Initial Statement of Beneficial Ownership (3)

February 01 2021 - 5:03PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Shear David Chan |

2. Date of Event Requiring Statement (MM/DD/YYYY)

1/22/2021

|

3. Issuer Name and Ticker or Trading Symbol

Restaurant Brands International Inc. [QSR]

|

|

(Last)

(First)

(Middle)

C/O RESTAURANT BRANDS INTERNATIONAL INC., 5707 BLUE LAGOON DRIVE |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

President, International / |

|

(Street)

MIAMI, FL 33126

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Shares | 103276.7558 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Exchangeable Units (1) | (1) | (1) | Common Shares | 2545 | (1) | D | |

| Option (Right to Buy) | (2) | 3/5/2025 | Common Shares | 169478 | $42.26 | D | |

| Performance Share Units | 2/26/2021 | 2/26/2021 | Common Shares | 60630.789 | (3) | D | |

| Dividend Equivalent Rights | (4) | (4) | Common Shares | 8378.991 | (5) | D | |

| Option (Right to Buy) | 2/24/2022 | 2/23/2027 | Common Shares | 100000 | $55.55 | D | |

| Restricted Share Units | (6) | (6) | Common Shares | 9000 | (7) | D | |

| Dividend Equivalent Rights | (8) | (8) | Common Shares | 1103.1433 | (5) | D | |

| Option (Right to Buy) | 2/23/2023 | 2/22/2028 | Common Shares | 40000 | $58.44 | D | |

| Restricted Share Units | (9) | (9) | Common Shares | 7811 | (7) | D | |

| Dividend Equivalent Rights | (10) | (10) | Common Shares | 846.4086 | (5) | D | |

| Restricted Share Units | (11) | (11) | Common Shares | 8463 | (7) | D | |

| Dividend Equivalent Rights | (12) | (12) | Common Shares | 626.3669 | (5) | D | |

| Performance Share Units | 2/22/2024 | 2/22/2024 | Common Shares | 50000 | (13) | D | |

| Dividend Equivalent Rights | (14) | (14) | Common Shares | 3700.6197 | (5) | D | |

| Options (Right to Buy) | 2/21/2025 | 2/20/2030 | Common Shares | 25000 | $66.31 | D | |

| Restricted Share Units | (15) | (15) | Common Shares | 6032 | (7) | D | |

| Dividend Equivalent Rights | (16) | (16) | Common Shares | 257.9665 | (5) | D | |

| Performance Share Units | 2/21/2025 | 2/21/2025 | Common Shares | 25000 | (17) | D | |

| Dividend Equivalent Rights | (18) | (18) | Common Shares | 1069.1583 | (5) | D | |

| Performance Share Units | 2/21/2025 | 2/21/2025 | Common Shares | 20000 | (19) | D | |

| Dividend Equivalent Rights | (20) | (20) | Common Shares | 175.1137 | (5) | D | |

| Explanation of Responses: |

| (1) | Each Restaurant Brands International Limited Partnership Exchangeable Unit is convertible, at the Reporting Person's election, into common shares of Restaurant Brands International Inc. or a cash amount equal to a prescribed cash amount determined by reference to the weighted average trading price of Restaurant Brand International Inc.'s common shares on the New York Stock Exchange for the 20 consecutive trading days ending on the last business day prior to the exchange date, at the sole discretion of the general partner of Restaurant Brands International Limited Partnership (subject to the consent of the Restaurant Brands International Inc. conflicts committee, in certain circumstances). This conversion right has no expiration date. |

| (2) | These options are immediately exercisable. |

| (3) | The shares reported represent an award of performance based restricted share units (the "2016 PBRSUs") granted to the Reporting Person. The 2016 PBRSUs had a three-year performance period beginning January 1, 2015 and ending December 31, 2019 and will vest 100% on February 26, 2021, which is the fifth anniversary of the grant date. |

| (4) | These dividend equivalent rights accrued on the 2016 PBRSUs. Dividend equivalent rights accrue when and as dividends are paid on the common shares underlying the 2016 PBRSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2016 PBRSUs to which they relate. |

| (5) | Each whole dividend equivalent right represents a contingent right to receive one common share. |

| (6) | These restricted share units vest on December 31, 2021 |

| (7) | Each restricted share unit represents a contingent right to receive one common share. |

| (8) | These dividend equivalent rights accrued on the 2017 restricted share unit award (the "2017 RSUs"). Dividend equivalent rights accrue when and as dividends are paid on the common shares underlying the 2017 RSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2017 RSUs to which they relate. |

| (9) | These restricted share units vest on December 31, 2022. |

| (10) | These dividend equivalent rights accrued on the 2018 restricted share unit award (the "2018 RSUs"). Dividend equivalent rights accrue when and as dividends are paid on the common shares underlying the 2018 RSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2018 RSUs to which they relate. |

| (11) | These restricted share units vest on December 31, 2023. |

| (12) | These dividend equivalent rights accrued on the 2019 restricted share units (the "2019 RSUs"). Dividend equivalent rights accrue when and as dividends are paid on the common shares underlying the 2019 RSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2019 RSUs to which they relate. |

| (13) | The shares reported represent an award of performance based restricted share units ("2019 PBRSUs") granted to the Reporting Person. The 2019 PBRSUs will have a three-year performance period beginning January 1, 2019 and ending December 31, 2021 and to the extent earned will vest 100% on February 22, 2024, which is the fifth anniversary of the grant date. The number of common shares that will be earned at the end of the three-year performance period is subject to increase or decrease based on the results of the Issuer performance condition. |

| (14) | These dividend equivalent rights accrued on the 2019 PBRSUs. Dividend equivalent rights accrue when and as dividends are paid on the common shares underlying the 2019 PBRSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2019 PBRSUs to which the relate. |

| (15) | These restricted share units vest on December 31, 2024. |

| (16) | These dividend equivalent rights accrued on the 2020 restricted share unit award (the "2020 RSUs"). Dividends equivalent rights accrue when and as dividends are paid on the common shares underlying the 2020 RSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2020 RSUs to which they relate. |

| (17) | The shares reported represent an award of performance based restricted share units (the "2020-1 PBRSUs") granted to the Reporting Person. The 2020-1 PBRSUs will have a performance period beginning January 1, 2019 and ending December 31, 2021 and to the extent earned will vest 100% on February 21, 2025, which is the fifth anniversary of the grant date. The number of common shares that will be earned at the end of the performance period is subject to increase or decrease based on the results of the Issuers performance condition. |

| (18) | These dividend equivalent rights accrued on the 2020-1 PBRSUs. Dividend equivalent rights accrue when and as dividends are paid on the common shares underlying the 2020-1 PBRSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2020-1 PBRSUs to which they relate. |

| (19) | The shares reported represent an award of performance based restricted share units ("2020-2 PBRSUs") granted to the Reporting Person. The 2020-2 PBRSUs will have a performance period beginning January 1, 2019 and ending December 31, 2021 and to the extent earned will vest 100% on February 21, 2025. The number of common shares that will be earned at the end of the performance period is subject to increase or decrease based on the results of the Issuer performance condition. |

| (20) | These dividend equivalent rights accrued on the 2020-2 PBRSUs. Dividend equivalent rights accrue when and as dividends are paid on the common share underlying the 2020-2 PBRSUs and vest proportionately with and are subject to settlement and expiration upon the same terms as the 2020-2 PBRSUs to which they relate. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Shear David Chan

C/O RESTAURANT BRANDS INTERNATIONAL INC.

5707 BLUE LAGOON DRIVE

MIAMI, FL 33126 |

|

| President, International |

|

Signatures

|

| /s/Michele Keusch, as Attorney-in-Fact for David Chan Shear | | 2/1/2021 |

| **Signature of Reporting Person | Date |

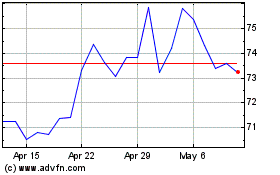

Restaurant Brands (NYSE:QSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

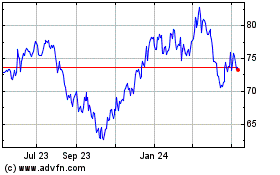

Restaurant Brands (NYSE:QSR)

Historical Stock Chart

From Apr 2023 to Apr 2024