

From 1987 to 1997 Mr. McDonald was Chief Executive Officer and Director of Interenergy Corporation, a natural gas gathering, processing

and marketing company. Prior to that he worked as an exploration geologist with Texaco International Exploration Company where

he was responsible for oil and gas exploration efforts in the Middle East and Far East. Mr. McDonald served as Chief Executive

Officer of Forest Oil Corporation from June 2012 to December 2014. Mr. McDonald is Chairman of the Board of Prairie Provident Resources

(TSX: PPR), an exploration and production company based in Calgary, Alberta, Canada. Mr. McDonald received a Bachelor’s degree

in both Geology and Economics from Ohio Wesleyan University and a Master’s degree in Business Administration (Finance) from

New York University. Mr. McDonald is a Certified Petroleum Geologist and is a member of the American Association of the Petroleum

Geologists and of the Canadian Society of Petroleum Geologists.

Erich W. Kirsch. Mr. Kirsch was

appointed the Company’s Principal Financial and Accounting Officer on June 11, 2020. Mr. Kirsch has served as the Company’s

Senior Vice President, Finance and Accounting since August 2019, and previously served as the Company’s Vice President, Accounting

and Finance from March 2018 to August 2019 and as the Company’s Director of Financial Reporting from May 2017 to March 2018.

From November 2015 to January 2017, Mr. Kirsch served as the Director of Accounting and Finance at Star Mountain Resources, Inc.

From April 2013 to March 2016, Mr. Kirsch served as the Corporate Controller of Rare Element Resources Ltd.

James H. Brandi. Mr. Brandi is Chairman

of the Board of Directors and has been a Director since 2012. Mr. Brandi was formerly a Managing Director of BNP Paribas Securities

Corp., where he served from 2010 until 2011. From 2005 to 2010, Mr. Brandi was a partner of Hill Street Capital, LLC, a financial

advisory and private investment firm purchased by BNP Paribas in 2010. From 2001 to 2005, Mr. Brandi was a Managing Director at

UBS Securities, LLC, where he was the Deputy Global Head of the Energy and Power Groups. Prior to 2001, Mr. Brandi was a Managing

Director at Dillon, Read & Co. Inc. and later its successor firm, UBS Warburg, concentrating on transactions in the energy

and consumer goods areas. Mr. Brandi currently serves as a director of OGE Energy Corp (NYSE: OGE) and had served as a member of

the board of directors of Approach Resources, Inc. from 2007-2017.

John A. Bailey. Mr. Bailey has been

a Director since December 2019. Since May 2019, Mr. Bailey is a member of Yorktown Partners LLC, a manager of private equity partnerships

which invest in the energy industry. Mr. Bailey was previously employed at Voya Investment Management since June 2011 with roles

in investment research and portfolio management. Mr. Bailey was a founder and Managing Partner of 1859 Partners LLC, an energy

investment partnership, from March 2009 until June 2011. From December 2006 until August 2008, Mr. Bailey was a Portfolio Manager

at Carlyle-Blue Wave Partners Management, LP, an investment partnership. Mr. Bailey served as a Director of LR Energy from

November 2011 until its merger with Vanguard Natural Resources in October 2015. Mr. Bailey also served as a Director of Encore

Acquisition Company, a NYSE-listed oil and gas exploration and production company, from May 2006 until its merger with Denbury

Resources Inc. in March 2010.

David H. Kennedy. Mr. Kennedy has

been a Director since December 2014 and previously served as a director from February 2011 to March 2012. Mr. Kennedy is since

2005 an Executive Advisor to Cadent Energy Partners. From 2001 - 2004, Mr. Kennedy served as an advisor to RBC Energy Fund and

served on the boards of several of its portfolio companies. Mr. Kennedy was a managing director of First Reserve Corporation from

its founding in 1981 until 1998, serving on boards of several of its portfolio companies. From 1974 to 1981, Mr. Kennedy was employed

by Price Waterhouse. Mr. Kennedy served as a director of predecessor company Carbon Energy Corporation.

Peter A. Leidel. Mr. Leidel has

been a Director since 2005. Since 1997, Mr. Leidel is a founder and member of Yorktown Partners LLC, a manager of private equity

partnerships which invest in the energy industry. Mr. Leidel had previously been employed at Dillon, Read & Co. since 1983,

serving as Senior Vice President until the merger of Dillon Read with SBC Warburg in 1997. He was previously employed in corporate

treasury positions at Mobil Corporation and worked for KPMG Peat Marwick and the U.S. Patent and Trademark Office. Mr. Leidel is

a director of Ramaco Resources, Inc. (Nasdaq: METC), Mid Con Energy Partners, L.P. (Nasdaq: MCEP), Extraction Oil & Gas, Inc.

(Nasdaq: XOG) and certain non-public companies in which Yorktown partnerships hold equity interests. Mr. Leidel served as a director

of predecessor companies, Carbon Energy Corporation and Interenergy Corporation.

Edwin H. Morgens. Mr. Morgens has

been a Director since May 2012. Since 1967, Mr. Morgens is Chairman and Co-founder of Morgens, Waterfall, Vintiadis & Company,

Inc., a New York investment firm. Mr. Morgens is a trustee of the American Museum of Natural History, an Overseer of the Weill

Cornell Medical College and emeritus trustee of Cornell University.

None of the Company’s

officers or directors have been convicted in a criminal proceeding during the past five years (excluding traffic violations or

similar misdemeanors).

None of the Company’s

officers or directors have been a party to any judicial or administrative proceeding during the past five years (except for matters

that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the officer or

director from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any

violation of federal or state securities laws.

On March 12, 2020

the Company granted shares of its restricted common stock to the following officers and directors:

|

Name

|

|

Shares

|

|

|

|

|

|

|

|

Patrick R. McDonald

|

|

|

25,000

|

|

|

James H. Brandi

|

|

|

5,000

|

|

|

David H. Kennedy

|

|

|

4,000

|

|

|

Peter A. Leidel

|

|

|

4,000

|

|

|

Edwin H. Morgan

|

|

|

4,000

|

|

On May 26, 2020 Patrick

McDonald returned 20,286 shares of common stock to the Company in payment of his tax liability associated with his award of restricted

common stock. On June 5, 2020 Mr. McDonald purchased 100 shares of common stock in the open market at a price of $3.06 per share.

On July 6, 2020 Mr. McDonald purchased 939 shares of common stock in the open market at a price of $1.10 per share.

Principal Stockholders

The following table

lists, as of July __, 2020, the shareholdings of (i) each person owning beneficially 5% or more of the Company’s common stock;

(ii) each executive officer and director of the Company, and (iii) all officers and directors as a group. Unless otherwise indicated,

each owner has sole voting and investment power over his shares of common stock. The business address for each of the Company’s

officers and directors is 1700 Broadway, Suite 1170, Denver, Colorado 80290.

|

Name and Address of Beneficial Owner

|

|

Shares Beneficially

Owned(1)

|

|

|

Percent of

Class(2)

|

|

|

|

|

|

|

|

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yorktown Energy Partners V, L.P.

410 Park Avenue,

19th Floor

New York, NY 10022

|

|

|

896,916

|

|

|

|

10.8

|

%

|

|

|

|

|

|

|

|

|

|

|

Yorktown Energy Partners VI, L.P.

410 Park Avenue,

19th Floor

New York, NY 10022

|

|

|

896,916

|

|

|

|

10.8

|

%

|

|

|

|

|

|

|

|

|

|

|

Yorktown Energy Partners IX, L.P.

410 Park Avenue,

19th Floor

New York, NY 10022

|

|

|

1,111,112

|

|

|

|

13.4

|

%

|

|

|

|

|

|

|

|

|

|

|

Yorktown Energy Partners XI, L.P.(3)

410 Park Avenue,

19th Floor

New York, NY 10022

|

|

|

2,584,829

|

|

|

|

28.9

|

%

|

|

|

|

|

|

|

|

|

|

|

Arbiter Partners QP, LP

530 Fifth Avenue

20th Floor

New York, NY 10036

|

|

|

655,733

|

|

|

|

8.2

|

%

|

|

|

|

|

|

|

|

|

|

|

AWM Investment Company Inc.(5)

c/o Special Situation Funds

527 Madison Avenue,

Suite 2600

New York, NY 10022

|

|

|

706,549

|

|

|

|

8.9

|

%

|

|

Executive Officers and Directors

|

|

Shares Beneficially Owned

|

|

|

Percent of

Class(2)

|

|

|

|

|

|

|

|

|

|

|

Patrick R. McDonald, Chief Executive Officer and Director(6)

|

|

|

340,553

|

|

|

|

4.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Erich W. Kirsch, Principal Financial and Accounting Officer, Secretary

and Treasurer

|

|

|

51,149

|

|

|

|

0.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

James H. Brandi, Director

|

|

|

42,000

|

|

|

|

0.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

John A. Bailey, Director(7)

|

|

|

5,493,773

|

|

|

|

66.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

David H. Kennedy, Director

|

|

|

32,154

|

|

|

|

0.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Peter A. Leidel, Director(8)

|

|

|

5,525,773

|

|

|

|

67.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Edwin H. Morgens, Director

|

|

|

119,334

|

|

|

|

1.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (seven persons)(9)

|

|

|

6,114,963

|

|

|

|

68.5

|

%

|

|

|

(1)

|

The amounts and percentages of common stock beneficially

owned are reported on the bases of rules of the SEC governing the determination of beneficial ownership of securities. Under the

rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting

power, which includes the power to vote or direct the voting of such security, or investment power, which includes the power to

dispose of or to direct the disposition of such security. In addition, shares are deemed to be beneficially owned by a person

if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as

of which the information is provided. Securities that can be so acquired are deemed to be outstanding for purposes

of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage.

Further, under the rules of the SEC, more than one person may be deemed beneficial owner of the same securities and a person may

be deemed to be a beneficial owner of securities as to which such person has no economic interest. Except as otherwise indicated

in these footnotes, each of the beneficial owners has, to our knowledge, sole voting and investment power with respect to the

indicated shares of common stock.

|

|

|

(2)

|

Calculated in accordance with Rule 13d-3 under the Securities

Exchange Act of 1934 based on 8,304,781 shares of our common stock issued and outstanding on July 15, 2020. Percentages are rounded

to the nearest one-tenth of one percent.

|

|

|

(3)

|

The amount reported includes 50,000 shares of Series B

convertible preferred stock which currently may be converted into up to 625,000 shares of our common stock.

|

|

|

(4)

|

Arbiter Partners QP, LP holds sole voting and investment

power over these shares. Arbiter Partners Capital Management LLC acts as investment advisor on behalf of Arbiter Partners QP,

LP and on behalf of certain other managed accounts none of which hold more than five percent of the common stock of the Company.

|

|

|

(5)

|

Consists of (i) 490,186 common stock shares owned by Special

Situations Fund III QP, L.P. (“SSFQP”), (ii) 144,134 common stock shares owned by Special Situations Cayman Fund,

L.P. (“Cayman”), and (iii) 72,229 common stock shares owned by Special Situations Private Equity Fund L.P. (“SSPE”).

AWM Investment Company, Inc., a Delaware Corporation (“AWM”) is the investment advisor to SSFQP, Cayman and SSPE.

AWM holds sole voting and investment power over these shares.

|

|

|

(6)

|

Includes (i) 24,136 shares owned by McDonald Energy, LLC

over which Mr. McDonald has voting and investment power.

|

|

|

(7)

|

Includes (i) 896,916 common stock shares owned by Yorktown

Energy Partners V, L.P., (ii) 896,916 common stock shares owned by Yorktown Energy Partners VI, L.P., (iii) 1,111,112 common stock

shares owned by Yorktown Energy Partners IX, L.P. and (iv) 2,584,829 (inclusive of 50,000 shares of Series B convertible preferred

stock which currently may be converted into up to 625,000 shares of our common stock) common stock shares owned by Yorktown Energy

Partners XI, L.P. over which Mr. Bailey and Mr. Leidel have voting and investment power. Pursuant to applicable reporting requirements,

Messrs. Bailey and Leidel are reporting indirect beneficial ownership of the entire amount of our securities owned by Yorktown

but they disclaim beneficial ownership of such shares. Also included are 4,000 shares owned by Mr. Bailey.

|

|

|

(8)

|

Includes (i) 896,916 common stock shares owned by Yorktown

Energy Partners V, L.P., (ii) 896,916 common stock shares owned by Yorktown Energy Partners VI, L.P., (iii) 1,111,112 common stock

shares owned by Yorktown Energy Partners IX, L.P. and (iv) 2,584,829 (inclusive of 50,000 shares of Series B convertible preferred

stock which currently may be converted into up to 625,000 shares of our common stock) common stock shares owned by Yorktown Energy

Partners XI, L.P. over which Mr. Bailey and Mr. Leidel have voting and investment power. Pursuant to applicable reporting requirements,

Messrs. Bailey and Leidel are reporting indirect beneficial ownership of the entire amount of our securities owned by Yorktown

but they disclaim beneficial ownership of such shares. Also included are 36,000 shares owned by Mr. Leidel.

|

|

|

(9)

|

The shares over which both Mr. Bailey and Mr. Leidel have

voting and investment power are the same shares and the percentage of total shares has not been aggregated for purposes of these

calculations.

|

The following table

lists, as of July 15, 2020, the shareholdings of each person owning the Company’s Series B preferred stock. Unless otherwise

indicated, each owner has sole voting and investment power over the shares of preferred stock:

|

Name and Address of Beneficial Owner

|

|

Shares Beneficially Owned

|

|

|

Percent of

Class

|

|

|

|

|

|

|

|

|

|

|

|

|

Yorktown Energy Partners XI, L.P.

|

|

|

50,000

|

|

|

|

100

|

%

|

|

|

(1)

|

Each Series B preferred share is currently convertible

into 12.5 shares of the Company’s common stock and is currently entitled to 12.5 votes on any matter submitted to the Company’s

stockholders.

|

The Reverse Stock Split

will have an insignificant effect on the relative voting power of the Company’s stockholders. Based on current record and

beneficial owner information, the Reverse Stock Split will result in an insignificant change in the relative voting power of the

Company’s directors and executive officers as a group.

None of the Company’s

officers, directors or affiliates currently intend to tender or sell the Company’s common stock owned or held by them to

the Company.

Market for Our Common Stock

The Company has one

class of common stock outstanding that is quoted on the OTCQB under the symbol CRBO.

The following table

sets forth the high and low bid price per share of our common stock for the periods presented, as quoted on the OTCQB. The information

reflects inter-dealer prices, without retail mark-up, mark-down or commissions and may not represent actual transactions:

|

Year Ended December 31,

|

|

Quarter

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

First

|

|

$

|

11.00

|

|

|

$

|

9.80

|

|

|

|

|

Second

|

|

$

|

12.00

|

|

|

$

|

9.80

|

|

|

|

|

Third

|

|

$

|

13.00

|

|

|

$

|

9.50

|

|

|

|

|

Fourth

|

|

$

|

9.25

|

|

|

$

|

6.50

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

First

|

|

$

|

10.00

|

|

|

$

|

9.25

|

|

|

|

|

Second

|

|

$

|

10.00

|

|

|

$

|

5.00

|

|

|

|

|

Third

|

|

$

|

8.00

|

|

|

$

|

4.00

|

|

|

|

|

Fourth

|

|

$

|

4.00

|

|

|

$

|

3.15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

First

|

|

$

|

4.50

|

|

|

$

|

3.15

|

|

|

|

|

Second

|

|

$

|

4.98

|

|

|

$

|

1.18

|

|

The limited and sporadic

quotations of our common stock do not constitute an established trading market for the Company’s common stock, and there

can be no assurance that an active market will develop in the future.

As

of July 14, 2020:

|

|

●

|

the

closing price of the Company’s common stock on the OTCQB was $0.95 per share.

|

|

|

●

|

there

were 310 holders of record of the Company’s common stock. The number of holders

does not include the stockholders for whom shares are held in a “nominee”

or “street” name; and

|

|

|

●

|

the

Company had 8,304,781 outstanding shares of common stock.

|

The

Company has not to date paid any cash dividends on its common stock and does not intend to pay any dividends in the foreseeable

future. The payment of dividends will be within the discretion of the Board of Directors.

The

terms of the Company’s loan agreements with two lenders prohibit the Company from paying dividends on the Company’s

stock while amounts are owed under the loan agreements.

The

provisions in the Company’s Amended and Restated Certificate of Incorporation relating to its preferred stock allow its

directors to issue preferred stock with rights to multiple votes per share and dividend rights which would have priority over

any dividends paid with respect to its common stock. The issuance of preferred stock with such rights may make more difficult

the removal of management even if such removal would be considered beneficial to stockholders generally, and will have the effect

of limiting stockholders participation in certain transactions such as mergers or tender offers if such transactions are not favored

by incumbent management.

Yorktown

Energy Partners

As

of July 15, 2020:

|

|

●

|

Yorktown

Energy Partners V, L.P.,

|

|

|

|

|

|

|

●

|

Yorktown

Energy Partners VI, L.P.,

|

|

|

|

|

|

|

●

|

Yorktown

Energy Partners IX, L.P., and

|

|

|

|

|

|

|

●

|

Yorktown

Energy Partners XI, L.P.

|

collectively owned 4,864,773 shares of

the Company’s common stock or approximately 58.6% of the Company’s outstanding common stock.

As of July 15, 2020

Yorktown Energy Partners XI, L.P. owned 50,000 shares of the Company’s Series B preferred stock or 100% of the outstanding

Series B preferred shares.

The foregoing entities

are controlled by Yorktown Partners, LLC. Yorktown Partners LLC is controlled by John A. Bailey and Peter A. Leidel, both of whom

are directors of the Company. The five entities named above are collectively referred to as “Yorktown”.

Neither Yorktown nor

any of Yorktown’s officers, managers or members have been convicted in a criminal proceeding during the past five years (excluding

traffic violations or similar misdemeanors).

Neither Yorktown nor

any of Yorktown’s officers, managers or members have been a party to any judicial or administrative proceeding during the

past five years (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or

final order enjoining the officer or director from future violations of, or prohibiting activities subject to, federal or state

securities laws, or a finding of any violation of federal or state securities laws.

Yorktown is a limited

liability company organized under the laws of Delaware. Yorktown’s address and telephone number are:

410 Park Avenue

19th Floor

New York, NY 10022

(212) 515-2114

Summary Financial Information

(In thousands, except per share amounts)

|

|

|

December 31,

|

|

|

March 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

26,269

|

|

|

|

34,010

|

|

|

|

36,027

|

|

|

|

29,032

|

|

|

Non-current assets

|

|

|

271,985

|

|

|

|

276,881

|

|

|

|

272,359

|

|

|

|

277,032

|

|

|

Current liabilities

|

|

|

48,718

|

|

|

|

52,855

|

|

|

|

40,800

|

|

|

|

49,215

|

|

|

Non-current liabilities

|

|

|

173,315

|

|

|

|

182,001

|

|

|

|

175,706

|

|

|

|

187,259

|

|

|

Stockholders’ equity (1)

|

|

|

50,071

|

|

|

|

47,751

|

|

|

|

60,074

|

|

|

|

43,874

|

|

|

Non-controlling interests

|

|

|

26,150

|

|

|

|

28,284

|

|

|

|

31,806

|

|

|

|

25,716

|

|

|

Total stockholders’ equity

|

|

|

76,221

|

|

|

|

76,035

|

|

|

|

91,880

|

|

|

|

69,590

|

|

|

|

|

Year Ended

December 31,

|

|

|

Three Months Ended

March 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2020

|

|

|

2019

|

|

|

Gross Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) before non-controlling interests and preferred

shares

|

|

|

(1,001

|

)

|

|

|

12,779

|

|

|

|

15,458

|

|

|

|

(6,690

|

)

|

|

Net income (loss) attributable to non-controlling Interests

|

|

|

(2,098

|

)

|

|

|

4,375

|

|

|

|

5,659

|

|

|

|

(2,590

|

)

|

|

Net income (loss) attributable to controlling interests before preferred shares

|

|

|

1,097

|

|

|

|

8,404

|

|

|

|

9,799

|

|

|

|

(4,100

|

)

|

|

Net income (loss) attributable to preferred shares – beneficial conversion feature

|

|

|

-

|

|

|

|

1,125

|

|

|

|

-

|

|

|

|

-

|

|

|

Net income attributable to preferred shares – preferred return

|

|

|

300

|

|

|

|

224

|

|

|

|

75

|

|

|

|

75

|

|

|

Net income (loss) attributable to common shares

|

|

|

797

|

|

|

|

7,055

|

|

|

|

9,724

|

|

|

|

(4,175

|

)

|

|

Income (loss) per share from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

.10

|

|

|

$

|

.94

|

|

|

$

|

1.25

|

|

|

$

|

(0.54

|

)

|

|

Diluted

|

|

$

|

.10

|

|

|

$

|

.87

|

|

|

$

|

1.20

|

|

|

$

|

(0.54

|

)

|

|

Net income (loss) per share from all operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

.10

|

|

|

$

|

.94

|

|

|

$

|

1.25

|

|

|

$

|

(0.54

|

)

|

|

Diluted

|

|

$

|

.10

|

|

|

$

|

.87

|

|

|

$

|

1.20

|

|

|

$

|

(0.54

|

)

|

|

Book value per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Exclusive of non-controlling interests.

|

The more complete financial

statements if the Company are incorporated by reference. See “Incorporation of Certain Documents by Reference” below.

Other

During the last two

years, none of the Company’s directors, executive officers or 10% stockholders have entered into any transactions with the

Company.

The Company has not

purchased any shares of its common stock within the past two years.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

In the Company’s

filings with the SEC, information is sometimes incorporated by reference. This means that the Company is referring you to information

that it has filed separately with the SEC. The information incorporated by reference should be considered part of this proxy statement,

except for any information superseded by information contained directly in this proxy statement or in any other subsequently filed

document.

This proxy statement

incorporates by reference the following documents that the Company has previously filed with the SEC. They contain important information

about the Company and its financial condition.

|

|

●

|

Quarterly Report on Form 10-Q for the period ended March 31, 2020; and

|

|

|

●

|

Audited consolidated balance sheets as of December 31, 2019 and 2018, the related consolidated

statements of operations, stockholders’ equity, and cash flows for each of the years in the two-year period ended December

31, 2019, and the related notes to the Company’s financial statements, are contained in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2019; and

|

|

|

●

|

Unaudited consolidated condensed balance sheet as of March 31, 2020, the related

consolidated condensed statements of operations, stockholders’ equity, and cash flows for the three months ended March 31,

2020 and 2019, and the related notes to the Company’s financial statements, are contained in its Quarterly Report on Form 10-Q for the period ended March 31, 2020.

|

The Company will send

any stockholder of record as of the record date for the Special Meeting a copy of any document incorporated by reference into this

proxy statement within three business days of receipt of a request. The request for any document incorporated by reference should

be addressed to us at the following address: 1700 Broadway, Suite 1170, Denver, CO 80290. Documents incorporated by referenced

are also are available on our website, www.carbonenergycorp.com and the SEC's website at http://www.sec.gov.

WHERE YOU CAN FIND MORE INFORMATION

The Company is subject

to the informational requirements of the Securities Exchange Act of 1934 and files reports and other information with the SEC.

Such reports and other information filed by the Company may be inspected and copied at the SEC’s Public Reference Room at

100 F Street, N.E., Washington, D.C. 20549, as well as in the SEC’s public reference room in New York, New York. Please call

the SEC at 1-800-SEC-0330 for further information on the operation of the SEC’s public reference room. The SEC also maintains

an Internet site that contains reports, proxy statements and other information about issuers, like us, who file electronically

with the SEC. The address of the SEC’s web site is http://www.sec.gov.

GENERAL

The Company will bear

the entire cost of solicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy card

and any additional materials requested by stockholders. The Company’s officers, directors and employees may solicit proxies

by telephone or other means. Approximately $30,000 will be incurred by the Company to effect the Reverse Stock Split which represents

estimated legal costs of $15,000 and estimated printing and mailing costs of $15,000.

Failure of a quorum

to be present at the Special Meeting will necessitate adjournment and will subject the Company to additional expense.

The

Company’s Board of Directors does not intend to present and does not have reason to believe that others will present

any other items of business at the Special Meeting. However, if other matters are properly presented to the Special Meeting

for a vote, the proxies will be voted upon such matters in accordance with the judgment of the persons acting under the

proxies.

CARBON ENERGY CORPORATION

NOTICE OF INTERNET AVAILABILITY OF

PROXY MATERIALS

Important Notice

Regarding the Availability of Proxy Materials for the Special Stockholder’s Meeting to Be Held on ____________, 2020.

|

|

1.

|

This notice is not a form for voting.

|

|

|

2.

|

This communication presents only an overview of the more complete proxy materials that are available

to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials

before voting.

|

|

|

3.

|

The Notice of the Special Meeting of Stockholders and related Proxy Statement are available

at www.carbonenergycorp.com.

|

|

|

4.

|

If you want to receive a paper or email copy of these documents, you must request one. There

is no charge to you for requesting a copy. Please make your request for a copy as instructed below on or before ________________,

2020 to facilitate timely delivery.

|

The Special Meeting

of the Company’s stockholders will be held at 1700 Broadway, Suite 1170, Denver, CO 80290 on ______________, 2020, at ____

a.m. Mountain Time, for the following purposes:

to approve an amendment to the

Company’s Amended and Restated Certificate of Incorporation to reverse split the outstanding shares of the Company’s

common stock on a 4-for-1 basis.

The Board of Directors

recommends that stockholders vote FOR the proposal to reverse split the Company’s common stock.

_____________, 2020

is the record date for the determination of stockholders entitled to notice of and to vote at such Special Meeting. Holders of

the Company’s common stock are entitled to one vote per share. Holders of the Company’s Series B preferred shares are

entitled to 12.5 votes per share.

Stockholders may access

the following documents at www.carbonenergycorp.com:

|

|

☐

|

Notice of the Special Meeting of Stockholders;

|

|

|

☐

|

Company’s Proxy Statement;

|

|

|

☐

|

Proxy Card; and

|

|

|

☐

|

December 31, 2019 10-K report.

|

Stockholders may request

a paper copy of the Proxy Materials and Proxy Card by calling 720-407-7030, or by emailing the Company at proxy@carbonenergycorp.com

and indicating you want a paper copy of the proxy materials and proxy card:

|

|

☐

|

for this meeting only; or

|

|

|

☐

|

for this meeting and all other meetings.

|

If you have

a stock certificate registered in your name, or if you have a proxy from a stockholder of record on ________________, 2020, you

can, if desired, attend the special meeting and vote in person. Stockholders can obtain directions to the Special Stockholders’

Meeting at __________________.

Complete and sign the

Proxy Card and mail, email or fax the Proxy Card to:

Carbon Energy Corporation

Attn: Erich Kirsch

1700 Broadway, Suite 1170

Denver, Co 80290

Email: proxy@carbonenergycorp.com

Fax: 720-407-7031

PROXY

CARBON ENERGY CORPORATION

This Proxy is solicited by the Company’s

Board of Directors

The undersigned stockholder of

Carbon Energy Corporation (“the Company”) acknowledges receipt of the Notice of the Special Meeting of Stockholders

to be held on ____________, 2020, at ____ a.m., local time, at 1700 Broadway, Suite 1170, Denver, CO 80290, and hereby appoints

_________________________ with the power of substitution, as Attorney and Proxy to vote all the shares of the undersigned at said

Special Meeting of Stockholders and at all adjournments thereof, hereby ratifying and confirming all that said Attorney and Proxy

may do or cause to be done by virtue hereof. The above named Attorney and Proxy is instructed to vote all of the undersigned's

shares as follows:

|

|

(1)

|

to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation

to reverse split the Company’s common stock on a 4-for-1 basis;

|

☐ FOR

☐ AGAINST ☐ ABSTAIN

to transact such other

business as may come before the Special Meeting.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL

BE VOTED AS DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER IF NO DISCRETION IS INDICATED, THIS PROXY WILL BE VOTED IN FAVOR OF

ITEM 1.

Dated this ____ day

of _____________, 2020.

_______________________________________

(Signature)

_______________________________________

(Print Name)

Please sign your name exactly as it appears

on your stock certificate.

If shares are held jointly, each holder

should sign.

Executors, trustees, and other fiduciaries

should so indicate when signing.

Please Sign, Date and Return this Proxy

so that your shares may be voted at the Special Meeting.

Send your proxy by regular mail, email,

or fax to:

Carbon Energy Corporation

Attn: Erich Kirsch

1700 Broadway, Suite 1170

Denver, Co 80290

Email: proxy@carbonenergycorp.com

Fax: 720-407-7031

APPENDIX A

CARBON ENERGY CORPORATION

AMENDMENT TO AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

Article 4 is amended

by adding the following:

4.5 Reverse Stock

Split

Every four shares of

this Corporation’s common stock will automatically be converted into one share of this Corporation’s common stock.

Stockholders owning fewer than four shares will only be entitled to a fraction of a share of common stock, will be paid cash in

lieu of such fraction of a share and will no longer be stockholders of the Corporation.

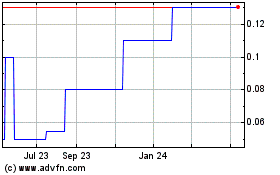

Carbon Energy (CE) (USOTC:CRBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

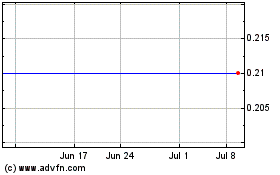

Carbon Energy (CE) (USOTC:CRBO)

Historical Stock Chart

From Apr 2023 to Apr 2024