Eastdil CEO hopes more nimble firm can better challenge tech and

startup rivals

By Konrad Putzier and Craig Karmin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 12, 2019).

Real-estate firm Eastdil Secured LLC is buying back control of

the company from Wells Fargo & Co., betting it can prosper as

an independent boutique operation even as its competitors are

growing bigger and going public.

Led by Chief Executive Roy March, Eastdil struck a deal for a

management buyout, the firm said. Guggenheim Investments' clients

and the Singapore investment company Temasek Holdings Pte. Ltd. are

also taking ownership stakes in the firm. Wells Fargo, which has

owned Eastdil for 20 years, will retain a minority position.

The deal values the firm at more than $400 million, and over

time Eastdil employees will be able to own more than 40% of the

equity, according to people familiar with the transaction.

Mr. March said as a wholly-owned subsidiary of Wells Fargo,

Eastdil felt hamstrung by banking regulations. Now, he is looking

to expand at home and abroad and develop more technology.

The deal, which is expected to close by the fourth quarter,

comes during a period of upheaval in the commercial real-estate

industry.

Co-working upstarts like WeWork Cos. are changing the way

companies rent office space by acting as middlemen between

landlords and tenants. Big property firms like CBRE Group, JLL,

Cushman & Wakefield and Newmark Group Inc. have been getting

bigger, acquiring competitors, adding new business lines or

launching public share offerings.

Mr. March believes that smaller, more nimble firms that focus on

big-ticket sales are better positioned to weather the new

challenges from tech firms and startups.

Co-working firms are increasingly offering leasing, property

management and other corporate services and are aiming to compete

with the big brokerage firms. Big tech companies like Alphabet

Inc.'s Google and Microsoft Corp. may be moving into these

businesses in the future, Mr. March suggested.

"We think that's going to disrupt the entire corporate-services

world," Mr. March said. Because Eastdil focuses instead on sales

and real-estate banking services, he says it is less vulnerable to

the new competition.

His bigger rivals say sovereign-wealth funds, family offices and

other big property investors want one firm to handle all related

business. But some investors warn against underestimating the

Eastdil chief.

"Betting against Eastdil or against Roy March is not a great

idea," said Jonathan Gray, president and chief operating officer of

Blackstone Group LP. "It's a very successful firm that is quite

effective at what it does."

What Eastdil does is large, complex deals. Mr. Gray ticked off a

list of some of Blackstone's biggest over the past dozen years:

acquiring G.E. Capital Real Estate assets with Wells Fargo for $23

billion, the buyout of Sam Zell's Equity Office Properties for $39

billion in debt and equity, and last week Blackstone's $18.7

billion deal for U.S. industrial warehouses held by Singapore's

GLP.

"He's been in the middle of every major real-estate deal in the

world," Mr. Gray said. "The model of being lean and nimble and

below the radar screen has worked for" Eastdil.

Daniel Fournier, CEO of real-estate investment company Ivanhoé

Cambridge, said Eastdil's approach to clients is "extremely

personalized" and that Mr. March is deeply involved. "There will

always be room for that kind of service," he said.

Eastdil says it will remain a specialized real-estate banking

and brokerage firm. It has about 335 real-estate professionals. JLL

and CBRE each have about 90,000 employees.

Mr. March, who is 62 years old, joined Eastdil in 1978 and

became president in 1994. In 1999, Wells Fargo bought the firm for

about $150 million, according to people familiar with the matter.

After Eastdil merged with Secured Capital, Mr. March became

CEO.

Eastdil's business soared as the real-estate market recovered

from the global financial crisis. But stricter regulatory oversight

of big banks curtailed the firm's overseas expansion at a time when

real-estate investors increasingly operate around the globe and

expect their brokers and advisers to do the same.

By 2017, Mr. March concluded the firm needed an ownership

change. "We approached Wells Fargo and said 'it's time to reassess

the relationship, '" he said.

Mr. March hopes the sale will allow Eastdil to develop its own

technology. The regulatory environment around a bank can inhibit

the development of new technology at a subsidiary. He also hopes

Temasek's backing will enable the company to do more business in

Asia, where the fund has deep connections.

In the U.S., Eastdil held the top market share for 2018 and

year-to-date through May in 2019 for real-estate deals greater than

$100 million across all property types in the U.S., according to

Real Capital Analytics.

But its dominance in New York City sales has declined in recent

years, and Eastdil fell to third place in 2017 and to second place

in 2018 for these large transactions, Real Capital said. Some

attribute that fall to a pair of high-profile office brokers moving

to a rival firm in 2016.

"It hurt," said Mike Kirby, co-founder and chairman of research

firm Green Street Advisors. "They really were dominant in their

market share in Manhattan."

Eastdil says its sales business globally has remained

consistent. The firm has also hired some prominent industry figures

recently. That includes broker Will Silverman from Hodges Ward

Elliott, who starts later this month, people familiar with the

matter said.

Eastdil President D. Michael Van Konynenburg said the buyout

enables top employees to acquire a stake in the company and will

keep them on board.

"In our business, a lot of people take checks to go," he said.

"They don't usually write checks."

Write to Konrad Putzier at Konrad.Putzier@wsj.com and Craig

Karmin at craig.karmin@wsj.com

(END) Dow Jones Newswires

June 12, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

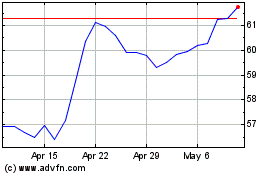

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

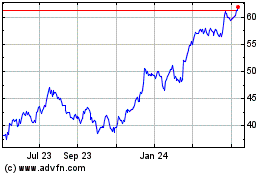

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024