Amended Tender Offer Statement by Issuer (sc To-i/a)

March 07 2017 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

(Amendment No. 2)

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

VIPSHOP HOLDINGS LIMITED

(Name of Subject Company (Issuer))

VIPSHOP HOLDINGS LIMITED

(Name of Filing Person (Issuer))

1.50% Convertible Senior Notes due 2019

(Title of Class of Securities)

92763WAA1

(CUSIP Number of Class of Securities)

Donghao Yang

Chief Financial Officer

Vipshop Holdings Limited

No. 20 Huahai Street

Liwan District, Guangzhou 510370

People’s Republic of China

+86 (20) 2233-0000

with copy to:

Z. Julie Gao, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 42/F, Edinburgh Tower, The Landmark

15 Queen’s Road, Central

Hong Kong

+852 3740-4700

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

|

CALCULATION OF FILING FEE

|

|

|

Transaction Valuation

|

|

Amount of Filing Fee

|

|

|

US$632,500,000

(1)

|

|

US$73,306.75

(2)

|

|

(1)

Calculated solely for purposes of determining the filing fee. The purchase price of the 1.50% Convertible Senior Notes due 2019 (the “Notes”), as described herein, is US$1,000 per US$1,000 principal amount outstanding. As of March 7, 2017, there was US$632,500,000 aggregate principal amount of Notes outstanding, resulting in an aggregate maximum purchase price of US$632,500,000 (excluding accrued but unpaid interest).

(2)

The amount of the filing fee was calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and equals US$115.90 for each US$1,000,000 of the value of the transaction.

x

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

Amount Previously Paid:

|

US$73,306.75

|

Filing Party:

|

Vipshop Holdings Limited

|

|

Form or Registration No.:

|

Schedule TO

|

Date Filed:

|

February 14, 2017

|

¨

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes to designate any transactions to which the statement relates:

o

third-party tender offer subject to Rule 14d-1.

x

issuer tender offer subject to Rule 13e-4.

o

going-private transaction subject to Rule 13e-3.

o

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer:

o

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

o

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

o

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

INTRODUCTORY STATEMENT

This Amendment No. 2 to Schedule TO (this “Amendment No. 2”) amends and supplements the Tender Offer Statement on Schedule TO that was initially filed by Vipshop Holdings Limited (the “Company”) on February 14, 2017 and then amended and supplemented by Amendment No. 1 on February 22, 2017 (as amended and supplemented, the “Schedule TO”) relating to the Company’s 1.50% Convertible Senior Notes due 2019 (the “Notes”). This Amendment No. 2 relates to the source and amount of funds that the Company may use to finance the repurchase of any Notes that Holders have validly surrendered for repurchase and not withdrawn. The information contained in the Schedule TO, including the Company’s Put Right Notice to the Holders dated February 14, 2017 (as amended and supplemented by Amendment No. 1, the “Put Right Notice”), as supplemented and amended by the information contained in Item 7 below, is incorporated herein by reference. Except as specifically provided herein, this Amendment No. 2 does not modify any of the information previously reported on the Schedule TO.

This Amendment No. 2 amends and supplements the Schedule TO as set forth below and is intended to satisfy the disclosure requirements of Rule 13e-4(c)(3) under the Securities Exchange Act of 1934, as amended.

ITEM 7. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

Item 7 of the Schedule TO and Section 2.4 entitled “Source of Funds” in the Put Right Notice are hereby amended and supplemented to include the following information:

In order to finance the payment of the 2017 Repurchase Price of the Notes, the Company (as borrower), a subsidiary of the Company, Vipshop International Holdings Limited (as guarantor), Credit Suisse AG, Singapore Branch (as mandated lead manager), Morgan Stanley Senior Funding, Inc. (as mandated lead manager and agent), and certain lenders entered into a facility agreement dated March 7, 2017 (the “Facility Agreement”). The maximum amount of financing available under the term loan facility pursuant to the Facility Agreement is US$632,500,000, subject to the actual amount of the 2017 Repurchase Price, to be utilized on or before the 2017 Repurchase Date in one loan with a term of 364 days. The loan will be guaranteed by Vipshop International Holdings Limited. The minimum amount of the loan that may be utilized under the Facility Agreement is US$5,000,000. The interest rate under the Facility Agreement is three-month U.S. dollar LIBOR plus a multi-tiered margin that ranges from 50 basis points to 275 basis points per annum depending on the age of the outstanding loan. During a specified period after the loan is utilized, the majority lenders may demand

that the Company carry out up to two take-out debt offerings in accordance with the Facility Agreement,

provided

that the amount of each take-out debt offering subject to such demand must be no less than US$50,000,000. The Facility Agreement contains various terms and conditions customary for term loan facilities of the same or similar nature, including conditions for utilization, affirmative and negative financial covenants and other undertakings. The Company has not arranged for alternative financing. A copy of the Facility Agreement is attached hereto as Exhibit (b)(1) and incorporated herein by reference.

If the loan under the Facility Agreement is utilized, the Company plans to use a combination of available cash and refinancing options to repay the loan, including possibly one or more term loan facilities and/or debt offerings, depending on the amount of the loan utilized under the Facility Agreement.

ITEM 12. EXHIBITS.

(a)(1)*

Put Right Notice to Holders of 1.50% Convertible Senior Notes due 2019 Issued by Vipshop Holdings Limited, dated February 14, 2017.

(a)(5)(A)*

Press release issued by the Company, dated February 14, 2017.

(a)(5)(B)*

Press release issued by the Company, dated February 22, 2017.

(a)(5)(C)

Press release issued by the Company, dated March 7, 2017.

(b)(1)

US$632,500,000 Facility Agreement, dated March 7, 2017, by and among the Company, as borrower, Vipshop International Holdings Limited, as guarantor, Credit Suisse AG, Singapore Branch, as mandated lead manager, Morgan Stanley Senior Funding, Inc., as mandated lead manager and agent, and the lender parties thereto.

(d)(1)*

Indenture, dated as of March 17, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 2.4 from the Company’s Annual Report on Form 20-F (File No. 001-35454) filed with the Securities and Exchange Commission on April 25, 2014.

(d)(2)*

First Supplemental Indenture, dated as of March 17, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 2.5 from the Company’s Annual Report on Form 20-F (File No. 001-35454) filed with the Securities and Exchange Commission on April 25, 2014.

(d)(3)*

Second Supplemental Indenture, dated as of November 11, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 2.7 from the Company’s Annual Report on Form 20-F (File No. 001-35454) filed with the Securities and Exchange Commission on April 24, 2015.

(g)

Not applicable.

(h)

Not applicable.

* Previously filed.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

VIPSHOP HOLDINGS LIMITED

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Donghao Yang

|

|

|

|

Name:

|

Donghao Yang

|

|

|

|

Title:

|

Chief Financial Officer

|

Dated: March 7, 2017

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

(a)(1)*

|

|

Put Right Notice to Holders of 1.50% Convertible Senior Notes due 2019 Issued by Vipshop Holdings Limited, dated February 14, 2017.

|

|

|

|

|

|

(a)(5)(A)*

|

|

Press release issued by the Company, dated February 14, 2017.

|

|

|

|

|

|

(a)(5)(B)*

|

|

Press release issued by the Company, dated February 22, 2017.

|

|

|

|

|

|

(a)(5)(C)

|

|

Press release issued by the Company, dated March 7, 2017.

|

|

|

|

|

|

(b)(1)

|

|

US$632,500,000 Facility Agreement, dated March 7, 201 7. by and among the Company, as borrower, Vipshop lnternational Holdings Limited, as guarantor, Credit Suisse AG, Singapore Branch, as mandated lead manager, Morgan Stanley Senior Funding, Inc., as mandated lead manager and agent, and the lender parties thereto.

|

|

|

|

|

|

(d)(1)*

|

|

Indenture, dated as of March 17, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 2.4 from the Company’s Annual Report on Form 20-F (File No. 001-35454) filed with the Securities and Exchange Commission on April 25, 2014.

|

|

|

|

|

|

(d)(2)*

|

|

First Supplemental Indenture, dated as of March 17, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 2.5 from the Company’s Annual Report on Form 20-F (File No. 001-35454) filed with the Securities and Exchange Commission on April 25, 2014.

|

|

|

|

|

|

(d)(3)*

|

|

Second Supplemental Indenture, dated as of November 11, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 2.7 from the Company’s Annual Report on Form 20-F (File No. 001-35454) filed with the Securities and Exchange Commission on April 24, 2015.

|

* Previously filed.

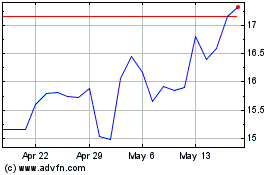

Vipshop (NYSE:VIPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

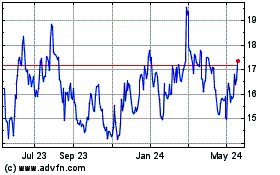

Vipshop (NYSE:VIPS)

Historical Stock Chart

From Apr 2023 to Apr 2024