Athabasca Oil Announces Approval of Normal Course Issuer Bid

March 14 2023 - 7:00AM

Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is pleased to announce that the Toronto Stock Exchange (“TSX”) has

approved the Corporation’s normal course issuer bid (“NCIB”) to

purchase up to 57,967,089 common shares during the 12-month period

commencing March 16, 2023 and ending March 15, 2024 or such earlier

time as the NCIB is completed or terminated at the option of

Athabasca.

Athabasca’s launch of a NCIB is based on the

strength of the balance sheet and the Company’s commitment to

augment shareholder returns through a buyback program. The

Company’s capital allocation framework will balance material

near-term return of capital initiatives for shareholders, with a

multi-year growth trajectory of cash flow per share. Athabasca sees

intrinsic value not reflected in the current share price and in

2023 is planning to allocate a minimum of 75% of Excess Cash Flow

(Adjusted Funds Flow less Sustaining Capital) to shareholders.

Pursuant to the NCIB, the maximum number of

common shares to be purchased represents 10% of the public float,

as defined by the TSX. As of March 13, 2023, the Company had a

public float of 579,670,895 common shares and 586,662,301 common

shares issued and outstanding. Purchases will be made on the open

market through the facilities of the TSX and/or alternative trading

systems in Canada at market prices prevailing at the time of the

acquisition. The number of common shares that can be purchased

pursuant to the NCIB is subject to a daily maximum of 1,068,617

common shares (which is equal to 25% of the average daily trading

volume of 4,274,469 from September 1, 2022 to February 28, 2023)

with the exception that one block purchase in excess of the daily

maximum is permitted per calendar week. Common shares acquired

under the NCIB will be cancelled.

In connection with the NCIB, Athabasca will

enter into an automatic share purchase plan (“ASPP”) with its

designated broker to allow for purchases of its common shares under

the NCIB during blackout periods. Such purchases would be at the

discretion of the broker based on parameters established by the

Company prior to any blackout period or any period when it is in

possession of material undisclosed information. Outside of these

blackout periods, common shares will be repurchased in accordance

with management's discretion, subject to applicable law.

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

| For more information, please contact: |

| Matthew

Taylor |

Robert

Broen |

| Chief Financial Officer |

President and CEO |

| 1-403-817-9104 |

1-403-817-9190 |

| mtaylor@atha.com |

rbroen@atha.com |

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “project”, “continue”, “maintain”,

“estimate”, “expect”, “will”, “target”, “forecast”, “could”,

“intend”, “potential”, “guidance”, “outlook” and similar

expressions suggesting future outcome are intended to identify

forward-looking information. The forward-looking information is not

historical fact, but rather is based on the Company’s current

plans, objectives, goals, strategies, estimates, assumptions and

projections about the Company’s industry, business and future

operating and financial results. This information involves known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that these expectations will prove to be correct and such

forward-looking information included in this News Release should

not be unduly relied upon. This information speaks only as of the

date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans; repayment plans; the

allocation of future capital; timing and quantum for shareholder

returns including share buybacks; the terms of our NCIB program and

ASPP; and other matters.

The actual number of common shares that will be

repurchased under the NCIB, and the timing of any such purchases,

will be determined by the Company on management's discretion,

subject to applicable securities laws. There cannot be any

assurances as to how many common shares, if any, will ultimately be

acquired by the Company.

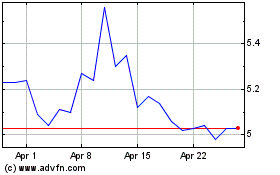

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Mar 2024 to Apr 2024

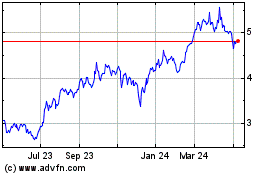

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Apr 2023 to Apr 2024