Current Report Filing (8-k)

May 20 2019 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 17, 2019

StarTek, Inc.

(Exact name of registrant as specified in charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12793

|

|

84-1370538

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

8200 E. Maplewood Ave., Suite 100, Greenwood Village, CO 80111

(Address of principal executive offices; zip code)

Registrant’s telephone number, including area code: (303) 262-4500

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

SRT

|

New York Stock Exchange, Inc.

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

The information set forth in Item 3.02 of this Current Report on Form 8-K that relates to the entry into material definitive agreements is incorporated by reference into this Item 1.01.

Item 3.02. Unregistered Sales of Equity Securities.

On May 17, 2019, StarTek, Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Purchase Agreement”) with Advance Crest Investments Limited (“Advance Crest”), CSP Alpha Holdings Parent Pte Ltd, a Singapore private limited company (“CSP Alpha Holdings”) and certain outside accredited investors (together with Advance Crest and CSP Alpha Holdings, the “Purchasers”) to sell 692,520 shares of its common stock (the “Shares”) to the Purchasers (including 274,064 Shares sold to Advance Crest and 100,267 Shares sold to CSP Alpha Holdings) in a private placement at a price of $7.48 per share for aggregate gross proceeds to the Company of $5,180,049.60, before offering expenses. Advance Crest is controlled by Bharat Rao and Mukesh Sharda, each of whom were appointed to serve as directors of the Company by CSP Alpha Holdings. The closing of the private placement took place on May 17, 2019.

The Company intends to use the proceeds from the Shares for general corporate purposes. Prior to the transactions contemplated by the Purchase Agreement, CSP Alpha Holdings owned 21,134,765 shares of the Company’s common stock, representing approximately 56% of the Company’s outstanding common stock. The Purchase Agreement and the transactions contemplated thereby were approved by the Audit Committee of the Company’s Board of Directors, which is comprised exclusively of independent directors unaffiliated with CSP Alpha Holdings. The purchase price for the Purchased Shares is equal to the volume weighted average price of the Company’s common stock on the New York Stock Exchange for the five trading days immediately preceding May 17, 2019, which was the date of Audit Committee approval.

The Shares were offered and sold in the private placement to the Purchasers without registration under the Securities Act of 1933, as amended, or the securities laws of certain states, in reliance on the exemptions provided by Section 4(2) of the Securities Act of 1933, as amended, and Rule 506 of Regulation D promulgated thereunder and in reliance on similar exemptions under applicable state laws.

In connection with the private placement, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Purchasers pursuant to which it will file a registration statement on Form S-3 to cover the resale of the Shares.

The foregoing description of the Purchase Agreement and the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement and the Registration Rights Agreement, copies of which are attached hereto as Exhibit 10.1 and Exhibit 10.2, respectively, and are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

The following exhibit is filed herewith:

|

|

|

|

|

|

Exhibit Number

|

Exhibit Description

|

|

10.1

|

|

|

10.2

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

STARTEK, INC.

|

|

|

|

|

|

|

|

Date: May 20, 2019

|

By:

|

/s/ Lance Rosenzweig

|

|

|

|

Lance Rosenzweig

|

|

|

|

Chief Executive Officer

|

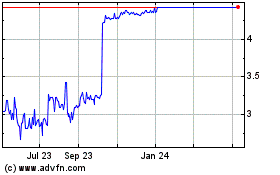

StarTek (NYSE:SRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

StarTek (NYSE:SRT)

Historical Stock Chart

From Apr 2023 to Apr 2024