Allied Energy (PINKSHEETS: AGGI) provided the following report for

its horizontal drilling and other current field operations in

Grimes and Leon Counties, Texas and Northern Ohio.

Allied Howard #1H (Grimes County, Texas) --

Production Operations

The Allied Howard #1H produced and sold 67 million cubic feet of

natural gas equivalent, including approximately 45 million cubic

feet of methane gas and 840 BOE (barrels of oil equivalent) of

condensate and NGL (natural gas liquids) for the 31-day period from

December 1, 2010 to December 31, 2010. Excluding downtime of

approximately five days, the well actually produced at a rate

approximating 80 million cubic feet of gas (MCFG) for the month

while in its first month of production.

It generally takes 4-6 months to better manage downtime and

lease operating expenses (LOE) for a horizontal well of this size

and depth. Typically, LOEs decline as a percentage of gross revenue

for a significant portion of the life of the well. Although

production for this well may or may not increase over the

short-term, oil and gas wells typically decline for the long-term.

The Company is projecting LOEs equal to 10% of gross revenues for

the long-term although they may be higher for the short-term. These

LOEs include but are not limited to water disposal/hauling,

electricity, pumping/administration, gas transmission, severance

taxes, compression and general maintenance.

Allied Howard #2H -- Production Test

The Howard #2H tested at a rate of approximately 4,000 MCFG per

day with associated condensate. We have constructed production

facilities, gas flow lines, processing facilities and other

necessary surface equipment in preparation to begin ongoing

production operations for the Howard #2H.

The Company is pleased with the volumes of gas, wellhead

pressure, etc. demonstrated during the production test for the

Allied Howard #2H and expects to have the well on-line as early as

this week. Although no assurances can be made and risks do exist,

we would like to target approximately 100 million cubic feet of gas

equivalent per month for an initial production rate for this well

in the near future including methane, condensate and NGL sales.

Again, this is a target estimate for an initial production rate for

the well, and whatever the level of initial production, it will

decline in the near future and over the life of the well. No

assurances can be made that this level of initial production will

be achieved.

The Company has an approximate 13% working interest and a 9.75%

net revenue interest in the Allied Howard #2H well.

Allied "Champion Ranch" Wallrath #1H Drilling

Operations -- Leon County, Texas

Allied Operating Texas successfully drilled the directional

curve and set / cemented casing in preparation to begin drilling

our horizontal lateral in the Woodbine formation for the Wallrath

#1H in Leon County, Texas. A formal oil show was encountered

immediately upon drilling the curve into the Woodbine Sand and the

well had a continued oil show reported by the mudlogger while

drilling the majority section of the lateral. Although oil and/or

gas shows are considered favorable indications that the well may be

capable of production, there are numerous wells that have such

shows but that never become capable of commercial production for

any of a number of reasons. Halliburton Services is tentatively

scheduled to perform a frac treatment for the Wallrath #1H in the

latter part of February. We will keep you updated as to our

projected timelines.

The Company has an approximate 13% working interest and a 9.75%

net revenue interest in the Wallrath #1H well.

Allied A-1 "SubClarksville" Re-entry (Leon

County, Texas)

Upon drilling through the SubClarksville formation in Leon

County, we encountered an increase in the rate of penetration and

had a formal gas show reported by the mudlog. As stated above,

although gas shows are considered favorable, they are not

determinative of commercial production, and many wells with formal

gas shows never become commercially productive. The Company plans

to move directly to the A-1 re-entry well-bore immediately

following the treatment and completion of the above Wallrath #1H

horizontal well. Our tentative operations re-entry schedule is

February-March 2011. The Company has an approximate 20% working

interest and a 15% net revenue interest in the A-1 well-bore.

Northern Ohio -- Trempeleau Drilling

Project

Allied participated as a non-operator in this exploratory

drilling program with a subcontracted operator and industry partner

in Ohio. The Dumbaugh #1 was drilled to approximately 3,400' to

test the Trempeleau Dolomite formation and any other potentially

productive reservoirs. Oil shows and increased porosity were

reported in several intervals at the target depth; however, oil

shows often do not result in commercial production. The Company is

now evaluating its plans for completion. The Company has an

approximate 50% working interest and a 40% net revenue interest in

the Dumbaugh #1 well.

Saltwater Disposal Well -- Grimes County,

Texas

We just recently received our approved injection permit and are

working to secure a rig in the very near future to begin drilling

our water disposal well in Grimes County. This should allow us to

dispose of water directly into a well-bore and prevent us from

continued hauling at a much more expensive cost to Allied and its

partners in the Howard #1H and #2H wells.

2011 Horizontal JV Program -- Grimes County,

Texas

We have selected our planned location as a direct offset to the

Apache Wells E #1H location and are currently making preparations

to drill in the future. The Apache Wells E #1H well, to date, has

been the best producer in this area, as per reported by the Texas

Railroad Commission and DrillingInfo.com. It is anticipated that

the Company will have an approximate 13% of working interest and a

9.75% net revenue interest in this well. The actual amounts are yet

to be determined based on a number of currently unknown

factors.

"We are currently making preparations to drill our third

horizontal well in Grimes County and plan to utilize many the

latest technological advancements in horizontal drilling in this

area of Texas," said Steve Stengell, Allied's President and

CEO.

No assurances can be made as it relates to present or future

production rates or estimated reserves for any given project.

Tremendous risks and uncertainty are associated with oil and gas

drilling, completion, development and production operations. It is

impossible to accurately estimate future rates and/or declines in

production operations for oil, condensate and natural gas.

About Allied Energy

Allied Energy, Inc. (PINKSHEETS: AGGI) is an independent energy

development firm primarily engaged in the exploration, development,

and production of oil and natural gas in the continental United

States. The Company relies upon its industry partners, well

operators, geologists, petroleum engineers, and other operational

personnel whose combined industry experience is essential to each

project. Allied Energy's strategic focus is the development of oil

and natural gas reserves.

Allied Energy has achieved the "Best of Bowling Green" award for

the category of crude oil and natural gas production for the last

two years and was recently chosen by an independent selection

committee as the recipient for the Bowling Green "Outstanding

Business of the Year" community impact award for 2010.

Allied Operating Texas, LLC, a wholly-owned subsidiary, operates

and develops certain of Allied Energy's vertical and horizontal

drilling programs. Allied Gas Transmission, Inc., a majority-owned

subsidiary of Allied Energy, was formed to construct, operate and

own gathering systems and/or pipelines to connect production

controlled by Allied Energy to larger pipelines.

For more information: www.alliedenergy.com

CAUTIONARY STATEMENTS

Certain statements in this release that are not historical facts

are "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Those statements may be

identified by the use of words such as "anticipate," "believe,"

"expect," "future," "may," "will," "would," "should," "plan,"

"projected," "intend," and similar expressions. Such

forward-looking statements involve known and unknown risks,

including but not limited to geological and geophysical risks,

risks of blow-outs and other potential damaging occurrences

inherent to the oil and gas industry, and uncertainties and other

factors that may cause the actual results, reliance upon expert

recommendations and opinions, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward-looking statements. The Company may have varying

degrees of working interest ownership in each well and/or prospect.

For these and other reasons, gross revenue projections may not be

equal to what is distributed net to the Company. The Company's

future operating results are dependent upon many factors, including

but not limited to the following: (i) the Company's ability to

obtain sufficient capital or a strategic business arrangement,

including the sponsoring of general or limited partnerships, to

fund its expansion plans; (ii) the Company's ability to acquire

interests in commercially attractive properties to develop and/or

operate; (iii) the Company's ability to build the management and

human resources and infrastructure necessary to support the growth

of its business; (iv) competitive factors and developments beyond

the Company's control, including but not limited to the strength of

the overall economy; and (v) other risk factors inherent to the oil

and gas industry.

Company Contact: Angela Stokes Heather Age Allied Energy, Inc.

2800 Griffin Dr. Bowling Green, KY 42101 Phone: 866-256-5836 Fax:

800-251-9322 Website: http://www.alliedenergy.com Email:

info@alliedenergy.com

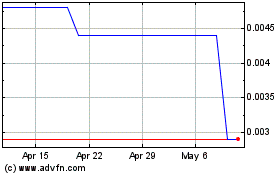

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Apr 2024 to May 2024

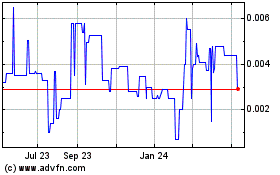

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From May 2023 to May 2024