Mark Bristow helped pull off partnership with Newmont; now he

has to make it work

By Jacquie McNish, Alexandra Wexler and Alistair MacDonald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 15, 2019).

TORONTO -- Six months ago, Mark Bristow was the chief of a

midsize African gold miner wrestling with political interference.

Today he heads Barrick Gold Corp., the world's largest gold

producer which this week struck an agreement to pool its Nevada

assets with its nearest rival Newmont Mining Corp.

The two miners had long sought a partnership, but couldn't agree

to terms. "What is amazing is that we were able to convince

everyone that this was a good idea," Mr. Bristow said of the Nevada

partnership.

The 60-year-old South African geologist has been a brash force

in the mining industry ever since he turned around a

financially-strapped junior miner in the 2000s with a winning bet

on the West African country of Mali. He subsequently transformed

that company, Randgold Resources Ltd., and its small portfolio of

remote African gold mines into one of the industry's most

consistently profitable companies.

He has developed mines in some of Africa's most politically

volatile countries, sometimes attacking competitors or politicians

for strategies that he felt hindered sustainable local prosperity.

In 2003, Mr. Bristow launched an unsolicited bid to merge with

Ghana's Ashanti Goldfields, which was twice the size of Randgold.

The attempt was unsuccessful, but established his reputation as an

aggressive deal maker.

Mr. Bristow was named Barrick's chief executive in January after

the company merged with the much smaller Randgold last year. He

described himself to his new executive team as a "consultative

dictator" who planned to dramatically shrink Barrick's Toronto head

office. He said he would spend the bulk of his time visiting mines,

which he told staff suffered under weak management.

At Barrick, he has sought to paint himself as a rough-hewed

miner's miner, in contrast to Executive Chairman John Thornton, an

urbane academic and former Goldman Sachs Group Inc. president. "He

is an email person, I am a talker," Mr. Bristow said at a recent

industry conference in South Africa, describing his relationship

with Mr. Thornton.

His exploits have helped build his image as a maverick. At

Randgold, Mr. Bristow operated out of an office in the English

Channel island of Jersey with seven employees, spending most of his

time piloting one of his five personal planes to far-flung mines.

He estimates he has competed in more than 200 marathons, kayak

races and Ironman triathlons. He climbed Mount Kilimanjaro with one

of his two sons, who was 12 at the time, and led both on motorcycle

treks across Africa. Once, it took paramedics four days to reach

him in Senegal after he was thrown off his motorcycle into a tree

and fractured two vertebrae.

As a child, Mr. Bristow says, he was knocked unconscious or

broke so many bones during sporting events that his father bought a

chair for his mother to sit in by the telephone because there were

so many emergency calls.

"I've always put myself out there," Mr. Bristow said. "You have

to make a difference."

In the early 2000s, when foreign mining giants shed African

assets after Nelson Mandela's rise to power in South Africa stirred

labor activism, Mr. Bristow saw an opportunity to buy cheap mining

properties in hot spots such as Mali, Ivory Coast and the

Democratic Republic of Congo. He staffed Randgold's mines with

locally trained managers and ceded minority stakes to governments.

"I wanted to prove you didn't need outsiders to develop Africa's

mines," he said.

"Running a global miner is his destiny," said Joe Foster,

manager of VanEck International Investors Gold Fund, who invested

in Randgold after meeting Mr. Bristow in 2002 when he was

struggling to raise money to develop the Mali mine.

Overseeing a company the size of Barrick, though, is a new

challenge for Mr. Bristow, especially now that it is tilted

primarily toward production in Nevada, not Africa. At Randgold, Mr.

Bristow oversaw five gold mines in three countries. At Barrick, he

now has a portfolio of 19 mines in 15 countries.

On Monday, Barrick abandoned a $18 billion unsolicited offer for

Newmont and agreed to a much more limited joint venture of the two

firms' Nevada operations. Newmont executives, in defending

themselves to investors against the takeover offer, frequently

pointed to Mr. Bristow's lack of experience leading a large,

globe-spanning company.

The "mystique and awe around Bristow is based around his running

five mines in one continent," Tom Palmer, Newmont's chief operating

officer, said last week before Newmont signed up for the joint

venture.

The two sides now agree they can squeeze hundreds of millions of

dollars annually in savings jointly running the Nevada mines.

Barrick, which controls more assets there, will be the operator of

the venture.

Mr. Bristow said he initiated discussions with foreign

competitors in 2015 to diversify away from his homeland. After a

series of preliminary talks with rivals, he said Barrick's Mr.

Thornton "was the only one who would listen to me."

Last September, Randgold agreed to be acquired by Barrick, which

was struggling with a swooning stock price over investor concerns

about its shrinking gold production. Even before Barrick and

Randgold completed the merger, Mr. Bristow said he was looking for

the next big deal. He and Newmont CEO Gary Goldberg exchanged

messages about a possible combination of their large Nevada

operations, but talks never materialized.

Mr. Bristow was caught off guard when Newmont announced a $10

billion all-share agreement in January to merge with Canadian gold

producer Goldcorp Inc. Barrick responded with a hostile merger

proposal. Eventually, investor support for Barrick's promise of

nearly $5 billion of savings in Nevada nudged the two CEOs to the

table. Six days after Mr. Goldberg joined Mr. Bristow in New York

to discuss the partnership, an agreement for the Nevada joint

venture was announced.

"I'm trying not to stick my finger up their nose anymore," Mr.

Bristow said.

Write to Jacquie McNish at Jacquie.McNish@wsj.com, Alexandra

Wexler at alexandra.wexler@wsj.com and Alistair MacDonald at

alistair.macdonald@wsj.com

(END) Dow Jones Newswires

March 15, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

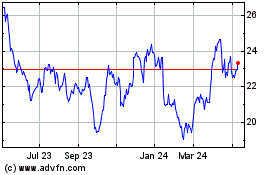

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Aug 2024 to Sep 2024

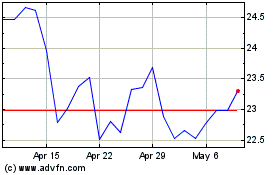

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Sep 2023 to Sep 2024