Cameco Shares Fall 16% After Deal to Buy Westinghouse Electric

October 12 2022 - 12:06PM

Dow Jones News

By Kathryn Hardison

Shares of Cameco Corp. slid 16% to $29.86 on Wednesday after the

company agreed to acquire Westinghouse Electric Co. through a

partnership with Brookfield Renewable Partners LP.

Cameco will own a 49% interest in Westinghouse, and Brookfield

Renewable, with its institutional partners, will own a 51% stake,

the companies said Tuesday. The total enterprise value for

Westinghouse is roughly $7.88 billion, which includes an estimated

$4.5 billion in equity and the rest in debt.

Cameco, the world's largest publicly-traded uranium company,

said it has enough liquidity to finance its share of the deal.

Concurrently, it said Tuesday that it plans to sell $650 million

work of the company's stock, priced at $21.95 a share.

Cameco shares are up 8.3% for the year.

Westinghouse will be acquired from Brookfield Business Partners

LP, the entity that Brookfield Asset Management Inc. uses to

operate business services and industrial operations of its

private-equity group.

Shares of Brookfield Business Partners were up 5% to $19.59,

while shares of Brookfield Asset Management were down 1.5% at

$52.80.

Write to Kathryn Hardison at kathryn.hardison@wsj.com

(END) Dow Jones Newswires

October 12, 2022 11:51 ET (15:51 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

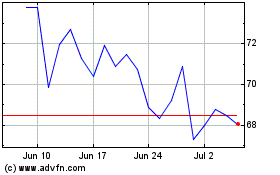

Cameco (TSX:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

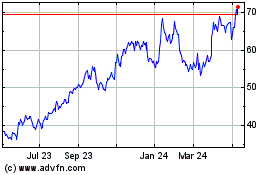

Cameco (TSX:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024