Vendetta Announces

Positive Preliminary Economic Assessment with Pre-Tax IRR of 31%

and NPV (8%) of $204M on Pegmont Lead-Zinc

Project

Vancouver, BC -- January 28, 2019 -- InvestorsHub

NewsWire -- Vendetta

Mining Corp. (VTT-TSX: V) (Vendetta or the

Company) is pleased to announce the results of an independent

Preliminary Economic Assessment (PEA) for its Pegmont Lead-Zinc

Project (the Project) in Queensland, Australia. The PEA was

prepared in accordance with National Instrument 43-101 Standards of

Disclosure for Mineral Projects (NI

43-101).

The PEA was developed by a team of independent

consultants, including

AMC Mining Consultants (Canada) Ltd., (AMC), GR

Engineering Services (GRES), and AARC Environmental Solutions

(AARC). Unless otherwise noted, all dollar figures reported are

Australian dollars.

Project

Economic Highlights:

- Mine Life 10 years

at 3,000 tonne per day open pit followed by

underground

- Long Term Consensus

Metal Prices: $0.94 /lb Lead, $1.09 /lb Zinc and $16.50 /oz

Silver

- US Dollar to

Australian Dollar exchange rate of 0.75

- Preproduction

Capital of $170M and Life of Mine Sustaining Capital of

$59M

- Pre-Tax NPV (8%)

$201M and IRR 32%

- After Tax NPV (8%)

$124 M and IRR 24%

- After tax payback

period 3.5 years

- Spot price case

after tax NPV (8%) $158 M and IRR

27%

- Spot price case

after tax payback period 3.0 years

- Average annual

production of 124M lbs of lead, 50M lbs of zinc and 298K ounces of

silver

- Life of mine all-in

sustaining Cash Cost (AISC) of $ 0.71 / lb payable lead in

concentrate (after credits)

- Average net smelter

return (NSR) 135 /t of ore

- Opportunities for

continued refinement through further mine plan optimization and

metallurgical test work

- There remain

significant Mineral Resources not included in the PEA mine plan,

which, with further drilling will potentially increase the mine

life or increase production rate

Michael

Williams, Vendetta’s President and CEO commented “The results

outlined in the PEA demonstrate a robust, stand-alone project. The

Project has been able to take advantage of Pegmont’s location in

the centre of well-developed infrastructure to deliver a pre-start

capital that makes this an achievable project to develop for an

aspiring junior miner. We are pleased with the strong results of

the PEA and intend to now move to add incremental tonnes that can

be brought into the mine plan, continue with early permitting work

and expand exploration efforts. In addition to extracting more

value out of the Project Vendetta will move forward with evaluating

value adding opportunities in the region. The PEA

demonstrates low risk economics and well-established mining and

milling techniques in a stable and supportive

jurisdiction.”

Project Technical and Financial

Details

Economic

Results and Sensitivities

Table 1

summarises the key economic inputs.

Base case metal prices and exchange rates are based on

institutional consensus pricing. Income and other taxes presented

in the PEA are preliminary, based on general Australian corporate

tax rates and do not reflect any tax planning

opportunities.

Table 1: Summary of

Key Economic Inputs and Results

| |

|

Unit |

Base Case |

Spot Case1 |

| Inputs |

Zinc

Price |

US$/lb |

$1.09 |

$1.18 |

| Lead

Price |

US$/lb |

$0.94 |

$0.91 |

| Silver Price |

US$/oz |

$16.50 |

$15.31 |

| Discount Rate |

% |

8 |

8 |

| Exchange Rate |

AUD/USD |

0.75 |

0.71 |

| Payable Metal – Lead |

% |

95 |

95 |

| Payable Metal – Zinc |

% |

85 |

85 |

| Minimum Deduction – Lead |

% |

3 |

3 |

| Minimum Deduction – Zinc |

% |

8 |

8 |

| Australian Corporate Tax |

% |

30 |

30 |

| Economics Pre-Tax |

NPV

at 8% |

$M |

201 |

249 |

| IRR |

% |

31 |

37 |

| Payback Period |

Years |

2.7 |

2.4 |

| Economics After-Tax |

LOM

Cash Flows (Undiscounted) |

$M |

288 |

343 |

| NPV

at 8% |

$M |

124 |

158 |

| IRR |

% |

24 |

27 |

| Payback Period |

Years |

3.5 |

3.0 |

| LOM Payable Metal |

Lead |

M

lbs |

1,069 |

1,069 |

| Zinc |

M

lbs |

317 |

317 |

| Silver |

M

oz |

1.1 |

1.1 |

| Costs |

Cash

cost2 |

$/lb

payable lead |

0.65 |

0.60 |

| AISC

cost3 |

$/t

lb payable lead |

0.71 |

0.66 |

-

As of January

22, 2019, spot lead, zinc and silver prices are London Metal

Exchange cash buyer, and exchange rate is Reserve Bank of Australia

official rate.

-

Cash costs

include all operating costs, smelter, refining and transportation

charges, net of byproduct (zinc

and silver)

revenues.

-

All in

Sustaining Costs (AISC) include total cash costs and all sustaining

capital

expenditures.

As indicated

in Table 2, project cashflow and NPV are particularly sensitive to

changes in exchange rate and lead price, while relatively less

sensitive to changes in zinc price, operating and capital

expenditures. The table below shows the effect on the after-tax

economics of the Project of increasing or decreasing metal prices,

capital and operating costs and exchange rates against the

disclosed base case assumption.

Table 2: After-Tax

NPV (8%) Sensitivities

| Input |

Input Factor |

| 85% |

90% |

95% |

100% |

105% |

110% |

115% |

| Lead

Price ($US / lb) |

42.7 |

70.0 |

97.3 |

124.4 |

151.1 |

177.8 |

204.5 |

| Zinc

Price ($US / lb) |

95.3 |

105.1 |

114.8 |

124.4 |

134.0 |

143.6 |

153.2 |

| Capex (life of mine) |

145.9 |

138.7 |

131.6 |

124.4 |

117.1 |

109.7 |

102.2 |

| Opex

(per tonne milled) |

174.9 |

158.1 |

141.2 |

124.4 |

107.4 |

90.2 |

73.1 |

| Exchange Rate (US$:A$) |

234.7 |

197.9 |

161.2 |

124.4 |

87.1 |

49.5 |

12.0 |

Capital

and Operating Cost Estimates

Initial and Sustaining

Capital

GRES provided

capital estimates for all project infrastructure, mineral

processing, bore field, gas pipeline, camp, fuel storage, offices

and workshops. Equipment pricing was based on quotations and actual

equipment costs from recent similar GRES projects considered

representative of the Project. The capital estimate is deemed to be

of a level of accuracy consistent with industry standards for a

PEA. Underground sustaining capital, including decline access,

ventilation and electrical was estimated by AMC based on

benchmarked data.

Contingencies

were applied to the capital cost estimate as an allowance by

assessing the level of confidence in the engineering estimate basis

and vendor or contractor information.

Table 3: Initial and

Sustaining Capital

| Area |

Initial

($M) |

Sustaining

($M) |

Total

($M) |

| Site

Infrastructure (on and off site) |

39.6 |

1.2 |

40.8 |

| Mineral Processing |

69.9 |

2.1 |

72.0 |

| Mining (establishment and underground) |

18.3 |

37.0 |

55.3 |

| Project Indirects (EPCM & Owner Costs) |

32.3 |

- |

32.3 |

| Closure |

- |

14.5 |

14.5 |

| Contingencies (mine, process &

infrastructure) |

10.3 |

3.9 |

14.2 |

| TOTAL PROJECT |

170.3 |

58.7 |

229.0 |

Operating Costs

Operating costs

were estimated by GRES and AMC are summarised in Table

4

Table 4: Operating

Cost Summary

| Area |

Units |

Cost |

| Open

Pit Mining |

$/tonne mined |

$3.08 |

| Underground Mining |

$/tonne mined |

$50 |

| Processing |

$/tonne milled |

$26.30 |

| Common Site G&A |

$/tonne milled |

$6.24 |

| All-In OPEX |

$/tonne milled |

$74.30 |

Off-site Charges

Projected

Treatment Charges (TCs) and transport charges for the lead and zinc

concentrates were provided to AMC by Ocean Partners, specialist

consultants and traders in base metal

concentrates.

Off-site charges

include concentrate transport to smelters, located in Mt Isa (Lead)

and Townsville (Zinc), treatment and refining charges and potential

penalties as shown in the Table 5 below.

Table 5: Off-Site

Cost Summary

| Off-site

Charges |

Units |

Lead

Concentrate |

Zinc

Concentrate |

| Transport to

Smelter |

$/wmt conc. |

$50 |

$100.58 |

| Smelter Treatment

Charge |

US$/dmt

conc. |

$165 |

$181 |

| Silver

Refining |

US$/oz |

$0.80 |

$0.80 |

| Minimum

Deduction |

units |

3 |

8 |

| Lead in Zinc

Concentrate |

US$/dmt

conc. |

- |

$2/1% lead >

3.5% |

| Chloride (Cl) +

Fluorine (F) Penalty |

US$/dmt

conc. |

$2/100 ppm

Cl+F

> 500 ppm |

- |

| Iron (F)

Penalty |

US$/dmt

conc. |

- |

$1.50/1% iron

>9% |

Note wmt: wet metric tonne, dmt: dry metric

tonne

Mineral

Resource Update

The basis for

the PEA is the Mineral Resource estimate completed by AMC. The

Company reported details of the Mineral Resource update in a news

release dated August 9, 2018. Table 6 summarises the current

Mineral Resource, including those Mineral Resources that were not

included in the PEA mining inventory. Full details of the Mineral

Resource estimate are detailed in the Technical

Report.

The Company

continued to drill subsequent to the effective date. Results from

these additional holes and future planned programs will be used in

future updates to the Mineral Resource. Assay results have been

released and will be described in the Technical

Report.

Table 6: 2018

Mineral Resource Estimate, as of July 31, 2018 (see notes for

details)

| Classification |

Material

type |

Tonnes (kt) |

Pb (%) |

Zn (%) |

Ag (g/t) |

| Indicated |

Transition |

1,111 |

4.9 |

2.3 |

8 |

| Sulphide |

4,647 |

6.9 |

2.6 |

12 |

| Total |

5,758 |

6.5 |

2.6 |

11 |

| Inferred |

Transition |

1,829 |

5.2 |

2.0 |

7 |

| Sulphide |

6,447 |

5.1 |

3.1 |

9 |

| Total |

8,277 |

5.1 |

2.8 |

8 |

1.

CIM Definition Standards (2014) were used to report the Mineral

Resources.

2.

Cut-off grade applied to the open pit Mineral Resources is 3% Pb+Zn

and that applied to the underground is 5%

Pb+Zn.

3.

Based on the following metal prices: US$0.95/lb for Pb, US$1.05/lb

for Zn, and US$16.5/oz for

silver.

4.

Exchange rate of US$0.75 :

A$1.0

5.

Metallurgical recoveries vary by zone and material type as

follows:

- Lead to lead

concentrate: from 80.6% to 91.3% for transition and 88.0% to 92.7%

for sulphide.

- Zinc to zinc

concentrate: from 19.3% to 75.2% for transition and 61.8% to 78.5%

for sulphide.

6.

Using drilling results up to April 15,

2018.

7.

Mineral Resource tonnages have been rounded to reflect the accuracy

of the estimate, and numbers may not add due to

rounding.

Mine

Planning

AMC utilized the

Geovia Whittle™ pit optimization process to define ultimate pit

limits. The mine scheduling package Minemax was then used to target

the most economic ore early in the mine life with constraints

applied for the timing of in-pit tailings

storage.

The open pit has

been designed to be a conventional contractor truck-and-shovel

operation. Average open pit mining recovery and dilution applied

were 95% and 5% respectively. Material is delivered by haul truck

to a run of mine (ROM) pad to be loaded into the primary crusher,

with discharge from the crusher conveyed to a coarse stockpile

adjacent to the mill.

Mining commences

in the Burke Hinge Zone pit (BHZ), a satellite pit to the main

zones which allows for 410 kt of sulphide and 80 kt of transition

plant feed to be stockpiled on the ROM pad for start of processing.

Mining then moves to another separate pit, Main 1, followed by Main

2 and a pushback into Main 3 to complete the locations for life of

mine in-pit tailing storage. The largest pit has four stages (Main

4 to 7).

The open pit

contractor mining fleet includes 90 t class trucks, loaded by 200 t

diesel-hydraulic shovels. Drill and blast will be undertaken with

track mounted drill rigs drilling 150 mm holes. Explosives are

planned as down hole service by an explosives supplier. Haul roads

are designed to be 23 m wide to allow for two-way traffic at a

maximum gradient of 10%. Where possible waste is also placed onto

in-pit dumps to reduce overall costs.

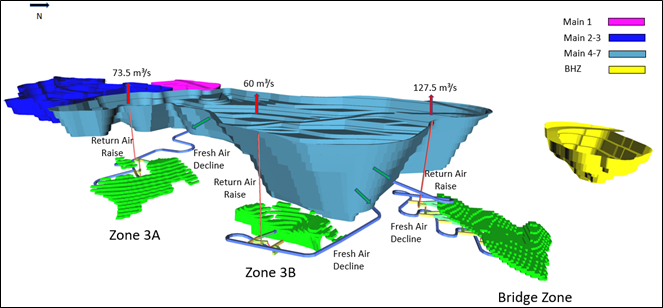

Over the mine

life, a total of 8.9 Mt of material is sent to the mill from the

open pits and a total waste movement of 110.8 Mt, for a life of

mine strip ratio of 12.5:1. Figure 1 illustrates a plan view of the

open pit areas.

The underground

areas were assessed by comparing open pit value to the value

generated using the DatamineTM Mine Shape Optimizer

(MSO) software. The combined value at each depth then determines

the maximum value. The underground Mineral Resources are primarily

flat dipping (23° to 30°) and vary in thickness across each zone (3

m to 12 m), lending themselves to room and pillar mining. The more

steeply dipping portions of Zone 3 are suitable for long hole open

stoping. Three separate areas could be optimally mined from

underground; one directly beneath the main pit (Zone 3A) and one to

the side of the main pit (Zone 3B), and the Bridge

Zone.

A minimum 20 m

crown pillar is left between the pit and stopes. For room and

pillar extraction AMC has applied a dilution factor of 10% at zero

grade to the Mineral Resource and a mining recovery factor of 86%

has been applied to the stopes. For long hole mining AMC has

applied a dilution factor of 12% at zero grade to the Mineral

Resource and a mining recovery factor of 95% to the stopes. Long

hole stopes are backfilled with waste rock.

Contractor

mining using trackless diesel loaders and trucks and

diesel-electric drilling equipment is planned. Declines provide

fresh air intake, with each panel having a ventilation shaft fitted

with a primary exhaust fan on surface.

Figure 2 shows

the underground panels in relation to the open pit

stages.

Open pit mining

accounts for 84% or 8.9 Mt and underground for 16% or 1.7 Mt of the

total 10.6 Mt of material processed.

The Mineral

Resource used for the PEA mine design does not include any of the

Zone 5 resource which is included in the Mineral Resources above

(Table 6). Screening work indicated that this zone needs to be

expanded to arrive at a potential extraction strategy, with the

possibility that these resources may ultimately be brought into a

future mining plan.

Figure 1: Open Pit

Areas

Figure 2:

Underground Mining Areas, view looking

west

Processing

Two

metallurgical test work programs have been conducted on samples

from Pegmont, as reported by the Company on March 6, 2017 and March

5, 2018, and summarised in Table 7. The later test work being more

detailed locked cycle test work on the zones forming the basis of

the mining inventory of the PEA, and were used as the basis for

developing the process design criteria for the

PEA.

Table 7: Recoveries

and concentrate grades by Zone mined in the

PEA

| Zone |

Test Type |

Bond Ball Mill Work Index

kWh/t |

Lead

Concentrate |

Zinc

Concentrate |

| Pb Recovery

% |

Pb

Grade % |

Zn Recovery

% |

Zn Grade % |

| Sulphide |

| Zone 1 |

Locked Cycle |

18.4 |

91.8 |

66.3 |

75.5 |

54.5 |

| Zone 2 |

Locked Cycle |

20.9 |

90.8 |

67.8 |

71.3 |

54.9 |

| Zone 3 |

Locked Cycle |

20.1 |

89.7 |

68.2 |

73.7 |

54.8 |

| Bridge Zone |

Locked Cycle |

19.1 |

92.7 |

68.0 |

70.4 |

52.3 |

| BHZ |

Locked Cycle |

16.6 |

91.5 |

70.6 |

61.8 |

50.7 |

| Transition |

| Zone 1 |

Locked Cycle |

- |

91.3 |

72.5 |

75.2 |

53.3 |

| BHZ |

Open Cycle |

- |

80.6 |

57.0 |

19.3 |

48.9 |

| |

|

|

|

|

|

|

|

The process

plant operating costs were developed by GRES based on a design

processing rate of 3,000 tonnes per day of material for the

flotation plant. The plant will normally operate 24 hours/day, 365

days/year.

A conventional

sequential flotation circuit has been selected for the recovery of

the lead and zinc minerals from the Pegmont

deposit.

The process

plant shall consist of a conventional three stage crushing and a

single stage ball mill grinding circuit, followed by differential

flotation of the lead and zinc minerals to produce separate

saleable lead and zinc concentrates. The concentrates from the lead

and zinc flotation circuits will be thickened and subsequently

filtered on site for road transport to off-site

smelters.

The lead

concentrate will be transported by road to the Mt Isa, while the

zinc concentrate will be transported by road to a rail siding

located at the nearby town of Malbon, and then transported by rail

to Townsville, Queensland. The containerised transport of

concentrate and rail loading infrastructure will allow the

transport lead and / or zinc concentrate to alternative smelters

out of the port of Townsville if commercially more advantageous to

do so.

Tailings from

the flotation plant will be thickened to approximately 53% solids

by weight. Water recovered in the tailings thickener will be

recycled to the process plant. Tails will be disposed of in mined

out open pits.

Figure 3: View of

the processing plant layout, looking

east

Broken Hill type

deposits typically have iron in the zinc concentrate, attracting a

penalty when present at over 9%. Iron in zinc concentrate ranges

from 5.5% to 11.0% in the zones at Pegmont. Fluorine + chlorine

attract a penalty in the lead concentrate over 500 ppm, this is

below detection limits for standard geochemical analysis for

fluorine, precise fluorine analysis is pending for most of the PEA

mine plan, precise fluorine assayed 50 ppm and 147 ppm in BHZ

transition and sulphide respectively. In the absence of precise

fluorine analysis in the other zones flouring levels of 500 ppm

were assumed. Cadmium is present in the zinc concentrates at levels

of between 2740 ppm and 3830 ppm in the PEA mine plan, it attracts

a penalty over 4000 ppm, hence no penalty is

applied.

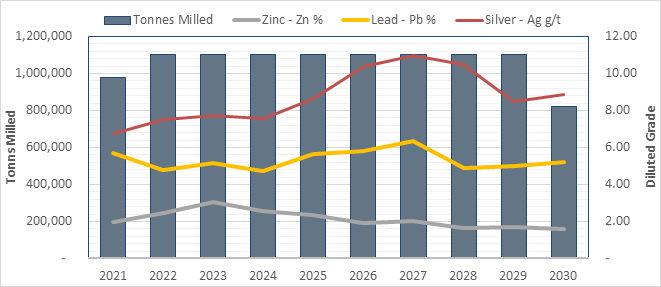

Figure 4: Production

Summary

Infrastructure

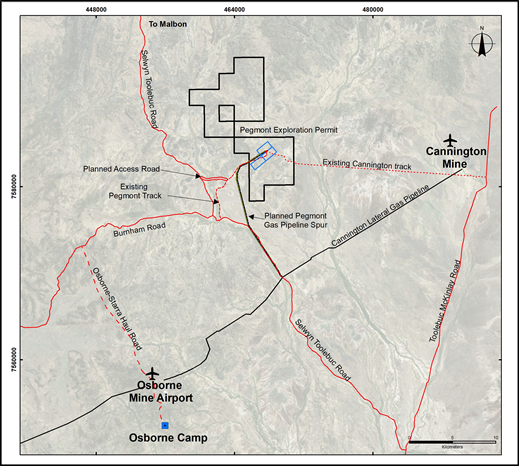

Access

Road access to

the Project is via public roads from the Selwyn Toolebuc Road,

approximately 130 km south-southeast of

Cloncurry.

The PEA includes

developing a 10.5 km all-weather unsealed road, 3.2 km of which is

new and includes a crossing of Sandy Creek from the Selwyn Toolebuc

Road to the plant which then continues onto the accommodation

village.

The Project will

be a fly in – fly out operation, with flights from Townsville to

the existing Osborne Airport, a fully sealed all weather airport,

capable of servicing jet powered aircraft, currently servicing

Chinova’s Osborne operations. These locations are shown on a map in

Figure 5.

Power

Located

approximately 16 km to the south of the Project is a high-pressure

natural gas pipeline, the “Cannington Lateral”, which provides gas

to the Osborne and Cannington Mine sites. The line runs from the

main north south line supplying Mt Isa. A 16 km long spur line is

planned to supply Pegmont with natural gas for power

generation.

Electrical power

for the operation will be gas fired generator sets, estimated to be

an average load of 6.1 MW for the processing plant and

associated services, and excludes the future underground mining

requirement. Electrical power will be generated by gas fired

generator sets, each rated at 2,500 kW at full load and

expected to run at 80% load and 2000 kW each. Including mining and

camp demand power, nominally four sets will be required to be

running with five sets installed for demand and standby

application.

Process

Water

Process water

shall comprise recovered water from the tailings thickener, return

water from the tailings storage facility and topped up by raw water

from a borefield. Both Osborne and Cannington Mines obtain process

water from borefields located in the Great Artesian Basin. The PEA

contemplates constructing a borefield comprising five bores sunk in

the Great Australian Artesian Basin, reporting to a transfer tank,

and then be pumped via a 27 km long pipe line and stored in a 1,000

m3 raw water tank located adjacent to the process water

pond. No specific groundwater investigation for process water was

performed for the PEA.

Airstrip,

Camp and Services

During

construction rooms at the existing 300-person Osborne camp will be

rented from Chinova. A new 204-person accommodation village will be

built to the north of the Project and shielded from both noise and

light by a series of local hills. The village is located

approximately 2 km from the processing plant, providing ease of

access for personnel.

Communications

to the Project is planned to be provided by a installing a spur

(approximately 16.6 km long) of the existing Telstra Fibre optic

cable which runs in parallel to the high-pressure gas line, offset

by 150 m.

Potable water

will be generated onsite from the raw water supply via a reverse

osmosis plant before being pumped to the plant and mining amenities

as well as the accommodation village.

Separate

packaged sewerage treatment system will be installed to treat both

the accommodation village and the processing plant/mining

demands.

Diesel fuel

for light vehicles and the mining fleet is stored in self bunded

modular tanks.

Figure 5: Map of

Local Area Infrastructure

Closure

Planning

The Project will

remove and stockpile topsoil from mining and infrastructure areas

for use in reclamation work. Waste dumps, including in-pit dumps

above pit lake water level, will be re-sloped and topsoil spread

prior to revegetation. In-pit tails areas, once stable will be

capped with waste rock, sloped to shed water off the tails area,

and topsoil spread prior to revegetation. A closure bund will be

placed around the pits.

Opportunities for Project

Enhancement

Additional

optimization studies are anticipated to improve the overall

economics. Specific areas of advancement include;

- Geostatistical review of the

Mineral Resource estimate, investigating grade envelope

definition

- Further infill drilling with

diamond core

- Additional metallurgical

test work to advance optimisation of recovery, including

variability test work

- Investigate post primary

crusher material sorting

- Investigate flash flotation

of lead and optimal grinding size to improve zinc

floatation

- Reduce reagent and collector

dosages to reduce mill OPEX

- Mining; waste dump

placement, scheduling of open pit and underground interaction, more

detailed underground mine planning

Permitting

The Pegmont

Project will be subject to federal, state and local regulatory

requirements. A new mining license covering parts of the existing

exploration permit will be required, at the same time application

for an infrastructure mining licences over the bore field pipeline,

gas pipeline corridor will be made. The applications trigger a

Right to Negotiate process with the Native Title party and

landholder compensation negotiations. ARC Environmental Solutions

have undertaken flora and fauna base line surveys over parts of the

Project located on the exploration permit and the mining licences,

indicating no threatened flora or fauna species are present.

Baseline flora and fauna surveys will need to be expanded to

include the infrastructure corridor containing the bore field water

and gas pipelines, and the fibre optic telecommunication cable.

Other baseline surveys and cultural heritage surveys over the

Project area will be required.

Project

development requires the existing Environmental Authority will be

amended by way of an Environmental Impact Assessment (EIA),

describing the Project design, baseline results and potential

impacts.

About

Preliminary Economic

Assessments

While the

results of the PEA are highly encouraging, by definition a PEA is

considered preliminary in nature and includes Mineral Resources,

including inferred Mineral Resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as Mineral

Reserves. Mineral Resources that are not Mineral Reserves have not

yet demonstrated economic viability. Due to the uncertainty that

may be attached to Mineral Resources, it cannot be assumed that all

or any part of a Mineral Resource will be upgraded to Mineral

Reserves. Therefore, there is no certainty that the results

concluded in the PEA will be realized.

About

Vendetta Mining Corp.

Vendetta Mining

Corp. is a Canadian junior exploration company focused on advanced

stage exploration and development at the Pegmont Lead Zinc Project

in Australia. Vendetta has an option to acquire a 100% interest by

completing certain work requirements and making option and advance

royalty payments. Additional information on the Company can be

found at www.vendettaminingcorp.com

Qualified

Persons and Technical

Report

Peter Voulgaris,

MAIG, MAusIMM, a Director of Vendetta, is a non-independent

Qualified Person as defined by NI 43-101, who participated in the

preparation of the Mineral Resource update and PEA. Mr. Voulgaris

has reviewed the technical content of this press release, and

consents to the information provided in the form and context in

which it appears.

The following

Qualified Persons, under the terms of National Instrument 43-101,

participated in the preparation of the Technical Report and have

reviewed the technical content of this press release for the

Pegmont Project and consent to the information provided in the form

and context in which it appears.

Geology and

Mineral Resource

John Morton

Shannon, P.Geo., Principal Geologist at AMC Mining Consultants

(Canada) Ltd., is an independent qualified person, as defined in NI

43-101.

Dinara

Nussipakynova, P.Geo., Principal Geologist at AMC Mining

Consultants (Canada) Ltd., is an independent qualified person, as

defined in NI 43-101.

Mining

Philippe Lebleu

P.Eng., Principal Mining Engineer at AMC Mining Consultants

(Canada) Ltd., is an independent qualified person, as defined in NI

43-101.

Gary Methven

P.Eng., Principal Mining Engineer at AMC Mining Consultants

(Canada) Ltd., is an independent qualified person, as defined in NI

43-101.

Infrastructure, Metallurgy and Mineral

Processing

Brendan

Mulvihill, MAusIMM CP (Met), Senior Process Engineer at GR

Engineering Services, is an independent qualified person, as

defined in NI 43-101.

A Technical

Report titled “Pegmont Project Mineral Resource Update and

Preliminary Economic Assessment” prepared in accordance with

National Instrument 43-101 Standards for Disclosure for Mineral

Projects (“NI 43-101”) will be filed on SEDAR within 45 days of

this news release. For the final full details and further

information with respect to the key assumptions, parameters, and

risks associated with the results of the PEA, the Mineral Resource

estimates included therein, and other technical information, please

refer to the complete Technical Report to be made available on

SEDAR.

ON

BEHALF OF THE BOARD OF DIRECTORS

“Michael

Williams”

Michael

Williams

President &

CEO

Forward

Looking Information

The TSX Venture Exchange does not accept

responsibility for the adequacy or accuracy of this

release.

This release includes certain

statements that may be deemed to be “forwardlooking statements”

within the meaning of the applicable Canadian Securities laws. All

statements in this release, other than statements of historical

facts are forward looking statements, including the anticipated

time and capital schedule to production; estimated project

economics, including but not limited to, mill recoveries, payable

metals produced, production rates, payback time, capital and

operating and other costs, IRR and mine plan; expected upside from

additional exploration; expected capital requirements; and other

future events or developments. Forward-looking statements include

statements that are predictive in nature, are reliant on future

events or conditions, Forwardlooking statements are often, but not

always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "estimate", "expect”, “may",

"will", "project", "predict", "potential", "targeting”, “intend",

"could", "might", "should", "believe” and similar

expressions.

These statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forwardlooking statements. Although the

Company believes the expectations expressed in such forwardlooking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results or

developments may differ materially from those in the forwardlooking

statements. Factors that could cause actual results to differ

materially from those in forwardlooking statements include, but are

not limited to, changes in commodities prices; changes in expected

mineral production performance; unexpected increases in capital

costs; exploitation and exploration results; continued availability

of capital and financing; differing results and recommendations in

the Feasibility Study; and general economic, market or business

conditions. In addition, forwardlooking statements are subject to

various risks, including but not limited to operational risk;

political risk; currency risk; capital cost inflation risk; that

data is incomplete or inaccurate; the limitations and assumptions

within drilling, engineering and socioeconomic studies relied upon

in preparing the PEA; and market risks. The reader is referred to

the Company’s filings with the Canadian securities regulators for

disclosure regarding these and other risk factors, accessible

through Vendetta Mining’s profile at

www.sedar.com

There is no certainty that any

forwardlooking statement will come to pass and investors should not

place undue reliance upon forwardlooking statements. The Company

does not undertake to provide updates to any of the forwardlooking

statements in this release, except as required by

law.

This news release presents certain

financial performance measures, including all in sustaining costs

(AISC), cash cost and total cash cost that are not recognized

measures under IFRS. This data may not be comparable to data

presented by other silver producers. The Company believes that

these generally accepted industry measures are realistic indicators

of operating performance and are useful in allowing comparisons

between periods. NonGAAP financial performance measures should be

considered together with other data prepared in accordance with

IFRS. This news release contains nonGAAP financial performance

measure information for a project under development incorporating

information that will vary over time as the project is developed

and mined. It is therefore not practicable to reconcile these

forwardlooking nonGAAP financial performance

measures.

Vendetta Mining (TSXV:VTT)

Historical Stock Chart

From Apr 2024 to May 2024

Vendetta Mining (TSXV:VTT)

Historical Stock Chart

From May 2023 to May 2024