UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): June 29, 2015 (June 26, 2015)

SYSCO CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-06544 |

|

74-1648137 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1390 Enclave Parkway, Houston, TX |

|

77077-2099 |

| (Address of principal executive office) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (281) 584-1390

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry Into a Material Definitive Agreement |

The disclosure set forth below under

Item 1.02 of this Form 8-K is incorporated by reference herein.

| Item 1.02. |

Termination of a Material Definitive Agreement |

On June 26, 2015, Sysco Corporation

(the “Company”), USF Holding Corp. (“USF”) and two merger subsidiaries of Sysco (“Merger Subs”) entered into an Agreement and Release (the “Termination Agreement”) to terminate the Agreement and Plan of

Merger, dated December 8, 2013, among the Company, USF and the Merger Subs (the “Merger Agreement”). Upon the termination of the Merger Agreement, the Asset Purchase Agreement, dated February 2, 2015, among the Company, USF, US

Foods, Inc., a wholly owned subsidiary of USF, a number of subsidiaries of US Foods, Inc. and Performance Food Group, Inc. (the “APA”) automatically terminated.

The parties mutually agreed to terminate the Merger Agreement following the decision of the U.S. District Court for the District of Columbia

to grant the Federal Trade Commission’s request for a preliminary injunction to block the transactions contemplated by the Merger Agreement.

The Company has paid a termination fee of $300 million to USF in connection with the termination of the Merger Agreement. The foregoing

description of the Termination Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Termination Agreement, which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Upon the termination of the Merger Agreement, the APA automatically terminated. The Company has paid a termination fee of $12.5 million

to Performance Food Group, Inc. pursuant to the terms of the APA.

Pursuant to the indentures governing the $5 billion in aggregate

principal amount of senior unsecured notes (the “Notes”) issued in six series by the Company on October 2, 2014, the Company is required, due to the termination of the Merger Agreement, to redeem within 40 calendar days each series of

Notes in whole, at a redemption price equal to 101% of the aggregate principal amount of such series of Notes, plus accrued and unpaid interest. The Company issued a redemption notice with respect to each series of Notes on June 29, 2015, and

expects to complete the redemption within the 40 calendar day period referenced above.

| Item 2.04. |

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

The disclosure set forth above under Item 1.02 of this Form 8-K is incorporated by reference herein.

| Item 8.01. |

Other Information. |

On June 29, 2015, the Company issued a press release announcing

the termination of the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Agreement and Release, dated June 26, 2015, among USF Holding Corp., Sysco Corporation, Scorpion Corporation I, Inc. and Scorpion Company II, LLC. |

|

|

| 99.1 |

|

Press Release dated June 29, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Sysco Corporation has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Sysco Corporation |

|

|

|

|

| Date: June 29, 2015 |

|

|

|

By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

|

Russell T. Libby Executive Vice

President-Corporate Affairs, Chief Legal Officer and Corporate Secretary |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Agreement and Release, dated June 26, 2015, among USF Holding Corp., Sysco Corporation, Scorpion Corporation I, Inc. and Scorpion Company II, LLC. |

|

|

| 99.1 |

|

Press Release dated June 29, 2015. |

Exhibit 10.1

EXECUTION VERSION

AGREEMENT AND

RELEASE

This AGREEMENT AND RELEASE, dated as of June 26, 2015 (this “Agreement”), is entered into by and among

USF Holding Corp., a Delaware corporation (the “Company”), Sysco Corporation, a Delaware corporation (“Parent”), Scorpion Corporation I, Inc., a Delaware corporation (“Merger Sub One”) and Scorpion

Company II, LLC, a Delaware liability limited company (“Merger Sub Two” and, together with Merger Sub One, the “Merger Subs”). Each of the foregoing are collectively referred to herein as the

“Parties” and each individually as a “Party.” Capitalized terms used but not defined in this Agreement shall have the respective meanings given to them in the Merger Agreement (as defined below).

RECITALS

A. WHEREAS, on

December 8, 2013, Parent, Merger Sub One, Merger Sub Two and the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), providing for the merger of Merger Sub One with and into the Company (the

“Initial Merger”), with the Company continuing as a surviving corporation and a wholly owned subsidiary of Parent, followed by the merger of the Company with and into Merger Sub Two (together with the Initial Merger, the

“Mergers”), with Merger Sub Two continuing as the surviving entity and a wholly owned subsidiary of Parent.

B. WHEREAS,

Section 8.1(a) of the Merger Agreement provides that the Merger Agreement may be terminated with the mutual written consent of the parties thereto.

C. WHEREAS, the parties to the Merger Agreement have determined that they desire to terminate the Merger Agreement on the terms and conditions

set forth herein.

NOW, THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants and agreements

contained herein, the Parties hereto hereby agree as follows:

AGREEMENT

1. Termination of Merger Agreement; Reverse Termination Fee. The Parties hereby mutually agree in accordance with Section 8.1(a)

of the Merger Agreement that, immediately upon execution of this Agreement, the Merger Agreement, other than the provisions of (i) Section 8.3, and the provisions referenced therein that survive termination, (ii) the second sentence

of Section 5.14 and (iii) the first sentence of Section 5.15(i), all of which shall survive the termination of the Merger Agreement hereby, is terminated and shall be of no further force or effect. For the avoidance of doubt, the

Confidentiality Agreement and the confidentiality and joint defense agreement between Parent and the Company shall continue to remain in full force and effect in accordance with their respective terms.

2. Reverse Termination Fee. In connection with the termination of the Merger Agreement, Parent hereby agrees to pay, or cause to be

paid, the Reverse Termination Fee to the Company at such times and to such accounts as specified in Exhibit A hereto.

3. Mutual Releases; Covenants Not to Sue.

(a) Parent and the Merger Subs, for and on behalf of themselves and the Sysco Related Parties (as defined below), do hereby unequivocally

release and discharge, and hold harmless, the Company and any of its former and current subsidiaries, equity holders, controlling persons, directors, officers, employees, agents, Affiliates, members, managers, general or limited partners or

assignees or any former or current stockholder, controlling person, director, managing director, officer, employee, general or limited partner, member, manager, family member, spouse, heir, trust, trustee, executor, estate, administrator,

beneficiary, foundation, fiduciary, partnership, joint venture, member firm, limited liability company, corporation, parent, division, associated entity, principal, predecessor, predecessor-in-interest, successor, successor-in-interest, advisor,

consultant, banker, entity providing any fairness opinion, underwriter, broker, dealer, lender, attorney, representative, accountant, insurer, co-insurer, reinsurer, associate agent or assignee of any of the foregoing (collectively, the

“Company Related Parties”), from any and all past, present, direct, indirect, individual, class, representative, and derivative liabilities, actions, potential actions, causes of action, rights, losses, obligations, duties, costs,

expenses, interest, penalties, sanctions, decrees, matters, cases, claims, suits, debts, dues, sums of money, attorney’s fees, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises,

variances, trespasses, injuries, harms, damages, judgments, remedies, extents, executions, demands, liens and damages of every kind and nature, in law, equity or otherwise, asserted or that could have been asserted, under federal, state, local,

foreign, regulatory, statutory, or common law or rule (including but not limited to any claims under federal securities laws or state disclosure law or any claims that could be asserted derivatively on behalf of the Parent), known or unknown,

suspected or unsuspected, foreseen or unforeseen, anticipated or unanticipated, disclosed or undisclosed, accrued or unaccrued, apparent or not apparent, foreseen or unforeseen, matured or not matured, liquidated or not liquidated, fixed or

contingent, whether or not concealed or hidden, from the beginning of time until the date of execution of this Agreement, that in any way arises from or out of, are based upon, or are in connection with or relate in any way to or involve, directly

or indirectly, any of the actions, transactions, occurrences, statements, representations, misrepresentations, omissions, allegations, facts, practices, events, claims or any other matters, things or causes whatsoever, or any series thereof, that

were, could have been, or in the future can or might be alleged, asserted, set forth, claimed, embraced, involved, or referred to in, or related to, directly or indirectly: (i) the Merger Agreement, the Stockholders Agreement and the Voting

Agreement and the other agreements and documents contemplated hereby or thereby (collectively, the “Transaction Documents”), (ii) any breach, non-performance, action or failure to act under the Transaction Documents,

(iii) the proposed Mergers, including the events leading to the abandonment of the Mergers and the termination of the Merger Agreement or any other Transaction Documents, (iv) any deliberations or negotiations in connection with the

proposed Mergers, (v) the consideration to be received by the Company’s stockholders in connection with the proposed Mergers, and (vi) any SEC filings, public filings, periodic reports, press releases, proxy statements or other

statements issued, made available or filed relating, directly or indirectly, to the proposed Mergers, including, without limitation, claims under any and all federal securities laws (including those within the exclusive jurisdiction of the federal

courts) (collectively, the “Parent Released Claims”); provided, however, that no Party shall be released from any breach, non-performance, action or failure to act under this Agreement or otherwise occurring on or

after the date hereof.

2

(b) The Company, for and on behalf of itself and the Company Related Parties, does hereby

unequivocally release and discharge, and hold harmless, Parent, the Merger Subs and any of their respective subsidiaries, former and current equity holders, controlling persons, directors, officers, employees, agents, Affiliates, members, managers,

managing directors, general or limited partners or assignees or financing sources or any former or current stockholder, controlling person, director, managing director, officer, employee, general or limited partner, member, manager, family member,

spouse, heir, trust, trustee, executor, estate, administrator, beneficiary, foundation, fiduciary, partnership, joint venture, member firm, limited liability company, corporation, parent, subsidiary, division, associated entity, principal,

predecessor, predecessor-in-interest, successor, successor-in-interest, advisor, consultant, banker, entity providing any fairness opinion, underwriter, broker, dealer, lender, attorney, representative, accountant, insurer, co-insurer, reinsurer,

associate, agent or assignee of any of the foregoing (collectively, the “Sysco Related Parties” and, together with the Company Related Parties, the “Related Parties”), from any and all past, present, direct,

indirect, individual, class, representative, and derivative liabilities, actions, potential actions, causes of action, rights, losses, obligations, duties, costs, expenses, interest, penalties, sanctions, decrees, matters, cases, claims, suits,

debts, dues, sums of money, attorney’s fees, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises, variances, trespasses, injuries, harms, damages, judgments, remedies, extents, executions,

demands, liens and damages of every kind and nature, in law, equity or otherwise, asserted or that could have been asserted, under federal, state, local, foreign, regulatory, statutory, or common law or rule (including but not limited to any claims

under federal securities laws or state disclosure law or any claims that could be asserted derivatively on behalf of the Company), known or unknown, suspected or unsuspected, foreseen or unforeseen, anticipated or unanticipated, disclosed or

undisclosed, accrued or unaccrued, apparent or not apparent, foreseen or unforeseen, matured or not matured, liquidated or not liquidated, fixed or contingent, whether or not concealed or hidden, from the beginning of time until the date of

execution of this Agreement, that in any way arises from or out of, are based upon, or are in connection with or relate in any way to or involve, directly or indirectly, any of the actions, transactions, occurrences, statements, representations,

misrepresentations, omissions, allegations, facts, practices, events, claims or any other matters, things or causes whatsoever, or any series thereof, that were, could have been, or in the future can or might be alleged, asserted, set forth,

claimed, embraced, involved, or referred to in, or related to, directly or indirectly (i) the Transaction Documents, (ii) any breach, non-performance, action or failure to act under the Transaction Documents, (iii) the proposed

Mergers, including the events leading to the abandonment of the Mergers and the termination of the Merger Agreement or any other Transaction Documents, (iv) any deliberations or negotiations in connection with the proposed Mergers, (v) the

consideration to be received by the Company’s stockholders in connection with the proposed Mergers, and (vi) any SEC filings, public filings, periodic reports, press releases, proxy statements or other statements issued, made available or

filed relating, directly or indirectly, to the proposed Mergers, including, without limitation, claims under any and all federal securities laws (including those within the exclusive jurisdiction of the federal courts) (collectively, the

“Company Released Claims” and, together with the Parent Released Claims, the “Released Claims”); provided, however, that no Party shall be released from any breach, non-performance, action or failure

to act under this Agreement or otherwise occurring on or after the date hereof.

3

(c) It is understood and agreed that, except as provided in the provisos to

Section 3(a) and Section 3(b), the preceding paragraphs are a full and final release covering all known as well as unknown or unanticipated debts, claims or damages of each of the Parties and their respective Related Parties

relating to or arising out of the Transaction Documents. Therefore, each of the Parties expressly waives any rights it may have under any statute or common law principle under which a general release does not extend to claims which such Party does

not know or suspect to exist in its favor at the time of executing the release, which if known by such Party must have affected such Party’s settlement with the other, including, without limitation, Section 1542 of the California Civil

Code, which provides:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER

FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

In

connection with such waiver and relinquishment, the Parties acknowledge that they or their attorneys or agents may hereafter discover claims or facts in addition to or different from those which they now know or believe to exist with respect to the

Released Claims, but that it is their intention hereby fully, finally and forever to settle and release all of the Released Claims. In furtherance of this intention, the releases herein given shall be and remain in effect as full and complete mutual

releases with regard to the Released Claims notwithstanding the discovery or existence of any such additional or different claim or fact.

(d) Except as provided in the provisos to Section 3(a) and Section 3(b), and except as required by applicable Law or

the rules or regulations of any Governmental Authority, any self-regulatory authority or by the order of any court of competent jurisdiction, each Party, on behalf of itself and its respective Related Parties, hereby covenants to each other Party

and their respective Related Parties not to, with respect to any Released Claim, directly or indirectly encourage or solicit or voluntarily assist or participate in any way in the investigation, filing, reporting or prosecution by such Party or its

Related Parties or any third party of a suit, arbitration, mediation, or claim (including a third-party or derivative claim) against any other Party and/or its Related Parties relating to any Released Claim. The covenants contained in this

Section 3 shall survive this Agreement indefinitely regardless of any statute of limitations.

4. Non-Disparagement.

Except as required by applicable Law or the rules or regulations of any Governmental Authority, any self-regulatory authority or by the order of any court of competent jurisdiction, each Party agrees that such Party shall not make, publish or cause

to be made or published any statement or remark concerning the subject matter of the Transaction Documents, the participation or involvement of the Parties in the transactions contemplated by the Transaction Documents or the reasons for or any of

the events or circumstances surrounding the termination of the transactions contemplated by the Merger Agreement that could reasonably be understood as disparaging the business or conduct of the other Parties or their respective Related Parties or

as intended to harm the business or reputation of the other Parties or their respective Related Parties.

4

5. Representations of the Parties. Each Party, on behalf of itself and its Related

Parties, represents and warrants to the other Parties as follows:

(a) This Agreement constitutes a valid and binding obligation of such

Party, enforceable against such Party in accordance with its terms, subject to laws of general application relating to bankruptcy, insolvency and the relief of debtors and rules of law governing specific performance, injunctive relief or other

equitable remedies.

(b) The execution and delivery of this Agreement by such Party do not, and the performance by such Party of the

transactions contemplated by this Agreement do not: (i) conflict with, or result in a violation or breach of, any provision of its charter or bylaws (or equivalent organizational documents); (ii) conflict with, or result in any violation

or breach of, or constitute (with or without notice of lapse of time, or both) a default under or require a consent or waiver under, any of the terms, conditions or provisions of any contractual restriction binding on such Party or affecting such

Party or any of their assets; or (iii) conflict with or violate any order or judgment of any court or other agency of government applicable to such Party or any of its assets.

6. Notices. Any notice, request, instruction or other document or other communication to be given hereunder by a party hereto shall be

in writing and shall be deemed to have been given (a) when received if given in person or by courier or a courier service (providing proof of delivery), (b) on the date of transmission if sent by confirmed facsimile, (c) on the next

Business Day if sent by an overnight delivery service (providing proof of delivery), or (d) five (5) Business Days after being deposited in the U.S. mail, certified or registered mail, postage prepaid:

If to the Company, addressed as follows:

|

|

|

| USF Holding Corp. |

| 9399 W. Higgins Road, Suite 600 |

| Rosemont, IL 60018 |

| Attention: |

|

Juliette W. Pryor |

| Facsimile No.: |

|

(480) 293-2705 |

with copies (which shall not constitute

notice) to:

|

|

|

| Simpson Thacher & Bartlett LLP |

| 425 Lexington Avenue |

| New York, NY 10017 |

| Attention: |

|

Marni J. Lerner |

| Facsimile No.: |

|

(212) 455-2502 |

5

If to Parent or a Merger Sub, or after the Closing, the Surviving Company, addressed as follows:

|

|

|

| Sysco Corporation |

| 1390 Enclave Parkway |

| Houston, TX 77077-2099 |

| Attention: |

|

Russell T. Libby |

| Facsimile No.: |

|

(281) 584-2510 |

|

|

|

| with a copy (which shall not constitute notice) to: |

|

|

|

| Wachtell, Lipton, Rosen & Katz |

| 51 West 52nd Street |

| New York, NY 10019 |

| Attention: |

|

Andrew R. Brownstein, Esq. |

|

|

Benjamin M. Roth, Esq. |

| Facsimile No.: |

|

(212) 403-2000 |

or to such other individual or address as a party hereto may designate for itself by notice given as herein provided.

7. Entire Agreement. This Agreement constitutes the entire agreement between the Parties with respect to the subject matter of

this Agreement and supersedes all prior agreements and understandings, both oral and written, between the Parties with respect to the subject matter of this Agreement.

8. Amendments and Waiver. Except for the provisions of Section 3, any provision of this Agreement may be amended or waived

if such amendment or waiver is in writing and is signed, in the case of an amendment, by each Party to this Agreement or, in the case of a waiver, by each Party against whom the waiver is to be effective. No failure or delay by any Party in

exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights

and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by Applicable Law.

9.

Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction or other Governmental Authority to be invalid, void or unenforceable, the remainder of the terms, provisions,

covenants and restrictions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated so long as the economic or legal substance of the transactions contemplated hereby is not affected in any

manner materially adverse to any Party. Upon such a determination, the Parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in an acceptable manner in order that the

transactions contemplated hereby be consummated as originally contemplated to the fullest extent possible.

10. APPLICABLE LAW.

THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE INTERNAL LAWS OF THE STATE OF DELAWARE WITHOUT GIVING EFFECT TO THE PRINCIPLES OF CONFLICTS OF LAW THEREOF.

6

11. JURISDICTION OF DISPUTES. IN THE EVENT ANY PARTY TO THIS AGREEMENT COMMENCES ANY

LITIGATION, PROCEEDING OR OTHER LEGAL ACTION IN CONNECTION WITH OR RELATING TO THIS AGREEMENT OR ANY MATTERS DESCRIBED OR CONTEMPLATED HEREIN, THE PARTIES TO THIS AGREEMENT HEREBY (A) AGREE THAT ANY SUCH LITIGATION, PROCEEDING OR OTHER LEGAL

ACTION SHALL BE INSTITUTED EXCLUSIVELY IN A COURT OF COMPETENT JURISDICTION LOCATED WITHIN THE STATE OF DELAWARE, WHETHER A STATE OR FEDERAL COURT; (B) AGREE THAT IN THE EVENT OF ANY SUCH LITIGATION, PROCEEDING OR ACTION, SUCH PARTIES WILL

CONSENT AND SUBMIT TO PERSONAL JURISDICTION IN ANY SUCH COURT DESCRIBED IN CLAUSE (A) OF THIS SECTION 13 AND TO SERVICE OF PROCESS UPON THEM IN ACCORDANCE WITH THE RULES AND STATUTES GOVERNING SERVICE OF PROCESS; (C) AGREE TO WAIVE

TO THE FULL EXTENT PERMITTED BY LAW ANY OBJECTION THAT THEY MAY NOW OR HEREAFTER HAVE TO THE VENUE OF ANY SUCH LITIGATION, PROCEEDING OR ACTION IN ANY SUCH COURT OR THAT ANY SUCH LITIGATION, PROCEEDING OR ACTION WAS BROUGHT IN AN INCONVENIENT FORUM;

(D) AGREE AS AN ALTERNATIVE METHOD OF SERVICE TO SERVICE OF PROCESS IN ANY LEGAL PROCEEDING BY MAILING OF COPIES THEREOF TO SUCH PARTY AT ITS ADDRESS SET FORTH IN SECTION 8 FOR COMMUNICATIONS TO SUCH PARTY; (E) AGREE THAT ANY

SERVICE MADE AS PROVIDED HEREIN SHALL BE EFFECTIVE AND BINDING SERVICE IN EVERY RESPECT; AND (F) AGREE THAT NOTHING HEREIN SHALL AFFECT THE RIGHTS OF ANY PARTY TO EFFECT SERVICE OF PROCESS IN ANY OTHER MANNER PERMITTED BY LAW.

12. WAIVER OF JURY TRIAL. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO

INVOLVE COMPLICATED AND DIFFICULT ISSUES OF FACT AND LAW, AND THEREFORE, EACH SUCH PARTY HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT SUCH PARTY MAY OTHERWISE HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION DIRECTLY OR INDIRECTLY

ARISING OUT OF OR RELATING TO THE NEGOTIATION, EXPLORATION, DUE DILIGENCE WITH RESPECT TO OR ENTERING INTO OF THIS AGREEMENT, OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT (A) NO REPRESENTATIVE,

AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER, (B) EACH PARTY UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF

THIS WAIVER, (C) EACH PARTY MAKES THIS WAIVER VOLUNTARILY, AND (D) EACH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 14.

7

13. No Assignment; Binding Effect. Neither this Agreement nor any right, interest or

obligation hereunder may be assigned by any Party hereto without the prior written consent of the other Parties hereto and any attempt to do so shall be void, except for assignments and transfers by operation of any laws. Subject to the preceding

sentence and Section 16, this Agreement is binding upon, inures to the benefit of and is enforceable by the Parties and their respective successors and assigns.

14. Third-Party Beneficiaries. Each Party acknowledges and agrees that the Company Related Parties and the Sysco Related Parties are

express third-party beneficiaries of the releases of such Related Parties and covenants not to sue such Related Parties contained in Section 3 of this Agreement and are entitled to enforce rights under such section to the same extent

that such Related Parties could enforce such rights if they were a party to this Agreement. Except as provided in the preceding sentence, there are no third-party beneficiaries to this Agreement.

15. Headings. The headings used in this Agreement have been inserted for convenience of reference only and do not define or limit the

provisions hereof.

16. Injunctive Relief. The Parties agree that irreparable damage would occur in the event that any of the

provisions of this Agreement was not performed in accordance with its specified terms or was otherwise breached and that money damages would not be an adequate remedy for any breach of this Agreement. It is accordingly agreed that in any proceeding

seeking specific performance each of the Parties shall waive the defense of adequacy of a remedy at law. Each of the Parties shall be entitled to an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the

terms and provisions hereof in any court of competent jurisdiction, this being in addition to any other remedy to which they are entitled at law or in equity.

17. Counterparts; Effectiveness. This Agreement may be signed in any number of counterparts, each of which shall be an original, with

the same effect as if the signatures thereto and hereto were upon the same instrument. This Agreement shall become effective when each Party hereto shall have received a counterpart hereof signed by all of the other Parties hereto. Until and unless

each Party has received a counterpart hereof signed by the other Party hereto, this Agreement shall have no effect and no Party shall have any right or obligation hereunder (whether by virtue of any other oral or written agreement or other

communication). Signatures to this Agreement transmitted by facsimile transmission, by electronic mail in PDF form, or by any other electronic means designed to preserve the original graphic and pictorial appearance of a document, will be deemed to

have the same effect as physical delivery of the paper document bearing the original signatures.

[signature page follows]

8

IN WITNESS WHEREOF, the Parties hereto have caused this Agreement to be duly executed and

delivered as of the date first above written.

|

|

|

|

|

| USF HOLDING CORP. |

|

|

| By: |

|

/s/ Juliette Pryor |

|

|

|

|

|

Name: |

|

Juliette Pryor |

|

|

Title: |

|

EVP, General Counsel |

|

| SYSCO CORPORATION |

|

|

| By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

Name: |

|

Russell T. Libby |

|

|

Title: |

|

Executive Vice President-Corporate Affairs, Chief Legal Officer and Corporate Secretary |

|

| SCORPION CORPORATION I, INC. |

|

|

| By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

Name: |

|

Russell T. Libby |

|

|

Title: |

|

Executive Vice President-Corporate Affairs, Chief Legal Officer and Corporate Secretary |

|

| SCORPION COMPANY II, LLC |

|

|

| By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

Name: |

|

Russell T. Libby |

|

|

Title: |

|

Executive Vice President-Corporate Affairs, Chief Legal Officer and Corporate Secretary |

[Signature Page to Termination Agreement]

Exhibit 99.1

|

|

|

|

|

|

| For more information: Charley Wilson

Vice President, Corporate Communications T: 281-584-2423

Shannon Mutschler

Vice President, Investor Relations T: 281-584-1308 |

|

SYSCO TERMINATES MERGER AGREEMENT WITH US FOODS

Company Reaffirms Commitment to Leverage Core Business Growth,

Announces $3 Billion Share Repurchase,

Plans to Redeem Merger-Related Debt

HOUSTON, June 29, 2015 – Sysco Corporation (NYSE:SYY) announced that it has terminated its merger agreement with US Foods, days after the

U.S. District Court in Washington, D.C., granted the Federal Trade Commission’s request for a preliminary injunction to block the proposed Sysco-US Foods merger. This action also terminates an agreement with Performance Food Group (PFG) to

purchase US Foods facilities in 11 markets.

Under terms of the merger agreement, the termination of the transaction requires Sysco to pay

break-up fees of $300 million to US Foods and $12.5 million to PFG.

“After reviewing our options, including whether to appeal the

Court’s decision, we have concluded that it’s in the best interests of all our stakeholders to move on,” said Bill DeLaney, Sysco president and chief executive officer. “We believed the merger was the right strategic decision for

us, and we are disappointed that it did not come to fruition. However, we are prepared to move forward with initiatives that will contribute to the success of Sysco and our stakeholders.”

1

Unwavering Focus on Customer Service

DeLaney underscored Sysco’s confidence in its existing business with a collective focus on the highest levels of customer service and

satisfaction, growing the business, reducing costs and generating substantial value for Sysco’s shareholders.

“Everything

starts with the customer,” DeLaney said. “Our vision remains clear: to be our customers’ most valued and trusted business partner. If our customers succeed, then we succeed. Our relentless focus on providing exceptional customer

service and differentiated solutions to help our customers grow is unwavering.”

Leverage Core Business Growth

“We also will continue to drive earnings through commercial and supply chain initiatives, including category management and revenue

management in our core business, as well as pursuing cost-saving opportunities,” he said. “We are confident in our ability to achieve these initiatives because of our success to date in transforming nearly all aspects of our business,

standing up several commercial and functional capabilities, and taking out or avoiding more than $750 million in annual product and operating costs.”

Sysco continues to generate strong and stable cash flow. “We have improved our discipline and efficiency in how we manage our substantial

cash flow, and we are committed to grow our free cash flow over time as we move forward,” DeLaney said. “We will continue to make prudent investments in our business. We also remain committed to growing our dividend because we know

that’s important to our shareholders. And, we will continue to look for strategic acquisitions that will enhance shareholder value over time.”

Share Repurchases

Sysco’s Board of

Directors has authorized the company to spend an additional $3 billion to buy back shares (approximately 13 percent of current outstanding shares at recent prices) over the next two years. The share repurchases will be in addition to the amount

normally purchased to offset benefit

2

plans and stock option dilution. The company intends to fund these purchases from new borrowings and cash flow from operations. The intent is to repurchase approximately $1.5 billion in shares in

each of the next two years and, as part of the first year’s purchases, the company expects to put in place an accelerated share repurchase program. Sysco will continue to assess the merits of repurchasing shares over time.

“While we are very comfortable leveraging our balance sheet to enhance returns to our shareholders, we remain committed to maintaining a

solid investment-grade credit rating and a strong balance sheet,” DeLaney said. “A strong balance sheet provides the capacity and flexibility to continue to pursue strategic opportunities as they may arise. While we anticipate the

possibility that our credit rating may be downgraded as a result of this new share repurchase program, we are comfortable operating our company with higher levels of debt.”

Merger Debt Redemption

Sysco also will

begin the process of redeeming the $5 billion of merger-related debt under the mandatory redemption provisions contained within those notes. This process is expected to take no more than 40 days.

Conference Call & Webcast

Additional details about the termination of the merger agreement, the share repurchase program, debt redemption and operational initiatives

will be discussed on a conference call at 10 a.m. (Eastern), Monday, June 29. A live webcast of the call and a copy of this news release will be available online at www.sysco.com in the Investors section.

# # #

About Sysco

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments

and other customers who prepare meals away from home. Its family of products also includes equipment and supplies for the foodservice and hospitality industries. The company operates 194 distribution facilities serving approximately 425,000

customers. For

3

Fiscal Year 2014 that ended June 28, 2014, the company generated sales of more than $46 billion. For more information, visit www.sysco.com or connect with Sysco on Facebook at

www.facebook.com/SyscoCorporation or Twitter at https://twitter.com/Sysco. For important news regarding Sysco, visit the Investor Relations portion of the company’s Internet home page at www.sysco.com/investors, follow us

at www.twitter.com/SyscoStock and download the new Sysco IR App, available on the iTunes App Store and the Google Play Market. In addition, investors should also continue to review our news releases and filings with the

Securities and Exchange Commission. It is possible that the information we disclose through any of these channels of distribution could be deemed to be material information.

Forward-Looking Statements

Statements made in

this news release that look forward in time or that express management’s beliefs, expectations or hopes are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements

reflect the views of management at the time such statements are made and are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. These statements

include our plans and expectations related to dividend growth, strategic acquisitions, and share repurchases. Our success with regard to each of these matters, including the timing and benefits thereof, is subject to the general risks associated

with our business, including the risks of interruption of supplies due to lack of long-term contracts, severe weather, crop conditions, work stoppages, intense competition, technology disruptions, dependence on large regional and national customers,

inflation risks, the impact of fuel prices, adverse publicity, and labor issues. Risks and uncertainties also include risks impacting the economy generally, including the risks that the current general economic conditions will deteriorate, or

consumer confidence in the economy may not increase and decreases in consumer spending, particularly on food-away-from-home, may not reverse. Market conditions may not improve. If sales from our locally managed customers do not grow at the same rate

as sales from regional and national customers, our gross margins may continue to decline. Our ability to meet our long-term strategic objectives to grow the profitability of our business depends largely on the success of our Business Transformation

Project. There are various risks related to the project, including the risk that the project and its various components may not provide the expected benefits in our anticipated time frame, if at all, and may prove costlier than expected; the risk

that the actual costs of the ERP system may be greater or less than currently expected because we have encountered, and may continue to encounter, the need for changes in design or revisions of the project calendar and budget, including the

incurrence of expenses at an earlier or later time than currently anticipated; the risk that our business and results of operations may be adversely affected if we experience delays in deployment, operating problems, cost overages or limitations on

the extent of the business transformation during the ERP implementation process; and the risk of adverse effects to our business, results of operations and liquidity if the ERP system, and the associated process changes, do not prove to be cost

effective or do not result in the cost savings and other benefits at the levels that we anticipate. Planned deployments in the coming quarters are dependent upon the success of the ERP system and the updates at the current locations. We may

experience delays, cost overages or operating problems when we deploy the system to additional locations. Our plans related to and the timing of the implementation of the ERP system, as well as the cost transformation and category management

initiatives, are subject to change at any time based on management’s subjective evaluation of our overall business needs. We may fail to realize anticipated benefits, particularly expected cost savings, from our cost transformation initiative.

If we

4

are unable to realize the anticipated benefits from our cost cutting efforts, we could become cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease.

We may also fail to realize the full anticipated benefits of our category management initiative, and may be unable to successfully execute the initiative in our anticipated timeline. Capital expenditures may vary from those projected based on

changes in business plans and other factors, including risks related to the implementation of our business transformation initiatives and our regional distribution centers, the timing and successful completions of acquisitions, construction

schedules and the possibility that other cash requirements could result in delays or cancellations of capital spending. Periods of high inflation, either overall or in certain product categories, can have a negative impact on us and our customers,

as high food costs can reduce consumer spending in the food-away-from-home market, and may negatively impact our sales, gross profit, operating income and earnings. Expanding into international markets presents unique challenges and risks, including

compliance with local laws, regulations and customs and the impact of local political and economic conditions, and such expansion efforts may not be successful. Any business that we acquire may not perform as expected, and we may not realize the

anticipated benefits of our acquisitions. Expectations regarding the accounting treatment of any acquisitions may change based on management’s subjective evaluation. Expectations regarding tax rates are subject to various factors beyond

management’s control. For a discussion of additional factors impacting Sysco’s business, see the Company’s Annual Report on Form 10-K for the year ended June 28, 2014, as filed with the Securities and Exchange Commission, and the

Company’s subsequent filings with the SEC. Sysco does not undertake to update its forward-looking statements.

5

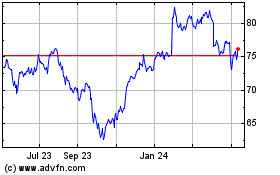

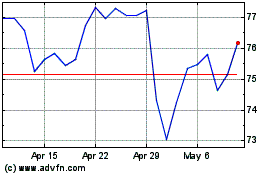

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024